Nvidia, a leader in graphics processing units (GPUs) and artificial intelligence (AI), announced its fourth-quarter earnings which surpassed Wall Street forecasts. The company is optimistic about future growth, driven by its cutting-edge AI chip, Blackwell, which is anticipated to significantly boost sales moving into 2025. Despite a deceleration in growth rates compared to prior years, Nvidia’s overall revenue remains strong, highlighting its continued dominance in the AI market.

| Article Subheadings |

|---|

| 1) Overview of Fourth-Quarter Earnings |

| 2) Future Prospects with Blackwell |

| 3) Diverse Revenue Streams Contributing to Growth |

| 4) Insights from Company Executives |

| 5) Trends and Challenges Ahead |

Overview of Fourth-Quarter Earnings

Nvidia’s latest earnings report indicated a notable performance for the fourth quarter, with revenues reaching $39.33 billion, outperforming the anticipated $38.05 billion. The company reported earnings per share adjusted to $0.89, which also exceeded estimates of $0.84. This financial success is attributed to the growing demand for Nvidia’s AI-related products and services, particularly its data center GPUs. Net income saw a significant increase to $22.09 billion for the quarter, a stark rise from $12.29 billion reported a year earlier, illustrating the impressive growth trajectory of the company.

In terms of growth rates, Nvidia has been at the forefront of the AI boom, with its revenue soaring by 78% during the fourth quarter alone. For the fiscal year, total revenue reached $130.5 billion, marking an astonishing increase of 114%. Such figures underscore the company’s strong foothold in the technology market, primarily due to its specializations in AI hardware and cloud computing solutions, which have seen a heightened demand in recent years.

Future Prospects with Blackwell

The launch of Nvidia’s next-generation AI chip, Blackwell, is poised to play a crucial role in the company’s future growth. Nvidia is forecasting approximately $43 billion in revenue for the upcoming first quarter, which, if realized, translates to an approximate 65% growth compared to the same period last year. However, this reflects a marked decrease from the staggering 262% growth experienced during the previous year. Nvidia’s Chief Financial Officer, Colette Kress, indicated that the sales momentum surrounding Blackwell is expected to be substantial, anticipating a “significant ramp” in sales as the company embarks on this new chapter.

During the fourth quarter, Nvidia reported $11 billion in Blackwell-related sales, with demand being characterized as “amazing.” A large portion of the sales was driven by major cloud service providers, making up approximately 50% of data center revenue, which demonstrates the robust interest from influential players in the technology sector. The transition of Nvidia’s chips from merely developing AI to delivering AI software, or inference, marks a significant evolution in the company’s strategic focus and product offerings.

Diverse Revenue Streams Contributing to Growth

Notably, Nvidia’s data center revenue for the fourth quarter reached $35.6 billion, reflecting a staggering 93% increase compared to the prior year. This facet of the business is now responsible for 91% of the company’s total sales, highlighting a substantial shift from previous years when it accounted for 60%. This diversification aligns with Nvidia’s successful expansion into various sectors, exemplified by its growing automotive sales, which amounted to $570 million, representing a 103% rise year-over-year.

Moreover, the report pointed out the integration of networking sales, which amounted to $3 billion within the data center operations, essential for connecting multiple GPUs. Although there was a slight drop of 9% from the previous year in this segment, Nvidia is still keen on capitalizing on emerging opportunities in networking technology. Overall, this diverse income source stream is vital for Nvidia as it prepares to navigate potential market fluctuations and technological advancements.

