Nvidia, a leader in the artificial intelligence (AI) sector, has made headlines as its shares experienced a significant upward surge of more than 4% on Wednesday, achieving a record closing price of $154.31. This rise in stock value took place despite emerging concerns regarding Chinese export controls that could potentially limit Nvidia’s market reach. As a result, the company’s market capitalization now stands at $3.77 trillion, making it the most valuable company globally, slightly surpassing its competitor Microsoft.

The surge comes after Nvidia disclosed its second-quarter earnings, showcasing impressive growth driven primarily by a booming data center business. With the ongoing challenges related to overseas regulations, including a $50 billion closure of the Chinese market for U.S. industry, Nvidia appears to pivot its focus towards other growth areas, including robotics.

| Article Subheadings |

|---|

| 1) Nvidia’s Impressive Market Performance Amid Regulatory Challenges |

| 2) Detailed Insights into Revenue Growth and Future Expectations |

| 3) The Impact of U.S. Regulations on Nvidia’s Operations |

| 4) Future Growth Areas Beyond AI for Nvidia |

| 5) Market Reactions and Implications for Investors |

Nvidia’s Impressive Market Performance Amid Regulatory Challenges

Nvidia celebrated a remarkable performance on the stock market, witnessing its shares rise significantly on Wednesday. This surge marked the first time in 2025 that the stock reached a record price, closing at $154.31, which surpassed its previous high of $149.43 set on January 6 of the same year. As of now, the company is valued at $3.77 trillion, putting it at the forefront of the global market, just ahead of major competitor Microsoft.

Investors appear optimistic about Nvidia’s continued dominance in AI technologies, especially in the field of graphics processing units (GPUs). These components are integral to constructing foundational technology like large language models, which are essential for AI workloads. The confidence among investors persists even amidst concerns over the company’s limitation in accessing opportunities in the expansive Chinese market due to recent regulatory changes.

Detailed Insights into Revenue Growth and Future Expectations

In May, Nvidia released its earnings report, revealing a dramatic year-over-year revenue increase of 69%. This remarkable growth was primarily propelled by a 73% surge in the data center business, a vital component in the company’s overall success. Analysts project that for the full fiscal year, Nvidia’s revenue could skyrocket by 53%, nearing an impressive $200 billion, which presents strong prospects despite ongoing regulatory battles.

The expectations for growth are underpinned by several factors, including the increasing global demand for AI technologies and Nvidia’s established reputation as a leading provider of the necessary hardware. Stakeholders are keenly watching a variety of indicators that could provide further insight into the company’s fiscal health and market standing throughout the year.

The Impact of U.S. Regulations on Nvidia’s Operations

The landscape for Nvidia has shifted considerably following new rules instituted by the Trump administration, which effectively cut off sales of the company’s H20 AI processor aimed at the Chinese market. Nvidia’s leadership has publicly acknowledged that these restrictions are projected to result in an estimated loss of $8 billion in sales, with a significant write-off of $4.5 billion in inventory impacting their balance sheet.

