Warren Buffett, the legendary investor, is set to address shareholders for the 60th time during Berkshire Hathaway’s annual meeting in Omaha, Nebraska, this Saturday. Following significant market volatility attributed to sweeping tariffs enacted recently, many investors are eager to hear his insights on the current economic climate. This edition of the meeting is particularly notable as it marks the second occurrence without Buffett’s longtime partner, Charlie Munger, who passed away late last year.

| Article Subheadings |

|---|

| 1) Investing Insights from the Oracle of Omaha |

| 2) Stock Market Movements and Berkshire’s Strategy |

| 3) Anticipated Questions on the Future of Apple |

| 4) The Changing Economic Landscape |

| 5) The Road Ahead for Berkshire Hathaway |

Investing Insights from the Oracle of Omaha

Warren Buffett, widely known as the “Oracle of Omaha,” is seen as a beacon of wisdom in the investment world. This meeting marks a pivotal moment, as Buffett is expected to address critical issues concerning current market challenges and investor sentiment. Many shareholders are eager to understand his views on how Berkshire Hathaway’s diversified portfolio could help navigate the turbulent waters created by recent economic shifts. Given Buffett’s investment philosophy, which emphasizes value investing, it is essential to discern whether he perceives any opportunities in the landscape shaped by recent tariffs.

In discussions leading up to the meeting, analysts highlighted that Buffett’s history of navigating economic uncertainties makes his opinions particularly valuable at this moment. As a proponent of long-term investment strategies, Buffett’s insights may provide guidance for both seasoned and novice investors looking to stabilize their portfolios during these volatile times. His communication style has always conveyed clarity and confidence, traits that many shareholders hope will be evident in his upcoming remarks.

Stock Market Movements and Berkshire’s Strategy

The recent volatility in the stock market has caught the attention of many investors, especially as Berkshire Hathaway has sold more stock than it has purchased in recent quarters. Over the last nine quarters, the firm has divested over $134 billion worth of stocks, primarily from its larger holdings like Apple and Bank of America. This trend has resulted in a remarkable cash reserve increase, culminating in a total of $334.2 billion in cash as of December 2023. Buffett’s approach of maintaining robust cash reserves positions Berkshire well to adapt to changing market conditions.

Market experts speculate that Buffett’s reduction of holdings in Apple may have been a strategic move to preemptively address potential downturns. His reluctance to hold stocks at inflated prices has garnered attention, particularly as many are keen to know whether this strategy will continue. By selling off stock in large quantities, Buffett may have positioned Berkshire Hathaway to capitalize on forthcoming opportunities when market prices stabilize.

Anticipated Questions on the Future of Apple

The tension surrounding Buffett’s decisions regarding Berkshire’s significant stake in Apple generates significant curiosity among shareholders. Over the last four quarters, Buffett’s strategy appeared to show a pattern of selling, with shares currently stabilized at 300 million. This leads many to question his motivations behind the recent adjustments. After all, his previous comments suggested that fiscal concerns related to potential tax implications may have influenced his decision to trim Berkshire’s stake in the tech giant.

As shareholders prepare their questions for Buffett, the ambiguity surrounding his stance on Apple is paramount. Many are curious whether Buffett will clarify if his past rationale still applies or if he sees new risks that could affect the technology sector in light of escalating tariffs and a shifting economic landscape. The outcome of his response could not only influence positions regarding Apple but also reflect the broader market sentiment.

The Changing Economic Landscape

The dynamics of the economy have shifted significantly due to tariffs enforced by the recent administration. Official reports have indicated a worrying trend, with Wall Street economists warning of potential recession conditions. Investors are left increasingly anxious by the signals of economic weakening, prompting the need for strategic adaptation. Buffett’s articulation of these concerns may provide crucial insight, potentially helping investors recalibrate their strategies accordingly.

Buffett’s experience navigating economic downturns could present a roadmap for shareholders grappling with these uncertainties. Should he express confidence in the U.S. economy, it could allay fears and reset expectations. Conversely, if he emphasizes rising concerns, it may lead to a more cautious approach among investors, further influencing stock market behavior in the weeks to come.

The Road Ahead for Berkshire Hathaway

As Berkshire Hathaway enters this next chapter without Charlie Munger, expectations are high for Buffett and his successor, Greg Abel. Many stakeholders are eager to understand how the leadership dynamics will evolve in response to ongoing market challenges. Buffett’s remarks on the future direction of the company will serve as a crucial touchstone for reflecting on Berkshire’s operations and strategic vision.

