In a pivotal move, the Federal Reserve has announced its decision to maintain benchmark interest rates at 4.25%-4.5% during a highly anticipated meeting. This decision comes as officials grapple with the economic uncertainties posed by recent tariffs and a cooling economy. Despite this, the Fed indicated that interest rate cuts are likely later in the year, which has prompted a positive reaction in the stock market, emphasizing the balancing act the central bank is undertaking in navigating inflation and growth pressures.

| Article Subheadings |

|---|

| 1) Federal Reserve Holds Steady on Interest Rates |

| 2) Economic Concerns Prompt Caution |

| 3) Adjustments to Monetary Policies |

| 4) The Impact of Tariffs on Consumer Confidence |

| 5) Future Projections and Market Reactions |

Federal Reserve Holds Steady on Interest Rates

On Wednesday, the Federal Open Market Committee (FOMC) opted to maintain the benchmark interest rate in a range of 4.25% to 4.5%, a level that has been consistent since December. This decision follows extensive market speculation whereby investors had anticipated no alterations during the two-day policy meeting. The Fed’s current approach signals a strategic stance amidst a mixture of economic growth factors and global uncertainties.

The decision to hold rates steady came as officials signaled potential interest rate reductions for later this year. With mounting speculation about economic factors, particularly those influenced by tariffs, the Fed is closely monitoring the situation. This cautious approach demonstrates the committee’s awareness of how external and domestic policies can significantly impact economic conditions. The central bank’s choice reflects an ongoing commitment to adjusting monetary policy based on prevailing economic circumstances.

