In a significant federal case, D**oren David Sela**, 36, was sentenced to five years in prison for a large-scale fraud operation that exploited vulnerable victims, many of whom were elderly. The operation involved stealing mail and hijacking phone numbers through a technique known as SIM swapping, allowing Sela to drain bank accounts and steal over $1.8 million. Investigators have provided insights into the mechanics of the scheme and how individuals can safeguard themselves against similar attacks.

| Article Subheadings |

|---|

| 1) Overview of SIM Swapping |

| 2) The Mechanics of the Fraud Scheme |

| 3) Consequences and Legal Repercussions |

| 4) Risks Associated with SIM Swapping |

| 5) Preventative Measures Against SIM Swapping |

Overview of SIM Swapping

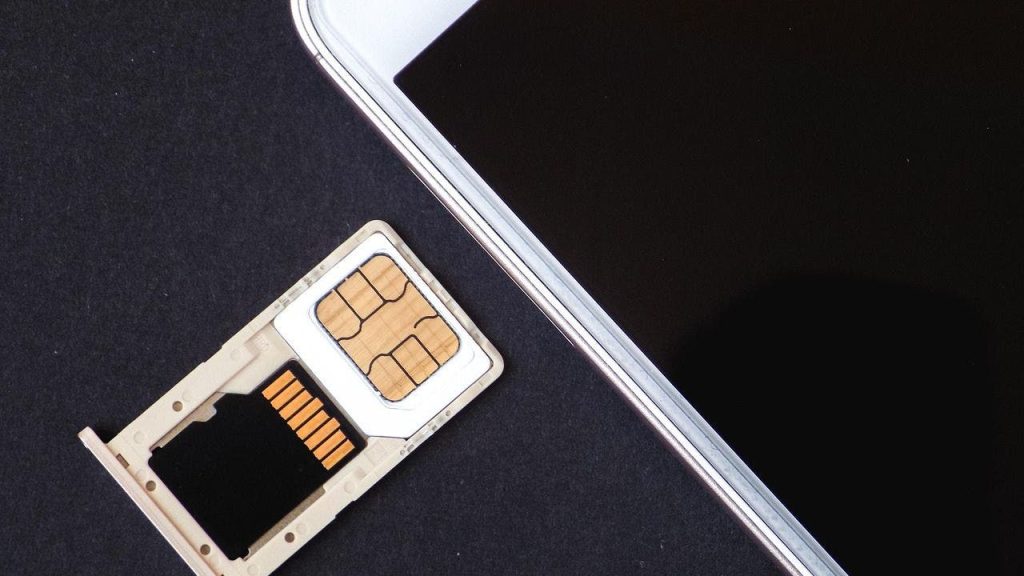

SIM swapping is a fraudulent manipulation where scammers trick mobile carriers into transferring a victim’s phone number to a SIM card controlled by the scammer. This enables the thief to intercept text messages, particularly the verification codes necessary for two-factor authentication (2FA), thereby gaining access to victims’ online accounts, including banking, email, and social media. The process often involves fraudulent impersonation, where the attacker pretends to be the victim to convince the service provider to issue a new SIM card.

There are two main methods that scammers use to execute SIM swaps:

- Social Engineering: The scammer contacts a carrier’s customer support, claiming their phone has been lost or stolen and requests a new SIM card be activated with the victim’s number.

- Insider Threats: Occasionally, scammers exploit vulnerabilities within the mobile network by bribing employees or using social engineering tactics to bypass verification procedures.

Once in control of the victim’s phone number, scammers can reset passwords, lock victims out of their accounts, and steal personal information, making SIM swapping a profound risk to individual identity security.

The Mechanics of the Fraud Scheme

Between November 2021 and October 2023, **Oren David Sela** stole mail from neighborhoods in Beverly Hills, California, gathering sensitive personal data from various victims. This data included:

- Debit and credit card information

- Bank account numbers

- Social Security numbers

- Driver’s licenses

Utilizing this stolen information, Sela executed several SIM swapping attacks which helped him circumvent two-factor authentication mechanisms. His fraudulent activities allowed him to:

- Access victims’ online banking accounts

- Create new accounts in their names

- Transfer funds into bank accounts that he controlled

- Order new debit and credit cards linked to the victims’ accounts

In total, he made countless unauthorized withdrawals and transfers, attempting to steal nearly $2.6 million, with successful transfers amounting to at least $1.8 million.

