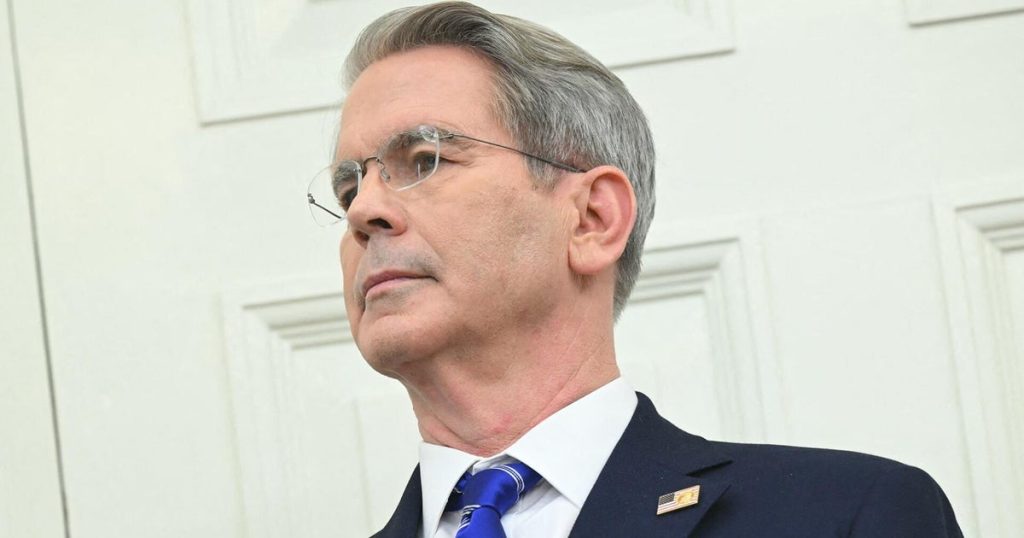

On Wednesday, Scott Bessent, the U.S. Treasury Secretary, indicated potential progress in trade relations between the United States and China, suggesting an opportunity for a significant agreement could emerge. Speaking at the Institute of International Finance in Washington, D.C., Bessent emphasized that the Trump administration aims to rebalance the U.S. economy, shifting toward a more robust manufacturing sector, while pushing China to address its reliance on export-driven growth. Bessent’s remarks coincide with increased tensions, as China has recently raised its tariffs on U.S. goods, creating new concerns in the ongoing trade dispute.

| Article Subheadings |

|---|

| 1) U.S. and China Trade Relations: Current Landscape |

| 2) Treasury Secretary’s Vision for Economic Rebalancing |

| 3) Implications of Increased Tariffs |

| 4) The Role of International Financial Institutions |

| 5) Market Reactions and Future Outlook |

U.S. and China Trade Relations: Current Landscape

Recent developments in U.S.-China trade relations have been marked by escalating tensions, culminating in a significant tariff exchange. The Trump administration’s decision to impose tariffs on numerous Chinese imports has led to retaliatory actions from Beijing, including increased levies on U.S. goods. As of this month, China’s tariffs on American products have soared to 125%, matching the tariffs placed by the U.S. on Chinese imports. The complexities of this trade war have raised concerns regarding its impact on the global economy, given that the two nations represent the largest economies in the world.

Treasury Secretary’s Vision for Economic Rebalancing

In his keynote address, Scott Bessent articulated the Trump administration’s intent to encourage a shift in China’s economic model. Bessent argued that China’s reliance on export-led growth is not only unsustainable but detrimental to both its economy and that of the wider international community. He reiterated that it is crucial for China to implement changes aligned with a more balanced approach to growth—one that reduces reliance on exports while enhancing domestic consumption. This change is viewed as an essential step in achieving economic stability not just for China but for the global economy as well.

Implications of Increased Tariffs

The hike in tariffs has created a climate of uncertainty for businesses and consumers in both nations. As tariffs on goods rise, costs typically get passed on to consumers, leading to an increase in prices for everyday items. The intensified trade war has raised questions about its long-term effects on investment, economic growth, and consumer behavior. Recent reports suggest that potential relief may be on the horizon, as discussions about slashing tariffs have gained traction. Bessent’s statements imply an awareness of the need to de-escalate pressure on both sides, indicating a willingness to explore diplomatic avenues for resolution.

The Role of International Financial Institutions

During his address, Bessent also focused on the necessity for reform within key international financial institutions, specifically the International Monetary Fund (IMF) and the World Bank. He contended that these institutions must evolve to effectively fulfill their original missions. Bessent emphasized that the IMF ought to assess its success based on economic stability and growth rather than the volume of loans disbursed. He urged the World Bank to clarify its goals, eschewing vague commitments in favor of actionable plans for reform. This call for change underscores the need for financial institutions to adapt to the realities of the current global economic landscape.

Market Reactions and Future Outlook

In light of Bessent’s remarks about potential easing of trade tensions, the stock market responded positively, registering a sharp rise. Investors have been closely monitoring the trade dispute, as developments directly influence their market strategies. Moreover, President Trump‘s recent comments about retaining Federal Reserve Chair Jerome Powell have contributed to a more stable investment environment. Observers now speculate on the implications of a potential agreement in trade discussions and how it could shape economic conditions in the forthcoming months. The ongoing diplomatic engagements could either lead to a cohesive resolution or prolong the trade war, with significant consequences for both economies.

| No. | Key Points |

|---|---|

| 1 | Scott Bessent indicates an opportunity for a significant trade deal between the U.S. and China. |

| 2 | The Trump administration seeks to shift the U.S. economy towards a stronger manufacturing base. |

| 3 | Increased tariffs on both sides have resulted in significant financial implications for consumers and businesses. |

| 4 | Bessent calls for reform in the IMF and World Bank to restore their effectiveness in a changing economic landscape. |

| 5 | The stock market has reacted positively to news of possible de-escalation in trade tensions. |

Summary

The statements made by Treasury Secretary Scott Bessent suggest a pivotal moment in U.S.-China trade relations, with a potential opportunity for a comprehensive agreement on the horizon. The emphasis on rebalancing both economies reflects a growing recognition of the need for sustainable growth models. As both nations grapple with the consequences of the ongoing trade war, the call for reform within international financial institutions signals a broader need for a strategic shift in global economic policies. Stakeholders will be closely watching for signs of progress in ongoing discussions that could shape the future economic landscape.

Frequently Asked Questions

Question: What are the current tariff rates between the U.S. and China?

Currently, China has increased its tariffs on U.S. goods to 125%, while tariffs imposed by the U.S. on Chinese imports can rise as high as 145% for certain products.

Question: What is the main goal of the Trump administration regarding China’s economy?

The Trump administration aims to encourage a shift in China’s export-driven economic model towards a more balanced growth strategy, focusing on increasing domestic consumption.

Question: How have international financial institutions been criticized in light of recent economic discussions?

Critics, including Treasury Secretary Bessent, argue that international financial institutions like the IMF and World Bank have strayed from their core missions, suggesting that they must reform to remain effective in promoting global economic stability.