In recent statements, U.S. Secretary of the Treasury Scott Bessent addressed the imminent tariffs proposed by President Donald Trump, emphasizing that they are unlikely to increase inflation. As the tariffs on imports from Canada, Mexico, and China are set to take effect, Bessent highlighted that China’s economic strategy may mitigate any inflationary impacts. The upcoming tariffs, which include a 25% tax on products from Mexico and Canada as well as an additional 10% on Chinese goods, have sparked a variety of reactions in economic circles regarding potential inflation and interest rates in the near future. Notably, China has already expressed its intent to retaliate.

| Article Subheadings |

|---|

| 1) Impending Tariffs and Economic Expectations |

| 2) Treasury Secretary’s Perspective on Inflation |

| 3) China’s Response and Countermeasures |

| 4) Canada and Mexico’s Potential Actions |

| 5) Future Economic Implications |

Impending Tariffs and Economic Expectations

On February 3, 2025, President Donald Trump announced a new series of tariffs set to take effect, targeting various imports from Canada, Mexico, and China. This move aligns with the administration’s ongoing strategy to reshape U.S. trade conditions. While the tariffs have garnered intense scrutiny, they are predominantly noted for a 25% duty on products imported from Mexico and Canada, alongside a supplementary 10% levy specifically on Chinese goods. The voice of concern among some economists has risen as they speculate that these tariffs could catalyze a surge in inflation rates, potentially affecting consumer prices and interest rates in the near future. As the new measures are scheduled to commence, market stakeholders are on high alert to assess their projected impacts on the economy.

These tariffs are expected to be implemented on February 6, 2025, and will be closely watched by economic analysts and policymakers alike. The ramifications could ripple through various sectors, from manufacturing to consumer goods, eliciting a broader discourse about the future of U.S. trade policy. Critics have raised alarms about the potential that these tariffs may lead to inflated import costs, thereby placing a heavier burden on households already grappling with rising expenses. However, the government maintains that these measures will ultimately benefit the U.S. economy by encouraging domestic manufacturing and reducing the reliance on foreign products.

