In recent discussions, Republican state financial officers have expressed a concerted effort to shift away from initiatives focusing on diversity, equity, and inclusion (DEI) and environmental, social, and governance (ESG) investments. At a recent conference, Utah State Treasurer Marlo Oaks outlined the importance of adhering to meritocracy and fiduciary responsibilities, arguing that incorporating DEI and ESG metrics violates established fiduciary standards. The emphasis on financial responsibility over social agendas is aimed at protecting the retirement funds of public sector employees, ensuring their interests take precedence in investment decisions.

| Article Subheadings |

|---|

| 1) Background on DEI and ESG Initiatives |

| 2) Impacts of DEI on Financial Responsibilities |

| 3) Opinions from State Treasurers at the Conference |

| 4) Case Studies: Companies Hurt by DEI Initiatives |

| 5) The Future of Investment Practices |

Background on DEI and ESG Initiatives

Diversity, equity, and inclusion (DEI) and environmental, social, and governance (ESG) initiatives have emerged as focal points of investment strategies in recent years. Advocates argue that these frameworks enrich corporations and communities by promoting responsible business practices. The principles of DEI aim to create work environments where diverse voices are heard and valued, while ESG incorporates broader societal and environmental issues into corporate governance. However, critics contend that these initiatives often serve political agendas that may deviate from traditional investment strategies focused solely on profitability.

In particular, the current discourse led by Republican financial officers revolves around the assertion that these measures can lead to conflicts of interest and undermine the fiduciary responsibilities of state investment managers. By intertwining societal issues with fiscal outcomes, it is argued that investors might be pressured to prioritize equity initiatives over sound financial decisions.

Impacts of DEI on Financial Responsibilities

Utah State Treasurer Marlo Oaks highlighted the potential consequences of DEI policies on financial management during discussions. His assertion centers on the belief that prioritizing social gains can introduce complications regarding fiduciary duty – an obligation to manage funds in the best interests of beneficiaries. Oaks indicated that state financial officers primarily manage taxpayer money and retirement funds, thus bearing the responsibility of ensuring these funds are invested wisely.

He elaborated on the critical distinction between individual investors making personal choices and public figures responsible for managing public funds. “When you are managing money for other people, we don’t have that choice,” he stated, emphasizing the strictures of fiduciary duty. Such sentiments encapsulate a pressing concern: that financial managers may unintentionally harm their beneficiaries’ financial health by integrating socially focused investment practices.

Opinions from State Treasurers at the Conference

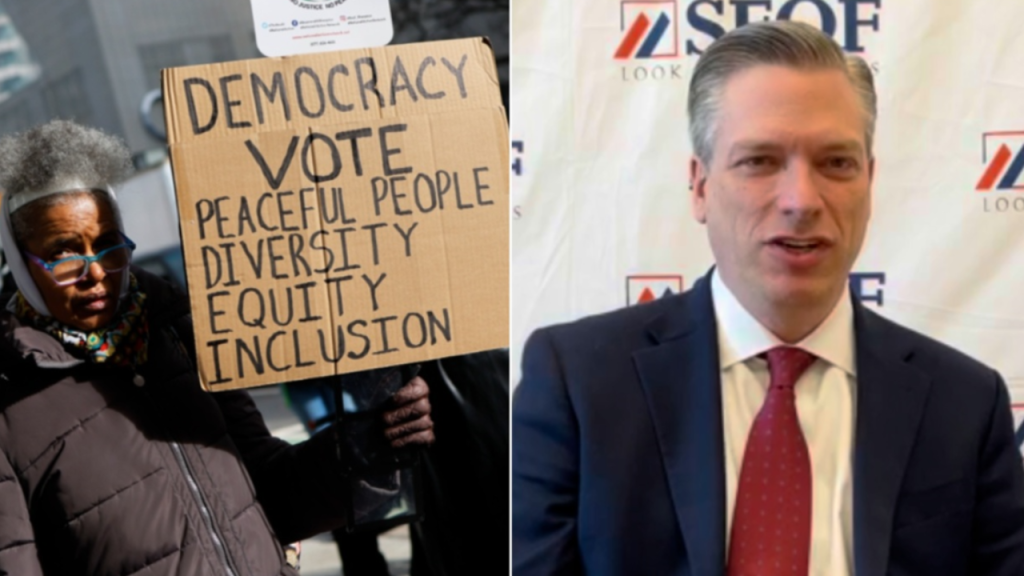

During the recent State Financial Officers Foundation (SFOF) conference held in Orlando, Florida, the dialogue surrounding DEI and ESG grew increasingly intense among Republican state treasurers. Oaks, serving as a pivotal voice, posited that integrating these initiatives directly conflicts with the essence of sound financial management. His arguments resonate with the treasurers of many states who concur that their priority should remain fixed on financial results rather than political motives.

