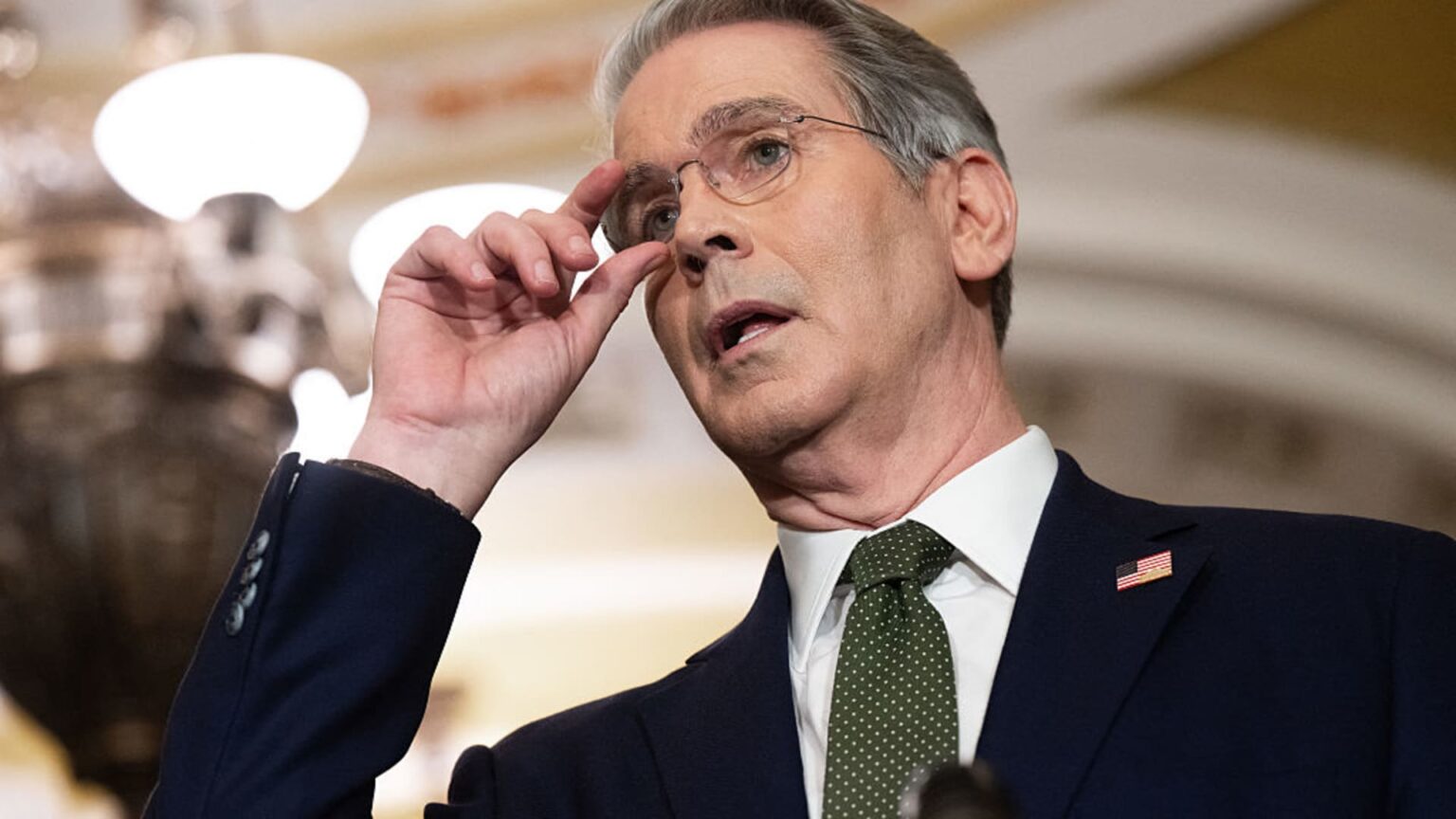

In the ongoing saga of U.S. tariffs, Treasury Secretary Scott Bessent expressed confidence that President Donald Trump’s controversial tariff plan will ultimately prevail at the Supreme Court. During an interview on NBC’s “Meet the Press,” Bessent warned that if the high court rules against the administration, it could trigger significant refunds that might amount to a colossal $1 trillion. The tariffs in question, impacting a vast percentage of U.S. goods imports, face an uncertain future following a federal court ruling that deemed most of them illegal.

| Article Subheadings |

|---|

| 1) Overview of the Tariff Controversy |

| 2) Implications of the Supreme Court’s Decision |

| 3) The Path to the Supreme Court |

| 4) Alternative Measures by the Administration |

| 5) Broader Economic Consequences |

Overview of the Tariff Controversy

The ongoing debate surrounding the tariffs imposed by the Trump administration has taken a contentious turn, marked by recent legal battles and public statements from officials. Scott Bessent, the U.S. Secretary of the Treasury, has expressed his belief that the Supreme Court will ultimately rule in favor of the administration’s tariffs. However, the uncertainty about their legality poses significant risks to the administration’s economic policies and revenue generation. The tariffs, which aim to protect American industries by imposing duties on foreign imports, have come under fire following a ruling from the U.S. Court of Appeals for the Federal Circuit. This ruling stated that most of the tariffs are illegal, leading to a heightened anxiety about their future consequences for the U.S. economy.

