In a recent post on his social media platform, President Donald Trump depicted a cartoonish scenario in which he fires Federal Reserve Chairman Jerome Powell, emphasizing ongoing tensions surrounding monetary policy. This image comes as part of Trump’s continuous critique of Powell’s handling of interest rates, which he perceives as damaging to the economy. With Powell’s term set to conclude in May 2026, the implications of Trump’s threats raise questions about the independence of the Federal Reserve and the potential risks to financial markets.

| Article Subheadings |

|---|

| 1) Trump’s Social Media Post and Its Implications |

| 2) The Historical Context of Federal Reserve Independence |

| 3) Economic Reactions and Market Stability |

| 4) The Role of Federal Reserve Chair in Monetary Policy |

| 5) Future Implications for U.S. Economic Policy |

Trump’s Social Media Post and Its Implications

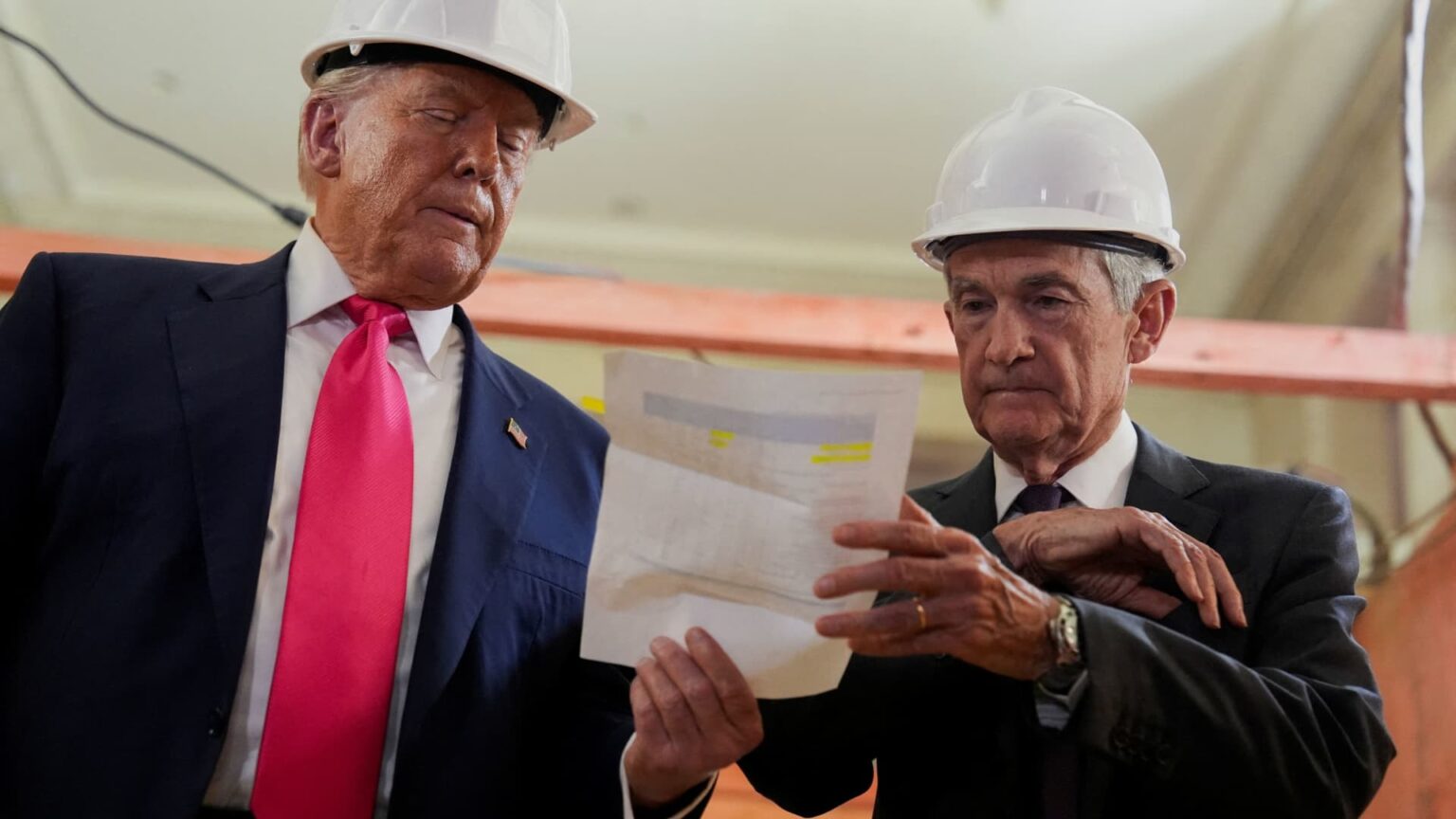

On Saturday, President Trump took to Truth Social, posting a cartoon image that showcased him in a threatening gesture towards Jerome Powell, portraying the Fed chair as being on the verge of being dismissed. The visuals, which feature Trump shouting, “YOU’RE FIRED!” echo the rhetoric Trump has employed repeatedly regarding Powell’s policy decisions. As Trump has labeled Powell as “Too Late Powell,” the image serves to amplify his ongoing dissatisfaction with the Fed’s approach to interest rates.

The timing of this post is significant. Just recently, the Federal Reserve enacted cuts to interest rates, the first such move of the year. However, Trump’s dissatisfaction stems from years of perceived slow responses and hesitations from Powell, which he believes have negatively impacted the economy. His depiction of Powell amid discussions of his potential removal raises alarms about the broader implications for economic policy and the integrity of the Federal Reserve as an institution.

Given that no U.S. president has attempted to dismiss a Federal Reserve chair, Trump’s rhetoric invites scrutiny. It raises questions about the appropriateness of such threats against an agency designed to function independently of political pressure. Market analysts and economists alike are setting their sights on how Trump’s actions may be perceived as a precedent for political intrusion in central bank operations, potentially undermining public confidence in the Fed.

