European markets experienced a decline on Friday, following the historic rally on Wall Street the previous day. The pan-European Stoxx 600 index concluded the session nearly 0.5% lower. Investors closely monitored the escalating conflict between Ukraine and Russia, particularly as NATO Secretary General Mark Rutte warned that Europe must prepare for the possibility of war. This commentary comes amidst ongoing discussions about using frozen Russian assets to aid Ukraine, further complicating Europe’s geopolitical landscape.

| Article Subheadings |

|---|

| 1) Economic Impact of the Ukraine-Russia Conflict |

| 2) Market Reactions to Latest NATO Statements |

| 3) Individual Stock Movements in Europe |

| 4) Broader Economic Indicators in the U.K. and Europe |

| 5) Future Outlook for European Markets |

Economic Impact of the Ukraine-Russia Conflict

The ongoing conflict between Ukraine and Russia has profound implications on global economic stability. As of Friday, global investors expressed heightened concern over the potential escalation of military activity in Europe, which is evidenced by recent statements from NATO Secretary General Mark Rutte. He remarked, “Russia has brought war back to Europe, and we must be prepared for the scale of war our grandparents or great-grandparents endured.” This comment underscores the urgency felt across European nations as they grapple with the complex dynamics of military aggression in proximity to their borders.

The conflict’s economic ramifications extend beyond military expenditures; it significantly affects resource supply chains, energy security, and international trade flows. Observers believe that the severity of the situation necessitates proactive measures from various stakeholders, including national governments, the EU, and NATO, to safeguard economic interests and maintain regional security. The dialogue surrounding the use of frozen Russian assets to assist Ukraine draws attention to legal and ethical considerations that may impact future agreements within the EU.

Market Reactions to Latest NATO Statements

The financial markets in Europe reacted cautiously to NATO’s recent assessments and strategic warnings. The decline in the Stoxx 600 index reflects investor apprehension regarding the geopolitical situation. A notable development came after the White House released a new national security strategy that raised alarms across Europe, warning of a potential “civilizational erasure” and casting doubts on the EU’s reliability as a geopolitically pivotal partner for the U.S.

Looking deeper into market sentiment, analysts suggest that countries may need to bolster their defense budgets and preparedness programs in light of these developments. Former CIA Director and four-star general David Petraeus echoed this sentiment by stating that European nations should prioritize their defense and security. This shift in focus indicates a broader understanding of military readiness as an essential component for economic stability and national security.

Individual Stock Movements in Europe

On the individual stock front, notable movements were characterized by sharp disparities among different companies. French private equity firm Wendel led the gains, showing a 5% increase coinciding with announcements to return €1.6 billion ($1.88 billion) to investors by 2030. This commitment to shareholder returns appears to have bolstered investor confidence in Wendel amidst a volatile market environment.

