As college application season heats up, prospective students face a critical decision that often extends beyond mere acceptance letters: evaluating financial aid awards. With nearly 75% of undergraduates receiving some form of financial assistance, understanding these offers becomes paramount in selecting an institution and determining funding methods. However, experts indicate that the lack of transparency in financial aid offers complicates the process, leaving families grappling with confusing terms and varying types of aid. This article delves into the significance of financial aid packages, tips for maximizing these opportunities, and navigating the current landscape of college funding.

| Article Subheadings |

|---|

| 1) Understanding the financial aid offer |

| 2) There may be more college aid available |

| 3) How changes at the Education Dept. factor in |

| 4) When in doubt, turn to private scholarships |

| 5) Strategies for navigating financial aid |

Understanding the financial aid offer

In examining financial aid offers, students encounter various forms of assistance, including grants, scholarships, work-study opportunities, and loans. The primary aim is to maximize the aid received in the form of grants or scholarships—termed as gift aid—while minimizing the reliance on loans that carry the obligation of repayment with interest. Given the potential for misunderstanding within these offers, it’s crucial that students thoroughly review the fine print. Not every grant or scholarship is guaranteed for the duration of the student’s study; some may require maintaining a specific grade point average (GPA) or meeting other conditions.

The confusion can lead to misinterpretation where families wrongly assume a larger financial aid offer is more advantageous. As indicated by experts from the financial lending sector, the inclusion of substantial loans in what appears to be a generous financial aid package can result in long-term debt burdens that students may not initially recognize. The current statistics indicate that the average undergraduate student graduates with approximately $30,000 in loan debt, highlighting the importance of discerning what forms of aid are truly beneficial versus burdensome.

There may be more college aid available

Despite receiving initial financial aid offers, many families are unaware that additional funding may still be attainable. Families who have completed the Free Application for Federal Student Aid (FAFSA) process but find themselves struggling to meet educational expenses can proactively reach out to the college financial aid office for possible aid increases. This request should be accompanied by documentation reflecting any significant changes in the family’s financial circumstances, including shifts in income or unexpected expenses.

Appealing for additional funding has proven to be effective; statistics reveal that 71% of families who petitioned for more aid during the 2023-24 academic year succeeded in securing additional resources. The appeal process can be particularly beneficial for families whose financial aid packages from comparable institutions significantly outshined their current awards, providing a valid basis for requesting enhanced aid offerings.

How changes at the Education Dept. factor in

The U.S. Department of Education, which plays a crucial role in administering student loans and federal aid programs, is currently undergoing significant restructuring. With nearly half of its workforce slashed, concerns arise regarding the agency’s ability to maintain efficient operations, including the management of Pell Grants and loan disbursement. The agency asserts that it remains committed to fulfilling its statutory responsibilities, including the processing of financial aid awards through FAFSA.

However, experts in higher education express concern that these staffing reductions could lead to delays in responses to student inquiries and adversely affect the support available to colleges as they navigate their own financial aid processes. As quoted by some experts, “The impact of staffing cuts could ripple through the system, leading to confusion and unresolved student financial inquiries.”

