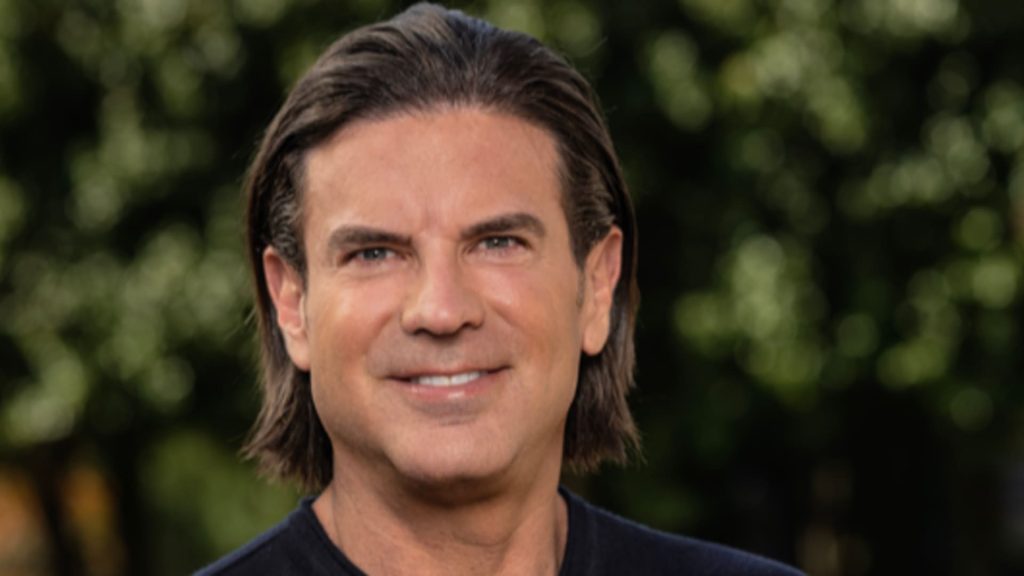

In an era where family offices are rapidly gaining prominence in the investment landscape, entrepreneur and family office founder David Adelman emphasizes their competitive edge over traditional venture capital and private equity firms. With assets exceeding $3 trillion, family offices are increasingly vying for startup investments and mergers. This shift presents unique advantages, including more expertise, flexibility, and enduring support for startups navigating turbulent economic climates. Adelman’s insights shed light on the evolving role of family offices as they not only seek to preserve wealth but also nurture innovative entrepreneurs.

| Article Subheadings |

|---|

| 1) The Rise of Family Offices in Startup Investments |

| 2) Advantages of Patient Capital |

| 3) Evaluating Startups: A Structured Approach |

| 4) Key Traits of Successful Investments |

| 5) The Future of Family Offices |

The Rise of Family Offices in Startup Investments

Family offices have seen a dramatic increase in their influence within the startup ecosystem. Spearheaded by individuals like David Adelman, who leads Darco Capital, these entities are challenging the status quo set by traditional venture capital (VC) and private equity firms. As of today, the collective assets under management by family offices have surpassed $3 trillion, showcasing their growing power in the financial sector.

Approximately half of family offices intend to invest in startups directly over the next few years, as revealed by a survey conducted by Bastiat Partners and Kharis Capital. This trend indicates a shift in strategy beyond merely preserving wealth for future generations. Instead, family offices aim to actively contribute to innovation and promote new business growth. This transition arises from a need for a more hands-on approach to fostering entrepreneurship.

Advantages of Patient Capital

A notable benefit of family offices is their ability to provide patient capital, as highlighted by Adelman. Unlike VC and private equity which often operate within rigid timelines and fund requirements, family offices can afford to take long-term views of their investments. “We’re there for the long haul,” said Adelman, explaining that their mission is to support startups through challenging times. Unlike traditional funds that may withdraw during downturns, family offices like Darco Capital remain committed to their portfolio companies.

During the COVID-19 pandemic, when many startups faced financial constraints, family offices extended vital support where big funds retreated. Adelman recounts providing low-cost lines of credit to distressed companies, emphasizing the essential role family offices played in stabilizing these ventures in turbulent times. “We were the last person standing,” he remarked, reflecting this supportive philosophy.

Evaluating Startups: A Structured Approach

Before launching Darco, Adelman recognized the need for a structured framework in assessing startup opportunities. His previous experiences with informal investments underscored the risks associated with investing solely on recommendations from friends. “I realized very quickly that it’s probably a money-losing prospect,” he admitted, advocating for a systematic evaluation process instead.

Darco Capital’s approach encompasses diverse sectors, with investments ranging from spirits and apparel to energy companies and sports teams. This diversification allows family offices not only to capitalize on emerging trends but also to create synergies among their holdings. By recognizing trends among young consumers, facilitated by his extensive real estate portfolio, Mendel aims to identify innovative products and brands that resonate with his clientele.

Key Traits of Successful Investments

When considering potential investments, one of the critical elements for Adelman is understanding the business model. “I will not invest in something I don’t understand,” he states, emphasizing the importance of thorough comprehension before committing funds. However, beyond business models, he emphasizes the significance of strong founders, or “jockeys,” in his investment strategy. This perspective is illustrated through his backing of women’s shoe company Margaux, driven primarily by his trust in its founders, Alexa Buckley and Sarah Pierson.

His investment philosophy not only prioritizes financial returns but also a commitment to the ethical and social impacts of his investments. Adelman seeks to partner with businesses that enhance financial wellness, particularly for underserved populations. For example, his support of cred.ai, a Philadelphia-based fintech, aims to improve financial literacy and stability among younger demographics, aligning with his vision of making a positive community impact.

The Future of Family Offices

As family offices evolve, they are increasingly characterized by a proactive investment style rather than a passive wealth management approach. Adelman advises prospective family office founders to critically assess whether they truly require a dedicated office, as numerous existing firms can provide essential investment services without requiring a complete in-house setup. “It’s often better to rent than to buy,” he notes, emphasizing that outsourcing certain services can yield favorable outcomes.

The trend towards direct investment in startups is likely to grow, driven by family offices’ unique capabilities to nurture emerging businesses and adapt to changing market dynamics. As they adopt more aggressive investment strategies, family offices will likely play a pivotal role in shaping the future of entrepreneurship across various industries.

| No. | Key Points |

|---|---|

| 1 | Family offices are gaining a competitive edge over venture capital and private equity firms. |

| 2 | These entities can provide patient capital, crucial during economic downturns. |

| 3 | A structured approach to evaluating startups is essential for successful investments. |

| 4 | Strong founders and ethical considerations play a key role in investment decisions. |

| 5 | Family offices are increasingly becoming proactive participants in the investment landscape. |

Summary

The emergence of family offices as valuable players in the startup investment arena is reshaping traditional financial landscapes. With an emphasis on patient capital and a structured approach to investment, leaders like David Adelman underscore the pivotal role these entities play in supporting entrepreneurial growth. By prioritizing social impact and fostering innovative startups, family offices not only preserve wealth but also actively contribute to community development. This shift could herald a new era wherein family offices redefine their purpose and approach in nurturing the next generation of businesses.

Frequently Asked Questions

Question: What are family offices?

Family offices are private companies that manage investments and wealth for high-net-worth families, focusing on long-term investment strategies.

Question: How do family offices differ from venture capital firms?

Family offices typically have more flexibility in their investment strategies and can provide patient capital, unlike venture capital firms that operate within strict timelines.

Question: Why is a structured approach vital in evaluating startups?

A structured approach allows family offices to systematically assess investment opportunities, minimizing risks associated with informal investment decisions and enhancing the likelihood of successful outcomes.