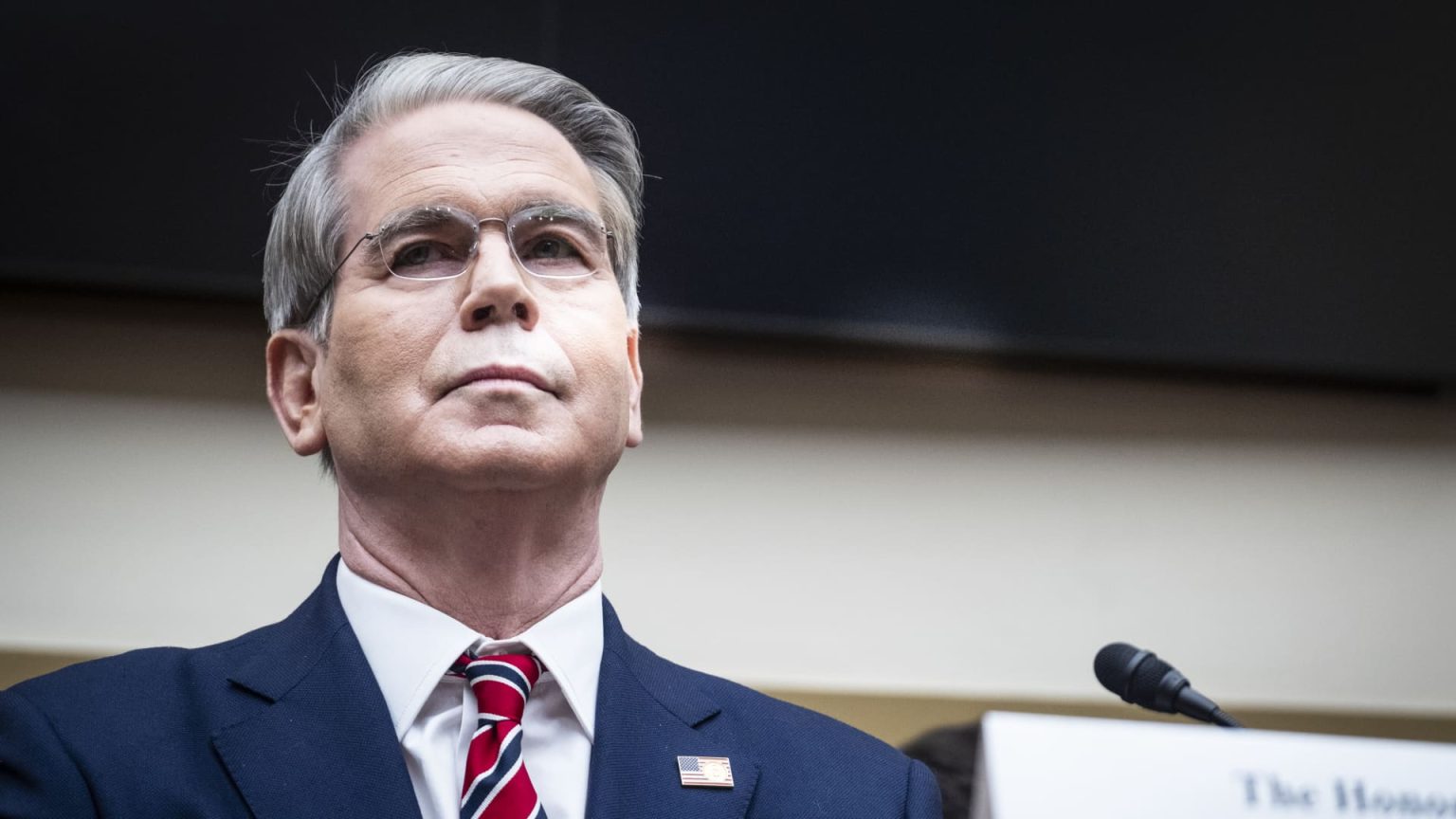

In recent comments on NBC News, Treasury Secretary Scott Bessent addressed the credit rating downgrade issued by Moody’s, calling it a “lagging indicator” of the U.S. economic situation. The downgrade from Aaa to Aa1 reflects a significant rise in government debt and interest payments, issues stemming primarily from the Biden administration’s spending policies. Bessent further discussed Walmart’s approach to tariffs and investments made during recent international trips, revealing the complexities of U.S. economic relations and business pressures.

| Article Subheadings |

|---|

| 1) Understanding the Credit Downgrade |

| 2) Impact of Tariffs on Retail |

| 3) Insights from Walmart’s CEO |

| 4) The Geopolitical Context |

| 5) Reactions from Political Figures |

Understanding the Credit Downgrade

The recent downgrade of the U.S. credit rating from Aaa to Aa1 by Moody’s Ratings has stirred considerable commentary among officials. Scott Bessent, the Treasury Secretary, characterized this move as indicative of past financial decisions rather than current policy directions. The downgrade, he explains, reflects over a decade of escalating government debt combined with rising interest payment ratios compared to similarly rated sovereign states. The key stakeholders—investors, economists, and policymakers—are now evaluating the implications of this downgrade for future financial stability and economic growth.

