In a recent statement, AerCap CEO Aengus Kelly raised concerns about the potential impact of rising tariffs on aircraft prices, specifically the Boeing 787, which could increase by as much as $40 million. This significant rise is attributed to a hypothetical scenario where a 25% tariff is imposed amidst escalating trade tensions. Kelly emphasized that such a cost increase might compel airlines to consider Airbus as a more financially viable option. Despite these challenges, AerCap’s positive outlook on Boeing’s product quality remains steadfast.

The ongoing tariff implications come at a time when the global economy is responding to President Donald Trump’s policy changes, particularly the recent introduction of tariffs on steel and aluminum imports. Kelly’s remarks reflect wider concerns in the aviation industry regarding market dynamics, pricing pressures, and the relationship between manufacturers and airlines.

As AerCap embarks on maintaining its position as a key player in the aircraft leasing market, its CEO suggests that both companies need to navigate the delicate landscape of tariffs and consumer demand to ensure their respective futures.

| Article Subheadings |

|---|

| 1) Impact of Tariffs on Boeing Prices |

| 2) Shift in Airline Preferences |

| 3) Global Economic Context |

| 4) Boeing’s Recovery and Prospects |

| 5) Market Outlook for AerCap |

Impact of Tariffs on Boeing Prices

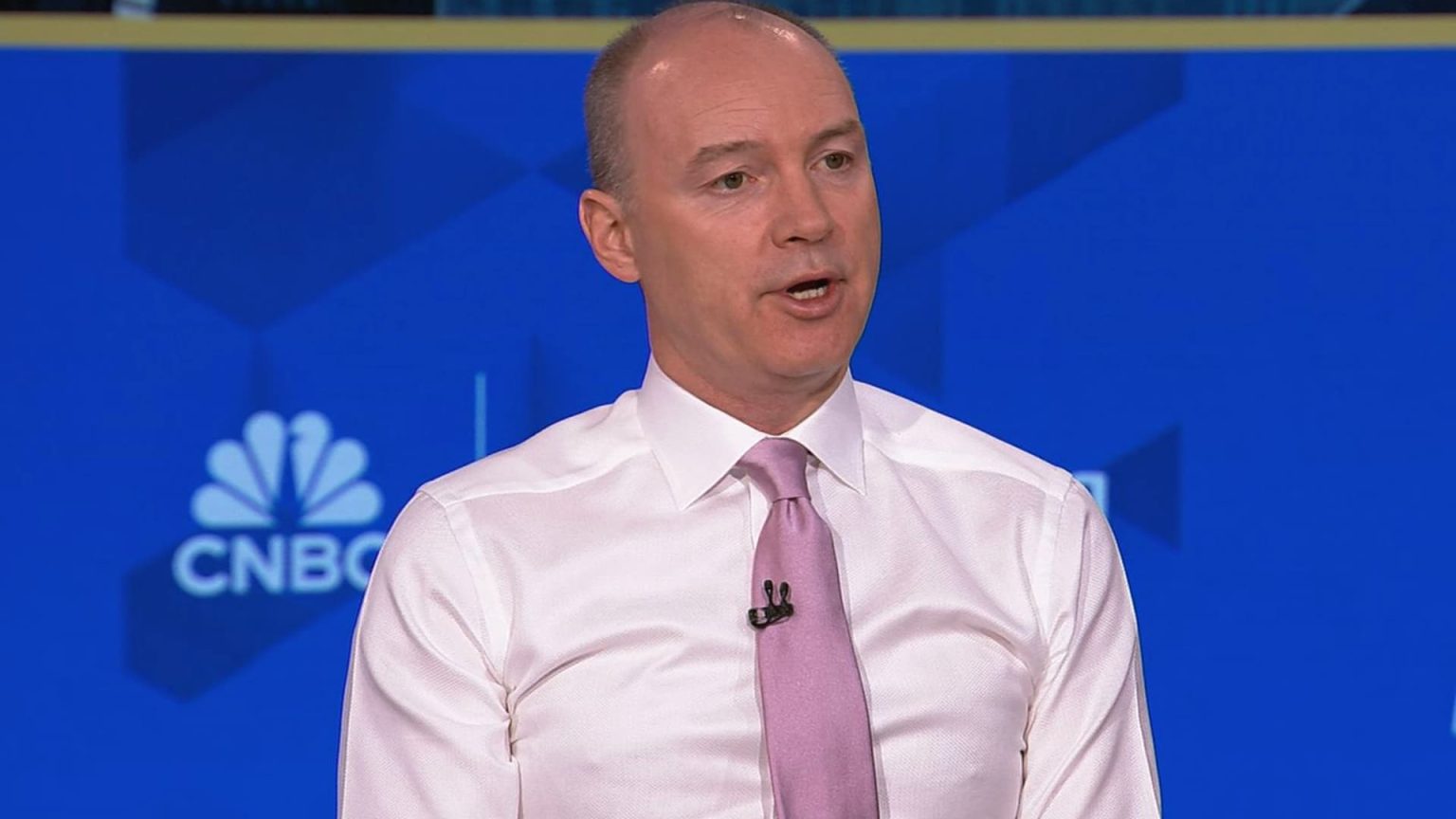

The aerospace industry is bracing for possible repercussions stemming from the trade war, particularly surrounding tariff increases. According to Aengus Kelly, the CEO of AerCap, a worst-case scenario could see tariffs rising by 25%, leading to an increase in the cost of a Boeing 787 aircraft by approximately $40 million. This stark projection, shared during his appearance on CNBC’s program “Squawk Box,” underscores the precarious position both manufacturers and airlines find themselves in as they navigate increasingly fraught trade relations.

Kelly asserts that such a dramatic price hike would likely deter airlines from purchasing Boeing planes, prompting a shift in their procurement strategies. He articulated that airlines would be disinclined to absorb these steep costs and may instead turn to alternative manufacturers like Airbus, indicating a potential shift in market dynamics as the aviation industry grapples with tariff-related challenges.