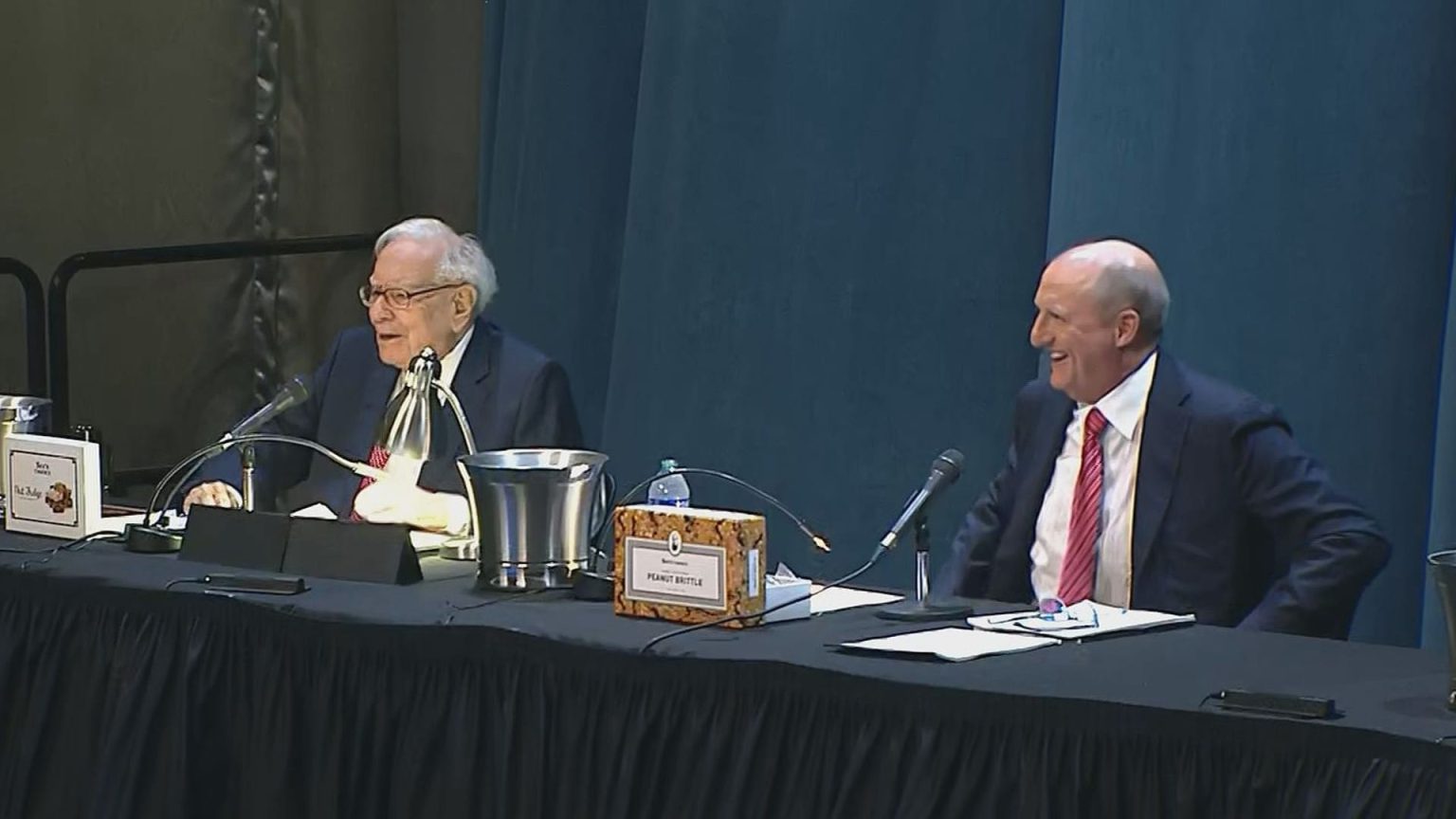

Investors are also focused on what actions will be taken with the substantial cash reserves that have built up at Berkshire. With many anticipating Buffett’s next significant investment moves, this meeting holds the promise of clarity regarding the company’s trajectory. The dual presence of Buffett and Abel on stage is intended to provide a seamless transition of leadership insights that assures stakeholders of Berkshire’s enduring values and strategies.

| No. | Key Points |

|---|---|

| 1 | Warren Buffett will address shareholders for the 60th annual meeting of Berkshire Hathaway. |

| 2 | The meeting is expected to provide insights on economic challenges arising from recent tariffs. |

| 3 | Buffett has significantly reduced holdings in Apple and other key stocks but retains a large cash reserve. |

| 4 | Shareholders are interested in understanding the context behind Buffett’s selling spree and future strategies. |

| 5 | The leadership dynamic at Berkshire is evolving after the passing of Charlie Munger, with expectations on Greg Abel. |

Summary

The upcoming annual meeting of Berkshire Hathaway represents a significant moment for both shareholders and the broader investment community. With Warren Buffett addressing the current economic landscape shaped by tariffs, along with his strategic decisions concerning major investments like Apple, the insights shared during this session are anticipated to inform and guide investor sentiment in turbulent times. As the company evolves its leadership dynamics with Greg Abel stepping into a more prominent role, the meeting promises to outline a clear path forward for the future of Berkshire Hathaway.

Frequently Asked Questions

Question: What is the significance of Berkshire Hathaway’s annual meeting?

The annual meeting serves as a key event where Warren Buffett addresses shareholders, discussing company performance, economic outlook, and future strategies, providing invaluable insights to investors.

Question: Why has Buffett been selling off stocks in recent quarters?

Buffett’s recent sell-off, particularly in high-profile stocks like Apple, is perceived as a strategic move to navigate market volatility and capitalize on future investment opportunities while mitigating risks.

Question: What role will Greg Abel play at Berkshire Hathaway following Munger’s passing?

Greg Abel is expected to take on a more prominent leadership role at Berkshire Hathaway, allowing for a smooth transition in response to changing market conditions and internal company dynamics.