Nvidia has announced its latest earnings report, posting impressive results that exceeded analyst expectations. The company’s data center business, a crucial segment for growth, noted a significant year-over-year increase of 73%. Despite challenges relating to U.S. export restrictions, Nvidia remains optimistic, projecting approximately $45 billion in sales for the upcoming quarter while also highlighting a notable rise in net income.

| Article Subheadings |

|---|

| 1) Earnings Exceed Expectations |

| 2) Impact of Export Restrictions |

| 3) Segment Growth Analysis |

| 4) Strategic Business Initiatives |

| 5) Future Market Outlook |

Earnings Exceed Expectations

Nvidia reported adjusted earnings of 96 cents per share, surpassing consensus estimates that predicted 93 cents. The total revenue for the quarter reached $44.06 billion, outpacing forecasts of $43.31 billion. This marked a substantial increase of 69% compared to the same quarter last year when revenues stood at $26 billion. The strong performance reflects the booming interest in artificial intelligence applications, with Nvidia at the forefront, driven by significant demand from various sectors.

The exceptional earnings were met enthusiastically by investors, as evidenced by a 6% rise in stock value during extended trading hours. Furthermore, Nvidia’s net income grew by 26%, climbing to $18.8 billion, or 76 cents per share, a notable increase from last year’s figures of $14.9 billion or 60 cents per share. These results underscore the company’s robust financial health and investor confidence in its future prospects.

Impact of Export Restrictions

Amidst the positive earnings report, Nvidia faced challenges stemming from new export restrictions imposed by the U.S. government. The company had to revise its sales projection down to $45 billion for the current quarter, just below LSEG estimates of $45.9 billion. Nvidia indicated that it could have possibly generated an additional $8 billion in sales, had it not been for the loss of sales associated with its H20 processor exports to China.

