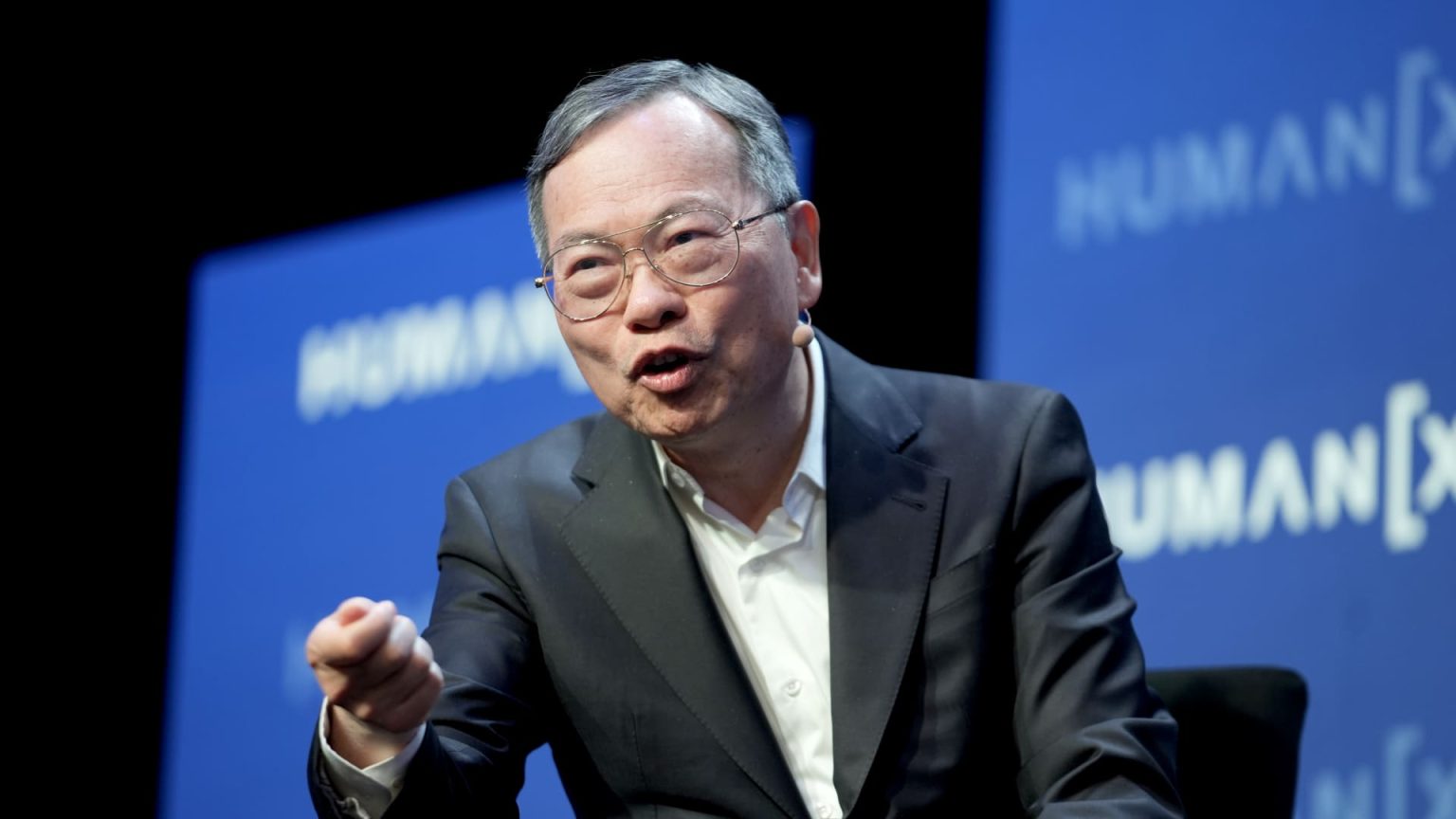

In a discouraging turn of events, Super Micro reported disappointing quarterly earnings, prompting a dip in its stock prices. The server manufacturer fell short of Wall Street’s expectations not only for the latest quarter but also for forthcoming projections. As CEO Charles Liang addressed analysts, he cited a challenging economic backdrop and uncertainties related to tariffs as key factors affecting the company’s performance.

| Article Subheadings |

|---|

| 1) Disappointing Quarterly Earnings Results |

| 2) Future Revenue and Earnings Outlook |

| 3) Impact of Economic Uncertainty |

| 4) Company Performance Trends |

| 5) Addressing Auditor Concerns |

Disappointing Quarterly Earnings Results

On Tuesday, Super Micro provided its quarterly earnings report, which revealed sobering results that did not meet anticipated figures set by market analysts. The company recorded adjusted earnings of 31 cents per share, compared to the expected 50 cents, and total revenue of $4.60 billion, falling short of the anticipated $5.42 billion. This news marked a significant disappointment, especially given the preliminary results disclosed just a week prior, which had already indicated that expectations were not being met.

