NEWYou can now listen to articles!

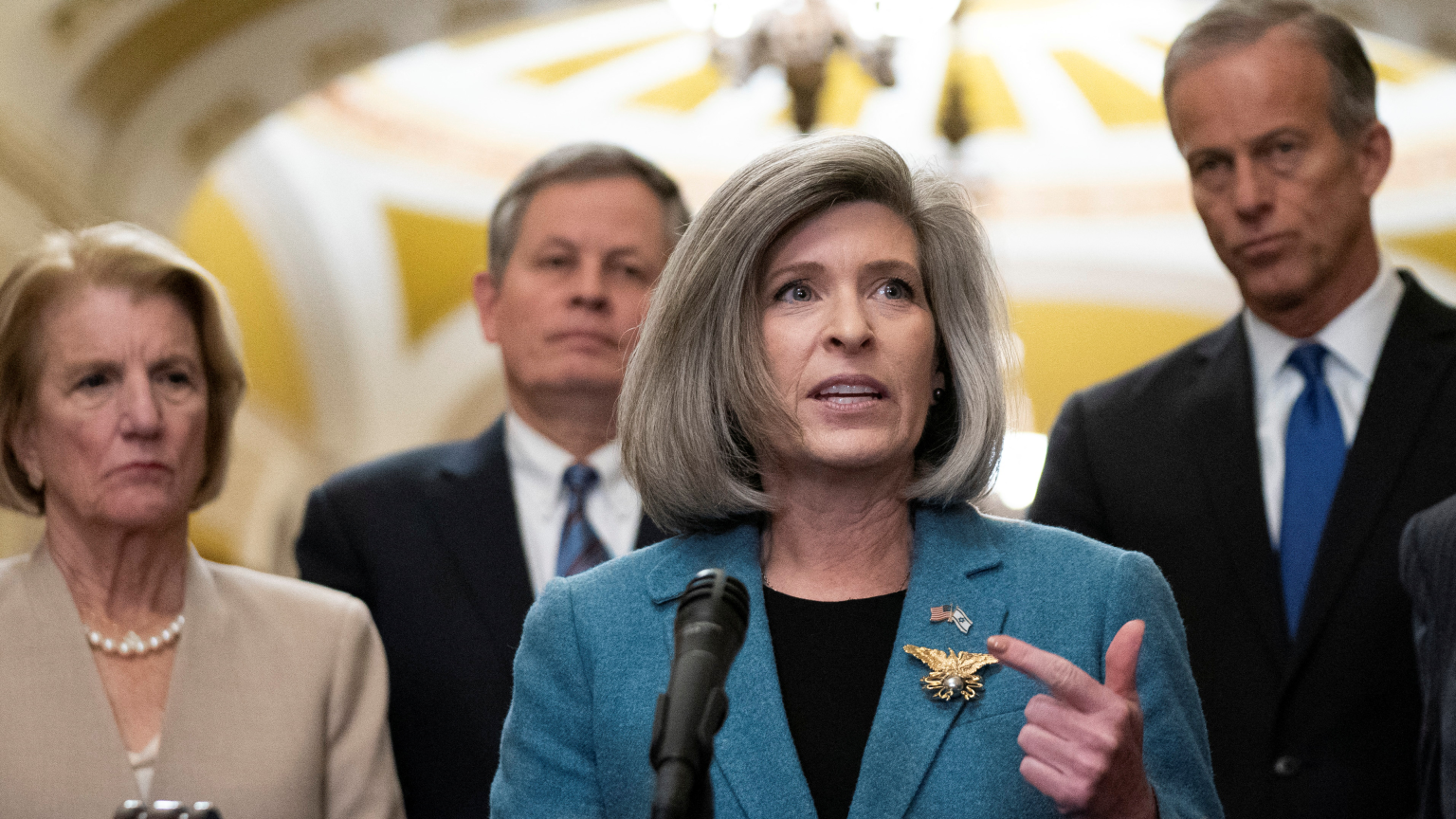

EXCLUSIVE: In a bold move to address the rising national debt, the Senate is considering the “For Sale Act,” which aims to liquidate select U.S. government real estate assets. Proposed by Senate leaders, including Joni Ernst of Iowa, the initiative targets several federal buildings in Washington, D.C., that currently house key cabinet agencies. This plan is driven by the urgent need to cut the national debt, which now stands at a staggering $36 trillion.

The act would not only sell off properties but also ensure that employees currently occupying these buildings are relocated, avoiding layoffs. By placing the James Forrestal Federal Building and others on the market, officials hope to streamline government operations and generate much-needed revenue.

| Article Subheadings |

|---|

| 1) The Proposed Sales List: Key Federal Buildings |

| 2) Financial Implications of the For Sale Act |

| 3) Employee Impact and Relocation Plans |

| 4) Legislative Safeguards Against Foreign Purchases |

| 5) Broader Impact of Federal Real Estate Sales |

The Proposed Sales List: Key Federal Buildings

The key component of the “For Sale Act” is the targeted list of federal buildings identified for sale. One significant property on this list is the James Forrestal Federal Building, often referred to as the “Little Pentagon.” Located across from L’Enfant Plaza, it was established as a crucial facility during the Vietnam War to house Department of Defense personnel. The building currently accommodates the Department of Energy, which moved in shortly after the agency’s creation in 1977.

