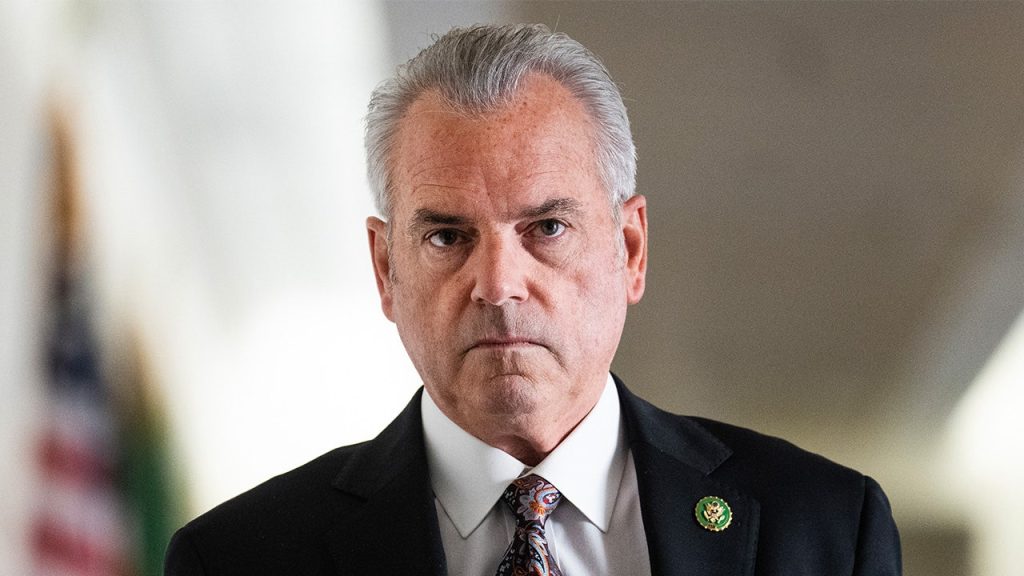

In a significant move aimed at enhancing congressional integrity, Representative Mark Alford of Missouri is set to introduce a bill that would prohibit stock trading by lawmakers. This legislation aligns with the previously proposed “PELOSI Act” by Senator Josh Hawley and seeks to address growing concerns about potential conflicts of interest in Congress. By prohibiting lawmakers and their spouses from trading individual stocks while in office, the bill aims to eliminate the appearance of corruption and restore public trust in government operations.

| Article Subheadings |

|---|

| 1) Overview of the Proposed Legislation |

| 2) Implications for Current and Future Lawmakers |

| 3) Calls for Congressional Accountability |

| 4) Support from Political Figures |

| 5) Summary of Next Steps and Conclusion |

Overview of the Proposed Legislation

The upcoming legislation introduced by Rep. Mark Alford seeks to impose a ban on stock trading among members of Congress and their spouses while in office. The bill outlines specific investment restrictions, permitting only diversified mutual funds, exchange-traded funds (ETFs), or U.S. Treasury bonds. If the legislation is passed, current lawmakers will have a 180-day period to divest from individual stocks, while newly elected officials will also be required to adhere to the same timeline once they assume office.

Alford emphasized the importance of maintaining a higher ethical standard for public servants, stating,

“As public servants, we should hold ourselves to a higher standard and avoid the mere appearance of corruption.”

This sentiment underscores the growing concern regarding lawmakers profiting from insider information, a situation that has raised ethical questions in the public domain.

The proposed bill aligns with ongoing discussions around ethical governance and aims to prevent scenarios where lawmakers could exploit non-public information for financial gain. Advocates argue that such practices erode the public’s trust in government institutions, necessitating firm legislative action to counteract perceived misconduct.

Implications for Current and Future Lawmakers

The implications of this legislation are significant, particularly for those currently serving in Congress. If enacted, it would compel all sitting lawmakers to liquidate their stock holdings and adhere to the investment restrictions established by the bill. Failure to comply could result in forfeiting profits made from wrongful transactions to the U.S. Treasury Department. Moreover, the House or Senate ethics committees may impose fines of up to 10% on each wrongful transaction, further incentivizing adherence to the new regulations.

The 180-day compliance period poses a particular challenge for lawmakers who have actively invested and profited from the stock market. It raises questions about the practicality of such a law, as certain assets may require substantial time to liquidate without incurring significant losses. The bill’s proponents argue, however, that the long-term benefits of preventing ethical breaches outweigh these immediate complications.

