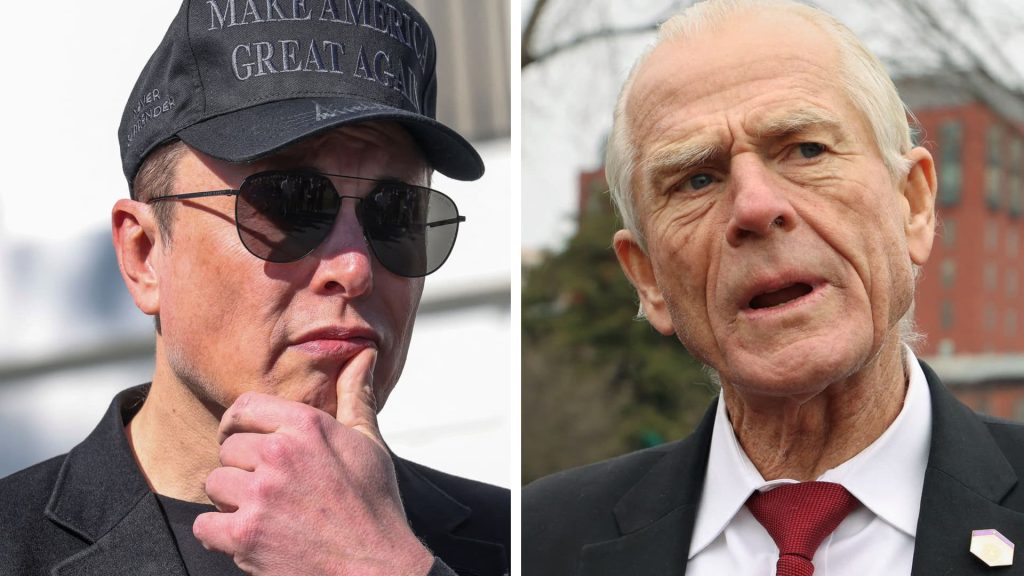

In a surprising turn of events, Tesla CEO Elon Musk has openly clashed with Peter Navarro, President Donald Trump‘s trade advisor, amid a significant downturn in Tesla’s stock price. Over the course of several days, Musk has unleashed a barrage of insults directed at Navarro, particularly responding to his remarks about Tesla’s manufacturing capabilities. The conflict reflects deeper tensions within the Trump administration regarding the implications of newly announced tariffs that are affecting the auto industry, highlighting Musk’s unique position as both a business leader and a political figure.

As the spat escalates, Kimbal Musk, Elon’s brother and Tesla board member, has also joined the conversation, criticizing the tariffs as detrimental to consumers. Tesla’s recent financial struggles, including a drop in stock value and declining production figures, are magnifying the stakes of this verbal skirmish. This report delves into the key elements of the feud, the broader implications for Tesla’s operations, and the potential impact on the company’s future prospects.

| Article Subheadings |

|---|

| 1) Rising Tensions Between Musk and Navarro |

| 2) Impact of Tariffs on Tesla’s Business |

| 3) Musk’s Global Trade Perspective |

| 4) Tesla’s Recent Financial Struggles |

| 5) The Broader Implications of This Dispute |

Rising Tensions Between Musk and Navarro

The public feud between Elon Musk and Peter Navarro has become a talking point in the media as well as within political and business circles. The altercation was ignited when Musk took to social media platform X to criticize Navarro, stating that having a “PhD in econ from Harvard is a bad thing.” Musk’s complaints escalated when he described Navarro as “truly a moron” after Navarro claimed that Tesla is more of a “car assembler” than a manufacturer. Such comments have prompted Musk to call him “dumber than a sack of bricks,” revealing the intensity of their disagreement.

This tension is particularly notable as it marks one of the few visible schisms within the Trump administration since Trump assumed office. Not only is Musk a high-profile business figure, but he also occupies a significant political role as head of the controversial Department of Government Efficiency, which is engaged in overhauling federal regulations. This clash between Musk and Navarro illustrates not just personal differences, but also conflicting ideologies regarding economic policy and trade, leaving observers questioning the broader ramifications for the administration.

Impact of Tariffs on Tesla’s Business

The tariffs announced by President Trump have immediate implications for Tesla, as they could substantially alter the company’s operational costs. Currently, Tesla’s stock has seen a downturn of 22% over four consecutive trading days, with an alarming annual decline of 45%. Analysts have reported that these tariffs could lead to increased costs for Tesla, especially concerning materials sourced from international suppliers. Major components like U.S. steel and aluminum, which are primarily imported from Canada and Mexico, also face surcharges, potentially leading to higher production costs for vehicles manufactured in the U.S.

