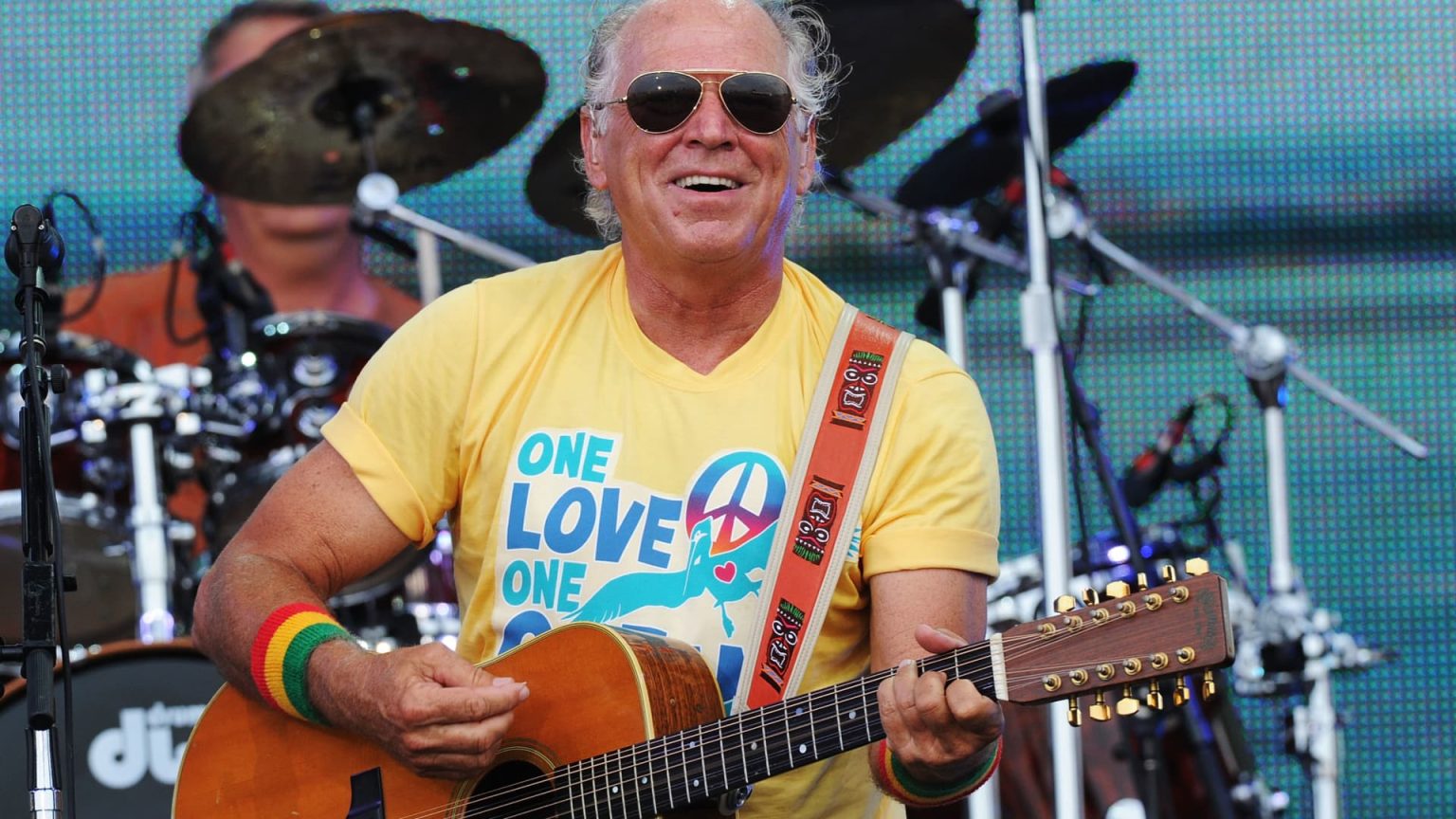

The ongoing litigation surrounding musician Jimmy Buffett‘s $275 million estate has emerged as a significant case in the context of increasing disputes over wealth transfer in the United States. Following Buffett’s death in 2023, his widow, Jane Buffett, filed a petition in Los Angeles court to remove her co-trustee, Richard Mozenter, from the marital trust meant to support her. The dispute highlights both the financial complexities and the emotional turmoil often associated with estate planning and management.

| Article Subheadings |

|---|

| 1) Background of the Estate Dispute |

| 2) Assets in Question |

| 3) Co-Trustee Responsibilities and Issues |

| 4) Legal Implications of Inheritance Lawsuits |

| 5) Lessons for Future Estate Planning |

Background of the Estate Dispute

In early October 2023, Jane Buffett filed a petition in a Los Angeles court, criticizing her co-trustee, Richard Mozenter, who had long been associated with her late husband. The two have been embroiled in a bitter dispute regarding the management of a marital trust designed to provide for Jane following Jimmy Buffett‘s death. Allegations from Jane claim that Mozenter has been “openly hostile and adversarial,” refusing to divulge essential financial information about the trust’s operations.

