The automotive industry is navigating through a time of significant upheaval, influenced by evolving regulations, the rise of electric vehicles (EVs), advancements in software, and intensified competition from China. This disruption has culminated in a volatile environment for automakers, questioning their strategies and future product offerings. Experts predict that the coming years will bring unprecedented challenges and alterations in the market dynamics, prompting companies to reconsider their approaches to vehicle production and sales.

| Article Subheadings |

|---|

| 1) Industry Overview: Current Disruptions and Challenges |

| 2) Predictions from the “Car Wars” Report |

| 3) Financial Implications: EV Write-Downs |

| 4) Shifts in Market Strategy: Returning to Core Products |

| 5) Consumer Trends: Changes in Vehicle Preferences |

Industry Overview: Current Disruptions and Challenges

The automotive sector is experiencing a phase of significant transformation, spurred by challenges both from within and outside the industry. In recent years, discussions surrounding climate change and sustainability have led to stricter regulations aimed at reducing carbon emissions. These regulations, coupled with advancements in electric vehicle technology, have forced traditional automakers to rethink their existing strategies. Disruptions are being observed globally, but the implications are perhaps most pronounced in major markets like the United States and China. The imperative for these changes has not only generated opportunities but also created uncertainty regarding product development and market positioning.

According to analysts, this turbulence is not a fleeting phenomenon but a precursor to a prolonged period of volatility in the sector. Many automotive companies are grappling with conflicting priorities—balancing the transition toward electric vehicles while also remaining competitive in a market historically dominated by internal combustion engines. With technological innovations evolving rapidly, manufacturers must also invest heavily into digital transformation and smart technologies to keep up with emerging trends. Now, more than ever, the uncertainties surrounding consumer preferences and market demands pose challenges for automakers as they attempt to navigate through this landscape.

Predictions from the “Car Wars” Report

The “Car Wars” report, produced by analysts at Bank of America Securities, presents a detailed analysis of the ongoing transformations within the automotive industry. The report predicts that the next four years will be particularly tumultuous, urging industry stakeholders to prepare for unforeseen challenges. The overall thesis of the report underscores the significance of the replacement rate of vehicle models—essentially, the percentage of vehicles expected to be replaced by newer models. This metric is crucial as it affects showroom age, market share, profitability, and ultimately stock prices for automotive companies.

As outlined in the report, certain automakers are outperforming their industry counterparts in terms of replacement rates over the next four years. Brands like Tesla and Honda Motor are expected to lead with replacement rates of 22.4% and 16.9%, respectively. Meanwhile, traditional players such as Ford Motor and General Motors hover closer to the industry average at 16.1% and 15.7%, respectively. In contrast, companies lagging in replacement rates include Nissan Motor at 12.3% and Toyota Motor at 13.7%. This highlights a pressing concern in terms of competitiveness for lower-performing firms and points to the necessity for aggressive strategic planning moving forward.

Financial Implications: EV Write-Downs

One of the stark realities that the automotive industry is facing is the financial repercussions of a hasty pivot toward electric vehicles. The report indicates that Ford Motor recently disclosed write-downs amounting to approximately $1.9 billion, stemming from canceling plans for an all-electric SUV. This situation serves as a harbinger of similar financial losses expected to reverberate across the industry as manufacturers wrestle with this transition. Analysts warn that numerous automakers may soon be forced to initiate substantial write-offs as they recalibrate their portfolios.

“There’s a lot of tough decisions that are going to need to be made,”

said John Murphy, the lead analyst of the “Car Wars” report, during a recent Automotive Press Association event in Detroit.

With automakers having already spent billions anticipating a robust market for electric vehicles, the slower-than-expected development poses significant financial risks. Automakers face mounting pressures to reassess their initial forecasts and make strategic adjustments to their product lines and investments.

