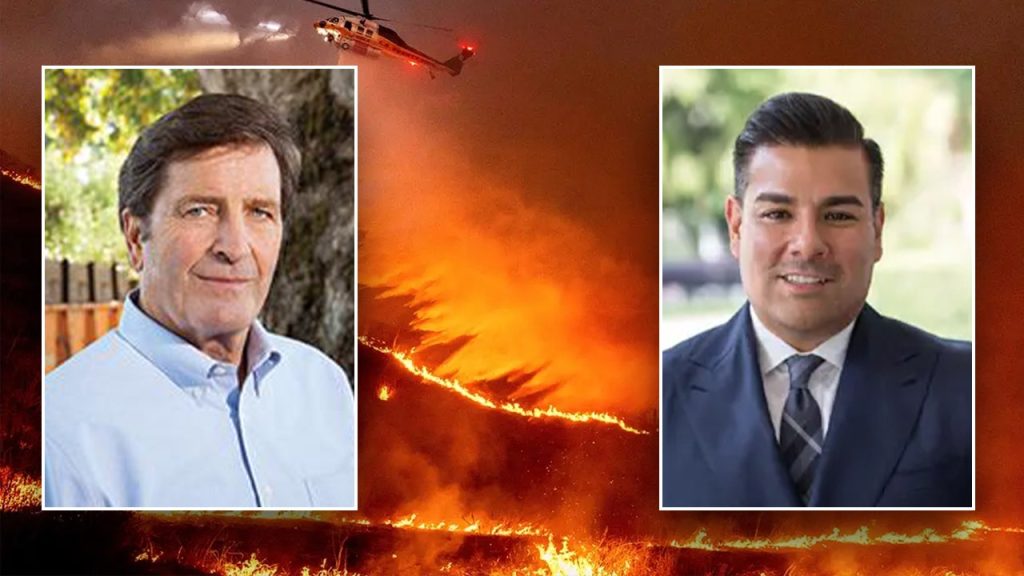

Allegations of close ties between California’s elected insurance commissioner, Ricardo Lara, and the insurance industry have sparked heated exchanges between him, critics in both Sacramento and Washington, and frustrated Californians affected by the recent Pacific Palisades fires. Following critical remarks from U.S. Representative John Garamendi, formerly California’s first insurance commissioner, accusations flew over accountability and reform efforts. As California’s insurance landscape continues to grapple with the fallout from devastating wildfires, these exchanges highlight the complexities and challenges of insurance policy and reform in a state facing increasing natural disasters.

| Article Subheadings |

|---|

| 1) Political Tensions Arise in California’s Insurance Landscape |

| 2) Controversy Over Insurance Practices Post-Fires |

| 3) Lara’s Reform Efforts Amid Criticism |

| 4) The Stakes Involved for Californians |

| 5) Future Implications for California’s Insurance Market |

Political Tensions Arise in California’s Insurance Landscape

The recent criticism directed at Ricardo Lara, California’s insurance commissioner, by John Garamendi, has sparked a heated political environment surrounding insurance regulation in the state. The tensions have been exacerbated by accusations of complacency regarding the insurance industry’s operations and their accountability, particularly following the devastating Pacific Palisades fires that left many residents without homes or proper insurance coverage. Garamendi’s remarks reflect a growing frustration amongst constituents who feel that their needs are not being represented or addressed adequately by state officials.

Lara, in response, has characterized Garamendi’s criticisms as unjustified and as a form of “White mansplaining.” He has defended his role and decisions, suggesting that criticism from Garamendi and others may stem from a misunderstanding of the challenges involved in regulating a complex insurance market amidst natural disasters. This political back-and-forth underscores the ongoing discourse about the efficacy of regulatory practices and the ultimate impact on the consumer.

Controversy Over Insurance Practices Post-Fires

The Pacific Palisades fire incident has placed additional scrutiny on the insurance industry’s practices in California. With estimates suggesting that insurance companies could face payouts around $45 billion due to damages caused by the wildfire, the pressure is mounting on both insurance firms and regulatory bodies to provide relief to affected individuals. Reports of rising premiums and insurance policies being canceled in high-risk areas have further fueled public outcry and calls for stringent regulations.

Following the fires, State Farm reportedly requested an emergency rate hike to offset projected losses, a request that Lara denied. The commissioner advocates measures to stabilize the insurance market while ensuring that residents can obtain coverage, even in disaster-prone areas. This intersection of industry interests and consumer protection is pivotal as California navigates an era increasingly marked by natural disasters.

