Recent trading reports reveal significant movements in various industries, highlighting key companies that made headlines in midday trading. Electric vehicle manufacturer Tesla saw a drop in shares due to declining sales in several European countries. Meanwhile, advertising stocks took a hit following Meta Platforms’ announcement of plans to automate ads using artificial intelligence. In contrast, steel stocks surged after tariff hikes, and biopharmaceutical company Blueprint Medicines gained substantially after a major acquisition announcement.

| Article Subheadings |

|---|

| 1) Tesla’s Sales Decline in Europe |

| 2) Impact of AI on Advertising Stocks |

| 3) Steel Stocks Surge Following Tariff Increase |

| 4) Acquisition Boosts Blueprint Medicines |

| 5) Movements in Auto and Sports Betting Stocks |

Tesla’s Sales Decline in Europe

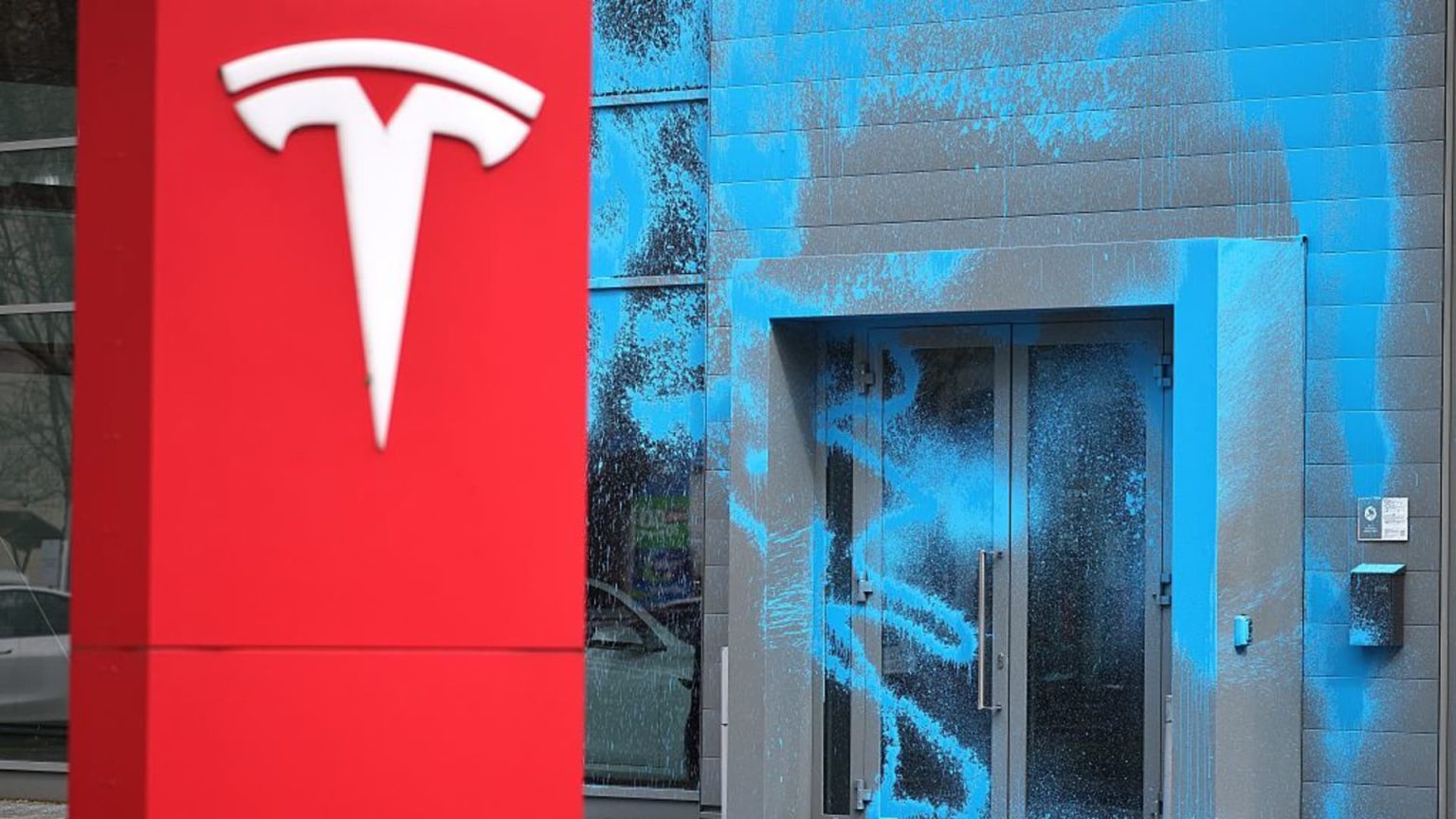

Tesla, the leader in electric vehicles, recently experienced a 3% drop in its share prices. This decline is attributed to dwindling sales reported in several key European markets. In countries such as Sweden, France, Spain, Denmark, and the Netherlands, Tesla’s sales showed a notable decrease, raising concerns among investors and analysts alike. The company, known for its innovation and market dominance, faces pressure as competition grows within the electric vehicle sector.

