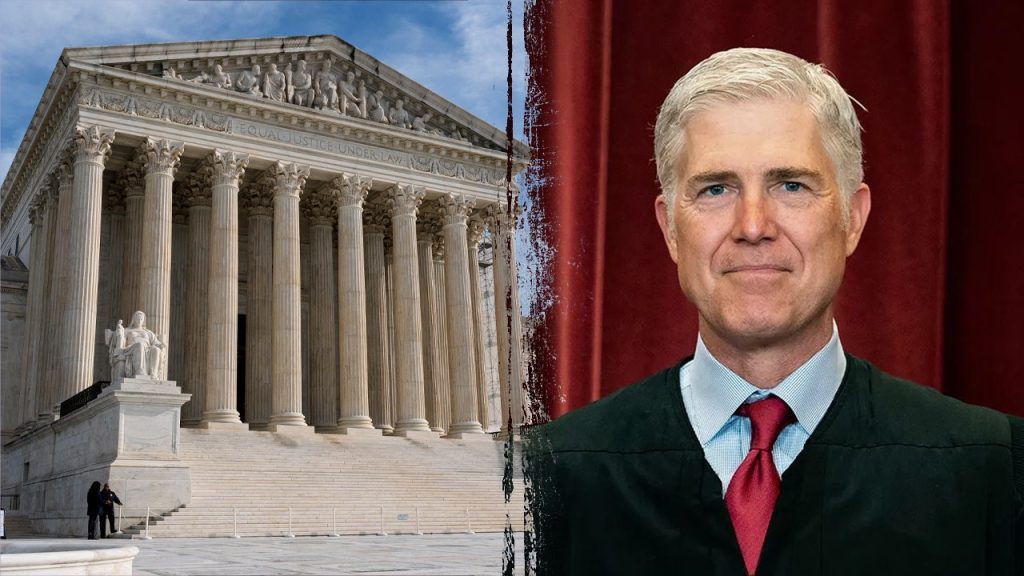

The United States Supreme Court has recently issued a ruling that restricts the Tax Court’s authority in specific cases involving the Internal Revenue Service (IRS), a decision led by Justice Neil Gorsuch’s dissent. The case revolved around Jennifer Zuch, who has been in a prolonged dispute with the IRS dating back to 2012 regarding the handling of her tax return. Gorsuch expressed concern that this ruling could provide the IRS with an opportunity to avoid accountability for future errors, thereby impacting taxpayers’ rights.

| Article Subheadings |

|---|

| 1) Overview of the Supreme Court’s Decision |

| 2) Background of the Zuch Case |

| 3) Gorsuch’s Dissent and Its Implications |

| 4) The Role of the IRS and Tax Court |

| 5) Future Impact and Conclusion |

Overview of the Supreme Court’s Decision

Recently, the United States Supreme Court ruled on a significant tax-related issue that has stirred considerable discussion among legal experts and taxpayers alike. The ruling centers around a case referred to as Commissioner of Internal Revenue v. Zuch, which looks into the IRS’s authority and the scope of the Tax Court’s jurisdiction. The Supreme Court decided that the Tax Court no longer had jurisdiction over a matter once there was no longer a proposed levy on the taxpayer’s property. This decision raises important questions about the balance of power between taxpayers and the IRS while also highlighting the legal framework governing such disputes.

Background of the Zuch Case

The roots of the case date back to 2012 when Jennifer Zuch found herself in a disagreement with the IRS over her 2010 federal tax return. Zuch claimed that the IRS mistakenly credited a payment of $50,000 to her then-husband’s account instead of her own. This misallocation led the IRS to pursue her for unpaid taxes, ultimately initiating a levy to seize and sell her property. Zuch, contesting this action, filed annual tax returns documenting overpayments, which, interestingly, the IRS chose to apply towards her earlier outstanding liability rather than issuing her refunds. When the outstanding liability was settled, the IRS sought to dismiss her case on grounds that the Tax Court could no longer assert jurisdiction over her dispute.

Gorsuch’s Dissent and Its Implications

Justice Neil Gorsuch wrote a dissenting opinion that raised alarms regarding the implications of the majority decision. Gorsuch argued that the ruling gives the IRS a “powerful new tool” to evade accountability for its mistakes, thereby endangering the rights of taxpayers. In his view, this sets a dangerous precedent where the IRS could potentially operate without facing scrutiny or responsibility for errors that affect taxpayers significantly. He emphasized that this decision could lead to a situation where the IRS would prioritize its interests over those of the taxpayer, limiting recourse for individuals who feel wronged by the agency’s actions.

The Role of the IRS and Tax Court

The IRS plays a crucial role in managing the collection of taxes and, by extension, enforcing tax laws. Over the years, the agency has been tasked with overseeing disputes involving taxpayers, especially cases where there are disagreements about owed taxes. The Tax Court exists to offer a venue for taxpayers to challenge IRS actions. However, the recent ruling significantly alters the dynamics. By stating that the Tax Court lacks jurisdiction without a pending levy, the Supreme Court has created a pathway for the IRS to circumvent review processes that could hold it accountable. This change raises concerns for taxpayers who may already feel disadvantaged in their dealings with the IRS. The prospect of having limited recourse may discourage individuals from challenging the IRS, even in cases where mistakes are evident.

Future Impact and Conclusion

Looking forward, this ruling has implications that extend beyond the current case. By limiting the Tax Court’s authority in IRS cases, the Supreme Court may have inadvertently fostered an environment where taxpayer rights are at risk. Legal experts and advocates for taxpayers are likely to criticize this decision, voicing concern that it could deter individuals from pursuing legitimate claims against the IRS. The long-lasting effects of this ruling could further entrench the power imbalance between taxpayers and the federal tax authority. As more individuals grapple with similar situations as Zuch, the demand for advocacy and reform might grow to ensure that taxpayers retain their rights in disputes against the IRS.

| No. | Key Points |

|---|---|

| 1 | The Supreme Court ruled that the Tax Court has no jurisdiction over cases without a proposed IRS levy. |

| 2 | Jennifer Zuch’s dispute with the IRS began in 2012 over a $50,000 payment misallocation. |

| 3 | Justice Neil Gorsuch’s dissent warns that this decision could allow the IRS to escape accountability for its mistakes. |

| 4 | The ruling may result in fewer taxpayers challenging IRS decisions, fearing lack of recourse. |

| 5 | There are calls for reforms to protect taxpayer rights in light of this ruling. |

Summary

The Supreme Court’s recent decision limiting the Tax Court’s authority presents significant implications for taxpayers and the IRS. Justice Gorsuch’s dissent underscores the potential dangers this ruling poses to taxpayers’ rights and the accountability of the IRS. As individuals like Jennifer Zuch navigate disputes with the IRS, there is growing concern that avenues for challenging IRS actions may be severely restricted, raising questions about fairness and transparency in tax administration.

Frequently Asked Questions

Question: What was the main issue in the Zuch case?

The main issue revolved around a $50,000 payment that was incorrectly credited to Zuch’s then-husband’s account, leading to disputes about unpaid taxes and the IRS’s authority.

Question: What does Gorsuch’s dissent signify?

Gorsuch’s dissent highlights concerns that the ruling could allow the IRS to evade accountability for errors that negatively impact taxpayers, creating an imbalance of power.

Question: How might this ruling affect taxpayers in the future?

The ruling could discourage future challenges to IRS decisions, as taxpayers may feel they lack feasible recourse when dealing with the agency.