In the rapidly evolving automotive landscape, the 2025 Ford Expedition highlights the challenges faced by U.S. manufacturers in sourcing local components. As the vehicle rolls off the assembly line at the Kentucky Truck Plant, it symbolizes the intricacies of the global supply chain, with a significant portion of vital components manufactured abroad. While the push for increased American production is gaining momentum, experts emphasize that achieving a fully “Made in the USA” vehicle remains a formidable task.

| Article Subheadings |

|---|

| 1) Global Supply Chain Complexities |

| 2) Economic Implications of Tariffs |

| 3) Challenges in Domestic Sourcing |

| 4) The Quest for “100% U.S.-Made” Vehicles |

| 5) Realistic Targets for American Content |

Global Supply Chain Complexities

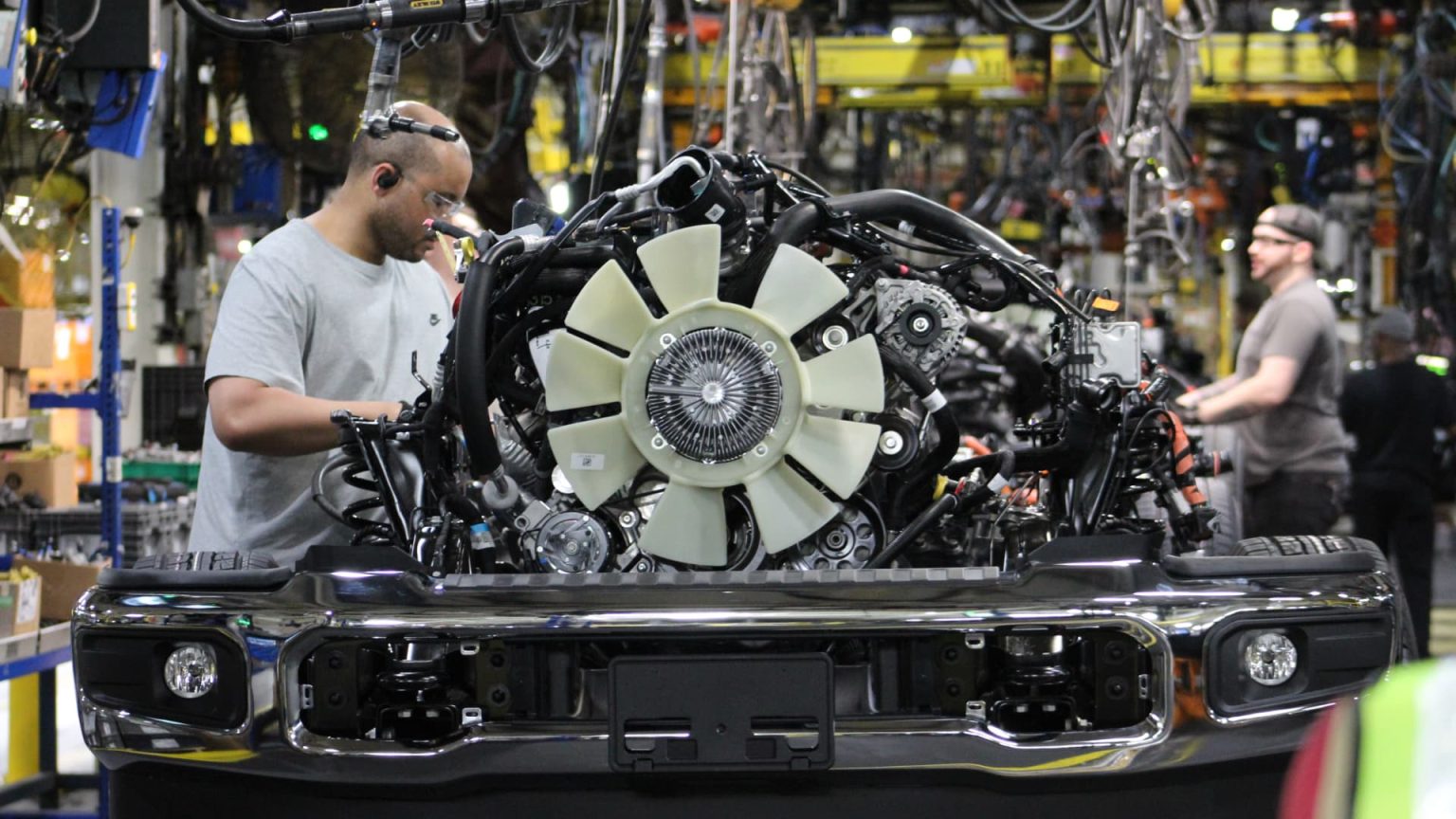

The assembly of the 2025 Ford Expedition at Ford’s Kentucky Truck Plant marks a significant moment in the automotive industry, but it also underscores the complexities of the global supply chain. At least 58% of the Expedition’s major parts are sourced from outside the United States, with 22% alone coming from Mexico. This includes crucial components such as the Ford-engineered, 3.5-liter twin-turbocharged V-6 EcoBoost engine.

