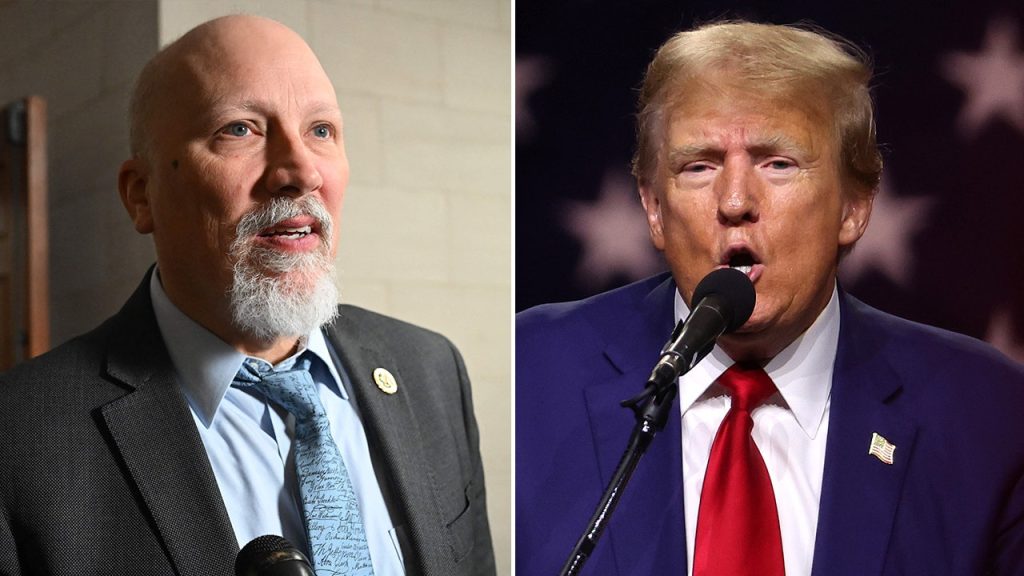

In a bold move aimed at reshoring American manufacturing, Rep. Chip Roy, a Texas Republican and a prominent figure in the House Freedom Caucus, has introduced a new bill that seeks to offer tax incentives for companies relocating their supply chains back to the United States. This legislation comes in response to recent tariff announcements made by former President Donald Trump, which have generated substantial market reactions. Roy’s bill, intended to specifically target practices linked to China’s economic strategies, underscores the urgency that advocates feel about reinforcing American industrial strength in the face of global competition.

| Article Subheadings |

|---|

| 1) Overview of the New Bill by Rep. Chip Roy |

| 2) The Context of Tariffs and Economic Strategy |

| 3) Implications for American Industries |

| 4) Legislative Processes and Future Actions |

| 5) The Global Manufacturing Landscape |

Overview of the New Bill by Rep. Chip Roy

On Thursday, Rep. Chip Roy took significant steps toward advocating for American manufacturing through the introduction of the tax incentive bill known informally as the BEAT CHINA Act. This legislation prohibits financial support for companies transferring their manufacturing outside the U.S. and instead promotes the move of supply chains back into American borders by offering potential tax deductions and benefits. The core goal is to ensure that these companies maintain consistent output levels during the transition process.

Rep. Roy articulated his vision to bring back manufacturing jobs to the U.S., citing national security concerns related to reliance on countries like China, which he described as adversarial. “The loss of our manufacturing base is a threat to both our economy and our freedom,” he stated. His remarks emphasize the urgency of the need, reflecting a broader desire within some political circles to bolster domestic industry as a safeguard against foreign competition and economic instability.

The Context of Tariffs and Economic Strategy

The introduction of Roy’s legislation follows Donald Trump’s recent announcement of a comprehensive strategy focused on tariffs aimed at revamping trade balances with various countries. Trump proposed a sweeping 10% blanket tariff on all U.S. imports and higher reciprocal tariffs on countries such as China, where a 34% tariff is suggested in response to existing Chinese tariffs on American goods, which reportedly reach up to 67%.

