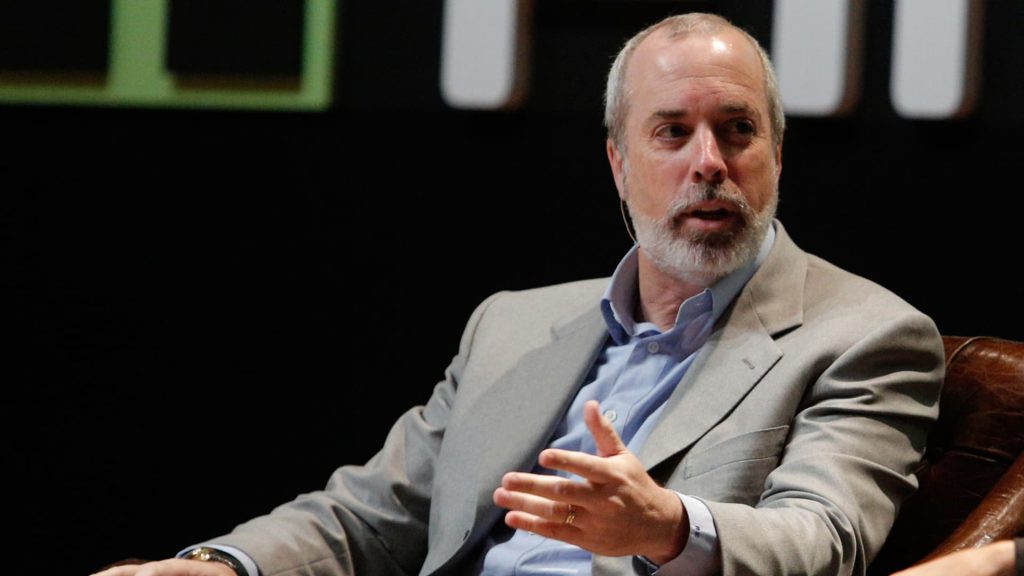

In a recent discussion highlighting the necessity of financial literacy in America, Ric Edelman, founder of Edelman Financial Engines, has called for greater emphasis on personal finance education. Edelman contends that the lack of a strong tradition in personal finance is problematic, especially as life expectancies increase. He warns that many young investors are falling prey to get-rich-quick schemes, often influenced by a slew of problematic financial advice from dubious sources. Additionally, he highlights the need for high schools to mandate personal finance courses, a move that is gradually gaining traction across the country.

| Article Subheadings |

|---|

| 1) The Problem of Financial Literacy in America |

| 2) The Impact of Longer Life Expectancy |

| 3) Risks of Modern Investment Strategies |

| 4) Moving Towards Mandatory Financial Education |

| 5) Young Investors and Their Unique Challenges |

The Problem of Financial Literacy in America

A major concern among financial experts is the pervasive lack of financial literacy in the United States. Ric Edelman openly criticized the current state of financial education, indicating that, “We stink at it.” He believes that Americans are not adequately prepared for managing their personal finances. This situation is exacerbated by the fact that many young people turn to social media platforms for financial guidance rather than reputable sources. The reliance on sources like TikTok for financial education is alarming, according to Edelman, who advises young investors to seek credible information to avoid costly mistakes.

The Impact of Longer Life Expectancy

As life expectancy continues to increase, the implications of improper financial planning become more severe. Edelman noted that the baby boomer generation is the first to experience longevity as a norm, unlike previous generations, which often did not plan for retirement due to shorter life spans. Today, however, people need to account for potentially decades of retirement when budgeting and investing. The dangers of running out of money in old age necessitate a paradigm shift in how Americans regard personal finance. With longer retirements come unique challenges related to healthcare costs, and individuals must rethink traditional investment models that may no longer suffice.

Risks of Modern Investment Strategies

In the digital age, the landscape of investing has changed dramatically. Edelman expressed concern regarding the increasing popularity of high-risk trading strategies among younger investors. He noted that many young individuals are enticed by get-rich-quick schemes that prioritize speculation over sound investing practices. Data from the New York Stock Exchange shows that retail trading participation in the options market approached 50% in 2022, a worrying trend. The rise of options trading and day trading has fostered a culture of financial gambling, where young investors may be more likely to make high-stakes bets rather than build long-term wealth.

Moving Towards Mandatory Financial Education

One of the recommended solutions to combat the growing financial illiteracy is mandating personal finance courses in high schools. Currently, only a fraction of schools in the U.S. require such courses, leaving many young adults unprepared for financial decisions. Since 2004, states like Utah have instituted graduation requirements for personal finance education, and as of this year, 27 states have followed suit. This change is vital in equipping the next generation with the tools they need to navigate complex financial landscapes, ensuring they won’t learn solely through “the school of hard knocks.”

Young Investors and Their Unique Challenges

Despite the grim landscape, there is a glimmer of hope among younger investors. They are keenly aware of the financial pitfalls that plagued their parents, leading them to be highly motivated to achieve financial security. Nevertheless, many recent graduates face significant obstacles, including student debt and high living costs, which make it challenging to allocate funds for investing. According to Edelman, “Today’s youth looks at their parents and sees how poorly they were prepared for retirement. They don’t want that to be their future.” This desire for financial independence drives many young people to seek out investment opportunities actively, even if their means are limited.

| No. | Key Points |

|---|---|

| 1 | Financial literacy in America is alarmingly low, with many relying on unreliable sources for guidance. |

| 2 | Increasing life expectancy necessitates better financial planning to avoid running out of money in retirement. |

| 3 | Many young investors fall for high-risk trading strategies, mistaking them for legitimate investment opportunities. |

| 4 | There has been a concerted effort to make personal finance education mandatory in high schools across the U.S. |

| 5 | Despite financial challenges, younger generations are motivated to achieve financial success and learn from past mistakes. |

Summary

The ongoing discussions around financial literacy underscore a critical gap in the U.S. education system and highlight the urgent need for immediate reform. As longer life expectancies lead to greater financial demands in retirement, there is a clear call for better education and resources, especially for younger generations. Improved personal finance education can empower individuals to make informed decisions, moving away from risky trading behaviors and fostering long-term financial security.

Frequently Asked Questions

Question: Why is financial literacy important?

Financial literacy is critical as it helps individuals make informed financial decisions, manage risks, and secure their financial future. In today’s complex financial landscape, understanding budgeting, investing, and retirement planning is essential.

Question: What are some signs of financial illiteracy?

Signs of financial illiteracy include difficulty in budgeting, inability to save for emergencies, reliance on payday loans, or investing based on speculation rather than research.

Question: How can young investors improve their financial knowledge?

Young investors can improve their financial knowledge by seeking credible resources, attending workshops, enrolling in financial literacy courses, and learning from trusted financial educators rather than relying solely on social media.