The state of the automotive industry in the United States is under scrutiny as officials express both caution and guarded optimism about its future amidst ongoing challenges. Rising tariffs, inflation, and geopolitical tensions have created uncertainty, yet industry leaders believe that resilience may outweigh these concerns. Recent reports indicate a notable stabilization, although significant issues such as auto lending crises and economic disparities continue to cast a shadow on the market’s outlook.

| Article Subheadings |

|---|

| 1) An Overview of the Automotive Landscape |

| 2) Economic Influences on Auto Sales |

| 3) The Balancing Act for Manufacturers |

| 4) Challenges Facing Suppliers |

| 5) A K-Shaped Economic Outlook |

An Overview of the Automotive Landscape

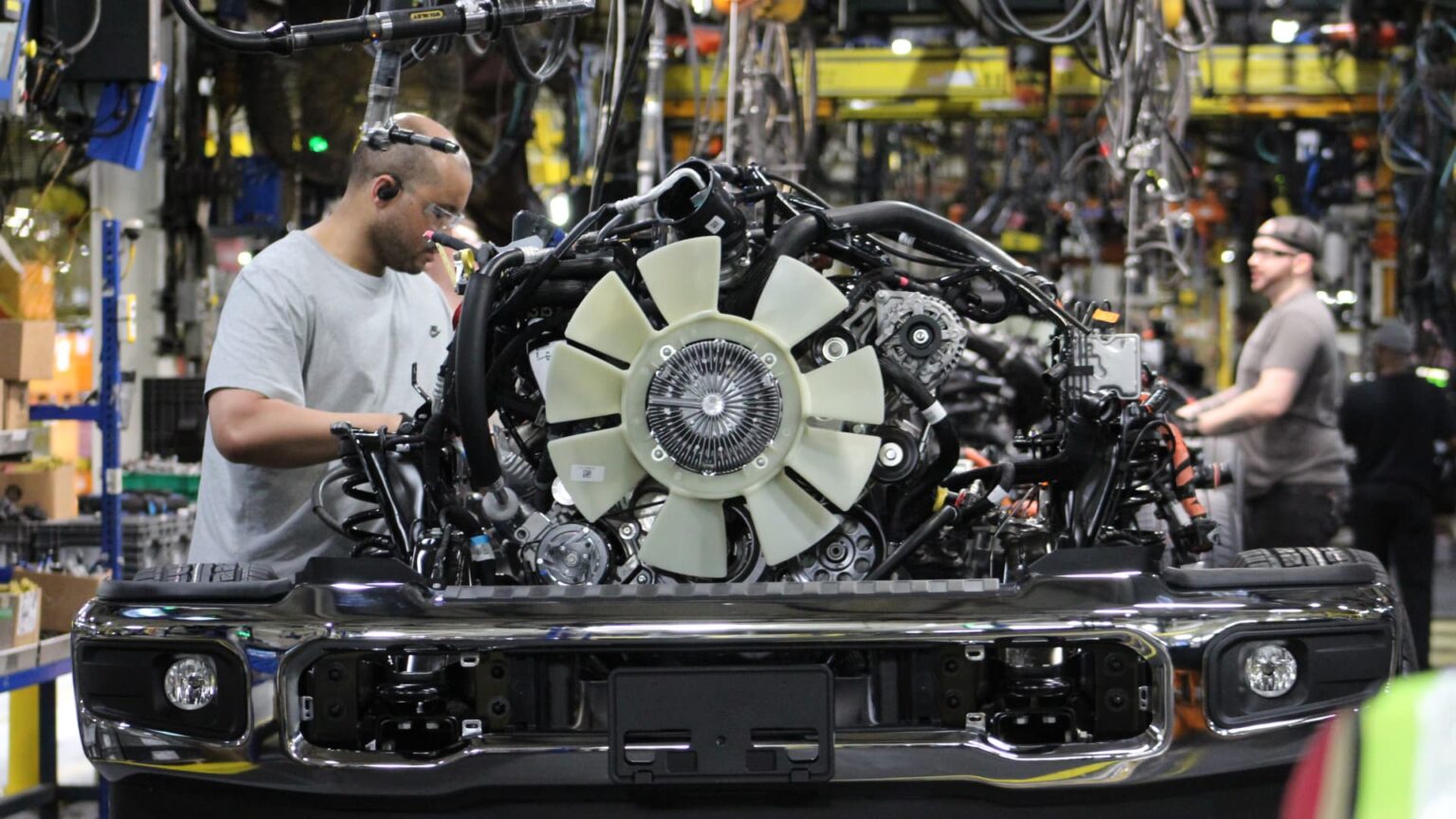

The automotive industry in the United States is currently entrenched in a state of flux, as evidenced by remarks from industry leadership, including Jim Farley, CEO of Ford Motor Company. Amid uncertainties heightened by geopolitical tensions and economic fluctuations, the sector confronts the dual challenges of tariffs and production costs. In early 2025, Farley commented on the situation, noting it involved “a lot of cost and a lot of chaos.” This sentiment reflects broader apprehensions within the industry, captured in analyst reports and monthly evaluations.

Industry projections for 2025 have not initially appeared favorable. Analysts have cataloged bearish outlooks fueled by tariffs and economic instability. However, as reports from Barclays and S&P Global suggest, the actual performance of the sector has outstripped these expectations. The narrative has shifted from impending doom to cautious optimism, indicating resilience amidst challenges.

Farley’s assessment resonates with analysts such as Dan Levy from Barclays, who noted that the automotive industry has shown robust performance in the face of adverse conditions. This perspective has allowed Barclays to modify its stance from a negative outlook to a neutral one for the U.S. auto/mobility sector. The updates stem from a recognition that the automotive market is not as dire as initially predicted.

