In a significant turn of events in the media landscape, David Ellison, CEO of Paramount Skydance, has found himself navigating unforeseen challenges following his push to acquire Warner Bros. Discovery. Initially sparking a bidding war that brought major players like Comcast and Netflix into play, Ellison’s strategy ultimately backfired as Netflix secured the coveted Warner assets for a staggering $72 billion. With Warner Bros. Discovery’s shares skyrocketing in value, the repercussions of this acquisition ripple through the entertainment sector, particularly affecting Paramount’s ambitions.

| Article Subheadings |

|---|

| 1) Zaslav’s Share in the Windfall |

| 2) Paramount’s Hostile Strategy |

| 3) The Competitive Landscape |

| 4) Future Prospects for Paramount |

| 5) Implications for the Media Industry |

Zaslav’s Share in the Windfall

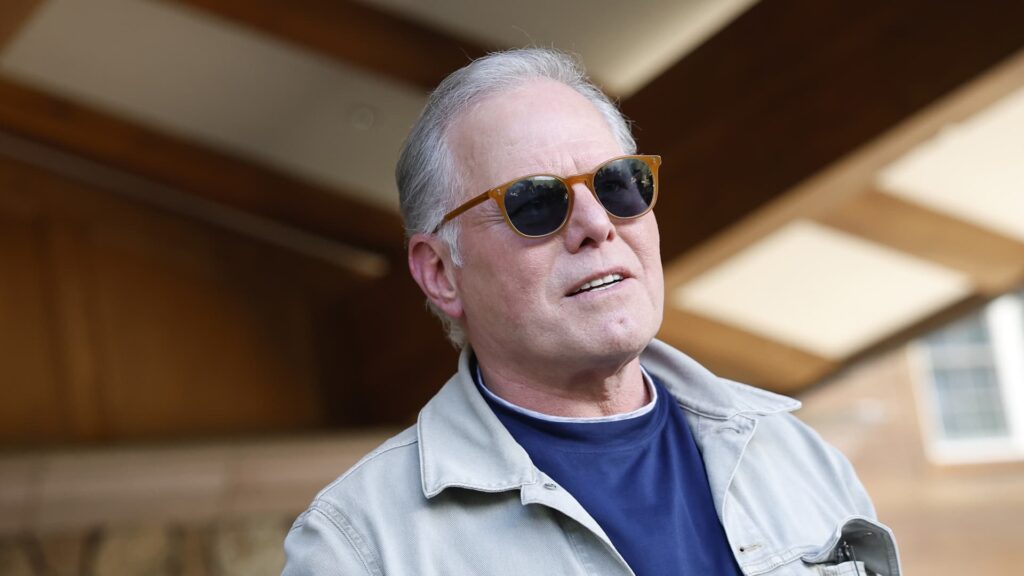

The recent acquisition of Warner Bros. Discovery by Netflix has turned the spotlight on David Zaslav, the company’s CEO, who stands to gain enormously from this deal. As of now, Zaslav owns over 4.2 million shares of Warner Bros. Discovery, with an additional 6.2 million shares set to be delivered to him in the future. According to reports, these stakes, when valued at the acquisition price of $27.75 per share, total more than $554 million for Zaslav. With additional shares expected in January, his total holdings could reach around $660 million.

Zaslav’s strategy appears to have paid off, particularly after initial concerns regarding the company’s performance following the merger of WarnerMedia and Discovery. On the day prior to the announcement, Warner Bros. Discovery’s shares were trading at approximately $12.54, reflecting a significant leap to over $25 following the transaction news. This robust share price reflects a recovery that vindicates Zaslav after years of criticism regarding his leadership.

Paramount’s Hostile Strategy

Under the leadership of David Ellison, Paramount has embarked on an aggressive pursuit of Warner Bros. Discovery assets. Shortly after the merger with Skydance, Paramount sought to solidify its position in the media industry. The strategy became even clearer when Paramount’s legal team claimed that Netflix was given an unfair advantage in the acquisition proceedings.

