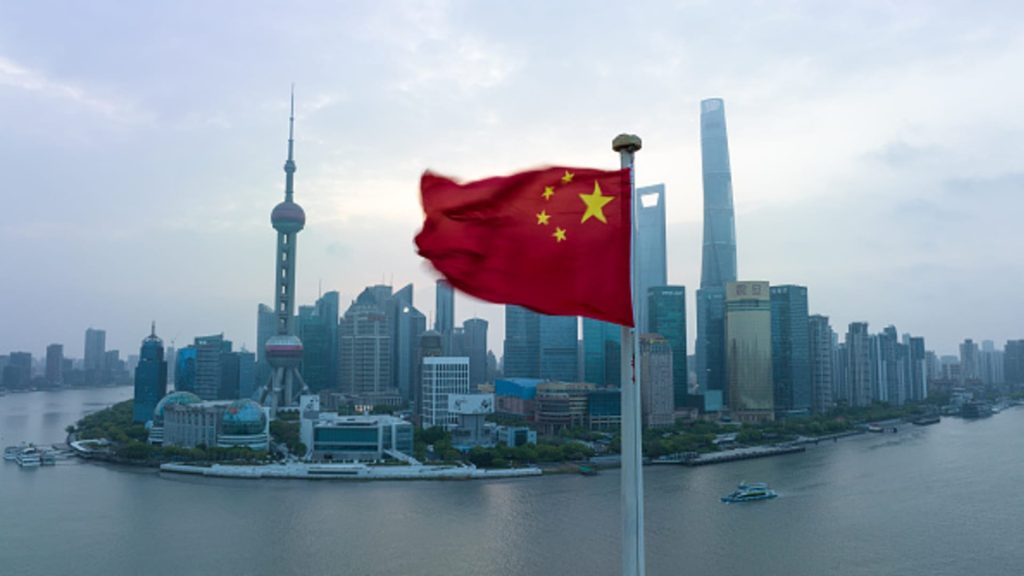

In recent months, a significant rally in Chinese stocks has repositioned investor sentiment towards expecting mainland shares to outperform their American counterparts, marking a notable shift in the financial landscape. This change in perspective comes as the S&P 500 finds itself in correction territory for the first time this year while the MSCI China Index has appreciated by over 19%, highlighting a stark contrast from earlier fears regarding China’s economic stability. Economic policies, market valuations, and recent technological advancements are among the factors driving this bullish behavior in the Chinese stock market.

| Article Subheadings |

|---|

| 1) Overview of Current Market Trends |

| 2) Shift from American Dominance |

| 3) Factors Influencing the Rally in Chinese Stocks |

| 4) Economic Implications and Market Valuations |

| 5) Future Outlook for Global Markets |

Overview of Current Market Trends

The divergence in performance between U.S. and Chinese stocks has become increasingly pronounced, with investors now eyeing the potential for Chinese equities to lead the market performance in the coming months. The MSCI China index marks a remarkable 19% gain since the beginning of the year up to March 9, constituting the best start to the year recorded in history. Meanwhile, major U.S. indices such as the S&P 500 have experienced setbacks, entering correction territory for the first time this year, driven largely by fears of an impending economic slowdown exacerbated by ongoing trade tensions and tariffs imposed by the Trump administration.

This turnaround highlights the evolving perceptions around global investment opportunities. With the U.S. markets having witnessed a prolonged period of growth, some analysts are suggesting that the resilience of the mainland Chinese economy, along with renewed optimism around technology and artificial intelligence advancements, could substantiate a sustained rally going forward. This marks a potential turning point for investors, who may be keen to reassess their allocation strategies with a view to capitalize on the strengths emerging in the Chinese market.

Shift from American Dominance

For several years, “American exceptionalism” has been a prominent theme in investment narratives, positioning U.S. equities as the frontrunners during economic recovery phases. However, sentiment appears to be shifting, as evidenced by analysts like Richard Harris, CEO of Port Shelter Investment Management, who noted, “The U.S. has had a good period, and that’s coming to an end.” This sentiment reflects concerns about stagnating growth rates projected below the 2% mark for the U.S. economy, as a result of ongoing trade policies that could potentially restrict economic activity.

