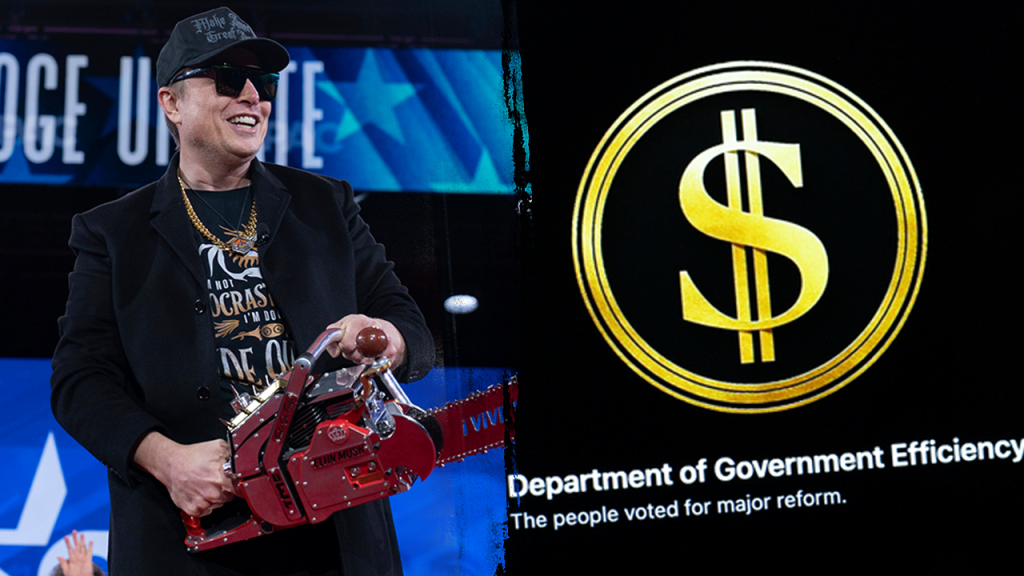

The Department of Government Efficiency (DOGE) has unveiled significant findings regarding questionable loan distributions made by the Small Business Administration (SBA). Under the stewardship of Elon Musk, DOGE discovered that nearly 5,600 loans, totaling over $312 million, were issued to individuals aged 11 and younger during the tumultuous years of the COVID-19 pandemic. This revelation has sparked a conversation about accountability and oversight within federal funding structures. Furthermore, the agency is now working in collaboration with the SBA to rectify these irregularities while planning broader strategies to reduce waste and fraud in government spending.

| Article Subheadings |

|---|

| 1) Overview of Loan Irregularities Identified by DOGE |

| 2) Analysis of Loans Granted to Minors |

| 3) Implications of Musk’s Leadership in Government Efficiency |

| 4) Congressional Concerns and Response to Findings |

| 5) Future Actions and Strategies to Combat Waste |

Overview of Loan Irregularities Identified by DOGE

The DOGE, under the oversight of Elon Musk, announced a staggering number of irregularities concerning loans disbursed by the Small Business Administration (SBA) during the pandemic. This initiative aims to identify and eliminate waste, fraud, and corruption within federal programs. A critical focal point of this investigation has been the alarming issuance of loans to individuals as young as 11 years old, amounting to over $312 million collectively. These findings have emerged from a broader review initiated in response to calls for greater financial accountability in government operations.

The loans in question were reportedly issued between 2020 and 2021, a period marked by the urgent need for financial assistance due to the COVID-19 pandemic. The reported cases raised serious concerns about the legitimacy of these loans, as regulatory safeguards and criteria may have been bypassed. The announcement from DOGE indicated a proactive approach to rectify these issues through audits and cooperative efforts.

Analysis of Loans Granted to Minors

The DOGE’s discovery that loans were granted to minors has triggered a discussion regarding the integrity of the SBA’s lending processes. With nearly 5,600 loans issued to individuals aged 11 and younger, the agency emphasized that securing appropriate business arrangements at such a young age is highly unlikely. Many loans were reportedly issued with Social Security Numbers (SSNs) linked to inappropriate or incorrect identities, thereby compounding the suspicion surrounding their validity.