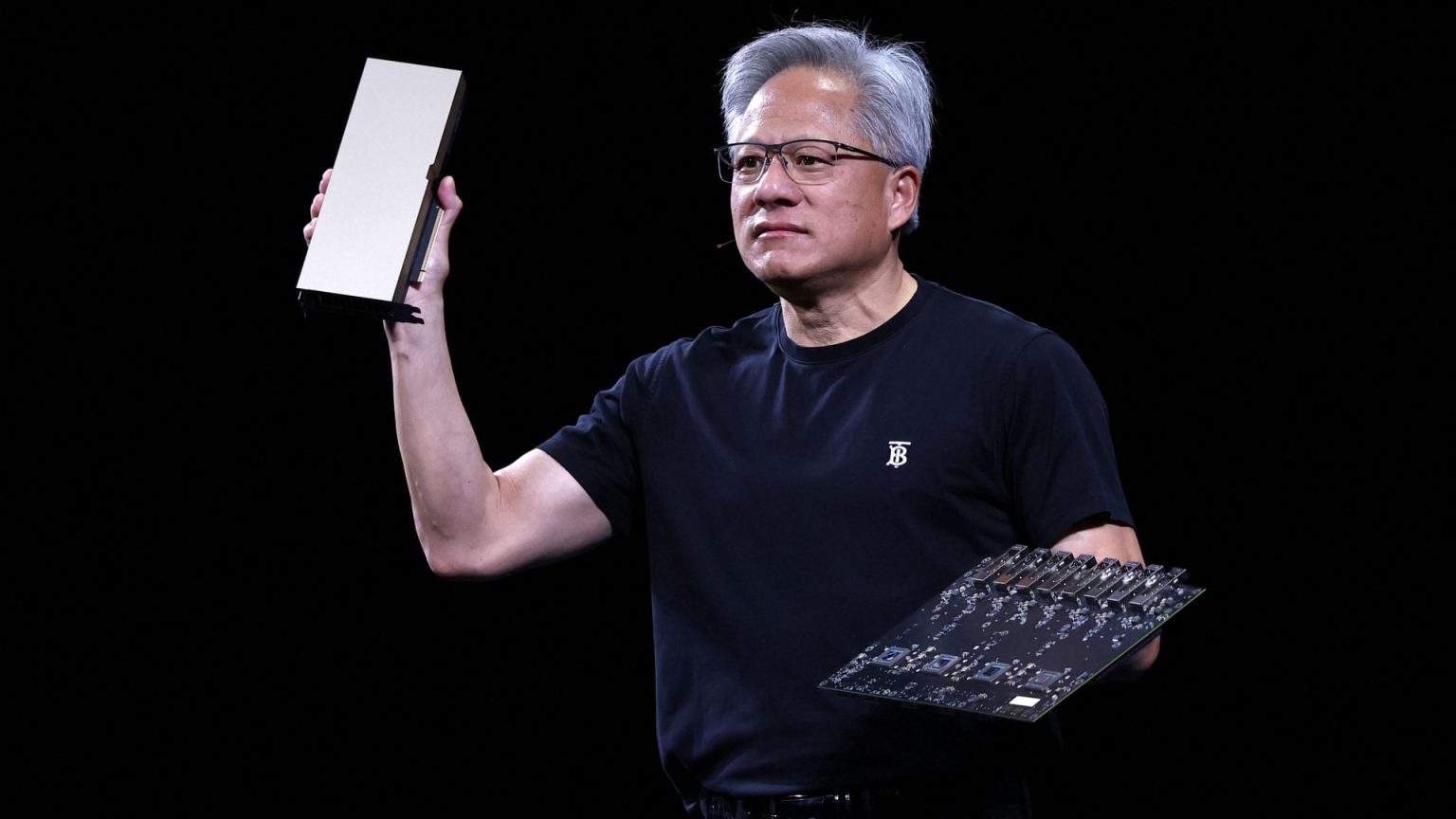

Nvidia’s CEO, Jensen Huang, articulated the challenges faced by the company, stating, “The $50 billion China market is effectively closed to U.S. industry.” Such statements reflect the broader implications of American policy on technology firms, forcing them to rethink their market strategies and adapt to the increasingly complex international regulatory environment.

Future Growth Areas Beyond AI for Nvidia

Despite the challenges posed by trade regulations, Nvidia is actively exploring other avenues for growth beyond AI. During the annual shareholder meeting, Jensen Huang emphasized that robotics represents another significant opportunity for expansion. This diversification may serve to cushion the company against revenue fluctuations due to regulatory constraints in the Chinese market.

The strategic focus on robotics is indicative of Nvidia’s broader ambition to leverage its technological prowess in various sectors. By engaging in additional industries, the company can distribute its growth potential, thereby reducing reliance on any one segment. This approach could prove to be beneficial in sustaining Nvidia’s impressive market position in the future.

Market Reactions and Implications for Investors

The market’s positive reaction to Nvidia’s latest performance showcases a broader trend among technology investors who are betting on the company’s resilience. As Nvidia continues to navigate challenges posed by global trade, the stock’s rise signals a growing investor confidence in the company’s long-term strategy and adaptability. The substantial market capitalization also reinforces the idea that Nvidia is a leading player in the high-tech industry.

For investors, the implications are significant. Nvidia’s stock performance may encourage investment in related sectors, such as semiconductors and AI technologies, potentially leading to further innovations. As analysts continue to monitor Nvidia’s performance, it becomes evident that how the company adapts to regulatory challenges will play a critical role in shaping market perceptions and future investment trends.

| No. | Key Points |

|---|---|

| 1 | Nvidia shares rose over 4% on Wednesday, reaching a record closing price. |

| 2 | The company now has a market value of $3.77 trillion, leading the tech sector. |

| 3 | New U.S. regulations limit Nvidia’s access to the Chinese market, impacting its revenue. |

| 4 | Nvidia reported a 69% revenue increase in the last quarter, driven by data center demand. |

| 5 | Future growth strategies include exploring robotics in addition to AI. |

Summary

Nvidia’s recent accomplishments underline its resilience and leadership in the competitive tech landscape. While facing hurdles in the form of regulatory restrictions and trade barriers, the company’s strong revenue growth showcases a commitment to innovation and adaptability. As Nvidia explores new opportunities in various sectors, including robotics, it remains a focal point for investors looking to understand the evolving dynamics of the technology market.

Frequently Asked Questions

Question: What factors contributed to Nvidia’s recent stock surge?

Nvidia’s stock surged due to positive investor sentiment rooted in substantial revenue growth, particularly in the data center sector, even amid challenges posed by regulatory changes in the Chinese market.

Question: How do U.S. regulations impact Nvidia’s business?

Recent U.S. regulations have restricted Nvidia’s ability to sell its products in China, which could result in significant revenue losses for the company.

Question: What other growth opportunities is Nvidia exploring?

Beyond AI, Nvidia is actively exploring growth opportunities in robotics, aiming to diversify its revenue streams and adapt to changing market conditions.