Nvidia Corp., once a prominent member of the exclusive $3 trillion market club alongside Apple, has recently witnessed a significant decline in its market capitalization. Following their quarterly earnings report, Nvidia’s share prices plummeted over 8%, leading to a loss of approximately $273 billion in value. Despite this setback, the company remains a formidable force in the tech industry, primarily due to its cutting-edge AI products and strong demand for its chips.

| Article Subheadings |

|---|

| 1) Synopsis of Recent Earnings Report and Market Impact |

| 2) The Key Drivers Behind Nvidia’s Market Performance |

| 3) Future Outlook for Nvidia and the AI Sector |

| 4) Analysis of the Competitive Landscape |

| 5) Insights from Industry Leaders on Upcoming Trends |

Synopsis of Recent Earnings Report and Market Impact

Nvidia reported its quarterly earnings on January 16, 2025, indicating a remarkable year-on-year revenue growth of 78%, amounting to $39.33 billion. The impressive financial results, however, were overshadowed by a sharp decline in share prices, which fell over 8% following the announcement, resulting in a loss of around $273 billion in market capitalization. As a consequence, Nvidia’s current market value stands at approximately $2.94 trillion, making it the second-most valuable technology firm in the United States, trailing only behind Apple. This decline in value reflects broader market sentiments, including a 1.6% drop in the S&P 500 and a 2.8% decrease in the Nasdaq.

The Key Drivers Behind Nvidia’s Market Performance

Several factors have contributed to the volatility in Nvidia’s stock prices. One significant concern includes ongoing investor trepidations about export controls and tariffs that may affect the availability and pricing of their products. In addition, there’s a growing worry regarding more efficient artificial intelligence models that may reduce demand for Nvidia’s chips in pursuit of cost-effective computing solutions. These issues, combined with an overall slowdown in growth, have made investors cautious, leading to the recent dip in share prices. Despite these challenges, Nvidia continues to outpace its market position, having added considerable value since the onset of the generative AI boom two years ago, where it first reached a $3 trillion valuation in June 2024.

