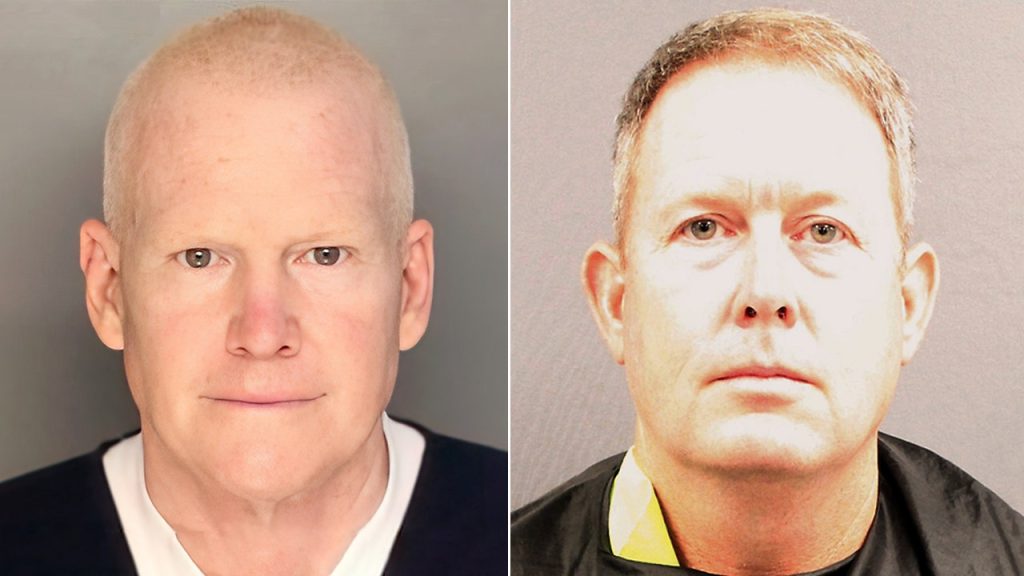

A former banker and alleged accomplice of the disgraced legal figure, Alex Murdaugh, has accepted a guilty plea regarding his involvement in financial crimes linked to Murdaugh. Russell Laffitte pleaded guilty to multiple federal fraud charges and has been sentenced to five years in prison along with a restitution obligation of over $3.5 million. As CEO of Palmetto State Bank, Laffitte utilized his role to assist Murdaugh in defrauding clients, a scenario that has attracted significant public and media scrutiny amidst a backdrop of complex financial misconduct within the legal profession.

| Article Subheadings |

|---|

| 1) Background of Russell Laffitte |

| 2) Details of the Guilty Plea |

| 3) The Connection to Alex Murdaugh’s Crimes |

| 4) Legal Consequences and Sentencing |

| 5) Wider Implications for Financial Fraud and Legal Ethics |

Background of Russell Laffitte

Russell Laffitte rose to prominence as the CEO of Palmetto State Bank, an institution founded by his family in 1907 located in Hampton, South Carolina. This small-town bank became intertwined with the life of Murdaugh and the infamous saga of financial corruption in South Carolina’s legal field. Laffitte’s career has now come under intense scrutiny, as documents reveal his collaboration with Murdaugh during a series of financial crimes that involve the manipulation and theft of client funds. His family legacy built over decades now faces tarnishment due to his alleged involvement in fraudulent activities, illustrating a stark contrast to the values once upheld by the bank.

Details of the Guilty Plea

In a decisive move last week, Russell Laffitte changed his plea to guilty concerning several federal fraud charges. The acceptance of this plea deal resulted in a sentence of five years in federal prison, alongside a hefty financial restitution requirement of $3,555,884.80. This figure represents a portion of the funds stolen in his collusion with Murdaugh. Additionally, as part of the plea agreement, Laffitte has been restricted from working at any federally insured bank or credit union without prior approval, further isolating him from the financial sector.

The guilty plea highlights not only Laffitte’s involvement but also underlines the serious breaches of trust and fiduciary duty that financial institutions and their executives must uphold. It signals a significant development in the legal proceedings surrounding financial corruption in South Carolina, shedding light on just how deep the corruption had run.

