Recent comments from President Donald Trump regarding potential tariffs have sent ripples through the stock market, highlighting the fragility of investor confidence amidst ongoing trade negotiations. In a social media announcement, Trump threatened a 50% tariff on goods from the European Union and a 25% levy on iPhones imported from elsewhere, triggering a notable decline in major stock indices. Experts are divided over the potential long-term implications of these tariffs, suggesting that investors may need to brace for continued volatility in the coming weeks as the market responds to Trump’s unpredictable strategies.

| Article Subheadings |

|---|

| 1) Trump’s Tariff Announcement and Its Immediate Effects |

| 2) Investor Reactions and Market Response |

| 3) Long-term Predictions: A Volatile Landscape |

| 4) Corporate Earnings and Their Impact |

| 5) Future Outlook and Potential Developments |

Trump’s Tariff Announcement and Its Immediate Effects

On Friday, Donald Trump took to social media to announce significant tariff measures that could reshape U.S.-European trade relations. The proposed tariffs include a hefty 50% levy on European goods starting June 1, amid ongoing frustrations over trade negotiations. This announcement came alongside a separate warning to Apple that it would face a 25% tariff on iPhones produced outside of the U.S. As a result, the Dow Jones Industrial Average experienced a nosedive of over 500 points, reflecting investor anxiety and uncertainty.

The announcement marks a significant pivot in Trump’s handling of trade talks, particularly with the European Union, which remains the U.S.’s largest trading partner by imports. This fluctuation in trade policy can lead to immediate consequences not only for businesses and their pricing strategies but also for consumer spending patterns as tariffs typically lead to higher costs for imported goods.

Investor Reactions and Market Response

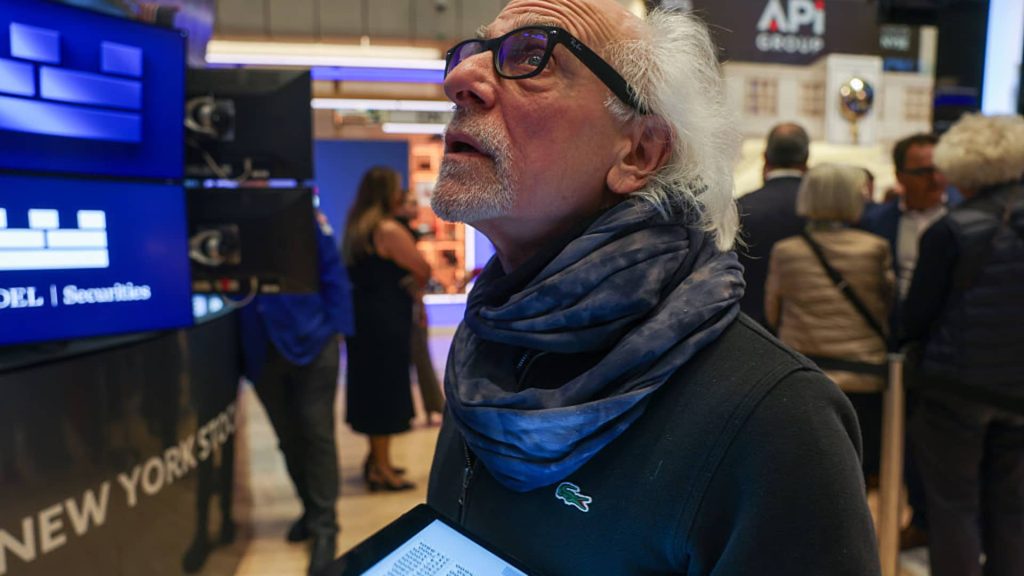

The reaction from investors was mixed, with some seeing it as a serious warning while others dismissed it as a negotiating tactic. Analysts at ClientFirst Strategy noted that the “tariff rollercoaster” is likely to deter investors from buying into market dips due to the ongoing uncertainty.

“Every time the market rebounds, they get kicked in the teeth,”

stated Mitchell Goldberg, the firm’s president.

Major indices, including the S & P 500 and Nasdaq Composite, also reflected the fallout from the tariff threat, dipping by approximately 2% over the course of the week. Furthermore, the ongoing concerns regarding the U.S. deficit have impacted bond yields, adding additional pressure to equity markets. As stocks are still grappling with these uncertainties, investor sentiment remains cautious.

Long-term Predictions: A Volatile Landscape

Analysts believe that Trump’s tariff threats may be indicative of a longer-term complication for both investors and corporations. According to Scott Ladner, chief investment officer at Horizon Investments, the negotiations with the EU could take significantly longer than what many are currently anticipating. This is particularly due to Trump’s long-standing antagonism towards Europe, which could complicate the negotiation process further.

“I don’t think he’s gonna be as inclined to cave on the European thing,”

suggested Ladner, emphasizing that this could introduce an extended period of market instability. The fear among investors is that even if a resolution does eventually materialize, it may not come without considerable turbulence along the way.

Corporate Earnings and Their Impact

Amid these challenges, the market is also bracing for upcoming corporate earnings reports that could influence stock performance. This week, Nvidia is set to report its earnings, and investors hope that a strong outlook could help alleviate some of the prevailing pessimism surrounding equity markets. The anticipation surrounding Nvidia reflects broader hopes for technology stocks to lead a recovery.

However, any sign of weakness in the tech sector, particularly from industry giants like Nvidia, could exacerbate the existing market dip, as investor confidence is already fragile. Mark Malek, chief investment officer at Siebert Financial, noted that the tech sector remains vital to revitalizing overall market health.

Future Outlook and Potential Developments

Looking ahead, the market must grapple with numerous factors that could influence its direction, notably the unpredictable nature of trade negotiations. Goldberg warned that investor appetite for risk could dwindle unless there is a move towards clarity and stability in trade policy.

“There is some chance that Trump will cave, but it probably is going to take longer than the China deal did to get resolution,”

he noted.

As concerns about inflation and interest rates continue to loom, investors are left weighing their options carefully. The upcoming week will be crucial as key economic indicators are set to be released alongside Nvidia‘s earnings report. The reactions to these metrics will further dictate market momentum, making this period critical for strategic investment decisions.

| No. | Key Points |

|---|---|

| 1 | President Trump threatens a 50% tariff on EU goods and a 25% levy on imported iPhones. |

| 2 | Major stock indices, including the Dow, fell significantly in response to the announcement. |

| 3 | Investor sentiment remains cautious due to ongoing uncertainty in trade negotiations. |

| 4 | Analysts suggest that negotiations with the EU may take longer than expected. |

| 5 | Upcoming corporate earnings reports, especially from tech sectors, could influence market momentum. |

Summary

The recent tariff threats from President Trump highlight the ongoing tensions and uncertainties in international trade relations, contributing to significant market volatility. Investor reactions indicate a blend of skepticism and caution, as many anticipate longer negotiations and the possibility of adverse market conditions. With critical corporate earnings on the horizon, the interplay of trade policy and company performance will be pivotal in shaping market trends.

Frequently Asked Questions

Question: What are the proposed tariff rates mentioned by President Trump?

President Trump proposed a 50% tariff on goods from the European Union and a 25% tax on iPhones not manufactured in the U.S. as part of his trade strategy.

Question: How did the stock market react to the tariff announcement?

The stock market saw a significant downturn, with major indices like the Dow Jones falling over 500 points, reflecting investor anxiety over the potential implications of Trump’s tariffs.

Question: What might be the long-term implications of these tariffs for investors?

Long-term implications may include ongoing market volatility, a potential dip in investor confidence, and prolonged negotiations impacting various sectors, particularly technology and imports reliant on European products.