Economic Concerns Prompt Caution

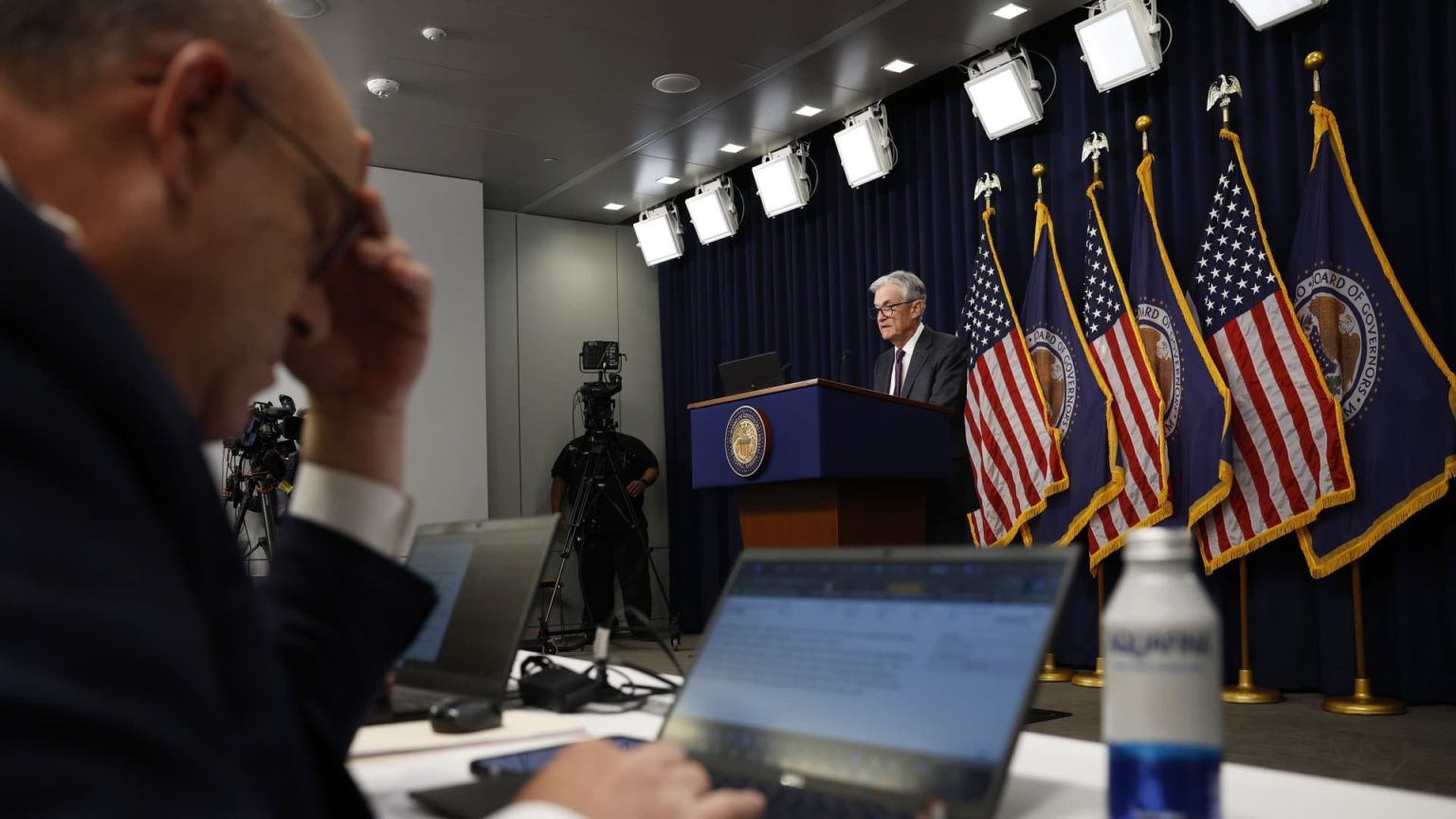

The FOMC underscored a growing uncertainty concerning the economy’s outlook, drawing attention to concerns such as President Donald Trump’s tariffs, which some fear may exert upward pressure on prices. At a press conference, Federal Reserve Chair Jerome Powell highlighted signs of moderation in consumer spending, suggesting that the consumer economy could be slowing. This creates a backdrop of caution as the committee navigates dual mandates of fostering maximum employment while keeping inflation regulated.

Economic growth projections have also been adjusted. The Fed predicts a mere 1.7% growth in the U.S. economy for the current year, showing a decline from previous expectations. On the inflation front, core prices are forecasted to rise at a 2.8% annual pace, significantly higher than earlier projections. These revisions signify a more cautious outlook on future economic performance, capturing the essence of current complexities faced by officials as they determine their next steps.

Adjustments to Monetary Policies

The Fed’s decision also involved alterations to its “quantitative tightening” program. Originally, the Fed’s strategy involved gradually reducing the bonds on its balance sheet; however, modifications now permit only $5 billion in maturing Treasury proceeds to roll off each month, down from $25 billion. Meanwhile, the cap for mortgage-backed securities has been maintained at $35 billion. This policy adjustment reflects an effort to soften the approach to balance sheet reductions, allowing for a more flexible response to economic conditions.

Fed Governor Christopher Waller was the sole dissenting vote in favor of the quantitive tightening having a more aggressive approach, opting instead to see interest rates remain steady. Observers argue that the Fed’s recent monetary actions indirectly provided rate reductions primarily by easing the pace of Treasury runoff. As various economic factors continue to transform, the central bank is positioned to further adjust policies as necessary.

The Impact of Tariffs on Consumer Confidence

Uncertainty surrounding international trade and domestic policies has taken its toll on consumer sentiment. There is growing evidence that tariffs have led to increased inflation expectations, as consumers adapt to an unpredictable economic landscape. The latest retail spending statistics indicate that while there was a rise in spending, it was less than what was anticipated. Indicators from consumer surveys further reveal that the political climate is influencing spending habits.

This context presents a complicated picture of consumer confidence, as tariffs implemented on key imports such as steel and aluminum are expected to contribute to rising prices. As David Russell, global head of market strategy at TradeStation pointed out, the economic dynamics reflect uncertainty in Wall Street’s expectations. In response, consumers are adjusting their expectations and spending in cautious ways. The gradual erosion of confidence could lead to longer-term effects on buying behavior if it continues in this direction.

Future Projections and Market Reactions

Looking forward, the Fed expects to implement another half percentage point cut through 2025, likely spaced out over two reductions this year, according to forecasts. The document known as the “dot plot,” which illustrates officials’ rate expectations, has displayed a notable shift towards a hawkish stance as compared to previous meetings.

Investors have responded positively to the Fed’s continued openness to rate cuts, resulting in a surge in the Dow Jones Industrial Average, which gained over 400 points post-announcement. This strong market reaction showcases the critical importance of the Fed’s messaging in determining investor confidence and market stability. However, as Powell articulated, if economic conditions necessitate, the Fed remains prepared to hold interest rates steady longer, prioritizing sound economic health over immediate reductions.

| No. | Key Points |

|---|---|

| 1 | The Federal Reserve holds benchmark interest rates steady at 4.25%-4.5%, indicating possible cuts later in the year. |

| 2 | Growing concerns surround the impact of tariffs on economic conditions and consumer spending. |

| 3 | The Fed adjusts its quantitative tightening strategy, reducing the pace of bond reductions. |

| 4 | Consumer confidence shows signs of waning due to uncertainty surrounding tariffs and inflation expectations. |

| 5 | Post-announcement market reactions are positive, with indications of potential interest rate cuts in the near future. |

Summary

The Federal Reserve’s decision to maintain interest rates amid economic uncertainty illustrates the complex balancing act central bank officials must perform. With external factors such as tariffs significantly influencing the economic landscape, the Fed remains on alert and is willing to adapt its policy measures as necessary. Market reactions to the Fed’s communication underscore the importance of maintaining consumer and investor confidence, while the ongoing adjustments to rates and quantitative measures aim to foster stability in an unpredictable economic environment.

Frequently Asked Questions

Question: What are the current interest rates set by the Federal Reserve?

The Federal Reserve has maintained the benchmark interest rate in a range of 4.25% to 4.5%.

Question: How do tariffs impact consumer spending and inflation?

Tariffs can lead to increased prices on imported goods, raising inflation expectations among consumers and prompting them to adjust their spending habits.

Question: What might be the implications of the Fed’s quantitative tightening program?

The scaling back of the quantitative tightening program may influence future interest rates, as it reflects the Fed’s ongoing strategy to manage economic risks while adjusting monetary policy as needed.