Senate Republicans have unveiled significant aspects of proposed legislation aimed at enacting President Trump’s second-term agenda. This sweeping bill marks a pivotal moment, as it focuses on alterations to tax and Medicaid provisions that initially passed in the House. While the Senate GOP aims for swift progress this week, unresolved issues could delay sending the bill to the President by their target deadline of July 4.

| Article Subheadings |

|---|

| 1) Medicaid and Provider Taxes Proposed Changes |

| 2) State and Local Tax Deduction (SALT) |

| 3) Increase in the Debt Ceiling |

| 4) Tax Provisions on Tips and Other Areas |

| 5) Legislative Timeline and Implications |

Medicaid and Provider Taxes Proposed Changes

Senate Republicans have introduced significant adjustments to Medicaid funding, primarily through the modification of provider taxes. The proposal seeks to reduce the provider tax rate from 6% to 3.5% by the year 2031. This tax is crucial for states as it aids in covering their share of Medicaid costs. In contrast, the current House bill proposes to freeze these provider taxes at existing rates, emphasizing a prohibition on the establishment of new provider taxes.

Key elements of the proposed alterations have raised concerns among several GOP senators. These individuals have expressed that the changes could lead to detrimental consequences for rural hospitals, vital care centers that rely heavily on Medicaid funding. For instance, Republican Senator Josh Hawley of Missouri voiced his alarm regarding the cuts, asserting that the proposal signifies a “major departure” from the House legislation. He elaborated on the potential negative ramifications, highlighting, “This is a whole new system that is going to defund rural hospitals effectively.”

Given the importance of Medicaid funding for rural areas, Hawley’s concerns reflect the wider apprehension among lawmakers. The decision to lower the provider tax could disrupt the fiscal stability of many healthcare providers, especially those serving vulnerable populations in rural communities. If significant amendments are not made, it is likely that the bill could face opposition from key Senate members.

State and Local Tax Deduction (SALT)

The Senate version of the bill proposes to permanently extend the $10,000 cap on state and local tax deductions, commonly referred to as SALT. This proposal diverges sharply from the House bill, which aims to increase the SALT deduction limit to $40,000 for households earning up to $500,000. The contrasting provisions have set the stage for potential resistance from House Republicans, especially those from states where residents are significantly impacted by these tax caps.

House Speaker Mike Johnson, a Republican from Louisiana, had previously indicated that many House members would not support the bill without an increase in the SALT deduction cap. Their stance has only heightened the tensions surrounding the negotiations, as some members deem extending the cap at $10,000 inadequate. Jeopardizing support from House Republicans could result in challenges for Senate negotiators as they work to finalize the proposal.

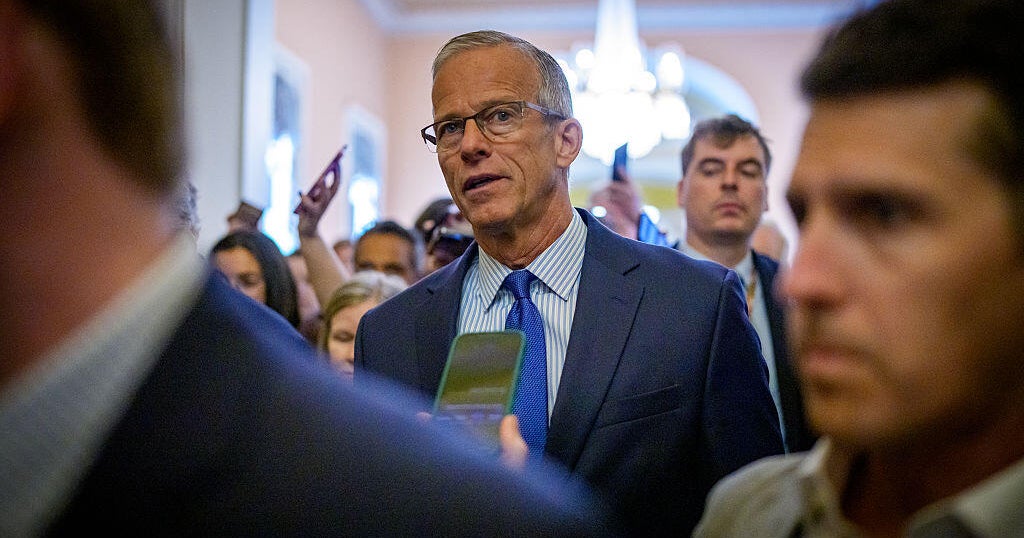

Senate Majority Leader John Thune (R-SD) underscored the necessity for compromise, stating that the $10,000 cap serves as a foundation for negotiation. He conveyed optimism regarding discussions with colleagues in the Senate, aiming to secure a solution that could meet the expectations of the House Republicans. Senator Markwayne Mullin (R-OK) added his agreement, declaring that the figure is merely a starting point, emphasizing the openness to negotiation on every aspect of the bill, including SALT.

