In a recent assessment of notable stocks, several companies have drawn attention due to fluctuating share prices resulting from their quarterly earnings announcements. Chipmaker Nvidia announced a significant financial charge tied to new export regulations, while J.B. Hunt Transport Services saw its stock dip despite beating expectations. Conversely, both United Airlines and Travelers reported better-than-expected earnings, leading to a positive response on the stock market. In contrast, companies like Interactive Brokers and ASML faced declines following disappointing earnings outcomes or lowered guidance.

| Article Subheadings |

|---|

| 1) Nvidia Faces Challenges Amid Regulatory Changes |

| 2) J.B. Hunt Reports Mixed Earnings |

| 3) United Airlines Exceeds Earnings Expectations |

| 4) Mixed Results for Interactive Brokers |

| 5) Travelers and ASML: Diverging Fortunes in Earnings |

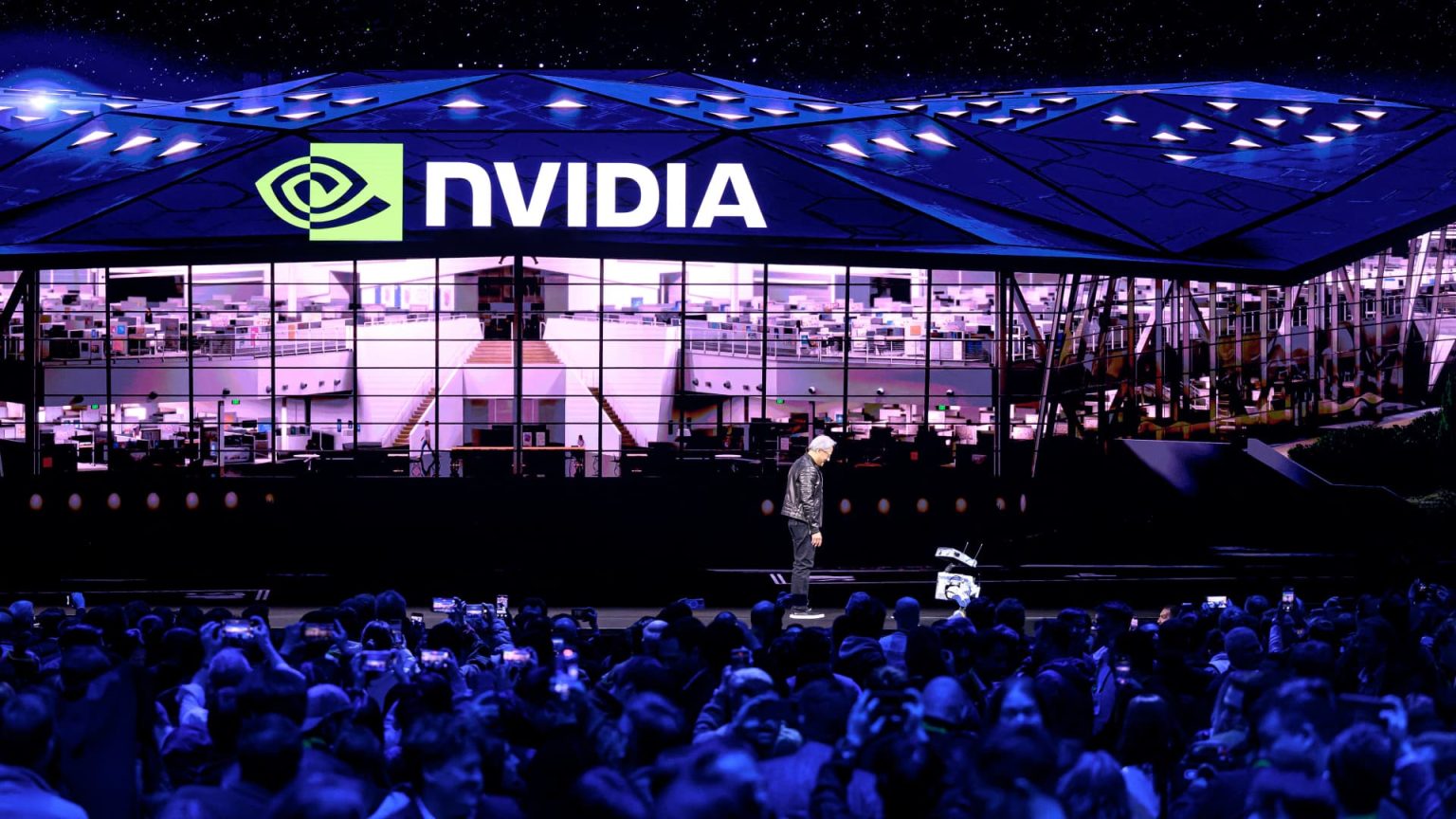

Nvidia Faces Challenges Amid Regulatory Changes

Nvidia, a leading manufacturer of graphics processing units (GPUs), has encountered significant challenges following a recent notification from the U.S. government about its export licenses. On reporting day, Nvidia revealed that it would incur a substantial charge of $5.5 billion linked to the inability to export certain H20 graphics processing units to China and additional markets. This regulatory roadblock has prompted uncertainty among investors, resulting in a sharp decline of over 6% in Nvidia’s stock price.

