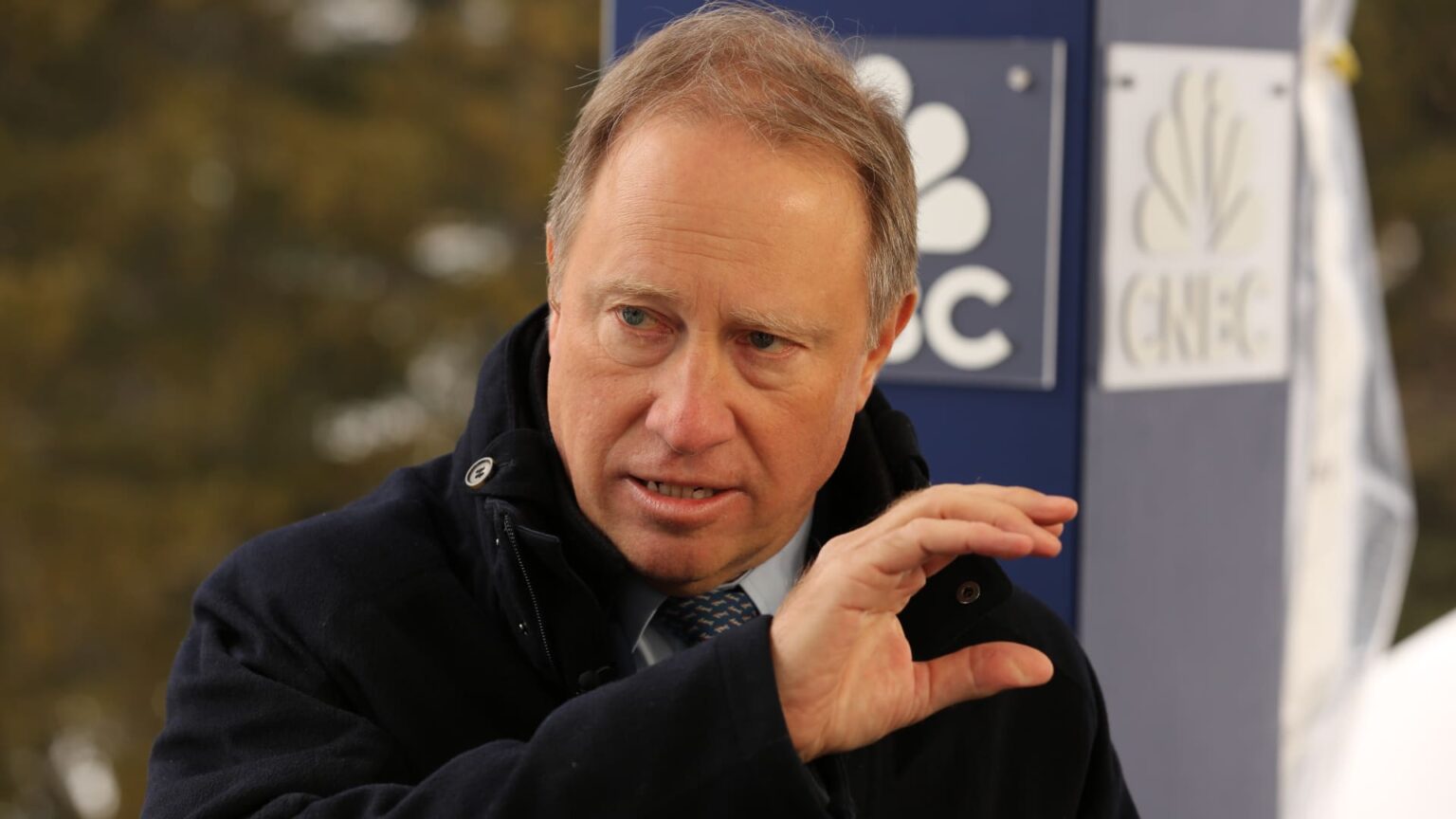

On January 23, 2025, Ted Pick, the CEO of Morgan Stanley, shared the bank’s impressive third-quarter earnings, which exceeded market expectations significantly, driven primarily by strong results across equities trading, investment banking, and wealth management sectors. The earnings reports indicate a robust environment for Wall Street banks, with Morgan Stanley witnessing notable growth compared to previous years. The positive results have led to a surge in the bank’s stock price, reflecting investor confidence amidst ongoing market activity.

Morgan Stanley reported on Wednesday that its third-quarter earnings surpassed expectations by the largest margin in nearly five years due to robust performance in equities trading, investment banking, and wealth management.

Here’s what the company reported:

- Earnings per share: $2.80 vs. $2.10 expected, according to LSEG

- Revenue: $18.22 billion vs. $16.7 billion, according to LSEG

The bank disclosed that its profit surged 45% year-over-year, reaching $4.61 billion, equating to $2.80 per share. Additionally, revenue rose 18%, marking a record high at $18.22 billion.

Morgan Stanley shares rose nearly 5% on the day of the announcement, demonstrating an increase of nearly 30% for the year thus far.

The trading desks on Wall Street experienced heightened activity during the quarter, driven by a resurgence of investment banking particularly in mergers and initial public offerings (IPOs). The performance was further supported by record highs in stock prices, which bolstered Morgan Stanley’s wealth management division.

Collectively, Wall Street-centric banks such as Morgan Stanley and peer Goldman Sachs find themselves in a favorable environment.

