Government forecasters have issued a warning for the 2025 hurricane season, indicating a 60% likelihood of above-average hurricane activity. The National Oceanic and Atmospheric Administration (NOAA) predicts there will be between 13 and 19 named storms, with six to ten expected to escalate into hurricanes, including three to five major hurricanes. Amid discussions surrounding climate science funding cuts, NOAA officials emphasize the agency’s commitment to safeguarding communities and improving disaster preparedness.

| Article Subheadings |

|---|

| 1) NOAA’s Forecast for Hurricane Season |

| 2) Impact of Recent Disasters |

| 3) The Insurance Industry’s Challenges |

| 4) Mitigation Efforts and Preparedness |

| 5) Lessons Learned Since Hurricane Katrina |

NOAA’s Forecast for Hurricane Season

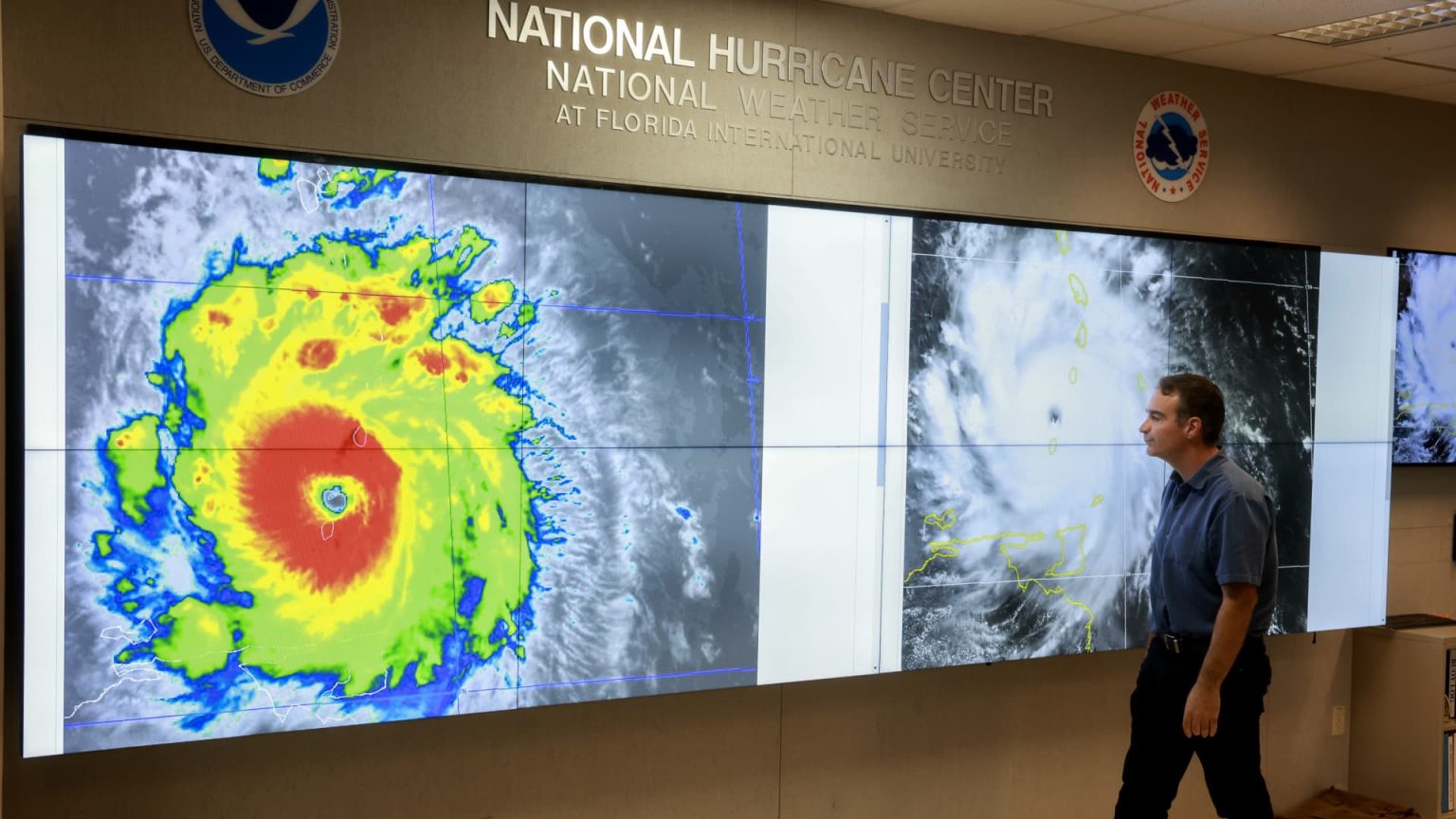

The National Oceanic and Atmospheric Administration (NOAA) has released its preliminary forecast for the 2025 hurricane season. According to the agency, which is responsible for monitoring and forecasting weather patterns, there is a 60% chance that the upcoming season will be above average. This prediction encompasses a range of 13 to 19 named storms, identified by winds that reach 39 miles per hour or greater. Of these storms, NOAA anticipates that six to ten will strengthen to hurricane status, and between three to five may escalate into major hurricanes categorized as Category 3 or above.