Increase in the Debt Ceiling

Another contentious element of the proposal is the call for a substantial increase in the debt ceiling by $5 trillion, surpassing the House’s limit by $1 trillion. This significant rise has elicited criticism, notably from Republican Senator Ron Johnson of Wisconsin, who articulated his opposition to such a large increase. He remains skeptical that the necessary revisions can materialize by the self-imposed deadline of July.

The implications of raising the debt ceiling are notable as they could greatly affect the federal budget and economic policy moving forward. Several lawmakers are cautioning against the risks associated with further elevating the debt, expressing concerns that these measures may result in long-term financial repercussions.

Tax Provisions on Tips and Other Areas

The Senate’s legislative package includes pivotal tax reforms, such as the elimination of taxes on tips, overtime, and auto loan interest. Alongside this, the bill aims to make tax cuts enacted during Trump’s first term permanent, presenting a significant policy shift for both businesses and consumers. However, amid these tax cuts, changes to child tax credits have also been proposed, with the Senate version suggesting an increase to $2,200; however, this is $300 less than the proposed increase from the House.

The proposed tax changes are part of a broader strategy to stimulate economic growth and alleviate the financial burdens on American families. Republican leaders view these reforms as essential for garnering wider support among constituents, particularly in the lead-up to the upcoming elections.

Legislative Timeline and Implications

As Senate Republicans look to fast-track the legislation, the timeline remains a crucial factor. The GOP leadership has articulated their goal of delivering the bill to the President by early July, but with only a few legislative days left, any delays could hinder their plans. Moreover, Senate Majority Leader Thune has expressed his intent to bring the budget agenda for a vote in the coming week.

If necessary, Thune has stated he is prepared to keep senators in Washington, D.C., over the Fourth of July recess to ensure advancement of the bill. The urgency is palpable as some members within the GOP have raised concerns regarding the ability of the Senate to finalize the bill before the imposed deadline. The potential repercussions of this short timeline are significant; if delays occur, they may prompt political ramifications within the party as unity becomes increasingly essential for passing the legislation.

| No. | Key Points |

|---|---|

| 1 | Senate Republicans are redrafting significant aspects of legislation to advance President Trump’s agenda. |

| 2 | Proposed cuts to Medicaid funding have raised concerns among several Republican senators regarding rural healthcare. |

| 3 | The Senate version proposes a permanent cap on SALT deductions at $10,000, sparking discontent among House Republicans. |

| 4 | There is a proposed $5 trillion increase in the debt ceiling amid concerns about long-term financial implications. |

| 5 | The urgency of passing the legislation is underscored by Senate Majority Leader Thune to meet the set deadlines. |

Summary

The ongoing legislative developments led by Senate Republicans present significant alterations to key areas of tax and healthcare policy. With pivotal debates surrounding Medicaid funding cuts, SALT deductions, and the increase in the debt ceiling, the decisions made by lawmakers could have profound implications for various sectors. The urgency to finalize the bill by early July showcases the political dynamics at play, presenting a critical moment for the GOP as they navigate internal divisions and external pressures.

Frequently Asked Questions

Question: What are the proposed changes to Medicaid funding?

The Senate Republicans propose to reduce provider taxes used to fund Medicaid from 6% to 3.5% by 2031, which has raised concerns about potential funding losses for rural hospitals.

Question: How does the SALT deduction differ between the House and Senate proposals?

The Senate aims to permanently cap the SALT deduction at $10,000, while the House proposes increasing this cap to $40,000 for households earning up to $500,000.

Question: What is the significance of the proposed $5 trillion debt ceiling increase?

This proposed increase is intended to allow for more federal borrowing but has faced criticism from some Republicans who are concerned about its potential long-term fiscal implications.