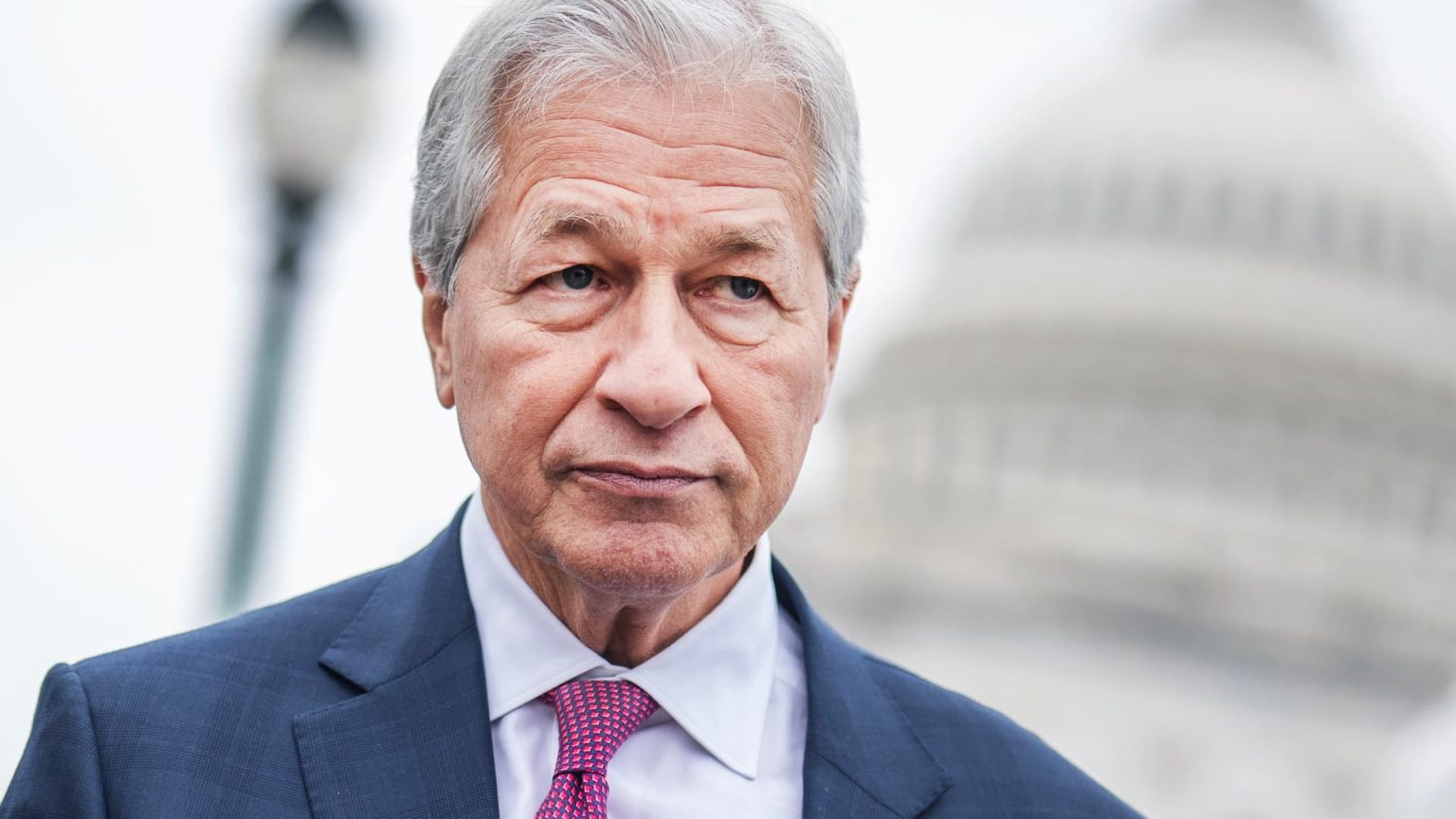

In a recent discussion regarding the evolving landscape of cryptocurrencies, Jamie Dimon, CEO of JPMorgan Chase, expressed his skepticism about stablecoins while underscoring the necessity for his institution to engage with this emerging technology. During an earnings call, Dimon revealed that JPMorgan plans to launch a stablecoin product tailored for its clients, indicating a shift in the bank’s approach to digital payment solutions. This development comes as traditional banking institutions, including Citigroup and Bank of America, begin to explore their own stablecoin projects, prompting a notable shift in the financial sector’s adaptability to digital currencies.

| Article Subheadings |

|---|

| 1) The Growing Importance of Stablecoins |

| 2) JPMorgan’s Stance on Stablecoins |

| 3) Competitive Landscape Among Banks |

| 4) Implications for the Future of Banking |

| 5) Regulatory Considerations and Challenges |

The Growing Importance of Stablecoins

Stablecoins have gained significant traction as a new class of cryptocurrency designed to offer stability in value, typically pegged to traditional assets such as the U.S. dollar. The primary allure of stablecoins lies in their capability to provide a reliable means of conducting transactions without the inherent volatility associated with other cryptocurrencies like Bitcoin. Over recent months, adoption has surged, primarily due to the increasing demand for faster and cheaper payment solutions in a technology-driven world.

