In the turbulent landscape of midday trading, several key stocks have experienced notable movements. The chipmaker Nvidia saw a surprising increase of more than 6% after suffering recent declines, while retail giant Target’s stock dropped approximately 3%, reflecting broader challenges in the consumer goods sector. Meanwhile, the online marketplace Groupon shone brightly with a staggering 39% surge following an optimistic revenue forecast. This article will delve into the performance of various major companies, exploring the factors influencing these stock fluctuations.

| Article Subheadings |

|---|

| 1) Nvidia’s Resurgence Amidst Market Volatility |

| 2) Target and Walmart: A Tough Day for Retail |

| 3) Groupon Surges on Positive Earnings Outlook |

| 4) Solar Sector Struggles: The Case of Sunrun |

| 5) Other Noteworthy Marketmovements |

Nvidia’s Resurgence Amidst Market Volatility

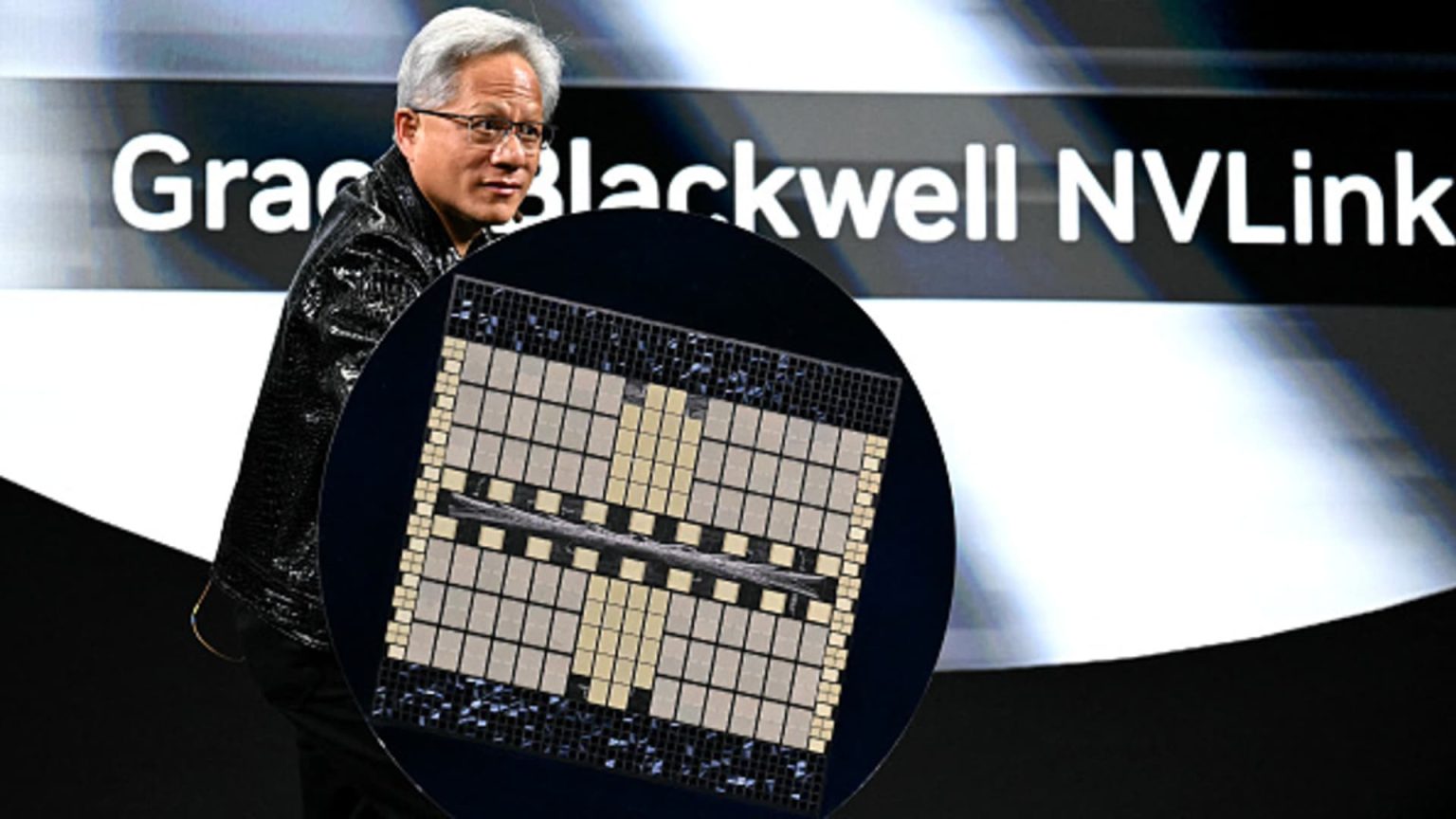

Nvidia, a prominent player in the semiconductor industry, has reported a remarkable rebound with stock prices rising over 6%. This increase comes after a stretch of difficulties, as the shares had previously experienced a decline of around 8% in March alone. Analysts point toward a variety of contributing factors for this sudden uptick, including renewed investor confidence in the company’s long-term viability.

The stock market is often influenced by broader economic indicators, and Nvidia’s recovery appears to mirror a more optimistic outlook for technology stocks in general. This shift can be attributed to a recent surge in demand for advanced computing and artificial intelligence solutions, which Nvidia is well-positioned to deliver. Speculation regarding potential upcoming product launches and growth in the gaming and data center markets may also have driven investor interest.