The Historical Context of Federal Reserve Independence

The Federal Reserve was established with a clear mandate meant to shield it from political pressures, ensuring independence in its economic decisions. This design underscores the conviction that monetary policy should be insulated from the immediate whims of political actors for the sake of economic stability. Historically, previous presidents have voiced criticisms of the Fed, yet none have dared to publicly commit to firing its leaders.

A recent U.S. Supreme Court ruling outlines a significant constraint on presidential power, making it clear that removing Fed officials without clear judicial or statutory backing could lead to legal challenges. Powell himself has emphasized that he believes his termination is “not permitted under the law,” reinforcing the institutional safeguards in place. This historical context makes Trump’s threats all the more unprecedented, placing a spotlight on the potential fallout from such an unprecedented move against a Federal Reserve leader.

Despite past criticism, the relationship between presidents and Federal Reserve chairs has often been navigated with caution, as both parties recognize the implications of erosion in public trust, which could have adverse effects on the economic landscape.

Economic Reactions and Market Stability

While the equity and fixed income markets have been relatively stable in reaction to Trump’s threats, the underlying tension continues to be a point of concern among economists. Despite the ongoing discussions regarding possible political maneuvers against Powell, market reactions have largely absorbed past volatility. Analysts speculate that significant declines in confidence towards the Fed’s independence directly correlate with rising long-term interest rates, which could exacerbate economic uncertainties.

Concerns linger regarding how Trump’s ongoing criticisms of the Fed could reshape investor sentiment. Economists are cautious, maintaining that any perception of the Federal Reserve acting in alignment with Trump’s interests rather than a commitment to its dual mandate could lead to a reassessment of risk across financial markets. The potential for longer-term interest rates to rise amid perceived political interference in the Fed’s actions underlines the gravity of this situation.