Morgan Stanley’s equities trading revenue achieved an impressive growth of 35%, totaling $4.12 billion, exceeding expectations by $720 million as reported by analysts from StreetAccount. The bank attributed this growth to heightened activity across various business segments and regions, in addition to record performance in its prime brokerage business serving hedge funds.

Fixed income trading experienced an 8% increase, reaching $2.17 billion, aligning closely with the expectations outlined by StreetAccount.

Investment banking revenue surged by 44% compared to the same quarter last year, achieving $2.11 billion, which was approximately $430 million above the estimates from StreetAccount. The bank cited a rise in completed mergers, IPOs, and fixed income fundraising as the key factors contributing to this quarter’s strong performance.

Wealth management revenue also rose by 13%, reaching $8.23 billion, surpassing expectations by around $500 million, bolstered by increased asset levels and transaction fees.

On the preceding Tuesday, major banks including JPMorgan Chase,, Goldman,, Citigroup, and Wells Fargo also reported earnings that surpassed analysts’ projections for both earnings and revenue.

This story is developing. Please check back for updates.

| Article Subheadings |

|---|

| 1) Key Earnings Highlights |

| 2) Equity and Investment Banking Surge |

| 3) Wealth Management Performance |

| 4) Market Conditions Favoring Banks |

| 5) Broader Implications for Wall Street |

Key Earnings Highlights

Morgan Stanley’s latest earnings report reveals several noteworthy highlights. The bank’s earnings per share reached $2.80, exceeding expectations which were set at $2.10 by industry analysts. Additionally, the overall revenue soared to $18.22 billion, surpassing the anticipated $16.7 billion. These achievements resulted in an impressive 45% increase in profit compared to last year, culminating in $4.61 billion in profit for the quarter. The year-on-year growth underscores the bank’s resilience and capacity to navigate a competitive financial environment successfully.

Equity and Investment Banking Surge

The significant growth in equities trading and investment banking is a pivotal factor contributing to Morgan Stanley’s impressive results this quarter. The bank’s equities trading revenue climbed by 35%, achieving $4.12 billion, which was approximately $720 million more than analysts’ expectations. This growth is attributed to increased trading activity across various business segments and regions, coupled with record performance in the bank’s prime brokerage services aimed at hedge funds. Meanwhile, investment banking revenue jumped by 44% year-over-year, amounting to $2.11 billion. This tremendous growth was propelled by an uptick in completed mergers, IPOs, and fixed income fundraising efforts, solidifying Morgan Stanley’s position in these markets.

Wealth Management Performance

Wealth management is another area where Morgan Stanley excelled this quarter. The wealth management revenue climbed 13%, hitting $8.23 billion and exceeding analyst predictions by around $500 million. The growth can be attributed to rising asset levels and higher transaction fees, which reflect increased investor activity and confidence in the markets. Such positive performance in wealth management signifies the bank’s capability to attract and maintain client investments, thus enhancing long-term growth prospects.

Market Conditions Favoring Banks

The favorable market conditions prevailing during this quarter have provided a conducive environment for banks like Morgan Stanley. Wall Street trading desks have been exceptionally active, contributing to heightened trading volumes and engagement. A resurgence in investment banking can be noted, especially concerning mergers and IPOs, reflecting a broader recovery in market confidence. The current climate—with stock prices near record highs—has distinctly bolstered Morgan Stanley’s wealth management division, making it a lucrative time for the investment banking sector.

Broader Implications for Wall Street

The successful earnings reports from Morgan Stanley could signal a trend among Wall Street banks as they continue to navigate through an evolving financial landscape. Major banks, including JPMorgan Chase, Goldman Sachs, Citigroup, and Wells Fargo, have all reported earnings exceeding analysts’ expectations for the quarter. This upswing points to a potentially strong season for the banking sector, lending credence to investor confidence in the financial markets. As these banks continue to perform well, it could lead to a ripple effect, impacting not only their stock prices but also broader economic indicators.

| No. | Key Points |

|---|---|

| 1 | Morgan Stanley’s third-quarter earnings surpassed expectations with earnings per share at $2.80. |

| 2 | Revenue reached $18.22 billion, marking an 18% year-over-year increase. |

| 3 | Equities trading revenue surged 35%, driven by increased trading activity. |

| 4 | Investment banking revenue grew by 44%, attributed to more mergers and IPOs. |

| 5 | Wealth management revenue rose 13%, reflecting heightened asset levels and transaction fees. |

Summary

Morgan Stanley’s latest earnings report not only reflects the bank’s robust financial health but also signals a healthier environment for financial institutions broadly. The substantial growth in both equities trading and investment banking underscores the bank’s adeptness in capitalizing on market opportunities. With confidence returning to Wall Street, the implications extend beyond Morgan Stanley as it may herald a positive trajectory for the entire banking sector.

Frequently Asked Questions

Question: What were Morgan Stanley’s earnings per share for the third quarter?

Morgan Stanley reported earnings per share of $2.80 for the third quarter, which exceeded analysts’ expectations of $2.10.

Question: How much did Morgan Stanley’s revenue increase in the latest quarter?

The bank’s revenue rose to $18.22 billion, representing an 18% increase when compared to the previous year.

Question: What factors contributed to the growth in investment banking revenue?

The 44% increase in investment banking revenue was primarily driven by a rise in completed mergers, IPOs, and fixed income fundraising.