The timing of this resurgence is crucial, as it reflects a stark contrast to the overall downward trend observed in the market for early 2025. With tech stocks facing scrutiny from investors, Nvidia’s performance provides a glimmer of hope and reinforces the potential for rallying within the sector.

Target and Walmart: A Tough Day for Retail

In stark contrast to Nvidia’s fortunes, retail giants Target and Walmart faced significant losses. Target’s stock slipped nearly 3%, while Walmart saw a decrease of almost 2%. These declines come amidst a broader downturn in consumer defensive stocks, which typically perform well during uncertain economic periods.

The drop in Target’s shares may be linked to concerns regarding consumer spending amidst inflation and rising costs. Analysts suggest that consumer habits are shifting, impacting traditional retailers who rely heavily on foot traffic and in-store shopping. The ongoing economic shifts could be forcing consumers to prioritize essential purchases over discretionary spending, a trend that may continue, particularly as inflation persists.

Market analysts will be keeping a close eye on retail earnings reports in the coming weeks to gauge how these companies adapt to changing consumer behaviors and economic pressures. Additionally, competition from e-commerce platforms has intensified, further challenging brick-and-mortar stores.

Groupon Surges on Positive Earnings Outlook

In a shining example of positive market movement, Groupon’s stock soared more than 39% after the company projected its full-year revenue to be significantly higher than Wall Street expectations. The anticipated revenue is projected to fall between $493 million and $500 million, comfortably exceeding the analysts’ forecast of $491.5 million.

The surge in Groupon’s stock illustrates the market’s receptiveness to encouraging financial outlooks. This sharp increase could indicate rekindled investor interest in the company’s ability to rebound from previous struggles. Groupon has been working on enhancing its business model and diversifying its offerings, which may be paying off as it moves into a more stable recovery phase post-pandemic.

Groupon’s strong earnings forecast will likely influence broader market sentiments, suggesting that while some segments of the economy struggle, others are finding innovative paths to growth. Shareholders and analysts alike will be keen to monitor how the company’s upcoming performance aligns with these optimistic projections.

Solar Sector Struggles: The Case of Sunrun

The residential solar energy company, Sunrun, faced a difficult trading day, with shares plummeting about 7%. This downturn follows Jefferies’ decision to downgrade the stock from “buy” to “hold,” mainly due to concerns surrounding the sluggish recovery in the solar energy sector.

Investors have been wary of the solar market as uncertainties related to federal policies—especially the Inflation Reduction Act—linger. Analysts express concerns that regulatory changes could stifle growth opportunities and impact consumer adoption rates.

With Sunrun and similar companies navigating these challenges, market observers will look for signs of a potential turnaround in the solar industry. The effectiveness of government policies in stimulating green energy investments will also come under scrutiny as part of the broader discussion around climate change and energy sustainability.

Other Noteworthy Market Movements

The trading session also featured prominent shifts in other key stocks. Shares of Intel jumped over 3%, following reports indicating a potential joint venture proposal from TSMC with major U.S. chipmakers, including Nvidia and Advanced Micro Devices. This collaboration could significantly enhance Intel’s foundry operations, a critical area for growth.

On another front, Tesla’s stock rose approximately 7% after President Donald Trump publicly expressed intentions to purchase a Tesla vehicle. Additionally, recent recommendations from Morgan Stanley analysts advising investors to buy shares during the current dip contributed to this upward movement.

Elsewhere, PepsiCo saw a dip of nearly 3% after receiving a downgrade to “hold” at Jefferies, which raised concerns over its stagnant growth potential, particularly in the competitive U.S. beverage market. Conversely, Myriad Genetics rallied 7% following an upgrade to “overweight,” attributed to optimism surrounding new leadership.

| No. | Key Points |

|---|---|

| 1 | Nvidia’s stock rebounded over 6% after previous declines. |

| 2 | Target and Walmart stocks faced losses as consumer discretionary spending wanes. |

| 3 | Groupon’s stock surged 39% due to a positive revenue outlook. |

| 4 | Sunrun shares tumbled 7% after a downgrade by Jefferies. |

| 5 | Tesla and Intel saw significant increases due to positive news surrounding both companies. |

Summary

The stock market exhibited notable disparities during midday trading, with major companies like Nvidia and Groupon achieving remarkable gains, while retail giants like Target and Walmart suffered declines. The performance of these diverse stocks underscores the variety of factors at play in current market sentiment, ranging from consumer behavior shifts to optimism in technological advancements. As companies navigate these complex dynamics, ongoing analysis will be essential to understand how they adapt and potentially recover in the fluctuating economic landscape.

Frequently Asked Questions

Question: What factors contributed to Nvidia’s stock increase?

Nvidia’s stock rose largely due to renewed investor confidence in the company’s future, driven by increasing demand for its products in AI and gaming, as well as speculation about upcoming innovations.

Question: Why did Target and Walmart’s stocks decline?

The decline in Target and Walmart’s stocks is attributed to broader challenges in consumer spending, particularly as economic uncertainties cause customers to limit discretionary purchases.

Question: What led to Groupon’s substantial stock surge?

Groupon’s significant stock increase was due to its optimistic revenue forecasts, exceeding analyst expectations, which restored investor confidence in its growth prospects.