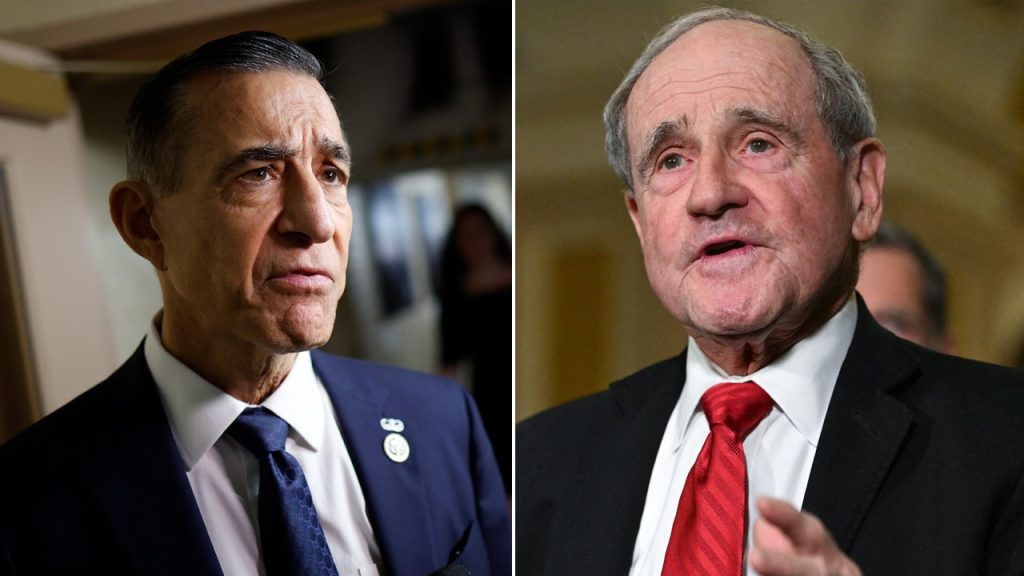

Republican lawmakers are advocating for a federal ban on state-imposed excise taxes on gun and ammunition sales, a move prompted by California’s recent legislation that instituted an 11% tax on these items. Introduced by Senator Jim Risch and Representative Darrell Issa, the Freedom of Unfair Gun Taxes Act aims to prevent states from levying taxes perceived as detrimental to Second Amendment rights. As other states, including Colorado, contemplate similar measures, the debate over gun control funding and taxation is heating up across the nation.

| Article Subheadings |

|---|

| 1) California’s Excise Tax on Gun Sales |

| 2) Reactions from Lawmakers |

| 3) The Freedom of Unfair Gun Taxes Act |

| 4) Broader Implications of the Tax |

| 5) Support from Republican Senators and Representatives |

California’s Excise Tax on Gun Sales

In 2023, California took a groundbreaking step by becoming the first state to implement an excise tax on gun and ammunition sales. The tax set at 11% is designed to fund various initiatives aimed at gun violence prevention. This funding will support programs such as the California Violence Intervention and Prevention program and court-based initiatives that facilitate gun relinquishment from individuals who pose a threat to public safety, such as domestic abusers and felons. The law, officially termed the Gun Violence Prevention and School Safety Act, received the endorsement of California Governor Gavin Newsom in September 2023 and went into effect in July 2024.

The motives behind this legislation are tied closely to the growing concern over gun violence, particularly among the youth. Jesse Gabriel, the California Assembly member who championed the bill, noted that gun violence has tragically become the leading cause of death for children in the United States. He stated, “This law will generate $160 million annually to fund critical violence prevention and school safety programs that will save lives and protect communities across the State of California.”

Reactions from Lawmakers

The introduction of this tax has provoked significant pushback from Republican lawmakers, who argue that such measures are unconstitutional and infringe upon the rights guaranteed by the Second Amendment. Senator Jim Risch expressed concern that “blue states that implement an excessive excise tax to fund gun control initiatives are exploiting the Second Amendment.” He sees the Freedom from Unfair Gun Taxes Act as a necessary response to protect law-abiding gun owners from unwanted financial burdens related to state-level tax measures aimed at gun control.