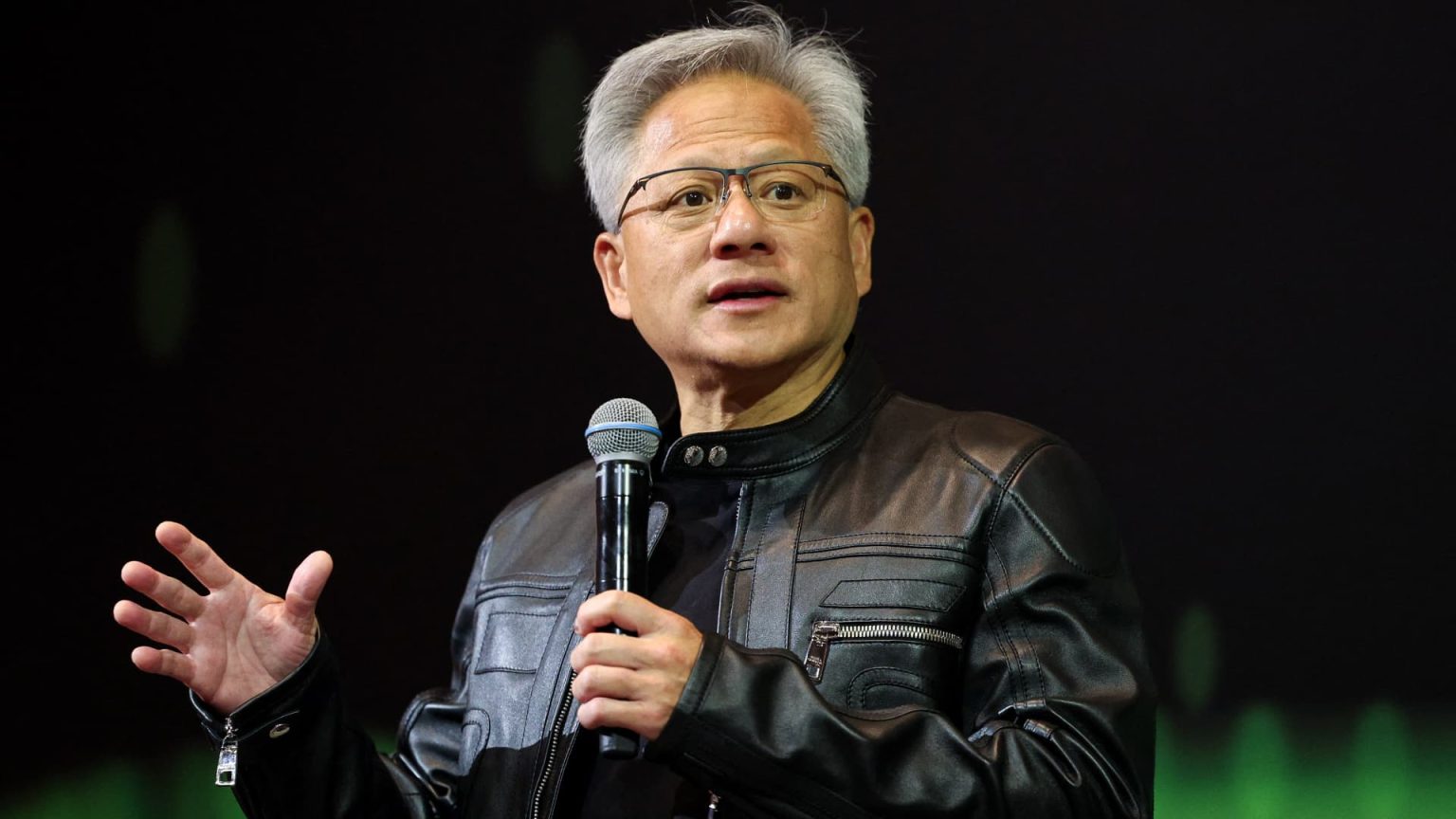

The restrictions necessitated that Nvidia seek an export license for its processors sold to China, a market valued at $50 billion for AI chips. CEO Jensen Huang emphasized that this ban effectively shut down Nvidia’s Hopper data center operations in China, demonstrating the significant impact of geopolitical tensions on business operations. The total financial burden from these restrictions amounted to $4.5 billion in excess inventory charges, highlighting the adverse effects on the company’s gross margin, which stood at 61% for the quarter but would have reached 71.3% without these charges.

Segment Growth Analysis

Despite the geopolitical landscape affecting its operations, Nvidia’s data center revenue continued to thrive, growing by 73% from the previous year. This segment accounted for a whopping 88% of total revenue, emphasizing its centrality to the company’s overall success. Sales within this division reached $39.1 billion, with major cloud service providers contributing nearly half of this figure. The data center unit’s robust performance was complemented by $5 billion in sales from networking products integral to connecting Nvidia chips in AI research.

The company’s gaming division also demonstrated resilience, achieving a 42% annual growth and generating $3.8 billion in revenue. Although Nvidia’s gaming chips were primarily designed for 3D gaming, they have now found applications in AI technologies. Furthermore, sales from the automotive and robotics division soared by 72%, reaching $567 million due to increased demand for self-driving car technologies. Overall, Nvidia’s diversified portfolio allowed it to withstand external challenges while capitalizing on increasing demand across its business units.

Strategic Business Initiatives

Nvidia has actively pursued strategic initiatives to strengthen its market position and drive growth. The company invested $14.1 billion in share repurchases during the quarter, a move aimed at returning capital to shareholders and bolstering the stock price. Additionally, Nvidia has a history of innovation in the AI space, with products increasingly becoming critical to enterprise solutions and cloud computing strategies. Nvidia’s Chief Financial Officer Colette Kress noted the deployment of tens of thousands of the company’s Blackwell GPUs, largely facilitated by partnerships with key players like Microsoft and OpenAI.

These partnerships illustrate the synergy between Nvidia’s hardware and software capabilities, ensuring its products remain at the cutting edge of technology development. Moreover, Nvidia’s efforts in professional visualization, which includes chips for 3D design and AI desktops, also experienced revenue growth of 19%, indicating a well-rounded approach to diversifying income streams.

Future Market Outlook

Looking forward, Nvidia’s prospects appear optimistic despite external economic pressures. The company is projected to continue leading the AI chip market as demand for artificial intelligence infrastructure shows no signs of abating. Nvidia’s innovations in AI and cloud computing are likely to solidify its position as an industry leader. As AI technologies become increasingly integral to various sectors, Nvidia’s products will likely be essential for companies looking to leverage this transformative technology.

However, the ramifications of geopolitical dynamics must also be considered as they could result in unforeseen hurdles. Ongoing trade tensions and regulatory environments will require Nvidia to navigate carefully to sustain its growth trajectory. Despite this, the company’s investment strategies, ongoing innovation, and established partnerships position it for continued success as it adapts to shifting marketplaces.

| No. | Key Points |

|---|---|

| 1 | Nvidia’s earnings and revenue exceeded analyst expectations, with significant growth reported in the data center business. |

| 2 | The company faced financial setbacks due to U.S. export restrictions on its H20 processors for China. |

| 3 | Total revenue for the data center division rose dramatically, contributing significantly to overall earnings. |

| 4 | Nvidia has engaged in strategic share buybacks and partnerships to position itself effectively in the AI market. |

| 5 | Despite challenges, Nvidia remains optimistic about future growth prospects in AI and cloud computing. |

Summary

Nvidia’s latest earnings report reflects a company experiencing robust growth amidst geopolitical challenges. With significant contributions from its data center operations, Nvidia has not only exceeded market expectations in terms of revenue and earnings but also showcased resilience through strategic industry initiatives. Looking ahead, the company is well-positioned to continue dominating the AI chip market, albeit with caution regarding potential external pressures.

Frequently Asked Questions

Question: What factors contributed to Nvidia’s increased revenue in the latest quarter?

Key factors included a booming demand for its AI chips in the data center segment and a notable increase in sales from its gaming and automotive divisions.

Question: How did the U.S. government restrictions impact Nvidia’s sales forecast?

The export restrictions on H20 processors for China limited Nvidia’s sales potential, leading to a downward revision in its sales forecast for the current quarter.

Question: What is Nvidia’s strategy moving forward in the AI market?

Nvidia aims to continue investing in innovative technologies, strengthen partnerships, and focus on diversifying its product offerings to maintain its leadership in the AI market.