These projections come in the wake of past seasons, where changing climatic conditions have intensified hurricane formation and impacts. To reinforce its predictive capabilities, NOAA has invested in advanced meteorological technology and improved modeling techniques that have proven effective in recent years. The acting administrator of NOAA, Laura Grimm, highlighted these advancements during a press conference in Louisiana, underscoring the role that technological enhancements play in life-saving weather predictions.

Impact of Recent Disasters

In 2024, hurricanes Helene and Milton caused extensive damage, resulting in over $37 billion in insured losses, revealing the financial vulnerability of the property and casualty insurance sectors. This staggering figure underscores the growing risks posed by severe weather events and raises concerns about future storm impacts and insurance premiums. Industry analysts noted that despite the overall insured losses, the U.S. property casualty insurance market recorded its best underwriting performance since 2013. However, factors such as January wildfires in California threaten to complicate these gains.

Wildfires across California inflicted over $50 billion in estimated losses on insurers and reinsurers, representing a burgeoning threat from climate change. Additionally, the Midwest is bracing for accountability as it records increasing severe thunderstorms, with reports indicating a 35% rise in local tornado accounts compared to past years.

The Insurance Industry’s Challenges

The insurance industry continues to grapple with growing challenges fueled by climate change. Rising insured losses exacerbate the financial strains on companies as they seek to maintain affordable coverage options for homeowners. According to Bill Clark, CEO of a reinsurance analytics firm, rising reinsurance costs are at a noteworthy high for severe convective storm losses. This has left many insurers with limited options, distorting their capacity to transfer impending losses onto reinsurers, effectively hampering their financial flexibility.

As reported by the Insurance Information Institute, losses related to severe storms have topped $10 billion in the early part of the year, furthering concerns for the industry’s long-term viability. This looming crisis puts pressure on the industry to enhance risk management strategies while also urging state and local governments to initiate programs aimed at constructing resilience against escalating natural threats.

Mitigation Efforts and Preparedness

In response to the increasing frequency and severity of natural disasters, both the insurance sector and governmental entities emphasize the desperate need for effective mitigation strategies. This includes improvements in building codes, enhancements in public infrastructure, and comprehensive community planning designed to safeguard properties. The financial rationale is compelling; it’s estimated that every dollar invested in mitigation yields a $13 return in savings through disaster recovery.

The active collaboration between insurance companies and state agencies aims to boost community resilience through more robust disaster preparedness programs. Efforts are focused on establishing stronger building regulations and enhancing disaster response frameworks. These proactive measures not only aim at protecting property and lives but also intend to mitigate escalating insurance costs that years of climate risks might command.

Lessons Learned Since Hurricane Katrina

The 20th anniversary of Hurricane Katrina serves as a critical reminder of the lessons learned from one of the deadliest hurricanes in U.S. history. Following the hurricane’s devastation, which claimed nearly 1,400 lives, significant overhauls were undertaken to improve disaster response capabilities and infrastructure in Louisiana. Improvements included upgrades to levees, flood walls, and drainage systems, designed with lessons from past experiences in mind.

Local officials such as Cynthia Lee Sheng, president of Jefferson County Parish, emphasize the collaborative efforts that emerged after the disaster, resulting in more efficient inter-agency communication during crises. They argue that enhanced coordination among key government agencies has drastically altered disaster recovery strategies, ensuring streamlined assistance for affected communities. Reflecting on these changes, Sheng stated,

“It’s estimated that $13 is saved for every $1 spent on mitigation efforts.”

This commitment to learn from historical mistakes is vital for navigating future climate challenges.

| No. | Key Points |

|---|---|

| 1 | NOAA anticipates up to 19 named storms for the 2025 hurricane season. |

| 2 | Wildfires in California are a significant threat to the insurance industry. |

| 3 | Rising reinsurance costs are impacting the financial sustainability of insurers. |

| 4 | Investment in mitigation strategies provides substantial savings in recovery efforts. |

| 5 | The aftermath of Hurricane Katrina prompted significant infrastructure improvements in Louisiana. |

Summary

As the 2025 hurricane season approaches, NOAA’s forecast raises alarm over potential storm activity, marking an urgent need for improved preparedness measures as climate threats escalate. The insurance industry’s ongoing struggles with runaway losses highlight the pressing necessity for not only increased funding but improved resilience strategies in vulnerable areas. The examples set during post-Katrina recovery underscore the importance of proactive disaster planning, showcasing how lessons from the past may inform actions for the future.

Frequently Asked Questions

Question: What does NOAA predict for the 2025 hurricane season?

NOAA predicts a 60% chance of an above-average hurricane season, with forecasts ranging from 13 to 19 named storms and up to 10 hurricanes.

Question: How have recent disasters impacted the insurance industry?

Recent disasters like hurricanes and wildfires have resulted in significant insured losses, estimated over $50 billion from California wildfires alone, creating financial pressure on the insurance sector.

Question: What role does mitigation play in disaster recovery costs?

Investing in mitigation is crucial; it is estimated that each dollar spent on these strategies can save $13 in recovery costs, significantly improving community resilience.