Other lawmakers have echoed these sentiments, with Representative Darrell Issa characterizing California’s excise tax as an “outrageous and unfair burden on law-abiding citizens.” This type of tax, according to Issa, not only targets gun owners unfairly but also represents a broader assault on constitutional rights. As the implications of this tax ripple through the political landscape, escalating tensions can be observed between states advocating for stricter gun control and those supporting gun rights.

The Freedom of Unfair Gun Taxes Act

The Freedom of Unfair Gun Taxes Act, introduced in both the Senate and House of Representatives, aims to erect a legal barrier against such state-level excise taxes. This legislative initiative comes as various states are either considering or have already enacted similar tax measures, including Colorado, which plans to impose a 6.5% tax on gun purchases starting in April. Lawmakers advocating for this act assert that it is essential to maintain the integrity of Second Amendment rights at a time when targeted taxation could significantly hamper lawful gun ownership.

The proposed federal ban on state taxes surrounding guns and ammunition seeks to protect citizens from being financially penalized for exercising their constitutional rights. As the political climate continues to evolve regarding gun legislation, the Freedom of Unfair Gun Taxes Act represents a direct challenge to a growing wave of regulations perceived as infringing on freedom.

Broader Implications of the Tax

The broader implications of California’s excise tax extend beyond the state’s borders, influencing the legislative climate across the United States. As more states consider similar initiatives, concerns about their potential to set a precedent for unconstitutional state tax measures grow among gun rights advocates. The discussion surrounding the appropriateness of such taxes encapsulates a larger conversation on state rights versus federal overreach when it comes to gun legislation.

Critics of the tax argue that taxing gun sales is tantamount to discouraging responsible gun ownership and could lead to a significant drop in firearm sales. They warn that such a tax could ultimately hurt both gun retailers and consumers, further complicating the landscape of responsible gun ownership and the rights surrounding it. Conversely, supporters of the tax claim that it represents a proactive approach to solving urgent public health issues linked to gun violence.

Support from Republican Senators and Representatives

The Freedom of Unfair Gun Taxes Act has garnered significant support from a cohort of Republican lawmakers who view this initiative as crucial for defending the Second Amendment. Notable co-sponsors in the Senate include senators such as Lindsey Graham of South Carolina, Marsha Blackburn of Tennessee, and Bill Cassidy of Louisiana. Similarly, representatives like Richard Hudson of North Carolina and Doug LaMalfa of California are backing the House version of the bill.

The cross-party support underscores the deep-seated concerns among Republican legislators about state-level regulations that they perceive as extreme and detrimental to constitutional rights. These lawmakers argue that a uniform federal standard should be established to prevent individual states from imposing taxes that could effectively act as an infringement on the right to bear arms.

| No. | Key Points |

|---|---|

| 1 | California has enacted an 11% excise tax on gun and ammunition sales aimed at funding violence prevention programs. |

| 2 | Republican lawmakers are rallying against state-imposed excise taxes, framing them as unconstitutional. |

| 3 | The Freedom of Unfair Gun Taxes Act seeks to prevent states from enacting similar tax measures. |

| 4 | Critics argue that such taxes could discourage lawful gun ownership and harm both retailers and consumers. |

| 5 | The initiative has received bipartisan support among Republican legislators concerned about Second Amendment rights. |

Summary

The growing trend of excise taxes on gun sales, exemplified by California’s recent legislation, has sparked a fierce debate about the legality and morality of such measures. With the Freedom of Unfair Gun Taxes Act, Republican lawmakers are aiming to establish federal protections against what they deem as unconstitutional taxation that threatens individual rights. As states grapple with the complexities of gun violence and regulation, the outcome of this legislative measure may hold significant implications for the future of gun ownership and rights across the nation.

Frequently Asked Questions

Question: What is the purpose of California’s excise tax on gun sales?

The excise tax is designed to generate revenue to fund violence prevention programs and initiatives that aim to reduce gun violence in the state.

Question: What does the Freedom of Unfair Gun Taxes Act aim to achieve?

The act seeks to prohibit states from imposing excise taxes on gun and ammunition sales, protecting the rights of gun owners against perceived unconstitutional taxation.

Question: Who are some key supporters of the Freedom of Unfair Gun Taxes Act?

Notable supporters include Senators Jim Risch, Lindsey Graham, and Representatives like Darrell Issa, among others.