This issue highlights the complex interplay between global trade policies and specialized industries like aviation, where financial pressures directly correlate with international relations. Should tariffs continue on their trajectory, the structure of the aircraft manufacturing market might soon change, placing substantial pressure on Boeing to remain competitive.

Shift in Airline Preferences

Amid the uncertainties of rising tariffs, airlines may find themselves compelled to rethink their aircraft sourcing strategies significantly. Kelly suggested that in light of inflated costs linked to potential tariffs, most carriers would likely pivot toward Airbus, which could capture a remarkable 75% to 80% of the global market share in this scenario. This anticipated shift showcases how changes in pricing strategies can dramatically affect industry competition and consumer choices.

For airlines, the decision to choose between Boeing and Airbus goes beyond a simple preference for brand; it also encompasses financial viability and operational considerations. With Boeing’s aircraft potentially becoming less economically attractive due to external tariff pressures, airlines might prioritize budget constraints and long-term budget planning when making procurement decisions. This shift could initiate a significant reallocation of resources and contracts across the industry.

Furthermore, this realignment is not just about securing favorable pricing; it also reflects broader market trends where airlines must balance operational efficiency, customer satisfaction, and profitability in navigating unpredictable economic circumstances dictated by global market forces.

Global Economic Context

The rising tariffs are part of a broader pattern of trade disruptions that have reverberated throughout the global economy in recent years. President Donald Trump’s administration introduced significant tariffs on a range of goods, including a recent implementation of 25% tariffs on steel and aluminum imports. The repercussions of these policy changes have led to swift retaliatory actions from key trading partners like the European Union, highlighting the fragile nature of international trade relations.

This scenario serves as a crucible for businesses that engage in global markets. Companies must now grapple with the unpredictability of trade policies while strategizing on how best to mitigate costs and maintain competitiveness. The turbulence of these changing economic tides necessitates that industry leaders remain alert and adaptable as they address the challenges posed by tariffs and trade relations.

