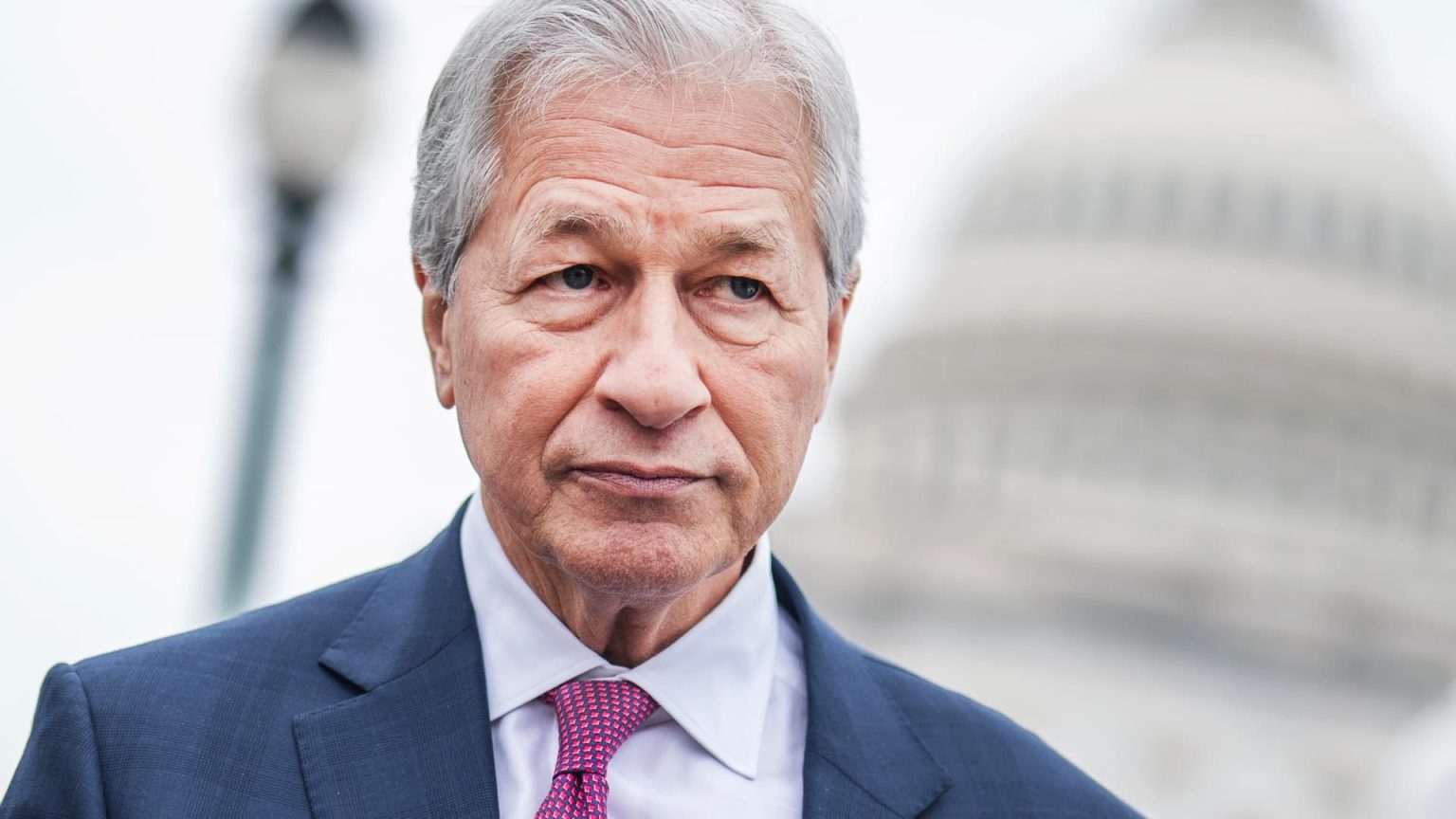

In a compelling address during JPMorgan Chase’s annual investor day, CEO Jamie Dimon expressed concern that markets are underestimating the risks posed by record U.S. deficits and ongoing international tensions. Dimon emphasized that complacency among central banks may not be sustainable, as inflation and stagflation could loom on the horizon. His remarks come in the wake of a recent downgrade from Moody’s, signaling heightened anxiety over the country’s financial health.

| Article Subheadings |

|---|

| 1) Dimon’s Perspective on Market Risk |

| 2) The Current Economic Landscape |

| 3) Implications for Corporations |

| 4) Investment Banking Trends |

| 5) Succession Planning at JPMorgan Chase |

Dimon’s Perspective on Market Risk

During the investor day meeting held in New York, CEO Jamie Dimon articulated his concerns regarding the state of the markets in light of various economic factors. He indicated that the prevailing narrative among traders and central bankers may not adequately capture the complexities associated with current U.S. deficits, tariffs, and international relations. Dimon stated, “We have huge deficits; we have what I consider almost complacent central banks.” His insights reflect a belief that the interconnectedness of financial markets and governmental policies could create precarious conditions for economic stability.