The Connection to Alex Murdaugh’s Crimes

Laffitte’s collaboration with Alex Murdaugh began during his tenure as a conservator and financial representative for Murdaugh’s personal injury clients. This cooperation allowed Murdaugh to orchestrate schemes that funneled millions of dollars from vulnerable victims, including protest clients. Court testimonies from Laffitte have positioned him as claiming ignorance to Murdaugh’s alleged misdeeds; however, the evidence suggests a complex collaboration that points to a deeper level of complicity.

During a trial held in 2022, Laffitte was implicated in facilitating Murdaugh’s theft of over $2 million from hapless clients. Inconsistent with his previous statements, Laffitte’s recent pleas reveal a recognition of the significance of his actions and the resulting damages inflicted upon innocent individuals who trusted him and Murdaugh. This relationship exposes the systemic failures within legal and banking sectors that once allowed such fraudulent behaviors to flourish without scrutiny.

Legal Consequences and Sentencing

Following his conviction, Laffitte faced a sentence of nearly seven years in prison, which was later linked to his obligation to pay restitution. However, the original sentence was overturned in November 2024 after it was determined that procedural rights were violated during his trial. This legal back-and-forth underscores the intricate nature of Laffitte’s case and the contentious legal landscape surrounding financial fraud.

The overturned ruling came after an appellate court identified initial mishandling of jury selection, highlighting broader implications for due process and legal fairness within high-profile cases of financial misdeeds. As the legal dramas surrounding financial crimes continue to unfold, the public’s interest remains peaked, particularly in how justice is served within this context.

Wider Implications for Financial Fraud and Legal Ethics

The implications of Laffitte’s plea deal and the broader Murdaugh financial scandal touch on significant issues within both the legal and banking industries. As these high-profile cases draw national attention, they serve to expose systemic weaknesses and highlight the urgent need for reform in oversight and ethical practices. The sordid details unfolding reveal not only the grotesque consequences for individual victims but also call into question the integrity of the institutions involved.

This evolving situation acts as a cautionary tale about the abuse of power and trust, pressing stakeholders within both sectors to adopt stricter regulatory measures to prevent future fraud. It emphasizes the essentiality of ethical accountability and transparency to restore faith in financial institutions and the legal system as a whole.

| No. | Key Points |

|---|---|

| 1 | Russell Laffitte, former CEO of Palmetto State Bank, pleaded guilty to multiple federal fraud charges. |

| 2 | Laffitte has been sentenced to five years in prison and ordered to pay over $3.5 million in restitution. |

| 3 | Laffitte was implicated in aiding Alex Murdaugh in the theft of client funds totaling over $2 million. |

| 4 | The case has raised significant concerns regarding ethical practices within financial institutions and the legal field. |

| 5 | The situation calls for reforms to prevent future financial fraud and restore public trust in these sectors. |

Summary

The legal saga surrounding Russell Laffitte and Alex Murdaugh continues to unravel, exposing layers of corruption and ethical failures within both the banking and legal systems. Laffitte’s admission of guilt not only implicates him directly in fraudulent activities but also highlights a widespread need for reform and accountability in the financial sector. As the investigation progresses, the hope is that such notorious cases will lead to systemic changes that prioritize the protection of clients and the integrity of legal practices.

Frequently Asked Questions

Question: What charges did Russell Laffitte plead guilty to?

Russell Laffitte pleaded guilty to multiple federal fraud charges related to his involvement in financial crimes associated with Alex Murdaugh.

Question: What was the sentence imposed on Laffitte?

Russell Laffitte was sentenced to five years in prison and ordered to pay restitution of $3,555,884.80 as part of his guilty plea.

Question: How did Laffitte’s actions relate to Alex Murdaugh’s financial schemes?

Laffitte, as CEO of Palmetto State Bank, assisted Murdaugh in defrauding clients out of millions of dollars, serving both as a conservator and a financial representative for Murdaugh’s clients.