In the complex world of healthcare, many patients face unexpected financial burdens due to surprise medical bills. This issue often arises during emergencies, leading individuals like Frank Esposito to confront staggering expenses—$650,000 in his case. As part of a broader initiative titled “Medical Price Roulette,” insights will be shared about the lack of price transparency in healthcare, aiming to illuminate the often confusing medical billing landscape and what triggers such exorbitant costs.

| Article Subheadings |

|---|

| 1) The Start of a Medical Crisis |

| 2) The Surge in Medical Bills |

| 3) Factors Compounding the Expense |

| 4) The Search for Transparency |

| 5) Lessons Learned and Moving Forward |

The Start of a Medical Crisis

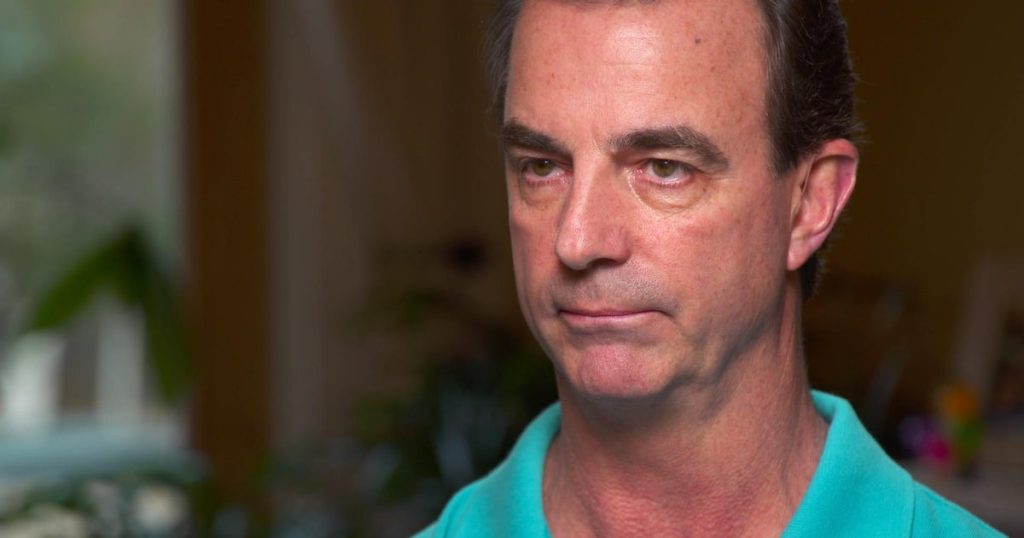

In March of last year, Frank Esposito, a tool and die maker from Long Island, New York, began experiencing severe back pain that left him immobile. Following an MRI, he was diagnosed with a bulging disc in his spine. Medical professionals quickly advised him to seek immediate help at a nearby hospital, fearing that any delay could result in permanent nerve damage or paralysis. This diagnosis propelled him into a medical emergency filled with uncertainty and fear.

Upon arrival at the emergency room, doctors confirmed that Esposito required urgent surgery to alleviate the pressure on his spine. The gravity of his condition led to an expedited procedure, which was deemed a success. However, what should have been a straightforward recovery turned into a financial nightmare.

The Surge in Medical Bills

Shortly after the surgery, patients like Esposito often find themselves grappling with overwhelming medical bills. In Esposito’s case, the total cost exceeded $650,000, a staggering sum for anyone to bear. Unsurprisingly, his insurance provider contested the necessity of the surgery, asserting that it did not qualify as an emergency. Instead, the insurance company claimed that the procedural decision was made hastily without sufficient grounds for the exorbitant costs incurred.

These unexpected expenses leave many consumers in a state of financial disarray. According to a 2018 poll by Kaiser Health, 40% of consumers reported receiving surprise medical bills, with half of those exceeding $500. Such figures highlight a disturbing trend in healthcare where patients are often left unforewarned about possible costs.

Factors Compounding the Expense

The bewildering complexity of healthcare billing complicates matters even further. Dr. Aaron Carroll, a pediatrician and health services researcher, emphasizes the lack of transparency in healthcare pricing. He notes that individuals in dire pain often do not have the luxury of time or freedom to research costs; instead, they are thrust into situations where they must make immediate decisions under duress.

A recent survey highlighted the variability in healthcare costs across different geographical locations. For instance, a simple blood test in the Dallas-Fort Worth area varied wildly from $10 to $176, while in San Francisco, it ranged from $15 to $126. Similarly, an abdominal ultrasound in Dallas could cost anywhere from $115 to $2,459, and the price in the Bay Area ranged from $100 to an astonishing $2,800. Such price discrepancies cause confusion among patients who may believe that their insurance networks will shield them from exorbitant out-of-pocket costs.

The Search for Transparency

Despite the challenging nature of healthcare costs, initiatives like “Medical Price Roulette” aim to shed light on this topic. Data collection efforts reveal that not everyone pays the cash price; however, these prices reflect the total amount that healthcare providers are willing to accept for procedures or tests. “Plans will have different deductibles, different degrees of co-insurance, and different co-payments,” explains Dr. Carroll. “What people are actually responsible for can often exceed their expectations and significantly impact personal finances.”

Esposito’s case becomes even more troubling as he has already drawn $49,000 from his retirement savings to cover medical expenses. He has also engaged a company to negotiate his bills. While some of his costs have been settled through appeals with his insurance company, he still finds himself burdened with a staggering $220,000 debt, for which no resolution seems in sight. The ongoing financial strain is almost as harrowing as the original medical emergency.

Lessons Learned and Moving Forward

Esposito reflects on the challenges he faces: “You work all your life to buy a house and save for your future. One should be able to seek medical help without risking financial ruin.” His statement underscores a crucial debate surrounding healthcare reform and the pressing need for systemic changes that provide real price transparency. With the current state of affairs, many like Esposito are left questioning the fundamental nature of healthcare in the country.

These ongoing issues are encouraging discussions among professionals and lawmakers about the need for comprehensive healthcare reforms. Health economists and consumer advocates are pushing for initiatives that not only facilitate price transparency but also aim to protect consumers from exorbitant medical bills. The hope is that future patients will be spared the undue stress of sudden financial burdens that come with their healthcare needs.

| No. | Key Points |

|---|---|

| 1 | A growing number of consumers are facing surprise medical bills, often exceeding $500. |

| 2 | Healthcare pricing lacks transparency, making it difficult for patients to prepare financially. |

| 3 | Disparities in medical pricing exist between different geographical areas, with wide variances in costs. |

| 4 | Patients are often forced to make hasty decisions under pressure, which can lead to large out-of-pocket expenses. |

| 5 | Initiatives aimed at increasing price transparency are needed to protect consumers in the healthcare system. |

Summary

The ongoing issue of surprise medical billing encapsulates the struggles faced by patients who are often unprepared for the financial ramifications of healthcare decisions. As illustrated by Frank Esposito’s story, the complexities within healthcare pricing can lead to devastating consequences. Initiatives aimed at improving transparency and consumer protection are vital and must be prioritized to ensure that individuals can seek the medical care they need without incurring life-altering debts.

Frequently Asked Questions

Question: What are surprise medical bills?

Surprise medical bills are unexpected charges that patients receive after receiving care, often in emergency situations where they cannot choose their provider.

Question: Why is there such variability in medical costs?

The costs of healthcare services can vary widely based on location, the healthcare provider, and whether the patient has insurance coverage or is paying out-of-pocket.

Question: What steps can patients take to manage medical expenses?

Patients can inquire about costs prior to receiving treatment, consider negotiating bills, and explore resources that provide price transparency in healthcare.