Dimon’s skepticism centers around the notion that many believe central banks can manage the situation effectively. He warns that this complacency could mask underlying financial risks that remain largely unaddressed. Such conditions may lead to both higher inflation and the specter of stagflation, which he believes the markets are unequipped to anticipate.

The Current Economic Landscape

The timing of Dimon’s remarks coincides with a significant event: Moody’s recent downgrade of the U.S. credit rating. This rating cut has sent ripples through financial markets and raised questions about the sustainability of U.S. debt levels. With the country’s debt burden growing, Dimon asserts that government policies, particularly those influenced by trade discussions, could have far-reaching consequences for economic growth. This creates a snowball effect that not only pressures markets but also affects corporate earnings forecasts.

According to Dimon, Wall Street’s earnings estimates are likely to decline further, with many companies needing to pull or revise their guidance due to prevailing uncertainties. At the beginning of the year, expectations stood at a healthy growth rate of around 12%, but he predicts that this could diminish to a mere 0% growth within just six months, leading to falling stock prices. In a financial environment marked by more significant risks, such earnings adjustments will likely create a ripple effect throughout various sectors.

Implications for Corporations

For many corporations, Dimon’s observations suggest a transitional period that requires a shift in strategy. His comments indicate that uncertainty surrounding trade policies and potential tariffs could inhibit corporate acquisitions and overall business expansion. Troy Rohrbaugh, one of Dimon’s top deputies, corroborates this sentiment by noting that corporate clients are still in a “wait-and-see” mode regarding making significant investments or acquisitions. This cautious approach could lead to decreased activity in investment banking and capital markets.

Furthermore, Dimon forecasts a “mid-teens” percentage decline in investment banking revenue in the second quarter compared to the previous year. He contrasts this with trading revenues, which are trending higher albeit at a modest “mid-to-high” single-digit percentage. The juxtaposition highlights the uneven economic terrain within the financial services sector as corporations adjust to the evolving economic climate.

Investment Banking Trends

One noticeable theme within Dimon’s address was the shift in focus among investment firms towards stability and risk management. Given the highly volatile market conditions, investment banks are finding it increasingly challenging to maintain robust pipelines of mergers and acquisitions. Companies are hesitant to engage in new investments due to fears over financial mismanagement amid rising inflationary pressures and potential trade barriers.

As a result, the landscape for investment banking continues to evolve. Dimon’s forecasts for declining investment banking revenue align with broader observations from the industry, where uncertainty influences decision-making. While trading revenue is experiencing modest growth, the declining investment banking sector raises important questions regarding the long-term outlook for financial firms in a changing market environment.

Succession Planning at JPMorgan Chase

As questions arise regarding the future leadership of JPMorgan Chase, Dimon reiterated that his timeline for stepping back from the CEO position remains unchanged. He stated, “If I’m here for four more years, and maybe two more” as executive chairman, “that’s a long time.” His comments reflect a level of commitment to the bank while also providing clarity regarding his tenure, a subject of considerable speculation in investment circles.

During recently held presentations, Marianne Lake, the bank’s consumer banking chief, garnered attention for her lengthy address, highlighting her potential as a successor. Lake is considered a strong candidate for leadership, particularly following remarks from Jennifer Piepszak, the bank’s Chief Operating Officer, indicating she would not pursue the top position. As the bank evaluates its future, questions of succession planning take on increased importance, particularly in light of the volatile market conditions that necessitate a strong, steadfast leadership.

| No. | Key Points |

|---|---|

| 1 | Jamie Dimon expresses concerns about market complacency regarding U.S. economic risks. |

| 2 | Moody’s downgrades U.S. credit rating, signaling growing anxiety over debt levels. |

| 3 | Wall Street earnings forecasts are expected to decline, raising risks for stock prices. |

| 4 | Investment banking revenue is projected to face significant declines amid cautious corporate outlook. |

| 5 | Succession planning at JPMorgan faces scrutiny as leadership questions arise. |

Summary

In conclusion, Jamie Dimon’s remarks during JPMorgan Chase’s annual investor day serve as a critical reminder of the mounting risks present in today’s economic landscape. His insights highlight the need for careful consideration among both corporate leaders and investors as they navigate increasingly complex financial waters. Dimon’s perspectives on the potential for economic stagnation, combined with ongoing uncertainty regarding U.S. trade policies, suggest a turbulent environment ahead for both markets and firms seeking growth.

Frequently Asked Questions

Question: What are the risks Dimon is concerned about?

Dimon is worried about the potential for higher inflation and even stagflation, driven by record U.S. deficits and complacent central banks.

Question: How have U.S. credit ratings changed recently?

Moody’s has downgraded the U.S. credit rating, reflecting growing concerns about the government’s increasing debt burden.

Question: What is the outlook for investment banking revenue?

Investment banking revenue is expected to decline significantly amid uncertainty in corporate decision-making, as many companies are in a “wait-and-see” mode regarding acquisitions and investments.