The crux of Bessent’s assertion lies in attributing the downgrade to the Biden administration’s spending initiatives, which have been positioned as long-term investments in critical areas such as healthcare and climate change. The administration’s rationale focuses on the anticipated economic benefits of these investments, yet critics argue that these spending levels have fundamentally strained the nation’s fiscal health. With the U.S. national debt standing at an unprecedented $36.22 trillion, the ramifications of this debt spiral continue to raise concerns about its sustainability in the long run, a point that Moody’s further clarifies through their recent downgrade.

Impact of Tariffs on Retail

In his interview, Bessent touched upon the ongoing issue of tariffs imposed during the previous administration. He noted that these tariffs exert significant pressure on retailers like Walmart, significantly affecting their pricing strategies. The Secretary underscored that companies often need to communicate the ‘worst-case scenarios’ during earnings calls, leading to heightened concerns about potential price hikes for consumers. This dialogue around tariffs is particularly poignant as rising material costs and global supply chain challenges have already strained the retail sector.

Bessent’s perspective sheds light on the intricate balancing act faced by retailers: absorbing costs versus passing them onto consumers. This is especially critical as inflationary pressures mount, and consumer confidence wanes. If retailers struggle to maintain affordability, we may witness a cascade of consequences, including a decline in consumer spending, which is essential for economic recovery. As the economy attempts to stabilize amidst these challenges, the role of tariffs in shaping market conditions cannot be understated.

Insights from Walmart’s CEO

During the discussion, Bessent referenced a phone conversation with Doug McMillon, the CEO of Walmart, highlighting the retail giant’s approach to handling tariff-related costs. McMillon had indicated Walmart’s historical precedence of absorbing some of the costs that tariffs impose, reflecting a commitment to keep prices low for consumers. This corporate strategy underscores the intersection between business ethos and economic realities—Walmart’s focus on maintaining competitiveness against a backdrop of rising costs is crucial as the nation grapples with economic uncertainty.

Additionally, this exchange sheds light on the broader implications of corporate strategy amidst government policy. While conversations on rates and tariffs are paramount, companies like Walmart are also navigating their operational strategies in this tumultuous economic climate. As such, Bessent’s remarks underscore the importance of direct communication between government officials and business leaders to better understand the evolving landscape of retail economics.

The Geopolitical Context

The conversation extended beyond domestic financial concerns to international relations, particularly addressing the investments and tariff negotiations surrounding the recent trip by the Biden administration to the Middle East. Bessent described discussions with leaders from Qatar and the UAE, implying that fruitful investment commitments were made, which could bolster economic ties. This geopolitical perspective is vital in comprehending how domestic economic policies intertwine with international relations and trade agreements.

Bessent articulated that nations reluctant to negotiate in good faith would face overdue tariffs reapplying at previously set rates. This stance indicates a firm approach to trade negotiations, suggesting that the administration seeks to leverage investments as a means to stabilize economic relations while promoting American interests abroad. In essence, the dealings made in the Middle East highlight a broader strategy to secure markets and involve multiple stakeholders within these complex financial agreements.

Reactions from Political Figures

Political reactions to Bessent’s comments and the broader situation have been polarized. Senator Chris Murphy, representing Connecticut, criticized Bessent’s remarks regarding the credit downgrade, emphasizing the serious repercussions that such a downgrade can trigger—namely, heightened risks of recession and increased interest rates. Murphy’s critique points to a growing concern among lawmakers about how economic policy choices affect average Americans and their financial prospects.

The backlash surrounding the discussion on both credit ratings and tariffs underscores a broader narrative of economic strategy—one that may be interpreted through various lenses, such as fiscal responsibility versus strategic investments. As public discourse continues to evolve, the impending impact of these policies on everyday individuals remains a core focus for both sides of the political aisle.

| No. | Key Points |

|---|---|

| 1 | Bessent labels Moody’s downgrade as a “lagging indicator” of economic conditions. |

| 2 | Moody’s cites escalating government debt as a key reason for the downgrade. |

| 3 | Walmart plans to absorb tariffs to avoid passing costs to consumers. |

| 4 | Bessent emphasizes the importance of direct communication between government and business leaders. |

| 5 | Political figures express concerns about the economic impact of the downgrade and tariffs. |

Summary

The dialogue surrounding the recent credit downgrade and tariffs illustrates a complex intersection of domestic and international economic policies. Treasury Secretary Scott Bessent provides a layered perspective on the health of the U.S. economy, contending with political critiques as he navigates through discussions of retail pressures and geopolitical commitments. The evolving dynamics remind both policymakers and the public that the economy’s trajectory relies heavily on prudent fiscal management and strategic international relationships.

Frequently Asked Questions

Question: What does Moody’s downgrade to Aa1 signify?

A downgrade to Aa1 indicates a decline in perceived creditworthiness, which could lead to higher borrowing costs for the government and impact economic growth.

Question: How might tariffs impact consumers directly?

Tariffs can lead to increased prices for goods as companies may pass the additional costs onto consumers, thereby affecting purchasing power and overall economic confidence.

Question: What role does effective communication between government and business leaders play?

Effective communication helps ensure that both parties understand economic challenges and collaborate on solutions, ultimately fostering a more stable economic environment.