The significance of stablecoins is further amplified by the ongoing digitalization of financial services. As consumers and businesses alike demand seamless and efficient transaction experiences, stablecoins present an alternative to traditional banking methods such as Automated Clearing House (ACH) transfers and SWIFT payments. These established systems are often slow, taking several days to settle transactions, whereas stablecoins can facilitate instantaneous transfers.

JPMorgan’s Stance on Stablecoins

During a recent earnings call, Jamie Dimon emphasized his cautious approach towards stablecoins while recognizing their potential importance for JPMorgan Chase. He articulated that while he does not fully grasp the appeal of stablecoins, the bank’s decision to delve into the realm of this digital asset class reflects a necessity to stay relevant in a rapidly evolving financial landscape.

JPMorgan’s announcement to launch a limited version of a stablecoin, specifically tailored for its clients, signifies a strategic pivot towards embracing blockchain technology solutions. Dimon stated, “We’re going to be involved in both JPMorgan deposit coin and stablecoins to understand it, to be good at it.” This statement indicates not only an acknowledgment of the importance of stablecoins but also a willingness to experiment and learn in this innovative space.

Competitive Landscape Among Banks

The competitive landscape among financial institutions is poised for transformation as banks like Citigroup and Bank of America join the conversation around stablecoins. Citigroup executives recently revealed that they are exploring the issuance of a Citi stablecoin, while Brian Moynihan, CEO of Bank of America, has indicated a similar interest in stablecoins as a new avenue for innovation.

As these banking giants begin to explore options for issuing their own stablecoins, the collaborative efforts seen in the industry reflect a strategic initiative to compete against burgeoning fintech companies. Dimon noted that failing to explore these technologies could risk ceding ground to non-traditional fintech players who are crafting innovative payment systems.

Implications for the Future of Banking

The exploration of stablecoins may have significant implications for the future of banking. By integrating stablecoins into their offerings, traditional banks could potentially streamline transactions, enhance customer experiences, and leverage new technologies for efficiency. The interest from JPMorgan and other banks indicates a broader trend of adoption that could redefine aspects of banking and payment systems.

However, this transition raises questions about the preparedness of existing financial infrastructures to handle the volatility and regulatory scrutiny associated with cryptocurrencies. The potential for stablecoins to disrupt conventional banking practices necessitates a careful examination of operational frameworks, compliance, and risk management strategies.

Regulatory Considerations and Challenges

As banks pivot towards embracing stablecoins, they face a myriad of regulatory considerations that cannot be overlooked. The evolving regulatory landscape poses challenges related to compliance with consumer protection laws, anti-money laundering regulations, and data privacy protections. Stability in the value of stablecoins must be maintained to ensure trust among users, and this reinforces the need for stringent regulatory oversight and clarity.

In his earnings call, Dimon highlighted the agile nature of fintech companies, pointing out that they are actively seeking ways to secure market share through innovative financial products. Consequently, this competitive advantage raises the stakes for traditional banks to engage in continuous innovation while also adhering to a complicated regulatory framework. Dimon acknowledged the importance of being involved in these technological advancements, stating, “And the way to be cognizant is to be involved.”

| No. | Key Points |

|---|---|

| 1 | Stablecoins are cryptocurrencies designed to maintain a steady value. |

| 2 | JPMorgan announces plans for a client-specific stablecoin. |

| 3 | Major banks like Citigroup and Bank of America are exploring their own stablecoin projects. |

| 4 | Collaboration among traditional banks may occur to address fintech competition. |

| 5 | Regulatory frameworks play a critical role in shaping the future of stablecoin adoption. |

Summary

The evolving dialogue around stablecoins highlights a fundamental shift in the banking sector’s approach to digital currencies. Jamie Dimon’s cautious acknowledgment of the potential of stablecoins, coupled with the proactive measures taken by JPMorgan and other major banks, signals a growing recognition of the importance of innovation in financial services. As the regulatory landscape becomes increasingly complex, the successful integration of stablecoins into the banking ecosystem will hinge on each institution’s ability to navigate these challenges while remaining competitive in the face of advancing fintech innovations.

Frequently Asked Questions

Question: What are stablecoins?

Stablecoins are a type of cryptocurrency designed to maintain a stable value, usually pegged to traditional fiat currencies like the U.S. dollar, providing a reliable medium for transactions.

Question: Why are traditional banks exploring stablecoins?

Traditional banks are exploring stablecoins to enhance transaction speed and cost-effectiveness, providing a competitive edge against emerging fintech companies.

Question: What challenges do banks face with stablecoins?

Banks must navigate complex regulatory requirements, ensuring compliance with laws related to consumer protection, anti-money laundering, and maintaining trust in stablecoin stability.