Legislators are currently working on a significant piece of legislation, often referred to as a Republican megabill, which seeks to impose tighter financial restrictions on immigrant households in the United States. This sweeping legislation, backed by President Donald Trump, includes measures that limit access to valuable tax benefits and impose new fees on asylum seekers. While the bill aims to generate revenue to support immigration enforcement, critics argue that it could have severe ramifications for immigrant families—especially those who are legally residing in the U.S.—by exacerbating their financial challenges.

| Article Subheadings |

|---|

| 1) Overview of the Legislation |

| 2) Key Tax Implications |

| 3) New Fees for Asylum Seekers |

| 4) Financial Impact on Immigrant Families |

| 5) Next Steps in the Legislative Process |

Overview of the Legislation

The proposal, currently under consideration in both the House and Senate, targets multiple aspects of immigration finance, aiming to tighten eligibility for financial benefits. Most notably, the legislation seeks to make permanent certain tax policies initiated during Trump’s first term, including restrictions on access to the child tax credit. The initiative has sparked heated discussions among lawmakers, with Republicans framing it as a necessary measure to ensure that immigration services are financially self-sufficient and that fiscal pathways are adhered to for immigrants. Meanwhile, experts warn that these measures could disproportionately affect those who are already facing financial hardships, including both undocumented and legally residing immigrants.

Key Tax Implications

Among the most consequential tax alterations proposed is the modification of the child tax credit. The 2017 tax reform barred parents from claiming this benefit for children without Social Security numbers. The current legislation seeks to solidify this restriction, thereby impacting around 1 million children and further penalizing children who are U.S. citizens or legal residents due to their parents’ immigration status. For instance, the House version of the bill states that children would be denied the credit if either parent lacks a Social Security number, which effectively disenfranchises nearly 4.5 million children and could lead to drastic reductions in family income, especially affecting states with large immigrant populations.

New Fees for Asylum Seekers

The proposed legislation includes a stinging array of new fees for immigrants applying for asylum—a move that many experts believe goes against the principle of humanitarian protection. Under the new rules, individuals seeking asylum would need to pay a $1,000 application fee and an additional $550 every six months for work authorization. Furthermore, other fees include a $500 charge for Temporary Protected Status and a punitive $5,000 fee for individuals apprehended illegally crossing the border. This significant financial barrier might discourage those in desperate need of asylum from applying, thus exacerbating humanitarian concerns.

Financial Impact on Immigrant Families

The combined effects of the proposed tax changes and introduction of new fees could severely strain immigrant families in various ways. Many of these families are already living on tight budgets, and such financial penalties may lead to increased hardship, pushing many families further into poverty. A report from the Institute on Taxation and Economic Policy emphasizes that families with mixed immigration statuses could bear the brunt of these tax provisions. For example, citizens married to undocumented immigrants will find themselves ineligible for several tax breaks, including the American Opportunity Tax Credit and potential future credits that may be added. This highlights a complex situation where innocent U.S. citizen children risk losing benefits due to their parents’ immigration status.