Implications of the Supreme Court’s Decision

The Supreme Court’s potential ruling on the legality of these tariffs carries immense ramifications. Should the Court decide against the Trump administration, it may be required to issue massive refunds for tariffs already collected. According to Bessent, this move could result in a windfall for businesses affected by the tariffs, with estimates suggesting that refunds could total between $750 billion and $1 trillion. Such refunds would not only drastically affect the Treasury but also raise questions about the administration’s economic strategy and its ramifications for job creation in the U.S. manufacturing sector. It is crucial for the administration to prepare for this possibility as the case sits at the intersection of legal authority and economic stability.

The Path to the Supreme Court

The legal path leading to the Supreme Court began with a significant ruling from the U.S. Court of Appeals for the Federal Circuit, which found that Trump’s tariffs were an overreach of presidential authority. This decision has been paused until mid-October, allowing the administration time to appeal. Trump has formally asked the Supreme Court to expedite the review of this appeal, with the goal of having a decision rendered shortly after the arguments are presented in early November. The situation has generated significant attention, particularly as Trump’s tariffs previously impacted nearly 70% of U.S. goods imports, a figure that would drop drastically if the Court rules against the administration.

Alternative Measures by the Administration

In anticipation of a potential negative ruling from the Supreme Court, the administration is reportedly considering alternative legal avenues to impose tariffs. National Economic Council Director Kevin Hassett indicated that several “other legal authorities” exist that could be leveraged to maintain some level of tariffs in the event that the Supreme Court rules against the current measures. This could include implementing tariffs under Section 232 of the Trade Expansion Act of 1962, which allows for tariffs based on national security considerations. The exploration of these alternatives reflects the administration’s commitment to protecting American industries, regardless of the legal challenges it currently faces.

Broader Economic Consequences

The broader economic implications of the tariff situation extend well beyond revenue collection and refund potentials. If the Supreme Court strikes down the tariffs, it may signal a shift in the U.S. approach to international trade that could reverberate throughout various sectors of the economy. Businesses that have adjusted their practices in reaction to the tariffs could face instability, and the resultant adjustments may lead to job losses in industries that were financially buoyed by the tariff regime. Furthermore, the recent end to the “de minimis exemption” on low-cost imports could also affect trade volumes, as evidenced by reports from the Universal Postal Union, indicating an 80% drop in U.S.-bound postal traffic following the change in tariff policies.

| No. | Key Points |

|---|---|

| 1 | Secretary of the Treasury Scott Bessent is confident about the Supreme Court ruling. |

| 2 | A ruling against the tariffs could lead to massive refunds for businesses. |

| 3 | The legal battle is expected to reach the Supreme Court by early November. |

| 4 | The administration has backup plans to implement tariffs through alternative legal authorities. |

| 5 | Economic consequences of the tariffs could substantially affect U.S. trade and employment. |

Summary

The ongoing tariff situation under the Trump administration is marked by significant legal challenges and uncertainties. Secretary Scott Bessent‘s optimism about a favorable outcome in the Supreme Court underscores the administration’s commitment to its tariff policies, despite the potential for vast refunds that could complicate its economic agenda. The months ahead will be pivotal in determining not only the fate of the tariffs but also the broader implications for U.S. trade practices and economic stability.

Frequently Asked Questions

Question: What are the potential financial implications of the Supreme Court ruling against the tariffs?

If the Supreme Court rules against the Trump administration’s tariffs, it could lead to massive refunds, amounting to between $750 billion and $1 trillion, impacting the Treasury and potentially creating significant financial windfalls for businesses that had paid those tariffs.

Question: What legal avenues is the administration considering if the tariffs are blocked?

The administration is exploring alternate legal authorities, such as Section 232 of the Trade Expansion Act of 1962, which allows for tariffs based on national security considerations, as a means to maintain some level of tariffs if the Supreme Court rules against the current measures.

Question: How have recent tariff policy changes affected postal traffic to the U.S.?

Recent changes, such as the end of the “de minimis exemption” for low-cost imports, have led to an 80% drop in postal traffic into the United States, indicating significant disruptions in trade resulting from the new tariff policies.