At the conference, Oaks noted, “We have a duty of loyalty and a duty of care,” which encompasses ensuring successful investment outcomes for public servants reliant on pension funds. The unified stance taken by the attendees revealed a broader movement among state financial officers to safeguard against what they see as legislative overreach into financial markets, particularly through DEI and ESG frameworks.

Case Studies: Companies Hurt by DEI Initiatives

Several high-profile cases have been pointed out as examples of companies suffering adverse effects from implementing DEI policies. Oaks noted incidents involving brands like Target and Bud Light, which faced significant backlash from consumers after adopting practices perceived as politically motivated rather than financially sound. These cases serve as cautionary tales, illustrating how a focus on non-financial goals can detrimentally impact shareholder value and, consequently, the financial well-being of public employees who rely on state pensions.

Critics of DEI initiatives argue that these policies shift the prevailing merit-based hiring practices towards methods that prioritize social factors over qualifications, potentially leading to reduced effectiveness within companies. Participants at the SFOF conference reiterated the belief that such practices not only harm the financial health of enterprises but ultimately burden the dedicated workers whose retirements are jeopardized.

The Future of Investment Practices

The voiced concerns regarding DEI and ESG by state financial officers signal a potential shift in investment priorities. As criticisms mount against politicizing financial practices, there is a growing call for regulatory changes and clearer guidelines that delineate the boundaries between social agendas and prudent financial management. Critics warn that without thoughtful examination, the intertwining of societal objectives and financial returns may continue to undermine fiduciary responsibilities across the board.

Given the increasing scrutiny, financial officers like Oaks are advocating for a return to an emphasis on meritocracy, suggesting that future strategies should prioritize fiscal outcomes above all else. This direction aims to reassure public servants relying on financial stability that their interests remain safeguarded amidst changing investment landscapes. The future of investment practices may very well depend on the successful disentangling of corporate responsibility from social activism.

| No. | Key Points |

|---|---|

| 1 | State financial officers advocate for the abandonment of DEI and ESG initiatives in investment strategies. |

| 2 | Utah Treasurer Marlo Oaks stresses the importance of fiduciary responsibility over social agendas. |

| 3 | DEI policies may adversely affect hiring practices and company performance. |

| 4 | Case studies of companies like Target illustrate potential financial harm from prioritizing DEI. |

| 5 | There’s a growing emphasis on returning to meritocratic principles in investment practices. |

Summary

The discourse surrounding DEI and ESG practices shows a significant shift among Republican state financial officers aiming to reinforce fiduciary responsibilities regarding public investments. The narrative led by figures like Marlo Oaks stresses the need for a return to meritocratic principles, highlighting the detrimental effects that social agendas can have on the financial health of publicly managed funds. This ongoing dialogue is likely to shape the future of state investment practices as officials push for prioritizing financial outcomes to secure the interests of public servants.

Frequently Asked Questions

Question: What are DEI and ESG initiatives?

DEI stands for diversity, equity, and inclusion, while ESG refers to environmental, social, and governance criteria. These initiatives aim to promote responsible business practices but have faced criticism for potentially conflicting with traditional financial responsibilities.

Question: Why do some financial officers oppose DEI policies?

Opponents argue that DEI policies introduce potential conflicts of interest, diverting focus from fiduciary responsibilities and financial outcomes. Financial officers believe prioritizing social goals over financial returns may jeopardize the interests of public employees relying on pension funds.

Question: What are some consequences of prioritizing DEI in investment practices?

Critics have cited instances where companies that adopted DEI policies faced backlash and suffered financial losses, ultimately impacting shareholder value. This underscores the argument that instituting such policies can be detrimental to the financial health of organizations and the employees dependent on them.