Lara’s Reform Efforts Amid Criticism

Amid escalating criticism, Ricardo Lara has outlined a reform plan aimed at improving California’s insurance climate. With extensive experience in public office, including nearly six years as the California insurance commissioner, Lara is positioning his reform strategy as a “carrot-and-stick” approach. This initiative includes concessions to insurance providers to encourage them to offer policies in high-risk areas, thereby attempting to incentivize industry cooperation while enhancing customer access to necessary coverage.

A spokesperson for Lara emphasized the normalcy of communication between regulatory bodies and industry stakeholders, arguing that this engagement is critical for effective governance. They highlighted that regular meetings with insurance companies are standard practice, noting that any indictment against these actions should be considered in the context of overall regulatory responsibilities. Lara believes that reforms can contribute to better insurance availability for Californians while fostering accountability among insurers.

The Stakes Involved for Californians

The stakes are monumental for many California residents, particularly those devastated by recent wildfires. The tension surrounding insurance policies and coverage options speaks to broader issues of economic stability and security for individuals and families. Many homeowners find themselves in precarious positions as insurers increasingly seek to limit their exposure to risk, resulting in higher costs and fewer options for coverage. These challenges are hitting hard in communities that have weathered natural disasters consistently.

Moreover, the potential collapse of the FAIR Plan, California’s safety net insurance program designed to provide coverage in high-risk areas, looms large. Lawmakers, including Senate Minority Leader Brian Jones, are warning that failure to tackle necessary reforms could cripple the insurance market and lead to more significant financial burdens on everyday Californians. The specter of inflated premiums covering mass policy cancellations raises concerns about the affordability and accessibility of home insurance in the future, adding urgency to proposed legislative reforms.

Future Implications for California’s Insurance Market

Looking ahead, the future of California’s insurance market is uncertain, driven by regulatory actions and ongoing tensions between state officials and insurance providers. The outcomes of the current political exchanges, ongoing reform discussions, and the immediate responses to the fallout from natural disasters will shape the direction of policy in the upcoming years. Consumer advocacy groups continue to press for transparency and accountability, fearing that the insurance needs of vulnerable populations may be overshadowed by corporate interests.

In summary, the interplay of these dynamics will not only affect insurance practices post-wildfires but could dictate the broader economic and social landscape of California. Continued scrutiny from consumer groups and political figures will be essential to drive the necessary reforms needed to stabilize the market and safeguard the financial well-being of Californians.

| No. | Key Points |

|---|---|

| 1 | The criticisms of insurance practices are becoming more vocal following the Pacific Palisades fires, reflecting widespread discontent among affected residents. |

| 2 | Political exchanges between Ricardo Lara and John Garamendi highlight the challenges and tensions within the California insurance regulatory environment. |

| 3 | The proposed reforms aim to strike a balance between providing consumer protections while ensuring the insurance industry remains viable in high-risk areas. |

| 4 | The potential collapse of the FAIR Plan raises alarm bells for consumers facing rising costs and fewer insurance options. |

| 5 | Ongoing scrutiny and pressure for accountability are vital for restoring consumer confidence in California’s insurance market. |

Summary

The unfolding controversy over California’s insurance practices in the wake of recent wildfires illuminates significant challenges within the state’s regulatory framework. With allegations of complicity and calls for accountability resonating across political lines, California’s path to reform is complex and fraught with uncertainty. As officials and insurance companies navigate public scrutiny and pressures, the future of insurance accessibility for vulnerable populations remains pivotal amidst increasing natural disaster occurrences. Whether these tensions lead to meaningful reforms or prolonged discontent will ultimately shape the insurance landscape in California for years to come.

Frequently Asked Questions

Question: What prompted the current criticisms of California’s insurance practices?

The criticisms stem from frustrations among Californians affected by recent wildfires who feel that their insurance needs are not being adequately addressed. The exchanges between officials highlight concerns regarding accountability and reform in the insurance sector.

Question: Who are the key players involved in the ongoing insurance controversy in California?

Key players include California’s insurance commissioner Ricardo Lara and U.S. Representative John Garamendi, as well as advocacy groups and affected residents pushing for reforms amidst rising insurance costs and policy cancellations.

Question: What potential changes are being proposed to improve California’s insurance market?

Proposed changes include Lara’s reform plan, which seeks to incentivize insurance companies to provide coverage in high-risk areas while ensuring that consumer protections are strengthened against excessive rate hikes and policy cancellations.