Treasury Secretary’s Perspective on Inflation

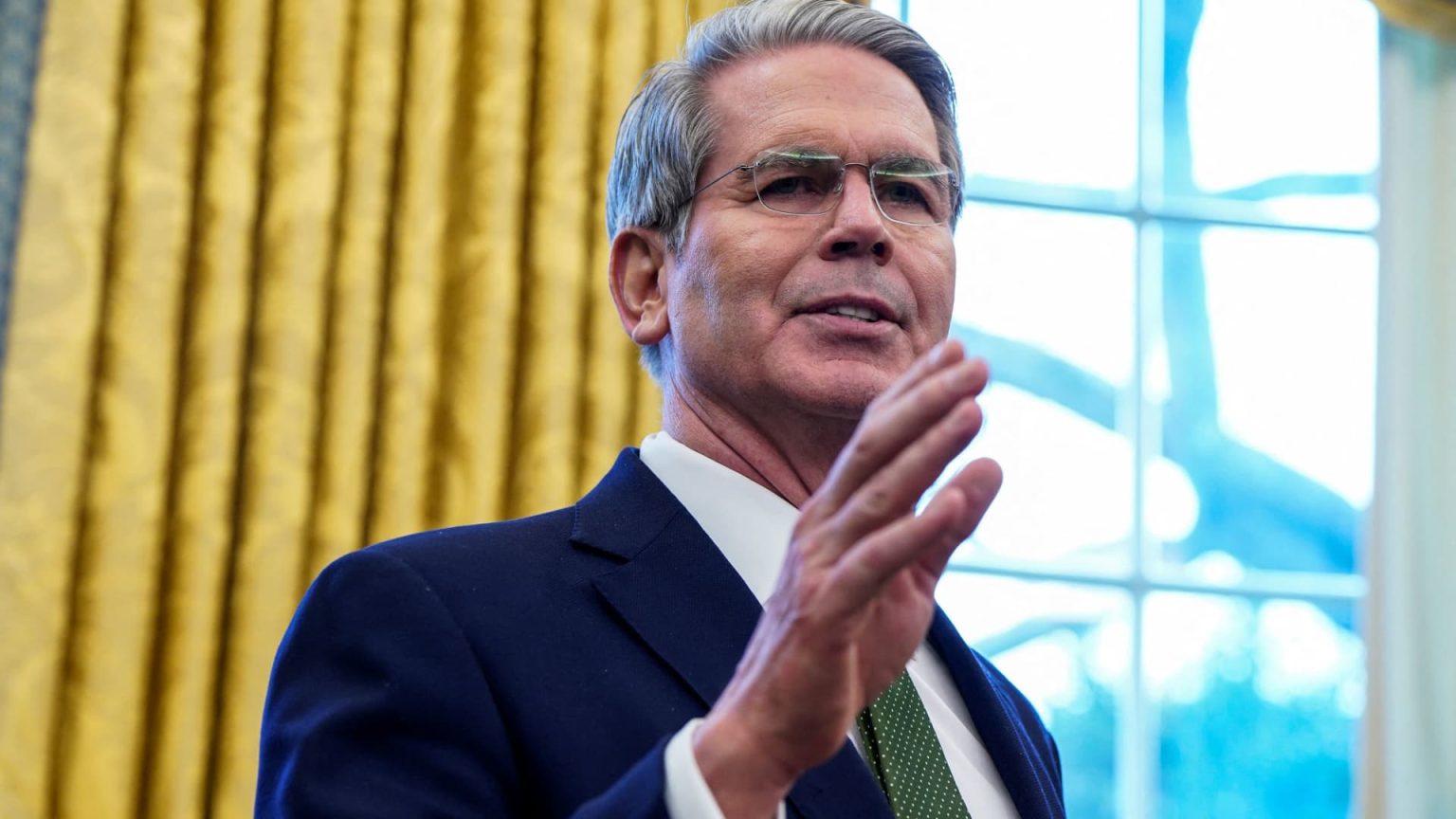

During a recent interview on CBS’s “Face the Nation,” Treasury Secretary Scott Bessent addressed concerns surrounding the tariffs’ implications on inflation. In response to questions about the potential effects, he articulated a stance of cautious optimism, asserting that the tariffs are unlikely to escalate inflation rates. Bessent emphasized that the true impact of the tariffs is difficult to predict, as it remains path-dependent based on various factors. He stated, “Well, we don’t know yet because it’s path-dependent, but what I can tell you is that I’m not worried about China. China will pay for the tariffs because their business model is exporting their way out of this inflation.”

This assertion reinforces the administration’s perspective that foreign suppliers, particularly China, would absorb the costs associated with the tariffs rather than passing them onto American consumers. Bessent further noted, “They will eat any tariffs that go on,” suggesting a level of confidence in the resilience of U.S. economic circuits. In this context, manufacturers and retailers preparing for the tariffs are encouraged to brace for potential adjustments in pricing trends depending on how the global supply chain reacts. Observers are left to wonder how implementing these tariffs will influence consumer spending patterns in the coming months.

China’s Response and Countermeasures

China’s Ministry of Commerce has openly challenged the upcoming U.S. tariffs, signaling a firm opposition and an intent to retaliate if necessary. In statements released prior to the tariffs’ imminent implementation, the Ministry underscored its commitment to defending its national interests through all available means. It is anticipated that China’s response mechanisms might mirror previous reactions witnessed after the initial tariffs were introduced in February, which included raising duties on select U.S. energy imports.

A spokesperson for the Ministry of Commerce indicated, “If the U.S. insists on its own way, China will take all necessary countermeasures to defend its legitimate rights and interests.” This defiance highlights the escalating tensions in U.S.-China trade relations, as both nations navigate a complex web of economic interdependencies and retaliatory stances. Analysts predict that Beijing might also consider adding more U.S. companies to its list of unreliable entities as a form of economic pressure against the U.S., leading to a potentially tit-for-tat trade conflict.

Canada and Mexico’s Potential Actions

As discussions about the tariffs develop, Secretary Scott Bessent hinted at the possibility of cooperative measures from neighboring countries Mexico and Canada. Earlier in the dialogue, he revealed that Mexican leadership had expressed an interest in matching the U.S. tariffs on China to sidestep being affected by the sanctions imposed by Trump. Bessent noted, “We’ll see. The Mexican leadership has offered to do that… but I think that would be a very good start.” He further elaborated that communication remains ongoing, with expectations for announcements from both countries possibly coinciding with the official implementation of the tariffs.

This strategic alignment could lead to a multifaceted negotiation process that not only involves U.S. tariffs but also the potential recalibration of trade agreements across North America. The Canadian government has remained silent on whether it will follow suit with such a proposal, yet analysts suggest that any coordinated response could substantially impact the efficacy of the U.S. tariffs and reframe regional trade dynamics.

Future Economic Implications

As the possibility of retaliatory measures looms and the effects of the tariffs begin to unfold, the ramifications may extend beyond inflation and into broader economic sentiments. The economic climate in the U.S. continues to be delicate; hence, these proposed measures may ignite further discussions about trade policies, job creation, and the sustainability of American manufacturing. There is a growing concern in various sectors about how increased costs from tariffs might affect consumer behavior, particularly as inflationary pressures are already mounting globally.

Analysts are keenly observing consumer response to these tariffs, positing that any abrupt shifts in pricing could alter purchasing habits and disrupt established market patterns. This uncertainty begs the question of how long it may take for the market to recalibrate in light of these adjustments. Policymakers will need to remain agile, adapting economic strategies that balance national interests and the realities of the interconnected global trade system.

| No. | Key Points |

|---|---|

| 1 | Tariffs on imports from Mexico, Canada, and China are set to take effect, raising concerns about inflation. |

| 2 | Treasury Secretary Scott Bessent believes China will absorb the tariff costs, minimizing inflation impact. |

| 3 | China’s Ministry of Commerce has expressed intentions to retaliate against U.S. tariffs. |

| 4 | Possible coordinated responses from Mexico and Canada to align tariffs against China. |

| 5 | Future implications may include consumer behavior changes and backlash against the tariffs’ economic strategy. |

Summary

In summary, the forthcoming implementation of tariffs by the U.S. government has sparked a multifaceted discourse on international trade, inflationary pressures, and retaliatory mechanisms among global economic powers. As Treasury Secretary Scott Bessent articulates concerns related to inflation, stakeholders from various sectors await the repercussions on both sides of the Pacific. The actions taken by China, Canada, and Mexico will remain pivotal in shaping the narrative around trade relations, indicating a continuously evolving economic landscape that merits close monitoring.

Frequently Asked Questions

Question: What tariffs are being implemented by the U.S. government?

The U.S. government is set to implement a 25% tariff on imports from Mexico and Canada, along with an additional 10% tariff on Chinese goods.

Question: How does Secretary Bessent believe tariffs will affect inflation?

Secretary Scott Bessent claims that the tariffs are unlikely to increase inflation and suggests that China will absorb these costs, preventing them from being passed on to consumers.

Question: What retaliation measures has China threatened in response to the tariffs?

China has indicated it will take necessary countermeasures to protect its interests and has previously raised duties on U.S. products in retaliation to earlier tariffs.