Specifically, the dip in sales in these regions could signal evolving consumer preferences, market saturation, or more formidable competition from local brands. However, there was a silver lining for Tesla in Norway, where sales reportedly improved, buoyed by the introduction of the revamped Model Y. This discrepancy in performance across different countries underscores the volatility Tesla experiences in foreign markets.

Impact of AI on Advertising Stocks

Advertising stocks have faced a downturn due to a significant announcement from Meta Platforms, the parent company of Facebook. The company plans to leverage artificial intelligence to automate its advertising processes fully by year-end. This strategic move has caused apprehension among advertising agencies, leading to a decline in their stock prices on Monday.

Specifically, shares of Omnicom Group fell by 4%, while both WPP and Interpublic experienced a decline of 2%. The report underlines the broader implications of AI on the advertising industry, raising questions about job security and the future of traditional marketing methods. As companies like Meta embrace automation, smaller firms in the advertising space fear they may struggle to compete effectively, given the potential cost reductions and efficiency gains that come with AI integration.

Steel Stocks Surge Following Tariff Increase

In a contrasting sector, steel stocks have seen a remarkable uptick following an announcement by President Donald Trump regarding tariffs on imported steel. The president has doubled tariff rates to an unprecedented 50%, leading to significant gains among domestic steel producers. Cleveland-Cliffs, for instance, experienced a surge of over 24% in its stock price, indicating a robust market reaction.

Both Nucor and Steel Dynamics also posted impressive increases of 10%, marking a general optimism surrounding the domestic steel industry. The decision to double tariffs is seen as a protective measure for U.S. manufacturers against foreign competition, and it likely signals a broader trend aimed at bolstering American production capabilities. Analysts suggest that while this might support U.S. firms, it may also lead to increased costs for consumers and businesses dependent on steel products.

Acquisition Boosts Blueprint Medicines

Another highlight in the stock market was the successful acquisition of Blueprint Medicines by Sanofi. Shares of Blueprint surged by 26% following this announcement, with the acquisition price set at $129 per share. The deal, valued at approximately $9.5 billion, marks a significant movement in the biopharmaceutical landscape, especially as companies scramble for innovative treatments and research opportunities.

The agreement illustrates the ongoing trend where larger pharmaceutical companies are seeking to expand their portfolios through acquisitions of smaller firms with promising pipelines. The increase in Blueprint’s stock price is seen as a clear validation of its worth and the expectations surrounding the future impact of its products. Conversely, shares of Sanofi saw a fractional decline, emphasizing the typical market reaction where the acquirer’s stock may not always see immediate gains post-announcement.

Movements in Auto and Sports Betting Stocks

The auto industry did not escape unscathed, as shares of major automakers declined after the announced tariff hikes on steel. Both General Motors and Ford saw their share prices tumble nearly 5%, while Stellantis experienced a 3.5% drop. These changes underscore the sensitive nature of the automotive sector to policy changes and raw material costs, particularly concerning steel, which is a critical component in vehicle manufacturing.

Additionally, the sports betting sector is grappling with its challenges following the passage of a budget in Illinois that includes a tax hike. Companies such as DraftKings saw a drop of more than 5%, while Flutter Entertainment and Rush Street Interactive noted declines of over 3% and 1%, respectively. The Roundhill Sports Betting & iGaming ETF (BETZ) also fell by 1.6%, reflecting investor sentiment that tax increases could dampen growth predictions for the industry.

| No. | Key Points |

|---|---|

| 1 | Tesla shares declined by 3% due to weakened sales in several European markets. |

| 2 | Meta Platforms announced plans to automate its advertising, hurting stocks of advertising firms. |

| 3 | Steel stocks surged after President Trump raised tariffs on imports to 50%. |

| 4 | Blueprint Medicines shares rose by 26% after being acquired by Sanofi for roughly $9.5 billion. |

| 5 | Auto and sports betting stocks faced declines due to rising costs and tax increases. |

Summary

The trading day reflected contrasting fortunes across different sectors, influenced by both external economic policies and strategic corporate decisions. While Tesla faces challenges in the European market, companies like Blueprint Medicines are thriving through strategic acquisitions. The impact of technology in advertising is reshaping the landscape, and fluctuating tariffs on steel are causing significant ripples in automotive manufacturing. Collectively, these developments highlight the dynamic nature of today’s market trends.

Frequently Asked Questions

Question: What factors contributed to Tesla’s sales decline in Europe?

The decline in Tesla’s sales in European markets can be attributed to increased competition, market saturation, and changing consumer preferences. Several key countries experienced notable drops, signaling potential challenges for the brand.

Question: How is AI transforming the advertising industry?

AI is transforming the advertising industry by automating ad placements and optimizations, allowing companies like Meta Platforms to reduce costs and improve efficiency. This shift raises concerns about the future of traditional advertising roles.

Question: What are the implications of rising steel tariffs?

Rising steel tariffs are intended to protect domestic production but could lead to increased costs for manufacturers in industries reliant on steel. This may ultimately affect consumer prices and market competition.