For future lawmakers, the bill sets a clear expectation regarding ethical investment behavior from the onset of their careers. It aims to foster a culture of accountability and transparency, thereby potentially transforming how elected officials approach financial markets during their tenure.

Calls for Congressional Accountability

The proposal to ban congressional stock trading has garnered broader support, with several lawmakers echoing Alford’s sentiments about the necessity for accountability. Many believe that the integrity of the legislative body is paramount, and allowing stock trading can create conflicts of interest that threaten public trust.

In a recent statement, Hakeem Jeffries, the House Minority Leader, expressed his support for the ban, reinforcing the idea that ethical governance should be a priority across party lines. This bipartisan interest in reform indicates a growing recognition among lawmakers that stringent measures may be necessary to preserve the integrity of congressional operations.

Critics of current practices argue that members of Congress frequently use privileged information to engage in stock trading, leading to a situation where lawmakers potentially benefit financially from decisions that affect the market. The resulting perception of impropriety has fueled popular support for reforms aimed at eliminating such practices altogether.

Moreover, public interest in congressional activities and ethics has surged, highlighted by the media focus on high-profile cases of alleged insider trading. Lawmakers now face increased scrutiny regarding their financial dealings, placing additional pressure on legislative bodies to act decisively on this issue.

Support from Political Figures

Support for the bill is not limited to members of Congress; it has also attracted endorsements from key figures outside the legislature. Former President Donald Trump recently conveyed his approval of a congressional trading ban during an interview, reinforcing the notion that bipartisan support exists for such reforms.

In the interview, Trump stated,

“I watched Nancy Pelosi get rich through insider information, and I would be okay with it. If they send that to me, I would do it,”

indicating a willingness to sign the bill should it reach his desk. This endorsement adds significant weight to the legislative efforts, suggesting an avenue for the bill to advance further, given Trump’s influence in political discourse.

Moreover, the bill has been tabled at a time when public scrutiny of ethical standards among lawmakers has intensified. Public sentiment appears to favor measures that close loopholes that could lead to conflicts of interest, and this may represent a pivotal moment in the broader dialogue surrounding the integrity of governmental action.

Summary of Next Steps and Conclusion

Looking ahead, the proposed legislation will undergo discussions and potential amendments before being placed for a vote in Congress. If passed, it will require a concerted effort from both lawmakers and the executive branch to ensure effective implementation, as well as ongoing compliance measures to monitor adherence to the ban.

As the political landscape continues to evolve, this bill represents a critical step toward redefining ethical standards in Congress. With a mix of bipartisan support and growing public interest, it has the potential to set a precedent for greater accountability and transparency among elected officials. The proposed ban on stock trading reflects a broader movement to enhance the integrity of governmental institutions and rebuild public trust.

| No. | Key Points |

|---|---|

| 1 | Rep. Mark Alford’s legislation seeks to ban stock trading by Congress members to eliminate conflicts of interest. |

| 2 | Current lawmakers will have 180 days to divest from individual stocks if the law is enacted. |

| 3 | Violators could face forfeiture of profits and additional fines by ethics committees. |

| 4 | The proposed ban has garnered support from both political parties, suggesting a growing consensus on the issue. |

| 5 | Public concerns over congressional ethics have propelled discussions around accountability and transparency. |

Summary

The introduction of legislation by Rep. Mark Alford to ban congressional stock trading marks a significant move towards maintaining ethical standards in government. Amid rising public concern regarding potential conflicts of interest, the proposal seeks to eliminate the practice of lawmakers trading individual stocks. With support from both sides of the aisle, this initiative emphasizes the need for transparency and accountability within the congressional framework, aiming to restore public trust in elected officials.

Frequently Asked Questions

Question: What is the main objective of Alford’s proposed legislation?

The legislation aims to ban stock trading by members of Congress and their spouses to prevent conflicts of interest and restore public trust in governmental institutions.

Question: How long do lawmakers have to comply with the new rules if the bill passes?

If the law is enacted, current lawmakers will have 180 days to divest from individual stocks, while newly elected officials must comply within 180 days of taking office.

Question: What are the penalties for violating the proposed stock trading ban?

Lawmakers who violate the ban may be required to forfeit profits made from wrongful transactions to the U.S. Treasury and could face additional fines imposed by ethics committees.