Shifts in Market Strategy: Returning to Core Products

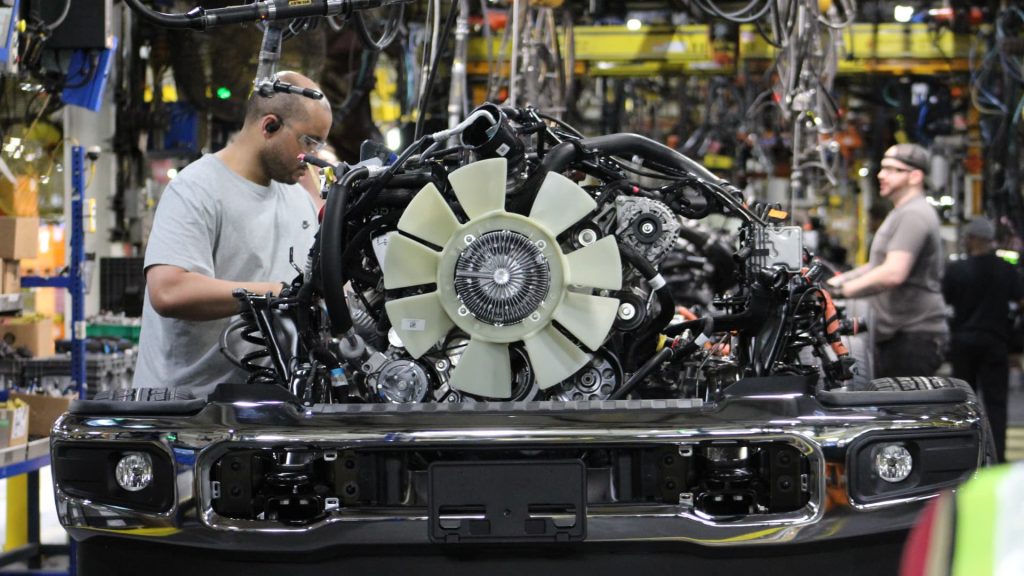

Amid the uncertainty surrounding electric vehicles, many automakers are returning to their core lineups, particularly models powered by internal combustion engines. This shift is driven by the need for immediate capital generation, as initial investments in electric vehicles may not yield the anticipated returns in the short term. Murphy highlights that many manufacturers have recognized the benefits of focusing on traditional vehicles, hybrids, and plug-in hybrids, creating a multi-faceted strategy toward catering to customer preferences.

“Really, everybody is leaning back into their core over the next four years in very uncertain times,”

said Murphy, pointing out that liquidity will be of utmost importance for automakers as they strategize for the future.

The shift is further underscored by the title of this year’s “Car Wars” investor note, which ominously reads, “The ICE Age Cometh as EV Plans Freeze.” This statement encapsulates the reality many automakers face as they balance between innovation and tradition in an uncertain market landscape.

Consumer Trends: Changes in Vehicle Preferences

Consumer preferences are in a state of flux, significantly impacting market dynamics. Analysts foresee a shift in new vehicle introductions during the latter half of this decade as automakers realign their strategies and adapt to transient consumer demands. Popular vehicle types like crossovers, which enjoyed a surge in popularity in the past two decades, appear to be transitioning back as automakers re-evaluate their offerings in lieu of economic uncertainties.

According to the report, a marked reduction in crossover vehicle launches is expected, suggesting a potential decline in demand. For the first time in nearly two decades, Murphy noted that crossover models are expected to underperform when compared to historical launch data, with anticipated production drops reflecting changing consumer sentiment.

Part of this slowdown may stem from automakers refocusing efforts on full-size pickup truck updates and redesigns, which have historically generated higher profit margins. Japanese manufacturers, traditionally focused on passenger vehicles, are adjusting their strategies, adapting to the shifting dynamics of the automotive market.

| No. | Key Points |

|---|---|

| 1 | The automotive industry is undergoing significant transformations due to evolving regulations and the rise of electric vehicles. |

| 2 | The “Car Wars” report predicts unprecedented volatility in the automotive market over the next four years. |

| 3 | Automakers are facing significant financial risks as they shift toward electric vehicle strategies. |

| 4 | Many automakers are pivoting back to core product lines, focusing on internal combustion engine models. |

| 5 | Changes in consumer trends are prompting a re-evaluation of vehicle production strategies. |

Summary

In conclusion, the automotive industry is standing at a crossroads, facing uncharted territory brought about by technological advancements, regulatory changes, and shifting consumer preferences. As companies strategize to navigate this volatility, the implications for both automakers and the broader market are profound. The next few years will be critical in determining which companies will adapt successfully and which may struggle to keep pace in this rapidly evolving landscape.

Frequently Asked Questions

Question: What is the impact of the “Car Wars” report on the automotive industry?

The “Car Wars” report provides essential insights into future trends and expectations within the automotive sector, highlighting critical shifts in product replacement rates and market dynamics.

Question: Why are automakers facing financial risks related to EV strategies?

Financial risks stem from significant investments made in electric vehicle development, which are not yielding anticipated returns, leading to write-downs and losses for companies.

Question: What are the potential changes in consumer vehicle preferences?

Consumer preferences are evolving, with a notable shift back toward traditional vehicles and pickups, impacting automakers’ production strategies in the years ahead.