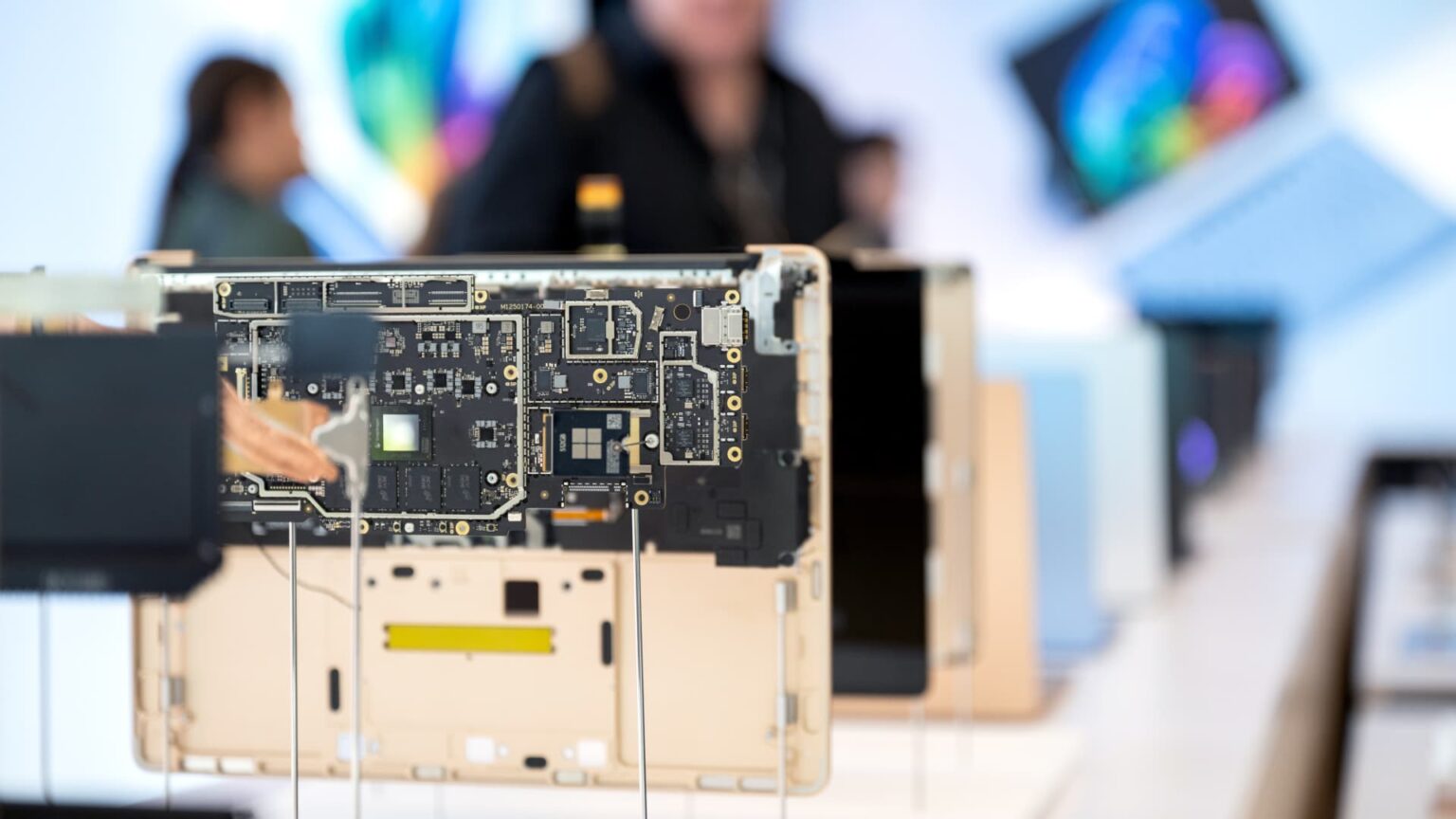

Conversely, the newly listed ice cream company Magnum reported a downturn, finishing the day over 1% lower. This drop came shortly after the company spun out from Unilever, with its stock initially opening below the anticipated reference share price on the Amsterdam stock exchange. Other Dutch firms, like ASMI and BESI, also faced declines, showcasing a broader trend of weakened performance in the semiconductor sector, particularly influenced by recent tech market slides.

Broader Economic Indicators in the U.K. and Europe

Macroeconomic indicators revealed concerning trends in the U.K. economy as it unexpectedly contracted in the three months leading up to October, contrary to economists’ predictions for stable growth. These figures, released on Friday, highlight the fragile condition of the U.K. economy, further compounded by international tensions and inflationary pressures.

Final inflation data from Germany, France, and Spain was also awaited, and could add further context to the situation as policymakers navigate growth and inflation dynamics within the EU. In Switzerland, the central bank’s decision to hold rates at 0% signals a cautious approach in response to slightly lower-than-expected inflation rates, illustrating that not all nations in Europe are facing the same challenges.

Future Outlook for European Markets

The future of European markets appears uncertain, contingent upon the evolving political landscape and economic indicators. The continued depreciation of the U.S. dollar, reflected in the euro’s rise to its highest level since October 3rd, showcases fluctuating currency dynamics and its impact on international trade. In Asia-Pacific markets, surges were observed following Wall Street’s record highs, suggesting a possible trajectory of recovery if investors can manage to navigate the pervasive risks associated with geopolitical tensions.

As Europe confronts these challenges, stakeholders must closely monitor both regional and global developments, including energy prices and defense strategies. Analysts emphasize the necessity for Europe to adapt swiftly in order to maintain not only its economic stability but also its geopolitical relevance in an increasingly volatile world.

| No. | Key Points |

|---|---|

| 1 | European markets experienced a decline, with the Stoxx 600 index down nearly 0.5%. |

| 2 | NATO officials are urging European nations to prepare for potential military escalation regarding the Ukraine-Russia conflict. |

| 3 | Wendel showed significant growth, whereas Magnum faced losses on its first trading week. |

| 4 | The U.K. economy saw an unexpected contraction, raising concerns for investors and policymakers alike. |

| 5 | The euro strengthened against the dollar, reflecting varying impacts of geopolitical issues on currency stability. |

Summary

The latest developments in Europe illustrate a complex intersection of geopolitical tensions and economic implications. As the conflict in Ukraine continues to cast a long shadow over global markets, European nations must navigate both military and economic uncertainties. The financial markets’ response reveals a cautious outlook, reflecting concerns about security risks and economic health. Moving forward, close monitoring of these interlinked factors will be crucial for stakeholders in understanding and mitigating impending challenges.

Frequently Asked Questions

Question: What has caused the decline in European markets recently?

The recent decline in European markets is attributed to geopolitical tensions between Ukraine and Russia, alongside investor reactions to new NATO warnings concerning military preparedness.

Question: How have individual stocks performed in this climate?

Individual stocks have shown mixed performance, with some, like Wendel, gaining significantly, while others such as Magnum faced declines, especially following their market debut.

Question: What economic indicators are impacting Europe currently?

Current economic indicators include an unexpected contraction in the U.K. economy and inflation data from Germany, France, and Spain, which are essential for assessing regional economic stability.