Concerns over the implementation of new tariffs by the United States on China and its Southeast Asian partners have stirred turbulence amongst investors. Despite this, analysts anticipate that China’s technology sector will maintain its momentum, particularly in the rapidly evolving sphere of generative artificial intelligence. This situation has sparked a notable investor interest, with many key players emphasizing the ongoing appeal of domestic technology stocks over export-driven companies amidst broader economic uncertainties.

| Article Subheadings |

|---|

| 1) Investor Reactions to Tariff Announcements |

| 2) Sectoral Performance Amidst Market Volatility |

| 3) Government Actions and Support Strategies |

| 4) The Booming AI Landscape in China |

| 5) Future Outlook for Chinese Industries |

Investor Reactions to Tariff Announcements

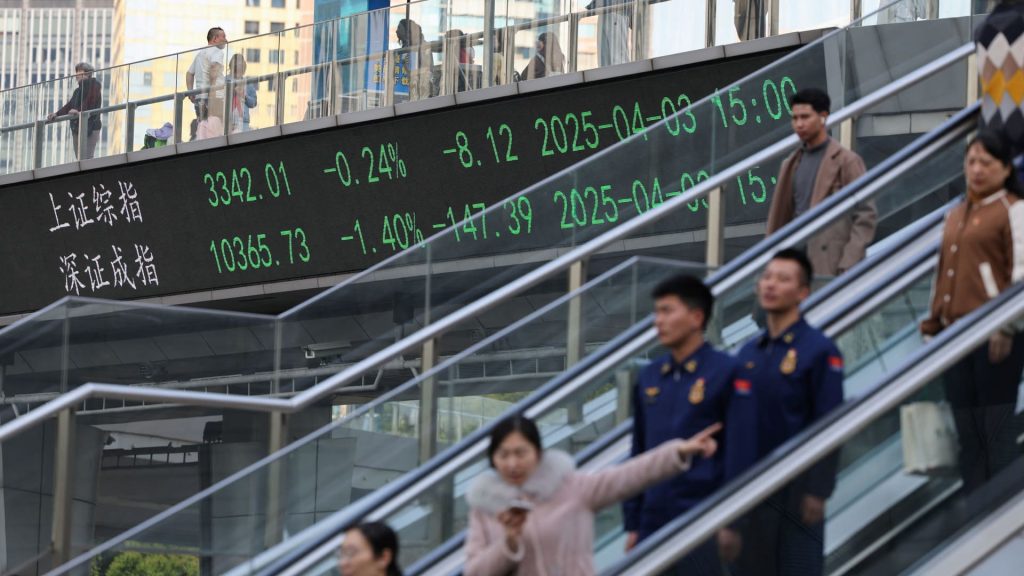

The announcement of increased tariffs by the United States has elicited a mixed response from global investors. On Thursday, the onset of these tariffs caused a significant dip in Chinese stocks, with prices plummeting at market open. However, by the end of the trading day, stocks managed to recover somewhat, closing off their lowest points of the day. This fluctuation reflects investor erraticism and the uncertainty surrounding how these tariffs will impact economic dynamics. Kai Wang, an Asia equity strategist at Morningstar, commented on the situation, stating that many major technology and consumer companies in China have limited exposure to the U.S. market, urging a more tempered reaction to drastic tariff measures.

Although there is an initial panic, analysts are hopeful that the Chinese government will intervene with proactive policies to stimulate the economy should the macroeconomic environment show signs of weakness. Wang further underscored that the Chinese finance ministry has indicated readiness to deploy fiscal resources to boost economic growth amidst these turbulent times. The growing sentiment that the Chinese tech sector is somewhat insulated from U.S. tariffs is leading many investors to adopt a wait-and-see approach.

Sectoral Performance Amidst Market Volatility

As U.S. tariffs loom, the performance of different sectors in China’s economy is drawing heightened scrutiny. Analysts at Citi have noted that valuations for major tech stocks in China remain favorable compared to their American counterparts. Their report highlighted that the average price-to-earnings ratio for seven prominent Chinese tech firms is 52% less than that of the U.S.’s “Magnificent Seven,” sending a signal of potential value in these stocks.

Despite the recent downturn, Chinese technology stocks have thus far outperformed the broader market indices. An index representing ten significant tech firms listed in Hong Kong saw only a 1.2% decline, demonstrating resilience amid uncertainty. This performance is notable when juxtaposed with the overall Hang Seng index, which dropped by 1.5%. Key sectors like transportation, technology, and domestic-focused internet services continue to attract investment, suggesting that market actors favor domestic growth stories over export-oriented companies during this period of tariff anxiety.