Economic Influences on Auto Sales

Sales performance within the automotive sector has been comparatively stable, according to timely analyses. An upward revision of U.S. light vehicle sales estimates by S&P Global reflects a growing demand for vehicles. The revised figures suggest a total of 16.1 million vehicles in sales for 2025 and 15.3 million for 2026. These enhancements point towards a regained consumer confidence that aligns with improving macroeconomic indicators.

Consumer spending remains integral to this optimistic forecast, particularly since such factors contribute positively to overall economic stability. Analysts continue to highlight a potential rebound as consumers adapt to fluctuating financial landscapes, indicating a willingness to invest in vehicles. Jonathan Smoke, Chief Economist at Cox Automotive, also echoed this sentiment, stating that the tariffs may not unravel the industry as feared.

Despite the emerging positive trends, headwinds persist. Economic factors such as inflation and rising disposable income disparities persistently complicate the consumer purchasing landscape. The accumulated challenges around inflation and a perceived consumer pessimism render a cautious approach to navigating the market essential for automakers and analysts alike.

The Balancing Act for Manufacturers

The automotive sector is positioned in a precarious balancing act, negotiating between increasing production costs and necessary adaptations to market demands. Tariffs imposed on automotive imports have reportedly resulted in billions of dollars in costs, which manufacturers strive to mitigate through strategic adjustments. As executives like Farley have asserted, deregulation of fuel economy penalties might ease some of the fiscal burdens introduced by tariffs.

However, significant vulnerabilities remain. Specific indicators, such as the distress within auto lending for lower-credit buyers and the bankruptcy of auto lender Tricolor, mark potential diving points for consumer confidence in the automotive market. While vehicle sales remained buoyant in the face of such pressures, dealers are closely monitoring the evolving landscape, balancing optimism and caution.

The interplay of these economic realities underscores that while the automotive industry displays robustness, looming concerns regarding consumer spending habits cannot be overlooked. The anticipated release of quarterly results from major players, including Ford and General Motors, is expected to clarify these conditions further.

Challenges Facing Suppliers

Supplier health within the automotive market presents additional concerns amid ongoing economic uncertainties. The automotive supplier base consists of varied companies, from large corporations to smaller operations contributing niche components. Given the industry’s current pressures, many suppliers lack the capability to absorb further cost increases, raising red flags for industry health.

Amidst these concerns, the recent bankruptcy filing of First Brands Group has escalated anxiety within Wall Street, highlighting precarious conditions within the credit market. The fallout from First Brands has sparked discussions regarding the broader implications for the automotive supply chain, especially concerning the inherent fragility associated with these operations, as noted by industry experts.

Automakers have attempted to ease some supplier burdens by not passing on additional tariff-related costs; however, it remains uncertain how sustainable this cooperation is in the face of continuing pressures. Analysts anticipate that the challenges for suppliers will need ongoing scrutiny as the industry evolves, particularly amid changes driven by a tumultuous economic landscape.

A K-Shaped Economic Outlook

The automotive industry disproportionately exemplifies ongoing K-shaped economic trends that have emerged in the post-pandemic U.S. economy. Wealthier consumers are experiencing gains, in stark contrast to lower-income households that face financial constraints exacerbated by inflation. This disparity poses a dilemma for automakers, as consumer financing structures shift as lower-income buyers confront tighter budgets.

Recently, CarMax highlighted this consumer distress, indicating that ongoing issues with auto lending may signal deeper ramifications for the industry. As noted by CEO Bill Nash, the increasing delinquency rates among subprime borrowers underline vulnerabilities within not just the automotive sector, but the economy at large.

Amid these concerns, consumers at the higher end of the income spectrum are displaying resilience, often buffered by increased home values and favorable credit conditions. Such trends raise additional uncertainties regarding how lower-income consumers react to shifts in market conditions, particularly if tariffs begin to translate to higher vehicle prices.

Given these dynamics, industry experts emphasize the importance of staying attuned to consumer behavior as it evolves, echoing sentiments that the approach to future market developments will be analogous to navigating a minefield.

| No. | Key Points |

|---|---|

| 1 | The automotive industry faces uncertainties but has shown surprising resilience against tariffs and economic upheaval. |

| 2 | Sales estimates have been revised upward, reflecting a potential stabilization in demand. |

| 3 | Supplier health is precarious, illustrated by recent bankruptcies and rising costs impacting operations. |

| 4 | Economic disparities, particularly K-shaped trends, are affecting consumer buying patterns in the automotive market. |

| 5 | Significant challenges remain for automakers and suppliers, with ongoing vigilance necessary as the market evolves. |

Summary

As the automotive industry navigates through a complex landscape laden with tariff implications, economic uncertainties, and evolving consumer demographics, a balanced perspective emerges. While positive sales adjustments represent a cautious optimism, concerns about supplier stability and the impact of economic divisions warrant continuous monitoring. Ultimately, the path forward for automakers will involve navigating both resilience and potential pitfalls, defining the trajectory of the sector in years to come.

Frequently Asked Questions

Question: What are the current challenges facing the automotive industry?

The industry grapples with rising tariffs, inflation, economic uncertainties, and the precarious health of auto suppliers amidst fluctuating consumer demand.

Question: How have auto sales estimates changed for the coming years?

Recent analyses have revised U.S. light vehicle sales estimates upward by about 2%, reflecting a total of 16.1 million vehicles for 2025, suggesting an improving demand environment.

Question: What is meant by a K-shaped economic outlook?

A K-shaped economic outlook refers to a scenario where high-income groups benefit from economic growth while lower-income groups struggle, highlighting disparities in financial recovery and spending power.