The Contemporary Amperex Technology Co. (CATL), a leading supplier of battery packs for electric vehicles, is expanding its horizons beyond hardware manufacturing. Analysts from Morgan Stanley have reported that CATL aims to establish itself as a software ecosystem provider, leveraging artificial intelligence to enhance battery monitoring and safety. Furthermore, the company stands to benefit from recent licensing agreements with major automakers and maintains an optimistic outlook despite facing geopolitical scrutiny.

| Article Subheadings |

|---|

| 1) CATL’s Shift Towards Software Solutions |

| 2) Licensing Agreements with Ford |

| 3) Political Scrutiny in the U.S. |

| 4) Plans for European Expansion |

| 5) Future of Electric Vehicles and New Technologies |

CATL’s Shift Towards Software Solutions

Recent analyses suggest that CATL is moving beyond its traditional role as a battery pack manufacturer. According to reports from Morgan Stanley, the company is positioning itself as a software ecosystem provider, which could deepen its influence within the electric vehicle market. This shift is fueled by the rapid advancement of technology, particularly artificial intelligence (AI), which CATL intends to use for battery monitoring and safety enhancements.

Morgan Stanley analysts, led by Jack Lu, highlighted CATL’s innovative tools that utilize AI for real-time battery health monitoring. This new capability could transform how manufacturers ensure safety and performance standards for electric vehicles. Analysts project that the evolution of AI will extend CATL’s reach into software services, creating added value for customers. Improved safety features not only enhance consumer confidence but also solidify CATL’s partnerships with major automotive brands.

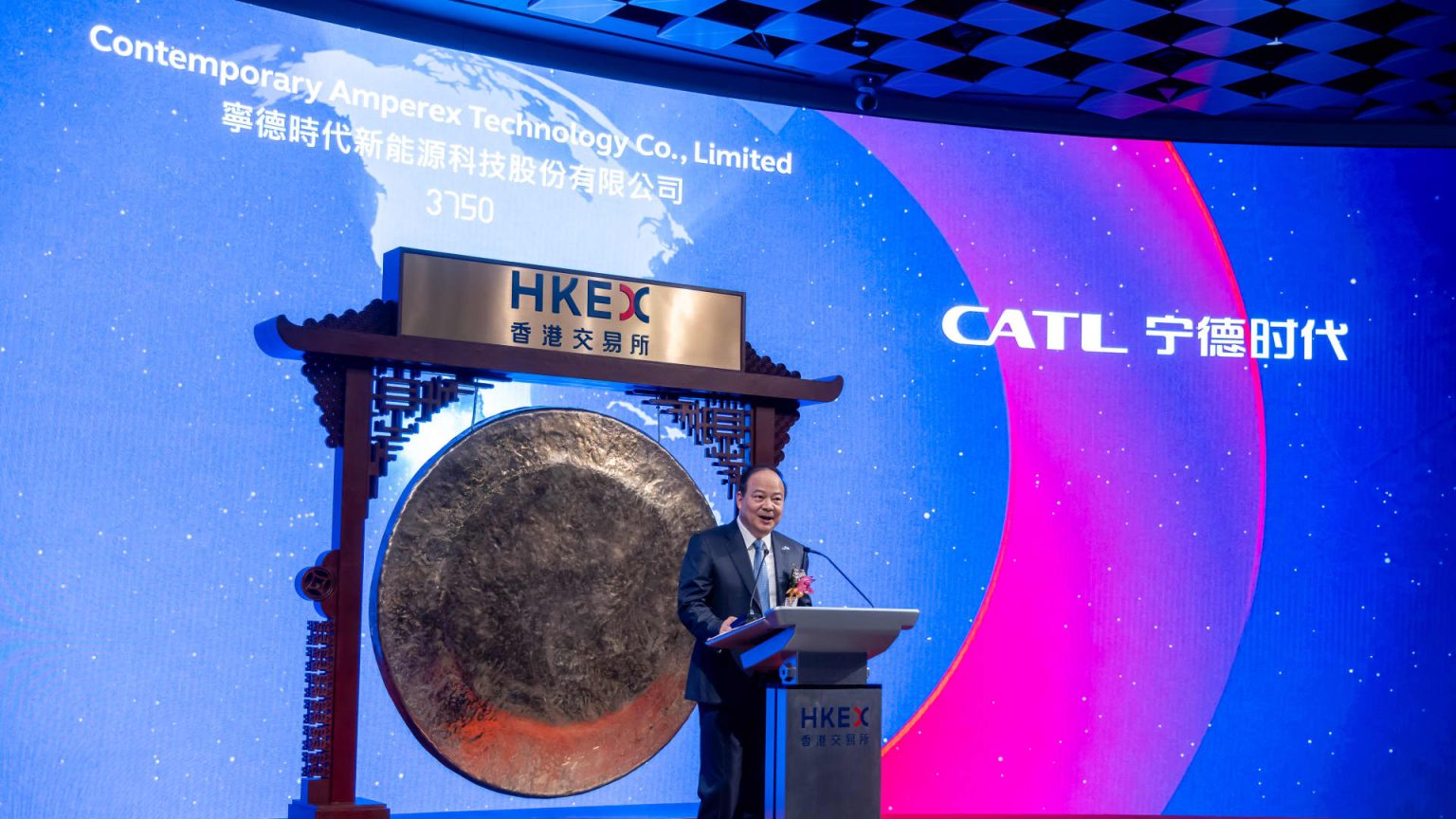

As CATL expands its technological footprint, the benefits are likely to reflect positively on its stock performance. Morgan Stanley has thus raised its price target for CATL’s Hong Kong-listed shares by 14%, indicating market confidence in the company’s trajectory. The new target of 445 Hong Kong dollars represents a significant premium over the company’s previous close.