Future Outlook for Nvidia and the AI Sector

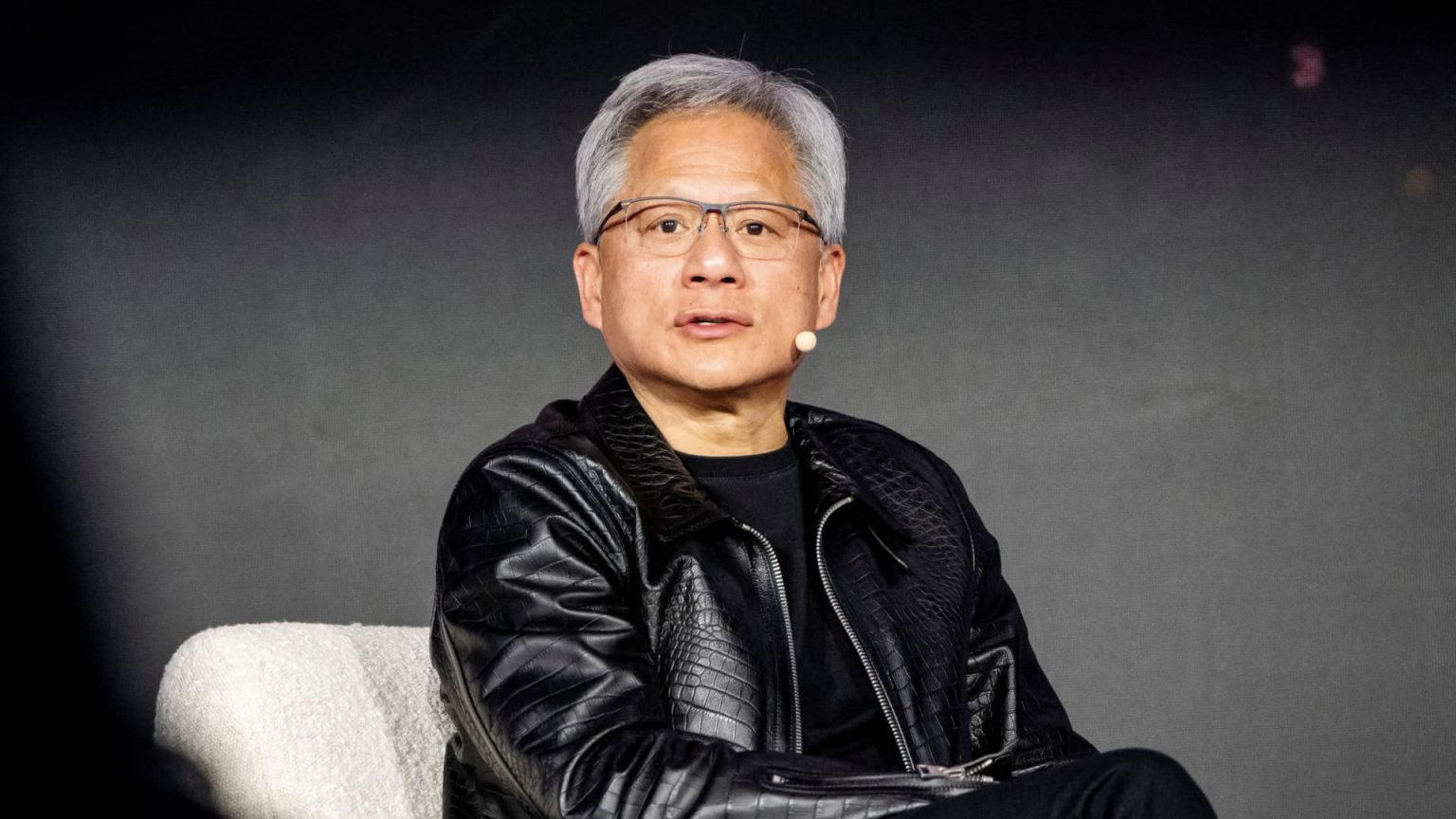

Looking ahead, Nvidia’s prospects appear promising, particularly in the context of advancing AI technologies. CEO Jensen Huang expressed optimism, indicating that broader adoption of next-generation AI models, which involve complex reasoning processes, may require significantly greater computational power than what is currently utilized. Huang stated, “The amount of computation necessary to do that reasoning process is 100 times more than what we used to do.” This critical evolution could lead to an increased demand for Nvidia’s products as cloud computing infrastructures expand. Moreover, production issues surrounding the company’s next-generation chip, Blackwell, have been largely resolved, setting a stable base for strong future performance.

Analysis of the Competitive Landscape

Nvidia, while facing challenges, still holds a competitive edge in the technology sector, particularly compared to major rivals like Microsoft, Google, and Amazon. These companies, categorized as large cloud service providers, contribute significantly to Nvidia’s data center revenue, which has reportedly increased by 93% year-on-year to nearly $36 billion. In an evolving landscape, the strategic partnerships and financial commitments from these tech giants indicate that the demand for Nvidia’s high-performance chips is unlikely to diminish in the short term, even amidst current market uncertainties.

Insights from Industry Leaders on Upcoming Trends

Industry experts emphasize that the future of computing and data processing lies heavily in AI capabilities, which suggests a fundamental shift in how technology will be utilized across various sectors. As firms like Nvidia strive to innovate, the emphasis on creating robust AI models that can facilitate complex decision-making processes will spotlight technology players capable of delivering unparalleled computational solutions. Huang’s assertions regarding increased computational demands signify an era where fans of generative AI will likely propel Nvidia into new heights, amidst an era of innovation and technological rivalry.

| No. | Key Points |

|---|---|

| 1 | Nvidia’s market capitalization has fallen below $3 trillion following a recent earnings report. |

| 2 | Quarterly earnings showed a 78% increase in revenue, totaling $39.33 billion. |

| 3 | Investor concerns include export controls and competition in the AI chip market. |

| 4 | Nvidia’s technology continues to be essential for major cloud service providers, accounting for a significant portion of its data center revenue. |

| 5 | Future demand for Nvidia chips is anticipated to grow as AI models evolve, requiring more computational resources. |

Summary

The recent financial performance of Nvidia Corp. highlights the complexities in the technology sector as it contends with market fluctuations and competitive pressures. Despite substantial revenue growth, challenges related to trade policies and advancements in AI technology have introduced uncertainties that could impact the company’s market position. Nevertheless, Nvidia’s leadership in AI and sustained demand from key industry players suggest a robust long-term outlook as the landscape of computing continues to evolve.

Frequently Asked Questions

Question: What contributed to Nvidia’s decline in market capitalization?

The decline in Nvidia’s market capitalization was primarily driven by an 8% drop in its share price following the release of quarterly earnings, along with broader investor concerns about export controls, competition, and overall market growth.

Question: How has Nvidia performed in comparison to its competitors?

Nvidia remains the second most valuable tech company in the U.S., trailing only Apple, despite facing increased competition from major players like Microsoft and Google. Its strong relationships with these companies for data center revenue underpin its market position.

Question: What is the future outlook for Nvidia based on current trends?

The future outlook for Nvidia appears positive, driven by increasing demands for AI capabilities and plans to expand its product offerings. As the complexity of AI models grows, so too does the potential demand for Nvidia’s advanced processing chips.