The earnings announcement spurred a reaction in the stock market, resulting in a roughly 4% decline during after-hours trading. Although these figures aligned with Super Micro’s earlier estimates of $4.5 billion to $4.6 billion in revenue and adjusted earnings of between 29 and 31 cents per share, the revelation still signified a notable setback for the company, with the stock previously plummeting by 12% following its early disclosures.

Future Revenue and Earnings Outlook

Looking ahead, Super Micro outlined its expectations for the fourth quarter, signaling potential underperformance compared to analysts’ forecasts. The company anticipates earnings between 40 cents and 50 cents per adjusted share, alongside projected revenue ranging from $5.6 billion to $6.4 billion. This projection stands in stark contrast to what analysts had hoped for, as they were estimating 69 cents in adjusted earnings per share with revenue of approximately $6.82 billion. These figures further highlight the uphill battle facing Super Micro.

During a conference call with financial analysts, Charles Liang indicated that while the company’s revenue has shown a 19% year-over-year growth in the recently concluded fiscal third quarter, there are concerns that ongoing economic factors may continue to hinder future performance. He attributed the current delays in customer commitments regarding artificial intelligence platforms directly to market uncertainties.

Impact of Economic Uncertainty

The macroeconomic environment has been a critical topic affecting Super Micro’s outlook, particularly following the announcement of new tariffs by President Donald Trump in early April. Liang explicitly noted that these tariff-related uncertainties pose a significant hurdle for the company, creating challenges not only in pricing but also in strategic planning.

Liang remarked on the indecisiveness among customers, noting that many are currently evaluating AI platforms linked with current and upcoming graphics processing units (GPUs). He emphasized that this analysis has caused a delay in commitments, impacting the company’s ability to forecast accurately moving forward. This factor is especially poignant for a company that has historically benefited from a more robust AI market.

Company Performance Trends

Despite the current obstacles, it is worth noting that Super Micro has experienced a year-over-year revenue growth of 19% in the latest quarter. This indicates that while the company struggles with short-term difficulties, it still maintains a degree of operational success. However, net income has seen a significant downturn, dropping to 17 cents per share from 66 cents during the same quarter last year. This decline in profitability emphasizes how increased revenues do not necessarily translate to better financial health when costs rise or market conditions worsen.

Over the past year, Super Micro has witnessed fluctuations in its stock performance. It had previously enjoyed a surge due to positioning in the AI market, but events such as scrutiny from short-sellers and the departure of its auditor have compounded existing challenges. The summer report from Hindenburg Research raised serious allegations regarding potential accounting manipulations, adding pressure on the company and its management.

Addressing Auditor Concerns

Super Micro’s credibility faced significant scrutiny after Ernst & Young resigned as the company’s auditor due to worries over internal financial controls and reporting mechanisms. In response to these developments, the company established an independent special committee to investigate and address these concerns. Fortunately for stakeholders, the committee concluded that it found no substantial issues concerning the integrity of Super Micro’s management team or the Audit Committee itself. This rebuttal should provide a degree of reassurance to investors amidst ongoing speculation.

Continuing with the narrative of compliance, Super Micro filed its annual report for the 2024 fiscal year in February. This action was a significant step in preventing the delisting of the company from the Nasdaq exchange, ensuring that the firm remains in line with essential filing requirements. By signaling its commitment to regulatory standards and financial transparency, Super Micro aims to allay investor fears, although challenges remain.

| No. | Key Points |

|---|---|

| 1 | Super Micro’s earnings report fell below Wall Street’s expectations. |

| 2 | Future earnings and revenue forecasts have also been downgraded. |

| 3 | Macroeconomic factors are contributing to the company’s current challenges. |

| 4 | The company has experienced significant year-over-year revenue growth. |

| 5 | The resignation of its auditor raises concerns which have been partially alleviated by an independent review. |

Summary

Super Micro faces a precarious situation amidst a challenging economic landscape, marked by disappointing earnings results and a murky outlook for future revenue. With declining profitability and swirling doubts regarding corporate governance and auditing practices, the company strives to navigate these hurdles while maintaining growth in its market segment. Investors will be closely monitoring Super Micro’s next moves as the company attempts to stabilize and regain their confidence in the coming quarters.

Frequently Asked Questions

Question: What were Super Micro’s earnings per share for the latest quarter?

Super Micro reported adjusted earnings of 31 cents per share for the latest quarter, compared to Wall Street’s expectation of 50 cents.

Question: What are the revenue expectations for Super Micro for the fourth quarter?

The company forecasts revenue between $5.6 billion and $6.4 billion for the fourth quarter, which is below analyst expectations of approximately $6.82 billion.

Question: Why did Super Micro’s auditor resign?

Ernst & Young resigned due to concerns over internal controls and financial reporting, prompting an independent investigation, which ultimately found no substantial issues with the management’s integrity.