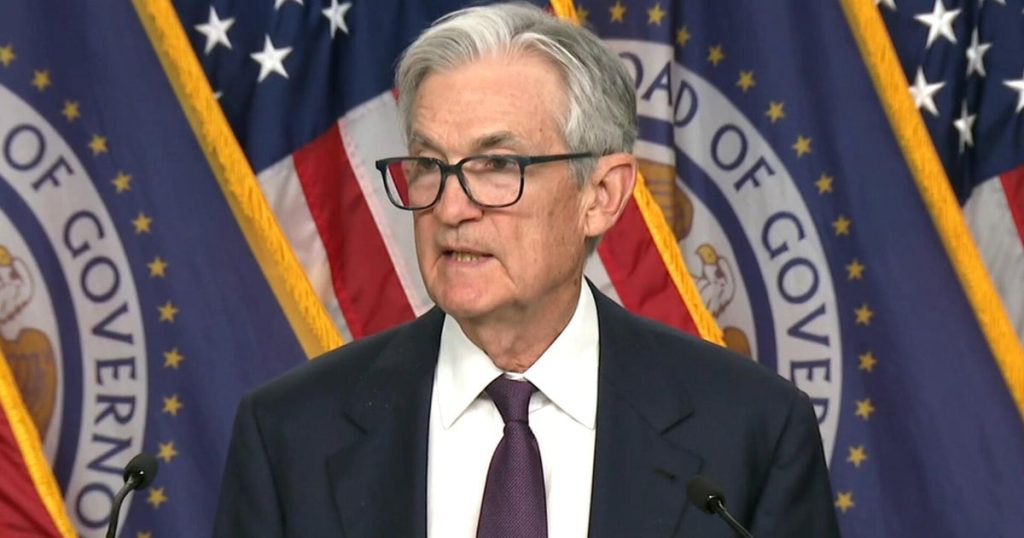

Federal Reserve Chair Jerome Powell recently issued a cautionary message regarding the potential for increasing supply shocks in the U.S. economy. This announcement follows the central bank’s decision to hold interest rates steady amid prevailing economic uncertainties. At a research conference in Washington, D.C., where U.S. bankers are discussing monetary policy, Powell emphasized that the nation might face more frequent and persistent supply challenges, which would pose significant hurdles for both the economy and central banks.

| Article Subheadings |

|---|

| 1) Powell’s Warning on Supply Shocks |

| 2) Economic Landscape and Interest Rates |

| 3) Inflation Volatility Concerns |

| 4) Impact of Tariffs on U.S. Businesses |

| 5) Future Outlook and Trade Relations |

Powell’s Warning on Supply Shocks

During a recent conference, Jerome Powell highlighted the likelihood of the U.S. facing an increase in supply shocks, which refers to unexpected disruptions in the supply of goods. He articulated that “we may be entering a period of more frequent, and potentially more persistent, supply shocks — a difficult challenge for the economy and for central banks.” This remark underscores the delicate position that both the economy and monetary policy currently occupy. Supply shocks can lead to shortages in product availability, increased costs of goods, and ultimately, inflationary pressure on consumers. Current indicators suggest that these supply disruptions are partly fueled by ongoing issues in global supply chains exacerbated by recent geopolitical events.

Economic Landscape and Interest Rates

Powell recently pointed out that the economic environment has significantly evolved since the Federal Reserve’s previous strategy meeting in 2020. Previously, interest rates were significantly lower. As of now, the federal funds rate remains fixed between 4.25% to 4.50%, with this steady rate a reflection of the monetary authority’s cautious approach toward rising economic risks. The Fed decided to maintain its current rate after a thorough analysis of economic conditions influenced by tariffs instituted by the previous administration. Experts anticipate that the Federal Reserve may keep the benchmark rate steady in its upcoming mid-June meeting, given the uncertain economic landscape, allowing for further observations before making any shifts in monetary policy.

Inflation Volatility Concerns

Powell expressed concerns that rising real interest rates could lead to greater inflation volatility than the U.S. experienced during the recovery period from the 2008 financial crisis through to the onset of the COVID-19 pandemic. Current inflation rates are still above the Fed’s targeted goal of 2%, causing unease among policymakers. Despite a slight easing of inflation in recent months, the uncertainty it brings continues to affect American consumers and businesses alike. The relationship between supply shocks and inflation remains crucial, as disruptive factors can lead to an imbalance of supply and demand, prompting potential price hikes on various goods and services.

Impact of Tariffs on U.S. Businesses

Recent analyses have indicated that U.S. companies may face inventory shortages primarily due to supply chain disruptions linked to tariff policies. Reports reveal a dramatic drop in container bookings from China to the U.S., dropping as much as 60% following a surge in imports before the implementation of new tariffs. This decline in bookings raises the alarm for U.S. businesses reliant on imports, as they may face challenges in maintaining adequate inventory levels, which could hinder their ability to meet consumer demand. The complexities of navigating tariffs imposed by the previous administration have had long-lasting impacts on economic performance and trade relations.

Future Outlook and Trade Relations

In the context of ongoing trade negotiations, the Trump administration’s tariff policies remain a significant point of focus. Recent trade discussions involving foreign leaders have indicated the Indian government’s proposal to eliminate tariffs on U.S. goods, reflecting ongoing attempts to navigate the complicated web of international trade. Additionally, recent agreements between the U.S. and other nations, such as the U.K. and China, have resulted in positive receptions in the stock market; however, economists caution that high tariffs are unlikely to dissipate in the near future. The intertwining of trade policies and economic performance necessitates continued scrutiny as businesses prepare for potential shifts in market dynamics.

| No. | Key Points |

|---|---|

| 1 | Jerome Powell warns of increasing supply shocks affecting U.S. economy. |

| 2 | Current federal funds rate is held steady at 4.25% to 4.50% amid economic uncertainty. |

| 3 | Powell highlights potential for greater inflation volatility due to rising real rates. |

| 4 | U.S. companies may experience inventory shortages due to tariff-induced supply chain disruptions. |

| 5 | Trade negotiations continue, with discussions surrounding tariff eliminations from India. |

Summary

In summary, the cautionary remarks from Jerome Powell about potential supply shocks signal significant challenges for the U.S. economy ahead. Coupled with rising interest rates and ongoing inflation concerns, the Federal Reserve faces a complex landscape for monetary policy. Furthermore, the effects of tariff-induced supply chain disruptions are expected to place additional strain on U.S. businesses as they navigate a changing trade environment. Engaging in careful scrutiny of economic indicators and supply chain dynamics will be essential as policymakers and analysts work to forecast the future economic landscape.

Frequently Asked Questions

Question: What are supply shocks?

Supply shocks refer to unexpected events that affect the supply of goods and services in an economy, often leading to shortages and price increases.

Question: How do tariffs affect inventories?

Tariffs can increase the cost of imported goods, leading to potential inventory shortages as businesses may struggle to maintain appropriate stock levels amidst supply chain disruptions.

Question: What is the current federal funds rate?

The federal funds rate is currently maintained between 4.25% and 4.50%, reflecting the Federal Reserve’s cautious approach to monitoring economic conditions.