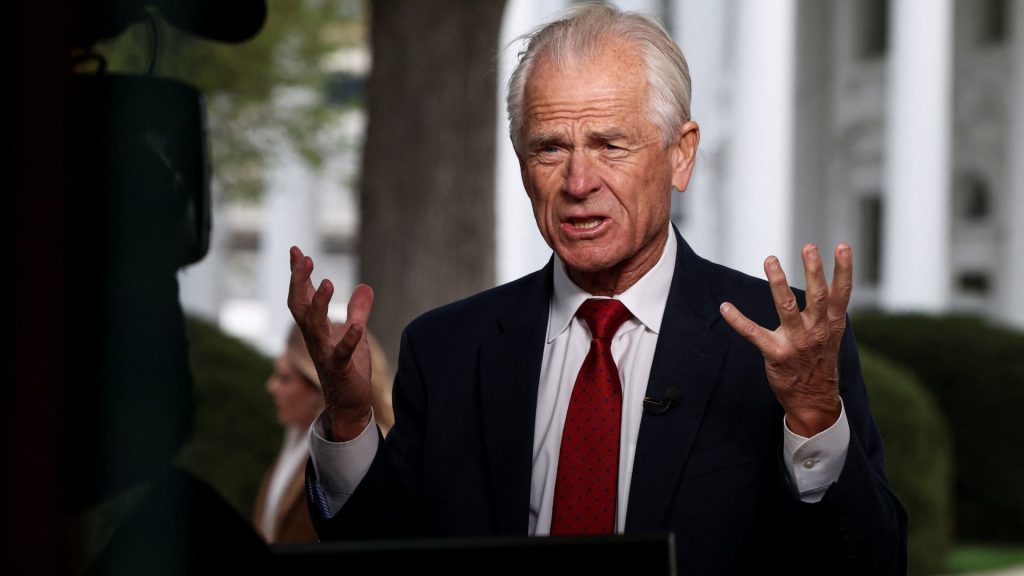

In recent developments regarding the U.S. stock market, Senior Trade Adviser Peter Navarro has expressed optimism amid ongoing volatility and fears of economic downturn. Following a significant drop in the stock indices, Navarro urged Americans to invest in stocks, placing his faith in President Donald Trump‘s proposed tax cuts and potential trade agreements. His remarks coincided with the backdrop of fluctuating market conditions and skepticism from financial leaders, raising questions about the advisability of adhering to Navarro’s bullish predictions.

| Article Subheadings |

|---|

| 1) Navarro Encourages Stock Purchases Amid Market Concerns |

| 2) Market Response to Navarro’s Optimism |

| 3) Critique of Financial Leaders and Institutional Giants |

| 4) Recent Market Trends and Economic Indicators |

| 5) Future Projections and Economic Strategies |

Navarro Encourages Stock Purchases Amid Market Concerns

In a surprising turn of events amidst significant fluctuations in the stock market, Senior Trade Adviser Peter Navarro made an impassioned appeal for Americans to invest in stocks. His comments came directly after a sharp drop in market indices, which left many investors anxious about the potential fallout from ongoing trade tensions. Addressing the media, Navarro characterized the market setback as “no big deal,” attributing the volatility to overreactions by investors rather than any fundamental weaknesses in the economy.

Navarro’s underlying belief hinges on the anticipated benefits of President Donald Trump‘s proposed tax cuts and broader economic reforms. He asserted that these initiatives would inevitably steer the market towards recovery and growth. In his conversation with financial commentators, he claimed, “Ninety deals in ninety days, biggest, broadest tax cut in American history should be driving the tape,” indicating that such measures would forge a bullish market. The timing of his call for stock investment, positioned just after a market downturn, highlights a strategic effort to reassure a jittery public about the future performance of their investments.

Market Response to Navarro’s Optimism

The stock market’s immediate response to Navarro’s pronouncements has been mixed, reflecting a broader skepticism among analysts and investors. Following Navarro’s public advice, the benchmark S&P 500 index closed significantly lower, having shed 12.5% since President Trump resumed office. Despite Navarro’s confidence and his encouragement for investors to remain in the market without panic, many remain cautious. The dips and surges in stock prices over recent days leave room for uncertainty surrounding the promised tax cuts and their actual implications on market performance.