Paramount has publicly criticized the bidding process, alleging that Warner Bros. Discovery favored Netflix’s bid over its own all-cash offer of $30 per share. The company argues it was the only bidder willing to acquire the entirety of Warner’s assets, including its film studio and streaming service. Paramount emphasizes that its proposal is superior, potentially offering more value to shareholders in the long run.

The Competitive Landscape

The acquisition of Warner Bros. Discovery has seemingly reshaped the competitive landscape in the media industry. With both Netflix and Paramount vying for an edge, gamesmanship has intensified. Notably, Netflix had initially extended a bid of $27 per share, surpassing Paramount’s original proposal. This shift triggered a domino effect, leading to an accelerated sale process that dramatically increased the value of Warner Bros. Discovery shares.

Industry experts point out that the frenzy for these assets is reflective of the broader trend in media consolidation, where companies seek to bolster their content libraries and streaming platforms to compete with giants like Amazon and Disney. The outcome of this acquisition has set a precedence for future mergers and acquisitions within the industry.

Future Prospects for Paramount

Despite its initial setbacks, Paramount is rumored to be contemplating its next steps to secure a better footing in the media realm. Insiders indicate that the company may consider presenting an improved bid to the shareholders or directly to Warner Bros. Discovery, with the possibility of revising its earlier offer, which could exceed $30 per share. Paramount’s drive to return to the negotiating table illustrates its commitment to solidifying its presence in an evolving industry.

The stakes have become even higher, with Paramount looking to leverage its position as the only bidder interested in acquiring Warner Bros. Discovery in its entirety. As the situation develops, the competition between Paramount and Netflix will likely intensify, with further implications for shareholders and the overall dynamics of the media market.

Implications for the Media Industry

The outcome of the Warner Bros. Discovery acquisition holds profound implications for the future of the media industry. As streaming services continue to rise in prominence, mergers such as this serve to enhance competition while simultaneously reshaping consumer choices. Analysts point to a growing trend where large conglomerates aggressively pursue diversified content portfolios to capture larger audiences.

Furthermore, with the rapid evolution of media consumption patterns and the ongoing scrutiny regarding regulatory practices, the outcomes of these acquisitions could affect how future transactions are structured. Paramount’s pursuit reflects a broader ambition in the industry to consolidate power while addressing shareholder concerns regarding returns and profitability.

| No. | Key Points |

|---|---|

| 1 | David Ellison’s push for Paramount to acquire Warner Bros. Discovery unintentionally sparked a bidding war. |

| 2 | Netflix successfully acquired Warner Bros. Discovery for $72 billion, significantly increasing its market position. |

| 3 | Zaslav stands to gain over $554 million from the acquisition, vindicating his leadership amid previous criticisms. |

| 4 | Paramount’s aggressive strategy included challenging the fairness of the bidding process and seeking to make another bid. |

| 5 | The acquisition has implications for future media consolidation, shaping competitive dynamics and shareholder value. |

Summary

The unfolding saga of Paramount Skydance’s failed acquisition of Warner Bros. Discovery not only highlights the intricacies of modern media mergers but also casts a spotlight on the competitive landscape. As Netflix emerges as a dominant player through this acquisition, the ramifications for Paramount underline the complexities and risks inherent in high-stakes negotiations. Ultimately, this situation presents crucial lessons for both industry leaders and stakeholders who navigate the evolving terrain of entertainment.

Frequently Asked Questions

Question: What triggered the bidding war for Warner Bros. Discovery?

The bidding war was initiated when Paramount Skydance, led by CEO David Ellison, expressed interest in acquiring Warner Bros. Discovery, prompting major players like Netflix and Comcast to enter the fray.

Question: How much did Netflix pay for Warner Bros. Discovery?

Netflix acquired Warner Bros. Discovery for $27.75 per share, amounting to an equity value of approximately $72 billion.

Question: What implications does this acquisition have for shareholders?

The acquisition significantly increased the value of Warner Bros. Discovery shares, leading to substantial gains for its shareholders, who saw stock prices double following the announcement.