Government Actions and Support Strategies

In light of the looming tariffs and their potential consequences, Chinese policymakers are expected to convene for a regular meeting later this month. Analysts speculate that the agenda may be heavily focused on economic policy adjustments designed to sustain growth and provide support to sectors most affected by international trade constraints. China’s finance ministry has conveyed an intent to maintain a reserve of fiscal capacity to propel domestic growth.

The government’s inclination to back high-tech sectors is proving vital in curbing the impact of tariffs. Certain industries, like healthcare, have managed to avoid the brunt of tariffs, with pharmaceuticals exempted from the latest U.S. measures. This exemption has highlighted a strategic layer within China’s approach to trade policy, focusing on retaining sectors that can leverage international partnerships while bypassing punitive tariffs. Analysts from firms such as Jefferies have suggested that the potential for pharmaceuticals to operate efficiently while maintaining positive growth trajectories is indicative of a broader economic strategy that emphasizes resilience and adaptability.

The Booming AI Landscape in China

AI has increasingly emerged as a significant player in China’s technology landscape, capturing considerable attention from both domestic and international investors. The recent launch of an AI model by the Chinese startup DeepSeek, which claimed to outpace OpenAI’s ChatGPT, is pivotal in this context. Although U.S. restrictions on access to advanced chips for AI training remain a limiting factor, the urgency for AI adoption among Chinese firms creates a fertile ground for innovation and cost-cutting initiatives.

Investment in AI technology is perceived as critical for fostering long-term company growth and productivity. Policymakers are expressing optimism toward supporting AI-driven initiatives and developing frameworks that facilitate tech adoption across multiple sectors. This dual helix of innovating technology while accommodating fiscal policy means that AI could serve as a critical pillar for China’s economic strategy in the coming years.

Future Outlook for Chinese Industries

Looking forward, analysts are cautiously optimistic about the trajectory of Chinese industries post-tariffs. There’s a growing consensus that while immediate volatility might occur, certain sectors—especially tech and healthcare—may still experience enviable growth metrics. As analysts suggest, the dual pressures of domestic consumer growth and international trade considerations will define much of the future landscape for China’s economy. Investor allocations towards Chinese equity markets, particularly in the high-tech space, are expected to trend upwards amid improving sentiment.

As these strategies unfold, the implications for foreign investments are equally profound. The return of positive investor sentiment, as indicated by the recent uptick in international allocations towards Chinese tech stocks, signals a potential turn in the wider investment narrative. Given that major players in this market are forecasting a return to strong performance metrics, the Chinese economy could well prove its resilience against external pressures, emerging stronger from the adversity posed by new tariffs.

| No. | Key Points |

|---|---|

| 1 | Concerns about new U.S. tariffs on China have created a volatile environment for investors. |

| 2 | China’s technology sector maintains an attractive valuation relative to U.S. stocks. |

| 3 | Chinese policymakers are expected to implement fiscal interventions to boost economic growth. |

| 4 | The AI sector in China is rapidly growing, with new models emerging to compete effectively against U.S. counterparts. |

| 5 | Analysts are cautiously optimistic about the resilience of Chinese industries amid tariffs. |

Summary

In conclusion, the latest wave of U.S. tariffs on China has introduced a mix of investor anxiety and opportunity within the Chinese technology sector. While the market faces significant challenges, analysts note that the enduring interest in domestic innovations—especially within artificial intelligence and healthcare—points towards a resilient outlook. Timely government interventions and strategic adaptations will likely define how Chinese industries navigate this turbulent economic landscape, providing avenues for potential growth in the coming months.

Frequently Asked Questions

Question: How have recent tariffs affected investor sentiment in China?

Recent tariffs have initially rattled investor sentiment, leading to declines in stock values. However, a substantial portion of investors have recognized the limited exposure that many major Chinese firms have to the U.S. market, prompting a more nuanced approach to investing in Chinese equities.

Question: What sectors in China are expected to fare well amidst these tariffs?

Sectors like technology and healthcare are anticipated to withstand the pressure stemming from tariffs. Analysts believe that the ongoing innovations and partnerships within these sectors will help mitigate the adverse impacts of tariffs.

Question: How is the Chinese government strategizing to cope with economic pressures from tariffs?

The Chinese government is likely to deploy fiscal support policies aimed at boosting growth while also protecting key industries. Preparations to convene for discussions about economic policy adjustments reflect their proactive stance in adapting to evolving challenges.