The timing of this announcement coincided with Nvidia’s quarterly earnings report, which has typically been viewed with optimism in the tech industry. However, the new requirement for a license specifically impacts Nvidia’s ability to conduct business in one of its largest markets. Analysts are closely watching the situation as they await further clarity on the government’s stance regarding semiconductor exports, which is crucial not only for Nvidia but for the broader tech supply chain. This scenario exemplifies how geopolitical factors can weigh heavily on the financial performance of companies reliant on international markets.

J.B. Hunt Reports Mixed Earnings

Despite a strong earnings report, J.B. Hunt Transport Services witnessed a considerable pullback of 6% in its stock following the financial disclosure. The transportation company announced first-quarter earnings that surpassed analysts’ expectations, generating both revenue and earnings per share that were higher than anticipated. Specifically, J.B. Hunt’s financial figures revealed a slight decline of 1% year-over-year in both revenue and operating income, raising concerns over the sustainability of its revenue growth.

The company’s leadership attributed the fall in revenue to various factors, including rising operational costs and changing demand patterns in the transportation sector. Analysts have indicated that while the first quarter presented some positive outcomes, continued scrutiny will be essential as the company navigates the evolving economic landscape. Stakeholders are particularly focused on J.B. Hunt’s capacity to adapt and maintain revenue growth amid macroeconomic challenges.

United Airlines Exceeds Earnings Expectations

In contrast, United Airlines reported a surge of over 7% in its stock price after delivering first-quarter results that exceeded expectations. The airline declared an adjusted earnings figure of 91 cents per share—significantly surpassing the Wall Street estimate of 76 cents per share. This performance is particularly encouraging given the broader context of fluctuating travel demand and pre-existing financial hurdles.

The results were bolstered by increased consumer travel demand and effective cost management strategies implemented by the airline. During the earnings call, United’s executives expressed a cautious optimism about the year ahead but emphasized the unpredictability of the economic environment. As a response to the challenges posed by inflation and evolving consumer preferences, the airline’s management is committed to strategic investments that will enhance operational efficiency while providing better services to its customers.

Mixed Results for Interactive Brokers

Interactive Brokers also saw its stock drop by 8% following the release of its first-quarter earnings, which underperformed analyst expectations. The electronic trading platform reported earnings of $1.88 per share, falling short of the projected $1.92 per share from analysts surveyed prior to the report. Despite the earnings miss, Interactive Brokers managed to align its adjusted revenue of $1.40 billion with market forecasts, suggesting that revenue generation remains stable.

The disappointing earnings figure was attributed to several underlying factors, including diminished trading volumes and fluctuations in market activity. Additionally, the company announced a four-for-one stock split and a minor dividend increase, which could appeal to investors looking for stability and long-term growth potential. Nonetheless, the immediate reaction of shareholders is indicative of the market’s sensitivity to performance metrics, particularly in a competitive trading environment.

Travelers and ASML: Diverging Fortunes in Earnings

In a tale of two companies, Travelers Companies experienced a boost of 2.9% in its stock after posting better-than-expected earnings for the first quarter. The insurance giant reported earnings of $1.91 per share, significantly outperforming the anticipated figure of 79 cents per share reported by analysts. Additionally, Travelers’ revenue of $11.81 billion also exceeds the consensus estimate of $10.84 billion, showcasing robust performance within the insurance sector.

Conversely, ASML, a major player in the semiconductor equipment industry, saw its shares tumble by 5.1% following disappointing quarterly bookings. The company’s CEO highlighted the challenges posed by tariff-driven uncertainties impacting customer orders, which could lead ASML to the lower end of its revenue guidance for the year. This contrast in results highlights the volatility present in the tech and industrial sectors, underscoring how external factors can directly influence business performance.

| No. | Key Points |

|---|---|

| 1 | Nvidia’s stock dropped over 6% after announcing a $5.5 billion charge due to export regulations. |

| 2 | J.B. Hunt’s shares fell despite beating earnings expectations, citing a drop in revenue year-over-year. |

| 3 | United Airlines stocks surged more than 7% after reporting adjusted earnings of 91 cents per share, exceeding forecasts. |

| 4 | Interactive Brokers’ stock fell 8% due to missed earnings estimates despite stable revenue figures. |

| 5 | Travelers saw a bump in stock price post earnings announcement, while ASML’s shares dropped due to lower-than-anticipated bookings. |

Summary

The recent fluctuations in the stock prices of major companies highlight the complex interplay between earnings reports, regulatory changes, and market expectations. As companies like Nvidia deal with external pressures, others like United Airlines demonstrate resilience in their performance. These dynamics underline the importance of investor sentiment and the influence of both internal and external factors on stock market performance. Consequently, stakeholders must remain vigilant and adaptable in their strategies in a rapidly changing market landscape.

Frequently Asked Questions

Question: What were the main challenges Nvidia faced recently?

Nvidia faced significant challenges due to a U.S. government notification requiring a license for exporting certain graphics processing units to China, resulting in a $5.5 billion charge expected for the next quarter.

Question: How did United Airlines perform financially?

United Airlines exceeded earnings expectations for the first quarter with an adjusted profit of 91 cents per share, benefiting from strong consumer travel demand and effective cost management.

Question: What was the impact of Interactive Brokers’ latest earnings report?

Interactive Brokers’ stock fell by 8% following a quarterly earnings report that missed analyst expectations, despite its revenue aligning with forecasts. This negative sentiment highlights investor reactions to performance metrics.