The potential removal of Powell could disrupt the Fed’s carefully measured approach towards managing inflation and unemployment stability, further aggravating the ongoing anxiety surrounding economic conditions. Understanding these implications underscores the need for the Federal Reserve to maintain its independence amidst political pressures.

The Role of Federal Reserve Chair in Monetary Policy

The chair of the Federal Reserve plays an essential role in determining the United States’ monetary policy, influencing decisions surrounding interest rates and regulating the money supply. Powell, appointed in 2018, has navigated a diverse set of challenges ranging from inflation management to employment levels. His leadership has been pivotal, especially during turbulent periods of economic adjustment in response to the pandemic.

The chair’s decisions are guided by a dual mandate established by Congress: to promote maximum employment and stable prices. The gradual easing of interest rates reflects Powell’s interpretation of data signaling a need for supportive monetary policy, despite political pressure. Trump’s portrayal of Powell as ineffective underscores a clash between the president’s immediate economic objectives and the Fed’s mandates designed for longer-term economic health.

This tension invites scrutiny not only of Powell’s capability but also of the broader system that enables such independence. The relationship between political leadership and economic stewardship must walk a fine line to ensure trust and stability in financial markets.

Future Implications for U.S. Economic Policy

Looking ahead, the implications of Trump’s threats against Powell potentially reshape how economic policy is viewed under different administrations. If the current political climate encourages more direct intervention in the Federal Reserve’s operations, it could undermine the long-term credibility of the institution. The potential for a politically motivated reshaping of the Fed raises alarms about the integrity of U.S. economic policy, promoting fears of increased volatility in financial markets.

As Trump continues to stir public sentiment against Powell while expressing intentions to exert authority over the Fed, observers remain vigilant of how this will potentially influence future regulatory frameworks. A shift in policy perception could lead to uncertainty, affecting investment decisions and economic forecasts.

In summary, as the political landscape continues to wrestle with economic realities, the importance of preserving the Federal Reserve’s independence has never been more pronounced. The long-term implications of undermining this independence could resonate through years of economic performance, affecting not just the markets but also the American public’s economic futures.

| No. | Key Points |

|---|---|

| 1 | Trump’s social media portrayal of firing Powell highlights ongoing criticism of the Fed’s interest rate policies. |

| 2 | No U.S. president has successfully dismissed a Federal Reserve chair, emphasizing Powell’s protection under current laws. |

| 3 | Market stability remains while uncertainties revolve around Trump’s threats and their potential impact on future economic policies. |

| 4 | The Fed’s dual mandate prioritizes maximum employment and stable prices, contrasting with Trump’s immediate economic agenda. |

| 5 | The future of U.S. economic policy hangs in the balance, particularly concerning the independence of the Federal Reserve amidst political pressures. |

Summary

President Trump’s recent threats against Federal Reserve Chairman Jerome Powell have raised significant concerns regarding the future of U.S. economic policy and the independence of the Federal Reserve. With Trump’s continued public critiques and provocative actions, the implications for economic stability and market confidence are profound. As stakeholders navigate this evolving landscape, the importance of maintaining a separation between political influence and economic stewardship becomes increasingly crucial.

Frequently Asked Questions

Question: What prompted Trump’s recent criticism of Jerome Powell?

Trump’s criticism of Powell stems from a belief that the Fed has been too cautious in cutting interest rates, which he contends has been detrimental to the economy. His frustrations were further highlighted through a recent post on Truth Social showing him firing Powell.

Question: How does the Federal Reserve maintain its independence?

The Federal Reserve is designed to function independently of political pressures, with a structure and legal framework that protects its leaders from being removed without clear justification, as highlighted by recent Supreme Court decisions.

Question: What could be the economic impacts if Trump were to successfully fire Powell?

If Trump were to successfully dismiss Powell, analysts fear it could lead to increased long-term interest rates and market instability, as trust in the Federal Reserve’s ability to act independently from political motivations might erode.