Licensing Agreements with Ford

In a significant development, U.S. automaker Ford aims to establish a battery factory through a licensing agreement with CATL. This collaboration has been met with intense scrutiny from U.S. authorities, particularly concerning tax incentives that Ford might lose. However, recent statements from Ford indicate optimism regarding the BlueOval Battery Park in Michigan, suggesting that tax credits will be applicable, allowing production of lithium iron phosphate (LFP) batteries to commence by 2026.

Analysts have interpreted this move as a positive sign for the licensing deal, labeling it a step toward normalization amid regulatory concerns. Macquarie analysts, including Eugene Hsiao and Fergus Kwan, noted that this arrangement helps alleviate one of the significant headwinds facing CATL’s shares. Should the BlueOval facility operate near full capacity, CATL could realize annual licensing fees potentially reaching 1.3 billion yuan ($181 million) by 2027, according to projections from analysts.

Political Scrutiny in the U.S.

Despite CATL’s promising outlook, the company is under increasing scrutiny due to geopolitical tensions, particularly with the United States. Earlier in the year, the Pentagon added CATL to a list of companies it associates with Chinese military operations, prohibiting the U.S. Department of Defense from purchasing its products starting in 2026. CATL has publicly defended itself against these claims, labeling the designation as a “mistake” and denying any involvement in military activities.

Both CATL and its partners are conscious of the potential implications of this scrutiny. Analysts from Macquarie noted that much of this geopolitical risk is already integrated into the company’s share prices. As market dynamics change, the belief in strong earnings fundamentals from CATL could lead to a favorable re-evaluation of its market position.

Plans for European Expansion

CATL is also making strides in expanding its operations in Europe. Pledging that 90% of the funds raised from its initial public offering will support its European expansion, CATL is nearing completion of a factory in Hungary. The company’s initiatives aim not only to broaden its manufacturing capabilities but also to capitalize on the growing demand for electric vehicles across Europe.

In addition to its European plans, CATL has announced a significant $6 billion project in Indonesia focused on nickel mining, processing, and battery production. This multifaceted approach demonstrates CATL’s commitment to securing its supply chain while diversifying its operational base. These strategic endeavors underscore CATL’s intent to harness market opportunities and maintain its competitive edge in the industry.

Future of Electric Vehicles and New Technologies

The future of electric vehicles is being shaped by partnerships and innovative technologies, and CATL is at the forefront of this evolution. In notable recent developments, companies such as Xiaomi and Geely-backed Zeekr intend to use CATL’s advanced battery technologies in their electric and hybrid vehicles. This collaboration with Xiaomi, which plans to install CATL’s batteries in its popular YU7 SUV, could further bolster CATL’s market share in China.

The hybrid vehicle market is also receiving attention, with Zeekr announcing plans to implement CATL’s “Freevoy Super Hybrid Battery” in its upcoming 9X SUV. This model is forecasted to achieve a commendable range of 380 kilometers on a single charge. The integration of CATL’s technology in various models reinforces its reputation as a leader in battery innovation and diversification. As the automotive landscape shifts towards electric and hybrid solutions, CATL’s ongoing research in battery swapping technologies further positions the company as a “go-to” provider for the industry’s evolving needs.

| No. | Key Points |

|---|---|

| 1 | CATL aims to transition from hardware manufacturing to a software ecosystem provider. |

| 2 | Ford is set to partner with CATL to produce batteries in Michigan amidst regulatory scrutiny. |

| 3 | The Pentagon has listed CATL due to geopolitical tensions, impacting its market perception. |

| 4 | CATL is investing heavily in expanding its operations in Europe and Indonesia. |

| 5 | New collaborations and technologies position CATL as a leader in battery innovation. |

Summary

The evolving landscape of the electric vehicle sector finds CATL at a pivotal junction, where its aspirations extend beyond conventional hardware into the realm of software and AI-driven solutions. Despite facing challenges such as geopolitical scrutiny and regulatory hurdles, CATL’s extensive expansion and partnerships signal a robust commitment to innovation and market leadership. As the need for advanced battery technologies intensifies, CATL is poised to maintain its relevance and capital gain in a rapidly evolving market.

Frequently Asked Questions

Question: What is CATL’s main focus going forward?

CATL is shifting its focus from being solely a battery manufacturer to becoming a software ecosystem provider, leveraging AI for battery health monitoring and management.

Question: How does CATL plan to expand its market presence?

CATL aims to expand its market through partnerships, new technologies, and substantial investments in European and Southeast Asian operations.

Question: What challenges does CATL face in the global market?

CATL faces challenges such as heightened geopolitical tensions, particularly with the United States, and scrutiny relating to its military affiliations despite its denials.