The administration has framed these tariffs as a necessary means to protect American manufacturers and workers from underpricing strategies deployed by foreign governments, particularly China. As tensions between the U.S. and China remain high, Trump’s tariff strategy underscores a broader economic agenda designed to diminish reliance on Chinese manufacturing capabilities while promoting a “stronger, bigger, better” America.

Implications for American Industries

If implemented, Roy’s legislation could have far-reaching consequences across various industries within the United States. By creating tax incentives for manufacturers to return to U.S. soil, it could disrupt existing global supply chains and lead to a reshaping of domestic production landscapes. The bill fundamentally seeks to encourage companies engaged in manufacturing hardware, electronics, textiles, and numerous other industries to reconsider their overseas establishments.

These tax reductions and the classification of certain real estate investments as 20-year property could encourage immediate investments in factories and facilities, ideally leading to job creation and economic revitalization. Some economists speculated that this strategic shift could lead to fluctuations in market dynamics, indirectly altering consumer prices as businesses restructure their supply chains and production costs.

Legislative Processes and Future Actions

The pathway for Roy’s bill through Congress remains uncertain. Support from House leadership and additional Republican lawmakers will be critical for its advancement. An optimistic Rep. Roy asserted the need for Congress to act swiftly, emphasizing a collaborative effort with the Trump administration to revise tax codes as essential to the bill’s success. The legislative process surrounding such measures could be lengthy, often involving debates, committee reviews, and potential amendments before any final votes are cast.

Critics of the bill voice concerns about its potential economic consequences, arguing that tariffs can inadvertently create higher costs for consumers and strain international trade relationships. Furthermore, potential pushback from stakeholders reliant on imported materials underscores a complex economic landscape that legislators will need to navigate carefully.

The Global Manufacturing Landscape

The legislative proposal coincides with a significant moment in global economics, where manufacturing activities are characterized by unprecedented shifts due to geopolitical tensions, technological advancements, and the ongoing ramifications of the COVID-19 pandemic. Countries are increasingly sorting through economic interdependencies, trying to find balances that nurture domestic growth while maintaining healthy trade relationships internationally.

China’s rising influence in global supply chains has driven some American lawmakers and businesses to reconsider the benefits of overseas manufacturing. Many argue that a robust domestic manufacturing sector is paramount to the U.S.’s long-term strategic economic positioning against adversaries. This view aligns with Roy’s objectives of supplanting Chinese dominance with American resilience and ingenuity, fostering a renewed focus on building capabilities that can withstand external pressures.

| No. | Key Points |

|---|---|

| 1 | Rep. Chip Roy’s BEAT CHINA Act aims to incentivize American companies to move manufacturing back to the U.S. |

| 2 | The act introduces tax benefits for companies relocating their operations while ensuring consistent production levels. |

| 3 | The bill prompts substantial discussion on tariffs recently put forth by former President Trump. |

| 4 | Successful implementation could reshape the American manufacturing sector and consumer market dynamics. |

| 5 | Economic specialists and industry stakeholders express concerns regarding the possible ramifications of tariffs on U.S. consumers. |

Summary

The introduction of Rep. Chip Roy‘s BEAT CHINA Act marks a consequential effort to return manufacturing jobs to the United States by providing targeted tax incentives. Amid existing discussions around tariffs introduced by Donald Trump, this legislation is positioned as a strategic measure to reinforce U.S. economic independence from adversarial trade partners. Its potential impacts on the market, employment, and international relations highlight the complexities of modern global economic interactions, making the legislative outcome significant for the future of American industry.

Frequently Asked Questions

Question: What is the BEAT CHINA Act?

The BEAT CHINA Act is proposed legislation by Rep. Chip Roy that aims to incentivize American companies to relocate their manufacturing back to the United States by offering tax benefits and deductions.

Question: Why are tariffs being implemented?

Tariffs are intended to protect American industries by imposing taxes on imports, thereby encouraging consumers and businesses to purchase domestically produced goods and countering economic strategies deployed by foreign competitors, especially China.

Question: How does the BEAT CHINA Act propose to change tax treatment of manufacturing investments?

The act suggests that certain non-residential real estate purchases by qualifying manufacturers should be treated as 20-year property instead of 39-year property, allowing companies to gain bonus depreciation benefits on these investments.