Consequences and Legal Repercussions

Sela’s extravagant lifestyle made headlines, as he spent stolen funds on luxury items, including a watch worth nearly $17,000. In 2022, law enforcement apprehended Sela in Beverly Hills, discovering approximately $25,000 in cash, various pieces of luxury jewelry, and numerous fraudulent cards belonging to elderly victims. Despite his arrest, he continued to commit fraud, with law enforcement eventually seizing over $70,000 in cash along with additional stolen mail and identification documents during searches of his properties.

In October 2024, **Oren David Sela** pleaded guilty to charges of bank fraud and aggravated identity theft. He was sentenced to 61 months of federal imprisonment on April 22, 2025, and ordered to repay $1,818,369 to the victims of his fraudulent activities.

Risks Associated with SIM Swapping

While two-factor authentication is meant to bolster security, it can become weak if scammers gain control over the victim’s phone number. By hijacking a victim’s phone, they can intercept essential security codes sent via text, providing them with access to bank accounts and sensitive information. Once inside these accounts, they can:

- Reset account passwords

- Transfer funds without authorization

- Open credit lines under the victim’s name

- Lock victims out from their own accounts

This compromised access significantly highlights the potential dangers associated with SIM swapping and identity theft.

Preventative Measures Against SIM Swapping

Individuals can take various steps to protect their personal information and mitigate the risk of falling victim to SIM swapping schemes:

1. Monitor Your Accounts: Regularly review financial statements, including bank accounts and credit cards, for signs of unauthorized activity.

2. Lock Your SIM Card: Secure your SIM card by setting up a personal identification number (PIN) through your mobile carrier.

3. Be Cautious About Sharing Personal Info: Limit sharing details on social media, as scammers can use this information for verification questions.

4. Place a Fraud Alert: Request a fraud alert with one of the major credit bureaus to make it challenging for identity thieves to open new accounts in your name.

5. Check Your Credit Reports: Regularly obtain copies of your credit reports and scrutinize them for anomalies.

6. Freeze Your Credit: Establish a credit freeze to prevent unauthorized accounts being opened under your name.

7. Use an Authenticator App: Instead of relying on SMS for two-factor authentication, use authenticator apps for added security.

8. Strengthen Your Passwords: Create unique, complex passwords for different accounts and consider a password manager for security.

9. Invest in Identity Theft Protection: Engage services that monitor personal information for exposure on the dark web.

10. Beware of Phishing Attempts: Stay alert for unsolicited communication requesting personal information and utilize strong antivirus software on your devices.

Key Points

| No. | Key Points |

|---|---|

| 1 | **Oren David Sela** exploited the elderly in a SIM swapping fraud scheme, stealing over $1.8 million. |

| 2 | The scheme involved stealing personal information from mail theft to execute identity fraud. |

| 3 | Sela was sentenced to 61 months in prison and ordered to repay nearly $1.8 million. |

| 4 | SIM swapping undermines security measures like two-factor authentication, making it crucial for individuals to protect their information. |

| 5 | Taking preventative measures can significantly diminish the risk of being a victim of SIM swapping. |

Summary

The sentencing of **Oren David Sela** showcases the alarming trend of SIM swapping fraud, particularly its targeting of vulnerable individuals. This case highlights the need for robust protections against identity theft and emphasizes the importance of public awareness of cybersecurity practices to safeguard sensitive information. By taking preventative measures and enhancing security protocols, individuals can better shield themselves from such fraudulent activities in this increasingly digital world.

Frequently Asked Questions

Question: What is SIM swapping?

SIM swapping is a form of identity theft where a scammer gains control of your phone number by tricking your mobile carrier, allowing them to access sensitive accounts linked to that number.

Question: How can I protect myself from SIM swapping?

You can protect yourself by monitoring your accounts, setting a SIM card PIN, limiting the personal information you share online, and utilizing authenticator apps for two-factor authentication.

Question: What are the risks of SIM swapping?

The primary risks include unauthorized access to bank accounts, identity theft, and the potential for significant financial losses, as scammers can bypass security measures to control your personal and financial information.