While AerCap and other companies are reassessing their positions in light of tariff impacts, the industry must also consider how these broader economic trends influence consumer behavior. As production costs rise, it’s reasonable to anticipate that airlines will think critically about pricing structures and route offerings, potentially impacting the passenger experience as well. Overall, the consequences of these trade tensions extend far beyond aircraft pricing, affecting a wide spectrum of industry sectors and international commerce.

Boeing’s Recovery and Prospects

Despite facing a tumultuous year punctuated by various operational setbacks, Aengus Kelly remains optimistic about Boeing’s recovery trajectory. He envisions that for the aircraft manufacturer to rebound effectively, it requires a robust cash flow to ensure timely and reliable deliveries of aircraft. This call for financial stability aligns with the company’s ongoing efforts to rebuild consumer confidence and operational excellence.

Kelly also cited improvements observed in Boeing’s product quality, reliability, and safety, asserting that the manufacturer has made commendable strides in enhancing its manufacturing process over the past year. He remarked,

“Boeing has made tremendous steps in terms of quality, safety and reliability over the last year.”

With a leading position in the aviation marketplace, these enhancements may ultimately strengthen Boeing’s appeal, ensuring customer loyalty amidst competitive pressures.

The positive developments within Boeing’s production lines are not merely anecdotal but are primarily demonstrated as AerCap engages with the manufacturer directly while procuring new aircraft. This firsthand insight reinforces Kelly’s confidence that despite the multifaceted challenges posed by tariffs and fluctuating market demand, Boeing retains a viable path forward, provided it can sustain the momentum of its recent improvements.

Market Outlook for AerCap

AerCap’s positioning as the leading aircraft leasing company serves as a litmus test for the aviation industry itself. With considerable reliance on the purchasing and leasing decisions made by airlines, AerCap’s trajectory must reflect broader market sentiments and operational trends. Although the firm faces potential turbulence drawn from tariff impacts, Kelly indicates that the company remains bullish and optimistic about overall market demand.

He noted that while the aviation industry may currently experience a temporary “soft patch,” largely influenced by rising labor costs, the fundamental demand for air travel continues to prevail. This suggests an inherent resilience within the sector that could counterbalance the uncertainties stemming from tariffs and economic adjustments.

Strategically, AerCap is positioned to navigate these challenges by leveraging its extensive portfolio and expertise in aircraft leasing. As the largest buyer of aviation assets globally, it can adjust its strategies to capitalize on emerging opportunities while mitigating risks linked to potential pricing pressures from competing manufacturers.

| No. | Key Points |

|---|---|

| 1 | A potential tariff increase of 25% could raise the cost of a Boeing 787 aircraft by $40 million. |

| 2 | Airlines may pivot towards Airbus due to inflated costs associated with Boeing aircraft. |

| 3 | Rising tariffs symbolize broader trade disruption affecting the global economy. |

| 4 | Boeing has shown recent improvements in product quality and manufacturing processes. |

| 5 | AerCap remains optimistic about overall market demand despite facing potential challenges. |

Summary

The aviation industry is currently at a crossroads, navigating the challenges posed by rising tariffs that threaten aircraft pricing and market dynamics. As highlighted by Aengus Kelly of AerCap, the potential increase in costs could significantly reshape airline procurement strategies, potentially tilting preference toward manufacturers like Airbus. Yet, despite these trade concerns, both Boeing and AerCap continue to exhibit resilience and adaptability, suggesting a cautiously optimistic outlook for the future of commercial aviation as they address these multifaceted challenges.

Frequently Asked Questions

Question: What are the implications of a 25% tariff on aircraft pricing?

A 25% tariff on aircraft pricing could lead to significant cost increases for companies like Boeing, potentially resulting in increased aircraft prices for airlines and shifting market dynamics.

Question: How might airlines respond to rising aircraft costs?

In response to rising aircraft costs, airlines may opt to procure more planes from Airbus or other manufacturers, which could lead to a substantial market share shift within the aviation sector.

Question: What operational improvements has Boeing made recently?

Boeing has reported improvements in product quality, reliability, and safety, positioning itself to better meet the demands of its airline customers and counteract pricing pressures.