This ambiguous climate was further complicated by a prior statement from Trump urging investors to “BE COOL!” and directing them to see the market drop as an opportunity for buying. Such contrasting signals create a complex environment where investor confidence is simultaneously buoyed and challenged. Observers noted that the flurry of opinions from economic advisors like Navarro and Trump might be interpreted as reactions to immediate market conditions rather than as assessments of long-term economic health.

Critique of Financial Leaders and Institutional Giants

Navarro did not hold back in his critiques of financial industry leaders, particularly directing some of his remarks toward JPMorgan Chase CEO Jamie Dimon. While highlighting the difficulties faced by everyday investors during times of volatility, Navarro claimed that Dimon’s firm profited significantly amid the ongoing uncertainty. “Jamie Dimon, while he’s wringing his hands about all this, his firm made out like bandits trading on the volatility,” Navarro remarked, suggesting that large financial institutions may exploit market fluctuations for their gain at the expense of smaller investors.

His insistence that small investors should remain grounded, maintain their portfolios, and avoid external pressure from major players indicates a wider concern for the equity of market practices. Navarro’s sentiments suggest a populist approach that resonates with average investors who might feel pushed to react hastily in turbulent economic times. His commitment to protect smaller investors from potential losses reflects broader discussions regarding the structure and ethics of financial markets during economic uncertainty.

Recent Market Trends and Economic Indicators

The recent pullback in stock indices, which included a notable drop of 3.46% in the S&P 500 and a loss of 1,000 points in the Dow Jones Industrial Average, is tied closely to ongoing economic indicators surrounding tariffs and fiscal policy. Analysts have suggested that Trump’s introduction of elevated tariffs on a range of imports, particularly from China, contrasts sharply with his calls for economic growth and stock market stability.

The volatility in the market raises questions about the interconnectedness of trade policies and investor sentiment—patterns that typically dictate market behavior. As observed during the rapid swings of the previous week, investor confidence can quickly fade as geopolitical uncertainties rise. Observers noted that while Navarro and his peers attempt to frame Economic policies in a positive light, external economic forces can and will shape market realities that investors must navigate.

Future Projections and Economic Strategies

Looking ahead, the future projections of the U.S. stock market remain uncertain and subject to a wide array of influences. Navarro’s declaration of an impending economic boom suggests a bullish outlook that isn’t universally accepted among analysts, who highlight significant risks that accompany rapid trade changes. While Navarro claimed that the smart strategy for investors is to stay in, particularly in light of the forecasted economic improvements, many ponder the viability of such advice.

The forthcoming weeks will be critical for evaluating the success of Trump’s tax plans and future trade negotiations, as they hold the key to realigning investor sentiments. The convergence of fiscal policy, trade relations, and investor behavior will likely shape the market trajectory and ultimately define the economic landscape well into the future. Critics will likely continue to scrutinize the validity of overly optimistic projections against the backdrop of actual economic performance and market realities.

| No. | Key Points |

|---|---|

| 1 | Peter Navarro encourages stock purchasing despite market volatility. |

| 2 | Navarro links optimistic market predictions to Trump’s proposed tax cuts. |

| 3 | Navarro criticizes large financial firms while defending small investors. |

| 4 | Recent market trends show significant volatility in response to tariff policies. |

| 5 | Future market stability depends on successful implementation of fiscal reforms and trade agreements. |

Summary

The current dialogue surrounding the U.S. stock market emphasizes a stark divide between optimistic government viewpoints and the cautious hesitations of investors and analysts. While Peter Navarro encourages confidence amid uncertainties and advocates for continued investment, significant economic indicators and reactions from major financial players underline an intertwined market narrative fraught with potential pitfalls. As reform strategies unfold, the investment landscape will continue to shift, necessitating close attention from all market participants.

Frequently Asked Questions

Question: What was Peter Navarro’s primary message regarding stock investments?

Peter Navarro urged Americans to buy stocks, suggesting that current market volatility was overblown and that long-term growth driven by Trump’s tax cuts would benefit investors.

Question: How did the stock market respond to Navarro’s comments?

The stock market experienced fluctuations, with significant drops following Navarro’s comments, reflecting investor caution amid ongoing economic uncertainties.

Question: What concerns did Navarro express regarding large financial institutions?

Navarro criticized large financial firms, particularly JPMorgan Chase, for profiting from market volatility and expressed a desire for small investors to protect their portfolios against such influences.