The loans, categorized under various federal assistance programs like the Paycheck Protection Program (PPP) and Economic Injury Disaster Loans (EIDL), reportedly lacked the critical documentation that would generally accompany such significant financial transactions. The initiative underscores the urgent need for enhanced regulatory mechanisms to prevent similar incidents in the future and ensure that government assistance is reaching legitimate entities in genuine need.

Implications of Musk’s Leadership in Government Efficiency

Elon Musk’s leadership of DOGE marks a shift towards a more aggressive stance on waste reduction and government efficiency. His role has been described as transformative, with a focus on identifying areas ripe for financial recovery and accountability. During recent discussions, Musk emphasized the necessity of an upward review of federal spending practices, promoting a culture of fiscal responsibility and transparency.

This new management approach is characterized by prioritizing efficiency over complacency. DOGE, under Musk, is determined to establish a framework for proactive audits of federal funding mechanisms, thereby allowing for corrective actions to be taken on identified patterns of abuse. As this initiative unfolds, it could set a precedent for future administrations to adopt similar practices aimed at enhancing government integrity.

Congressional Concerns and Response to Findings

Congressional leaders have expressed serious concern regarding the findings related to the SBA’s lending practices. The revelations have prompted a bipartisan response, calling for immediate hearings to address the issues raised by the DOGE audit. Transparency and accountability have become focal points of the discussion, with legislators advocating for comprehensive reforms to safeguard against malpractice in federal lending.

Some lawmakers have praised DOGE’s findings as a necessary step in reestablishing faith in federal oversight. They noted that while financial assistance programs are intended to support small businesses and vulnerable populations, the integrity of these initiatives can easily be undermined if proper controls are not firmly in place. The bipartisan appeal for legislative measures to bolster oversight reflects a shared understanding of the potential consequences of unchecked government waste.

Future Actions and Strategies to Combat Waste

In response to the alarming findings regarding loan distributions, DOGE is implementing strategies designed to combat waste and bolster accountability. As Elon Musk continues to engage with various factions in Washington, discussions have centered on how to secure up to $1 trillion in savings through streamlined operations and preventing further instances of fraud.

Future actions include re-evaluating existing contracts and funding agreements that have not yielded measurable outcomes. This involves a comprehensive review of federal agency expenditures, identifying excessive financial practices, and implementing policy changes tailored to instill greater oversight across various programs. A culture of efficiency is sought, one that not only identifies past mistakes but also sets forth a path towards sustainable governance.

| No. | Key Points |

|---|---|

| 1 | DOGE reveals that over $312 million in loans were granted to individuals aged 11 and younger. |

| 2 | Investigations raise questions about the legitimacy of these loans and their intended use. |

| 3 | Elon Musk’s leadership aims to overhaul accountability and efficiency in federal spending. |

| 4 | Congress plans to hold hearings to address the findings and push for reforms in federal lending oversight. |

| 5 | Future strategies focus on identifying $1 trillion in government waste and improving contract evaluations. |

Summary

The DOGE’s findings on fraudulent loans issued under dubious circumstances represent a significant challenge to the integrity of federal funding mechanisms. With Elon Musk at the helm, there is a renewed commitment to accountability, aiming to curb wasteful spending and improve the functionality of government assistance programs. The implications of this investigation extend beyond monetary concerns, representing a critical moment for government reform focused on transparency and efficiency in public service. The outcomes of upcoming congressional inquiries will likely shape federal oversight in spending for years to come.

Frequently Asked Questions

Question: What is the role of the Department of Government Efficiency (DOGE)?

The DOGE is responsible for identifying and eliminating waste, fraud, and corruption within federal government operations, focusing on improving overall efficiency.

Question: Why were loans issued to individuals aged 11 and younger?

These loans were granted during the pandemic under federal assistance programs, raising concerns about the validity and regulatory compliance of these transactions.

Question: What actions is the government taking in response to the findings?

The government is planning to conduct hearings in Congress and implement reforms aimed at enhancing oversight and preventing corruption in federal lending practices.