The crux of the conflict arises from Jane’s assertion that Mozenter’s actions, including charging excessive fees of $1.7 million annually and mismanaging the assets, are detrimental to her financial stability. Meanwhile, Mozenter has countered with a lawsuit in Florida, accusing Jane of being “completely uncooperative,” suggesting a breakdown in communication and trust that has escalated into all-out litigation.

Assets in Question

The dispute spotlights the considerable assets left by Jimmy Buffett, which extend beyond his famous music catalog. Buffett, known for breezy tunes like “Margaritaville,” amassed a considerable estate comprising real estate, vehicles, and a multi-million-dollar stake in his branding ventures. Legal filings estimate the trust includes approximately $34.5 million in real properties, $15 million equity in a company managing his aviation interests, $2 million in musical equipment, $5 million in vehicles, and $12 million in other investments.

Particularly notable is Buffett’s stake in the Margaritaville brand, which, according to the filings, stands at an estimated $85 million. The talented musician also had a well-established business empire involving restaurants, hotels, and merchandise, which contributed significantly to his wealth. As the details of these assets come to light, the ongoing disputes over the control and management of these assets shed light on complexities inherent in wealthy estate management.

Co-Trustee Responsibilities and Issues

Buffett appointed Mozenter not only to assist in managing the trust but also because he experienced ongoing concerns regarding Jane’s capacity to handle such substantial assets. The relationship between Jane and Mozenter has soured since Jimmy’s passing, becoming a focal point for animosity. Jane claims Mozenter’s refusal to provide her with vital information regarding the trust’s financial health has left her in a precarious position, unable to access necessary resources for her daily living and other expenses.

Moreover, as the co-trustee, Mozenter is seen as navigating the delicate balance between adhering to the terms established by Buffett while managing the needs and requests presented by Jane. Legal experts have pointed out that such dueling trustee scenarios create a ripe environment for disputes, especially when there is a lack of trust and communication. Attorneys note that in many cases, relationships can deteriorate simply due to differing expectations about responsibilities and transparency as illustrated in this case involving a spouse.

Legal Implications of Inheritance Lawsuits

The Buffett case highlights a growing trend of inheritance litigation. Experts estimate that over $100 trillion will be transferred from one generation to the next, a statistic that underscores the potential for conflict. As family dynamics shift and the value of estates grow, disputes are becoming increasingly common, revealing underlying tensions that accumulate over time.

Within this context, the co-trustee situation reflects common themes that play out in many inheritance cases—namely, beneficiaries feeling excluded or left in the dark about their rights and entitlements. Trust attorneys emphasize that the situation can devolve rapidly once communication breaks down, often leading the involved parties to the courtroom. The implications of the Buffett estate dispute may not only affect the immediate parties but could also set a precedent for handling similar disputes in the future, shifting how courts interpret fiduciary responsibilities.

Lessons for Future Estate Planning

As this high-profile case unfolds, it serves as a learning experience for families contemplating their estate plans. One apparent lesson is the importance of clear communication regarding the intentions behind estate divisions and the roles of any appointed trustees. Had Jimmy Buffett more explicitly defined the roles and responsibilities of both Jane and Mozenter, the risks of misunderstanding could have been mitigated.

Additionally, legal professionals recommend considering professional fiduciaries over personal acquaintances or friends when it comes to managing estates. Often, trusted friends can lack the objectivity necessary to manage a deceased’s assets effectively, leading to conflicts of interest that can exacerbate tensions among heirs. By choosing a professional trustee or a trust company, families may avoid some of the pitfalls currently on display in the Buffett case and ensure that fiduciary responsibilities are upheld in a more impartial manner.

| No. | Key Points |

|---|---|

| 1 | Dispute arises from Jane Buffett‘s petition to remove Richard Mozenter as co-trustee. |

| 2 | Buffett’s estate includes various valuable assets, exceeding $275 million. |

| 3 | Divergent views on management responsibilities have escalated tensions. |

| 4 | The case underscores a broader trend in inheritance litigation. |

| 5 | Importance of clear communication in estate planning to avoid disputes. |

Summary

The ongoing dispute concerning Jimmy Buffett‘s estate reveals critical insights into the complexities of wealth management and the emotional turmoil that often accompanies estate planning. As the litigious landscape increasingly reflects the nuances between family relationships and fiduciary duties, couples and families face an urgent need to communicate openly about their financial arrangements. The outcome of this case may influence not only the individuals involved but potentially reshape legal interpretations surrounding trust management in inheritance scenarios.

Frequently Asked Questions

Question: What are the key issues in the Buffett estate dispute?

The main issues primarily center around the removal of co-trustee Richard Mozenter by Jane Buffett, along with allegations of mismanagement, excessive fees, and a lack of communication.

Question: How does this case illustrate wider trends in estate litigation?

The Buffett estate case highlights an ongoing pattern of disputes as families manage the inherited wealth projected to transfer over the coming decades, often caused by misunderstandings and differing expectations among beneficiaries and trustees.

Question: What can families do to improve their estate planning process?

Families can enhance their estate planning by fostering clear communication about roles and responsibilities, including appointing professional trustees and ensuring all parties understand their rights and the distribution of assets.