In today’s interconnected market, the sourcing of vehicle parts transcends national borders. Today, an average vehicle can consist of thousands of individual components manufactured in numerous countries, reflecting a broader trend in globalization. This global distribution of parts is especially pronounced in the automotive sector, where manufacturers often seek cost efficiencies and supply chain advantages by outsourcing production to regions with lower labor costs. Hence, even vehicles proud to showcase their American roots may not be fully composed of domestically manufactured components.

Economic Implications of Tariffs

The push for a more localized supply chain has gained urgency amid heightened tariffs on imported vehicles and parts, as seen during the Trump administration, which introduced a 25% tariff on such goods. This measure was aimed at reshaping the automotive landscape to favor American manufacturing by making imported vehicles significantly more expensive. However, the unintended consequence of these tariffs has been a race among automakers to not only show profitability but also to localize their supply chains.

Experts note that while jobs and economic output in the U.S. could be bolstered by sourcing and manufacturing auto parts domestically, the reality is far more complicated. As stated by automotive analysts, the cost of manufacturing in the U.S. remains substantially higher compared to overseas markets, primarily due to labor and production costs. The concern is that if every vehicle’s production cost skyrockets, it could price many consumers out of the market, resulting in diminished demand and reduced production overall.

Challenges in Domestic Sourcing

Ford’s CEO, Jim Farley, articulated these challenges, stating that 15% to 20% of vehicle components are currently difficult or impossible to source within the U.S. This encompasses small fasteners, labor-intensive wiring harnesses, and vital semiconductor chips, overwhelmingly sourced from Asia. In fact, an average vehicle may comprise approximately 20,000 parts, sourced from anywhere between 50 to 120 different countries.

Even vehicles that are entirely assembled in the U.S. often fall short in terms of domestic content. For instance, the Ford F-150 shares a platform with the Expedition, yet contains a staggering 2,700 main billable parts. This illustrates a fundamental issue: while assembly may occur on American soil, the parts themselves often originate in diverse locations worldwide, undermining claims of being “Made in the USA.”

The Quest for “100% U.S.-Made” Vehicles

Calls for achieving a 100% “Made in the USA” vehicle often overlook the practicalities involved in such a monumental task. Industry experts like Mark Wakefield from AlixPartners stress that while it may be theoretically possible, the economic implications are daunting. The cost associated with sourcing materials domestically compounds exponentially as companies near the 100% threshold, further widening the gap between consumer affordability and production costs.

Wakefield highlights that the closer manufacturers aim for a fully American-made vehicle, the more significant the investment required becomes. Achieving over 90% U.S. content is not only financially burdensome but also time-intensive, as establishing U.S. facilities for raw materials processing and sourcing will take well over a decade. This further complicates the broader narrative of American manufacturing and the push towards local components.

Realistic Targets for American Content

While achieving a “100% U.S.-made” status seems far-fetched, targets such as reaching 75% U.S. and Canadian content appear to be more achievable. Several vehicles already meet this higher standard today, although scalability poses long-term challenges. Models like the Kia EV6, Tesla Model 3, and Honda Ridgeline AWD Trail Sport represent a more realistic approach to domestic sourcing.

However, moving toward this goal necessitates substantial financial investments in local production. Industry experts assert that some manufacturers may transition more easily than others, depending on their existing supply chains. Reports indicate that many vehicles are already exhibiting significant drops in U.S. content compared to years past, primarily influenced by the expansion of globalization investment from automakers.

The 2025 Ford Expedition, while showcasing increased domestic content from prior model years, demonstrates the complex nature of assessing American-made status. Analysts emphasize that the assembly location and parts origin don’t necessarily correlate, as vehicles may be assembled in the U.S. but still lack a significant American parts composition.

| No. | Key Points |

|---|---|

| 1 | The 2025 Ford Expedition primarily consists of foreign-made parts, highlighting global supply chain reliance. |

| 2 | Tariffs implemented to encourage U.S. production create economic pressure on manufacturers and consumers alike. |

| 3 | Challenges persist in sourcing specific components domestically, with many still dependent on international markets. |

| 4 | Striving for a fully “Made in the USA” vehicle necessitates significant investment and time, often deemed impractical. |

| 5 | Achieving a target of 75% U.S. and Canadian parts is more feasible and aligns with current industry standards. |

Summary

The complexities involved in achieving a fully domestic supply chain for vehicles like the Ford Expedition underscore significant challenges beyond mere assembly. The interplay of global manufacturing and economic pressures from tariffs creates a landscape filled with obstacles that manufacturers must navigate. As the automotive industry evolves, the move toward localized production remains an arduous endeavor, albeit with some targets achievable in the nearer term.

Frequently Asked Questions

Question: Why is the Ford Expedition not fully ‘Made in the USA’?

The Ford Expedition, while assembled in the U.S., relies heavily on parts sourced from abroad, with over 58% of its main components made outside the country, including a significant portion from Mexico.

Question: What impact do tariffs have on U.S. manufacturing?

Tariffs were intended to encourage domestic manufacturing by making imported vehicles more expensive. However, they have also increased operational challenges for manufacturers and could potentially raise vehicle prices for consumers.

Question: Is achieving a ‘100% U.S.-made’ vehicle realistic?

While theoretically possible, experts argue that achieving a 100% U.S.-made vehicle is economically daunting and would require significant investments and time, making it currently unrealistic for most manufacturers.