Next Steps in the Legislative Process

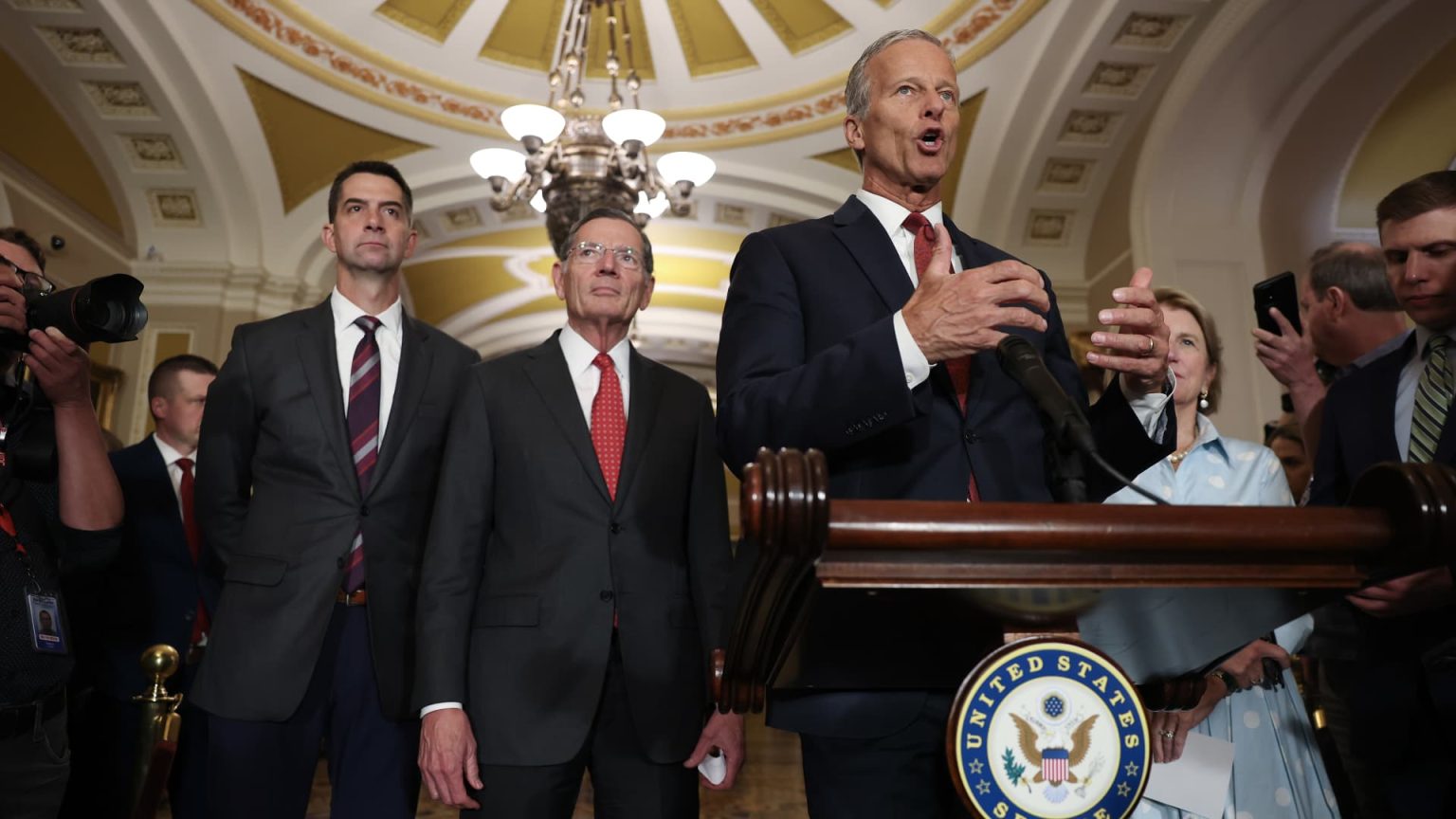

As this legislation moves through the legislative process, key decisions will be made that could alter or strengthen its original objectives. Currently, the Senate is expected to vote on its version soon, but internal disagreements among Republicans may necessitate revisions. Recent rulings from the Senate parliamentarian have already forced amendments to the proposed bill, requiring lawmakers to focus more on what provisions can realistically pass Congress. How these revisions will play out remains uncertain, especially as pressure mounts from advocacy groups urging for a more inclusive approach towards immigrant families.

| No. | Key Points |

|---|---|

| 1 | Legislation aims to tighten financial restrictions on immigrant households. |

| 2 | The child tax credit restriction could impact around 1 million children. |

| 3 | New fees for asylum applications may deter vulnerable individuals from seeking protection. |

| 4 | Provisions disproportionately affect mixed-status families and potentially impoverish them further. |

| 5 | Next steps in the Senate may require revisions due to parliamentary rulings. |

Summary

The proposed Republican megabill represents a significant shift in U.S. immigration policy, particularly in relation to the financial landscape for immigrant families. Through a mix of tax restrictions and new fees, this legislation attempts to enforce stricter immigration policies while also raising revenue. However, it raises serious questions about the ethical ramifications of targeting vulnerable populations, particularly in the context of current humanitarian principles. The continued debate and revision process within Congress will determine its ultimate scope and impact on millions of immigrant households.

Frequently Asked Questions

Question: What are remittances and how would they be affected by the new legislation?

Remittances refer to the funds that immigrants send back to their home countries. The proposed legislation includes a 3.5% tax on these transfers, which could further burden families financially, especially those sending money to countries in need.

Question: How will the child tax credit changes impact mixed-status families?

The changes to the child tax credit could disenfranchise U.S. citizen children in mixed-status families. If a child’s parent lacks a Social Security number, the child may be ineligible for the tax credit, severely impacting family income and access to essential services.

Question: What can families do to prepare for these potential changes in legislation?

Families can begin by staying informed about legislative developments and consulting financial advisors or legal experts specializing in immigration to navigate potential changes and their implications effectively.