While Tesla’s domestic assembly gives it a competitive edge in weathering tariffs better than many international competitors, the company may find itself at a disadvantage due to the added costs of raw materials. Furthermore, with Navarro’s portrayal of Tesla’s operational model, questions about the company’s ability to maintain its innovative edge in light of rising costs become pressing. Musk’s vocal criticism of such tariffs suggests that any policy adjustments could have significant consequences for Tesla’s market position and profitability moving forward.

Musk’s Global Trade Perspective

In contrast to Navarro and Trump’s hardline approach to trade, Musk advocates for a strategy of free trade, notably articulating his vision for the U.S. and Europe to enter a “zero-tariff” arrangement. Speaking at an event in Italy, Musk indicated that fostering economic cooperation between regions could benefit both continents’ automotive industries. His remarks reflect a broader perspective that prioritizes market efficiency and international collaboration over isolationist policies, contrasting sharply with the current U.S. administration’s stance.

Musk’s interests in Europe are underscored by the existence of Tesla’s large manufacturing plant in Berlin, which represents a significant investment in one of the world’s leading automotive markets. Considering that Europe continues to be an essential market for Tesla’s growth, Musk’s comments highlight the intricate relationship between geopolitics and corporate strategy. His position on tariffs not only emphasizes the potential pitfalls of trade barriers but also indicates his desire to remain ahead of the competition in a rapidly evolving global industry.

Tesla’s Recent Financial Struggles

The backdrop to this feud is marked by troubling financial indicators for Tesla. On the first quarter earnings report, Tesla announced a significant 13% decline in year-over-year deliveries, which not only missed analysts’ projections but also marked a period of stagnation for the company. Coupled with the drop in stock value, these figures illustrate a challenging financial landscape for Tesla. Musk himself has seen substantial paper losses, amounting to over $585 billion in value since the year began.

These struggles are compounded by heightened scrutiny from shareholders and the public, especially in light of Musk’s political activism. Tesla faces an uphill battle to renew investor confidence as it works to navigate operational challenges while also dealing with external criticisms stemming from Musk’s public remarks and political entanglements. With the automotive market growing increasingly competitive, Tesla’s ability to rebound financially becomes ever more critical.

The Broader Implications of This Dispute

The public clash between Musk and Navarro sheds light on broader themes within the U.S. administration, particularly surrounding economic policy and the role that businesses play in political discourse. White House press secretary Karoline Leavitt remarked, “Boys will be boys,” indicating a somewhat dismissive view of the public disputes. However, these sparring matches hint at deeper divisions within the government’s approach to trade, particularly as it impacts the industries crucial to the American economy.

As Tesla, a flagship company in the electric vehicle space, grapples with these challenges, the responses from its leadership carry significant weight. The ongoing issue of tariffs, combined with the necessity of addressing internal concerns, positions Tesla in a precarious situation. As the conflict escalates, observers will be keenly monitoring whether this feud represents just the tip of the iceberg regarding future corporate-political relations.

| No. | Key Points |

|---|---|

| 1 | Elon Musk’s public feud with Peter Navarro highlights tensions within the Trump administration over trade policy. |

| 2 | Tesla has experienced significant stock declines and challenges tied to tariffs and market pressures. |

| 3 | Musk advocates for zero tariffs between the U.S. and Europe, contrasting Trump’s more restrictive approach. |

| 4 | Tesla is facing financial difficulties, including reduced deliveries and market capitalization losses. |

| 5 | The ongoing dispute raises questions about the balance between corporate influence and government policy direction. |

Summary

The clash between Elon Musk and Peter Navarro showcases not only personal animosities but also significant policy disagreements that could have widespread repercussions for the auto industry and the economy at large. As Tesla navigates these turbulent waters amidst falling stock prices and ongoing tariff challenges, the outcomes of this feud may influence the company’s trajectory in both the short and long term. As tensions within the Trump administration become more pronounced, the implications of this conflict could resonate beyond the immediate conflicting parties, shaping discussions related to trade and economic policies in the future.

Frequently Asked Questions

Question: How has Tesla’s stock been affected by recent events?

Tesla’s stock has decreased by 22% over the past four trading sessions and 45% for the year, leading to major paper losses for CEO Elon Musk.

Question: What was the nature of Musk’s disagreement with Navarro?

Musk criticized Navarro’s views on Tesla’s manufacturing capabilities, labeling him as “truly a moron” and declaring his statements as “demonstrably false.”

Question: What are the implications of new tariffs for Tesla?

New tariffs imposed by the Trump administration are likely to increase production costs for Tesla, as many materials are sourced from foreign suppliers, potentially impacting their pricing and profitability.