Insights from Company Executives

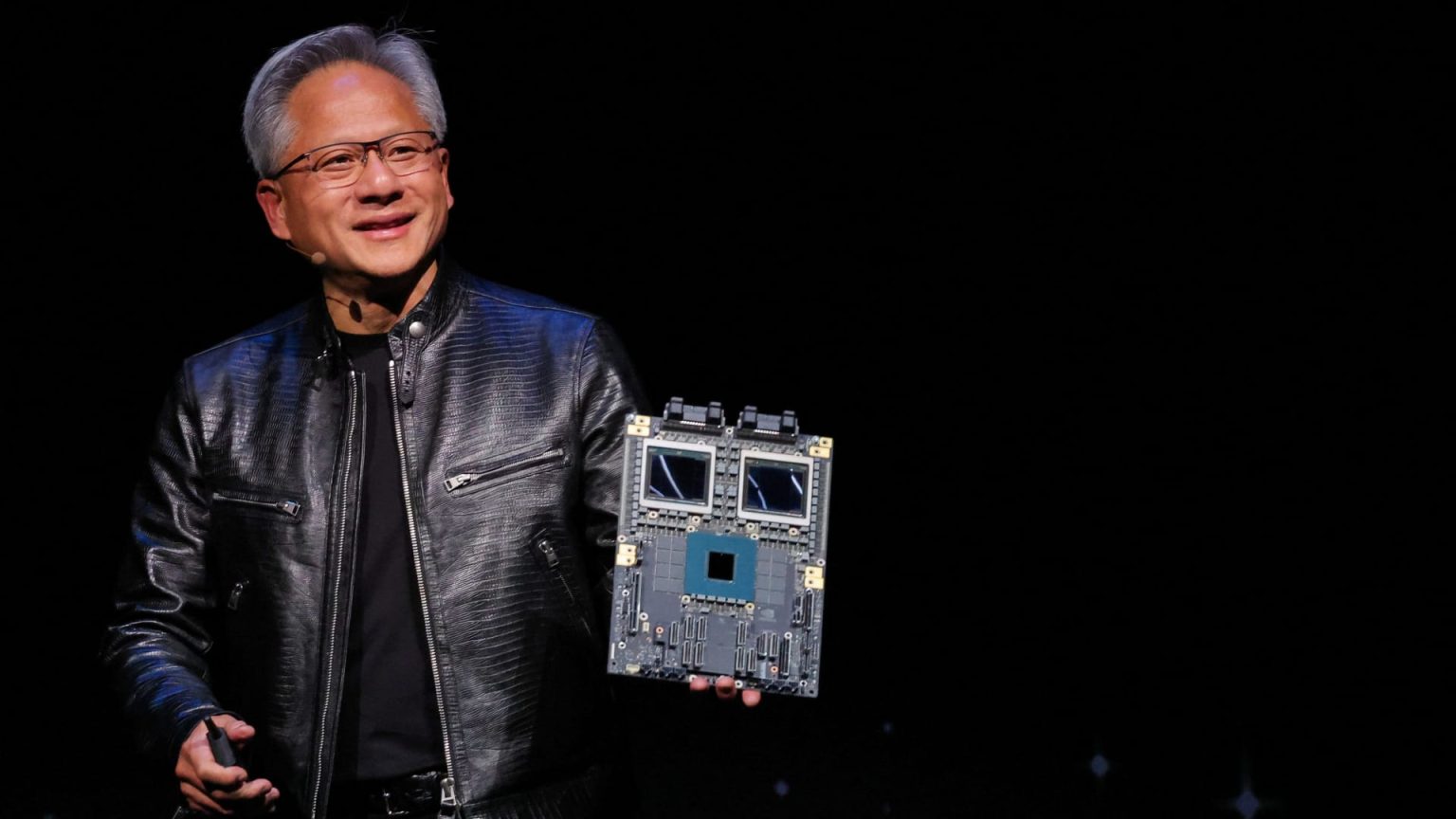

In addressing Wall Street’s excitement as well as concerns regarding future competition, Jensen Huang, Nvidia’s CEO, emphasized the distinction between designing chips and deploying them in a productive manner. While technology leaders like Amazon, Microsoft, and Google are developing custom chips, Huang reassured stakeholders that the complexity of deployment is a significant hurdle that could limit the impact of competitors’ chips. He noted,

“Just because the chip is designed doesn’t mean it gets deployed.”

Kress responded to investor queries concerning the potential limitations caused by new AI models, reiterating the idea that while efficient models might exist, the next-generation AI innovations could escalate hardware demands drastically. Highlighting the disparity between training and inference processes, she stated that advanced AI functionalities could require up to 100 times the current amount of compute, etching a clear path of demand for Nvidia’s GPUs moving forward.

Trends and Challenges Ahead

As Nvidia continues to navigate an evolving market landscape, it faces several challenges. The company is aware of the necessity to innovate swiftly to keep pace with rapid advancements in AI and computing. The anticipated slowdown in growth rates poses a concern for shareholders and analysts, with expectations that the level of expansion experienced in prior years may not be sustainable. Nevertheless, Nvidia’s strong forecast and strategic emphasis on AI technology position the company to maintain relevance in an ever-competitive environment.

Furthermore, as the market for AI hardware continues to grow, Nvidia is preparing to introduce cutting-edge technologies such as Blackwell that cater to this need. In doing so, the company aims to solidify its status as a key player in artificial intelligence and ensure it is equipped to tackle both competition and the demands of this burgeoning sector. Continued investment in research and development will be paramount for Nvidia to remain at the forefront of the AI revolution.

| No. | Key Points |

|---|---|

| 1 | Nvidia’s fourth-quarter earnings exceeded expectations with significant year-over-year growth. |

| 2 | The company anticipates substantial revenue from its new AI chip, Blackwell. |

| 3 | Nvidia reported a 93% increase in data center revenue, with major contributions from cloud service providers. |

| 4 | Nvidia faces challenges from competitors but remains focused on innovation and deployment capabilities. |

| 5 | The expectation of growth may slow while the company adapts to future market demands. |

Summary

Nvidia’s robust earnings report reflects its dominant position in the AI sector, with promising growth trajectories fueled by innovations like the Blackwell chip. Despite challenges and a potential slowdown in growth rates, the company’s continued investment into data centers and AI technology positions it well for the future. As Nvidia adapts to market changes and competitive pressures, its strategic focus on cutting-edge products and services remains vital to its sustained success in an ever-evolving industry.

Frequently Asked Questions

Question: What primarily drives Nvidia’s current financial success?

Nvidia’s financial success is mainly driven by the strong demand for its AI-related products, particularly in data center operations, which now constitute the majority of its revenue.

Question: How does the introduction of Blackwell impact Nvidia’s market position?

The introduction of the Blackwell chip is expected to enhance Nvidia’s market position significantly by providing advanced capabilities for AI software delivery, thereby driving future revenue growth.

Question: What concerns do executives have regarding competition?

Executives have expressed concerns about competition from custom chips developed by major tech firms, while emphasizing that design does not guarantee successful deployment of those chips.