In addition to the Forrestal Building, several other sites along Independence Avenue are earmarked for sale. Notably, an outbuilding associated with the Department of Agriculture is also considered for disposal. This building is reportedly operating at merely a quarter of its capacity and has accumulated maintenance needs that require nearly $2 billion in expenditures. Here, Joni Ernst humorously commented, describing it as the perfect “fixer-upper” for potential buyers.

The Hubert H. Humphrey Jr. Building is another federal property slated for sale. This building, named after a former vice president, is dramatically visible to motorists leaving the Third Street Tunnel near the Capitol. Additionally, HUD’s headquarters, officially termed the Robert C. Weaver Federal Building, is cited as underutilized and will be required to enter the market within 18 months if the act passes. The Theodore Roosevelt Building and the Frances Perkins Federal Building also round out the highlighted list.

Financial Implications of the For Sale Act

A critical aspect of the “For Sale Act” revolves around its intended financial implications. Currently, the U.S. taxpayers bear about $81 million in annual expenses to maintain underutilized federal offices, according to a recent report from the Office of Management and Budget. As of June 2025, the national debt is near an alarming $36 trillion, necessitating urgent fiscal strategies to alleviate this situation.

With approximately 7,700 federal office spaces identified as vacant and 2,200 more termed majority-empty, the need for efficiency in federal real estate management is paramount. The sales of such assets are seen as a pathway not only to reduce operational costs but also to generate revenue that can be redirected towards eliminating part of the national debt.

Republican Senate members stress that annual maintenance costs for 277,000 federal buildings exceed $10 billion, placing undue financial burden on taxpayers. By divesting from older, underperforming buildings, the expectation is to alleviate significant portions of this expenditure whilst improving the efficiency of government operations.

Employee Impact and Relocation Plans

An essential consideration in the proposed real estate sales is the impact on employees currently working within these buildings. Joni Ernst has made it clear that there will be no layoffs as a result of this action. Instead, the plan includes provisions for relocating employees to different government facilities, ensuring that they will not lose their jobs as a direct consequence of the sales.

This aspect of the “For Sale Act” has been designed to reassure federal workers who may be concerned about job security. The approach combines fiscal responsibility with an employee-first strategy, aiming to balance necessary budget cuts and the preservation of job roles within the federal system. The relocation plans will be carefully managed to ensure minimal disruption and optimal support for all affected employees.

Legislative Safeguards Against Foreign Purchases

In light of increasing concerns about foreign investment in U.S. assets, the legislation will include protections against foreign entities acquiring these federal properties. Recent events have highlighted instances where rival nations, including China, have secured land in close proximity to sensitive military installations.

To mitigate these risks, the “For Sale Act” will mandate that any entity associated with foreign nationals as beneficial owners will be expressly prohibited from participating in federal real estate sales. This safeguard aims to enhance national security by ensuring that strategic assets remain under American control, particularly those positioned near key installations such as military bases.

Broader Impact of Federal Real Estate Sales

The implications of the proposed federal real estate sales extend beyond financial and operational considerations. The sales initiative represents a significant shift in how the federal government approaches its real estate portfolio and overall responsibilities to taxpayers. By effectively identifying and divesting from underperforming assets, the government opens discussions about modernizing its real estate strategy.

As more federal agencies rethink the management of their spaces, the proposed legislation paves the way for potentially more aggressive measures to address the nationwide debt crisis strategically. The success of this initiative may inspire other branches of government or even state governments to examine similar strategies to optimize their asset management practices, thereby enhancing efficiency and accountability.

| No. | Key Points |

|---|---|

| 1 | Senate’s “For Sale Act” aims to sell federal buildings to cut U.S. national debt. |

| 2 | Key buildings targeted include the James Forrestal Federal Building and the Hubert H. Humphrey Jr. Building. |

| 3 | The act ensures employees are relocated without layoffs during sales. |

| 4 | Legislation includes safeguards against foreign purchases to protect national security. |

| 5 | The initiative reflects a broader strategy to optimize federal real estate management. |

Summary

The Senate’s proposed “For Sale Act” emerges as a proactive strategy to confront the daunting $36 trillion national debt by divesting from underperforming federal properties. This initiative not only aims to streamline government operations and improve fiscal responsibility but also emphasizes a commitment to retaining federal jobs through relocation. By introducing measures to safeguard national interests against foreign entities, the act reflects a comprehensive approach to real estate management that could set a precedent for governmental efficiency moving forward.

Frequently Asked Questions

Question: What is the “For Sale Act”?

The “For Sale Act” is legislation proposed by Senate leaders to sell select federal properties in order to reduce the national debt and improve government efficiency.

Question: What buildings are included in the proposed sales?

Notable buildings on the sale list include the James Forrestal Federal Building and the Hubert H. Humphrey Jr. Building, among others.

Question: How will employees be affected by the property sales?

Employees currently working in the targeted buildings will be relocated to other facilities without layoffs, ensuring job security amid changes.