In stark comparison, the recent leaps in Chinese stock performance suggest that the dynamics of global investment are changing. The Hang Seng Tech Index, which tracks leading technology firms in China, has surged by over 30% this year, further solidifying China’s position on the global economic stage. As analysts reassess their confidence in U.S. markets, it becomes evident that globalization is reshaping investment ideologies, moving away from relying solely on past performance metrics of U.S. dominance.

Factors Influencing the Rally in Chinese Stocks

The recent rally in Chinese equities can be largely attributed to various factors, including innovations in technology and direct government support for critical sectors. The introduction of groundbreaking AI models such as DeepSeek’s R1 has fueled investor excitement and confidence in sustained economic recovery. Analysts expect that with significant advancements in various technology sectors, buoyant public policies aimed at technology investments will accompany this growth.

The Chinese government, recognizing the importance of technology in economic advancement, has also indicated intentions to intensify funding and support for its tech sector. This includes strategic investments and measures aimed at bolstering the development of artificial intelligence and other emerging technologies, which creates an attractive environment for both local and foreign investments. Such backing from the government builds a strong foundation for recovery, fostering an atmosphere of optimism that is vital for reshaping market perceptions.

Economic Implications and Market Valuations

Valuations of Chinese stocks relative to their potential are extraordinarily favorable when juxtaposed against global counterparts. The MSCI China Index trades at a mere 13.38 times its projected one-year earnings, substantially below the S&P 500 index, which stands at 20.72 times its projected earnings. This discrepancy provides a clear indication to investors that there exists a vastly undervalued segment within the Chinese market.

Furthermore, according to research from JPMorgan, positioning in China remains extremely low, signaling an opportunity for investors looking to capitalize on potential reversals in fortunes. Similar sentiments expressed by analysts from Citi Research, who have recently upgraded China to an overweight position while downgrading U.S. equities to neutral status, suggest a growing consensus on the necessity of reassessing investment distributions in light of evolving market dynamics.

Future Outlook for Global Markets

As investor attributes shift, the general outlook for both U.S. and Chinese markets is being cautiously monitored. The Deutsche Bank recently communicated a sentiment of caution regarding ongoing selloffs in U.S. equities, presuming that the uncertain trade policy landscape will continue to weigh heavily on market performance. Their research suggests that with macroeconomic uncertainty remaining prevalent, bullish momentum in U.S. equities may still encounter various hurdles before any significant turnaround occurs.

In contrast, the optimism surrounding the Chinese markets could facilitate sustained growth, leading many analysts to believe that investors should consider reallocating their portfolios. Reports from analysts in various sectors hint at the initiation of a fundamental shift, where traders may need to embrace opportunities in traditionally undervalued markets like China while cautiously approaching heavily inflated U.S. indices.

| No. | Key Points |

|---|---|

| 1 | Chinese stocks have demonstrated a remarkable performance, with the MSCI China Index gaining 19% since the start of 2023. |

| 2 | The S&P 500 has entered a correction phase, indicating potential instability in U.S. equities. |

| 3 | Technological advancements, particularly in artificial intelligence, are contributing to renewed investor confidence in China. |

| 4 | Valuations of Chinese stocks remain highly attractive compared to U.S. peers, presenting investment opportunities. |

| 5 | Market analysts suggest a strategic reallocation towards undervalued markets is essential as global investment dynamics shift. |

Summary

In conclusion, the evolving economic narratives suggest that Chinese stocks may soon eclipse their American counterparts, driven by technological advancements, attractive market valuations, and supportive governmental policies. As U.S. markets face significant headwinds, investor sentiment is increasingly pivoting towards the Chinese market, which could lead to substantial changes in global investment approaches moving forward. The shifting dynamics serve as a reminder of the fluidity of financial markets, stressing the importance of adaptability for investors.

Frequently Asked Questions

Question: Why are Chinese stocks rallying while American stocks are struggling?

Chinese stocks are rallying mainly due to significant technological advancements and strong government support for the tech industry. In contrast, U.S. stocks are facing headwinds from economic uncertainties and correction phases.

Question: What role does government support play in stock market performance?

Government support can provide essential funding and confidence in certain industries, as seen in China’s tech sector. This support can stimulate growth and attract both domestic and foreign investments, reinforcing positive market sentiment.

Question: How should investors approach the current market landscape?

Investors are advised to reallocate their portfolios by considering emerging markets like China, where technology is fostering strong growth potential and valuations are attractive. Caution is also warranted in U.S. equities due to ongoing economic uncertainties.