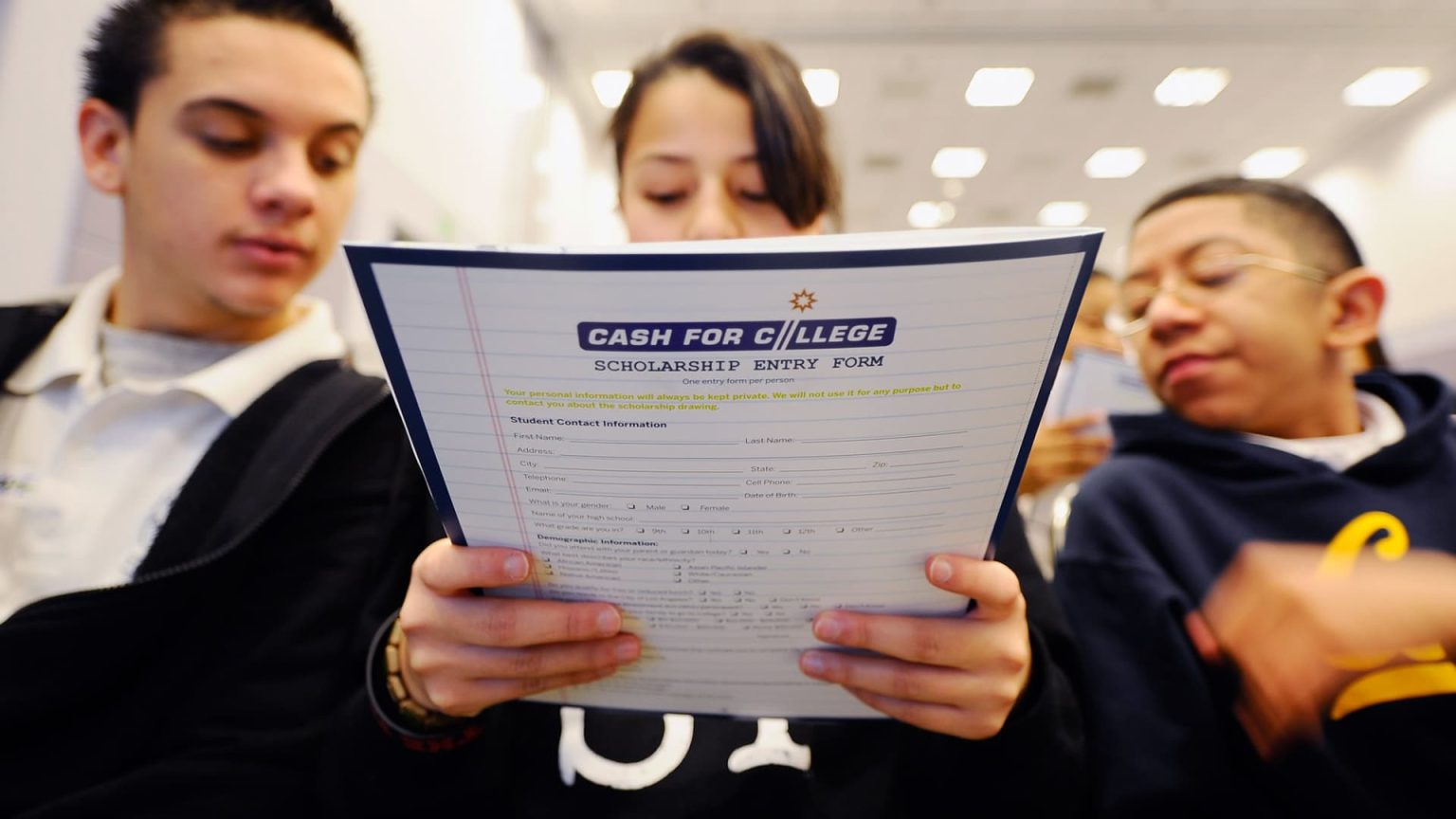

When in doubt, turn to private scholarships

In addition to federal and state aid, a plethora of private scholarships and fellowships exist, offering students further financial relief. Reports indicate that more than 1.7 million private scholarships, totaling over $7.4 billion, remain available. These awards are generally funded by independent organizations, foundations, or corporate sponsors and are often merit-based rather than need-based.

Prospective students and their families are encouraged to explore these alternatives as a means to bridge gaps left by traditional financial aid packages. It is essential for students to discard misconceptions regarding eligibility, as many families erroneously believe they may not qualify for such opportunities. Those pursuing additional funding should persist in their search and consider innovative approaches, such as enlisting the help of high school counselors or utilizing online scholarship search platforms.

Strategies for navigating financial aid

Navigating the complexities of financial aid requires strategic planning and diligence. Students must take a proactive approach to education financing by researching all available aid sources, both governmental and private. As experts advocate, students should not shy away from applying for numerous scholarships, as many awards go unclaimed due to insufficient applicant turnout. Furthermore, it is wise to carefully consider the types of institutions being applied to in light of their respective financial aid profiles.

In addition, seeking counsel from knowledgeable sources, such as financial advisors or school guidance counselors experienced in financial aid can provide essential insights necessary for making informed decisions. The goal is to gain a comprehensive understanding of all offerings on the table before ultimately committing to an educational institution.

| No. | Key Points |

|---|---|

| 1 | Understanding the types of financial aid is crucial; grants and scholarships are preferable to loans. |

| 2 | Students should be proactive in requesting additional aid if financial situations change. |

| 3 | The Department of Education is undergoing staffing changes, which may impact aid processing. |

| 4 | Numerous private scholarships are available; students should not hesitate to seek these resources. |

| 5 | Strategic planning and research are vital for navigating the financial aid landscape effectively. |

Summary

As aspiring students evaluate their financial aid offers, the pressing need for clarity and understanding remains evident. With the intricacies of aid packages coupled with ongoing changes within the Department of Education, families must be diligent in exploring available resources. By advocating for themselves, maximizing gift aid options, and considering private scholarships, students can better position themselves to manage college expenses and reduce long-term financial burdens associated with education.

Frequently Asked Questions

Question: What is the role of FAFSA in securing financial aid?

The FAFSA, or Free Application for Federal Student Aid, is a critical form that students must complete to determine eligibility for federal financial aid, including grants, loans, and work-study programs.

Question: How can students appeal their financial aid offer?

Students can appeal their financial aid offer by contacting their college’s financial aid office and providing documentation of any changes in their financial situation or a comparison of offers from other institutions.

Question: What should students look for in their financial aid offer?

Students should carefully review their financial aid offers to identify the types of aid offered, such as grants versus loans, and understand any conditions or renewal requirements associated with the aid.