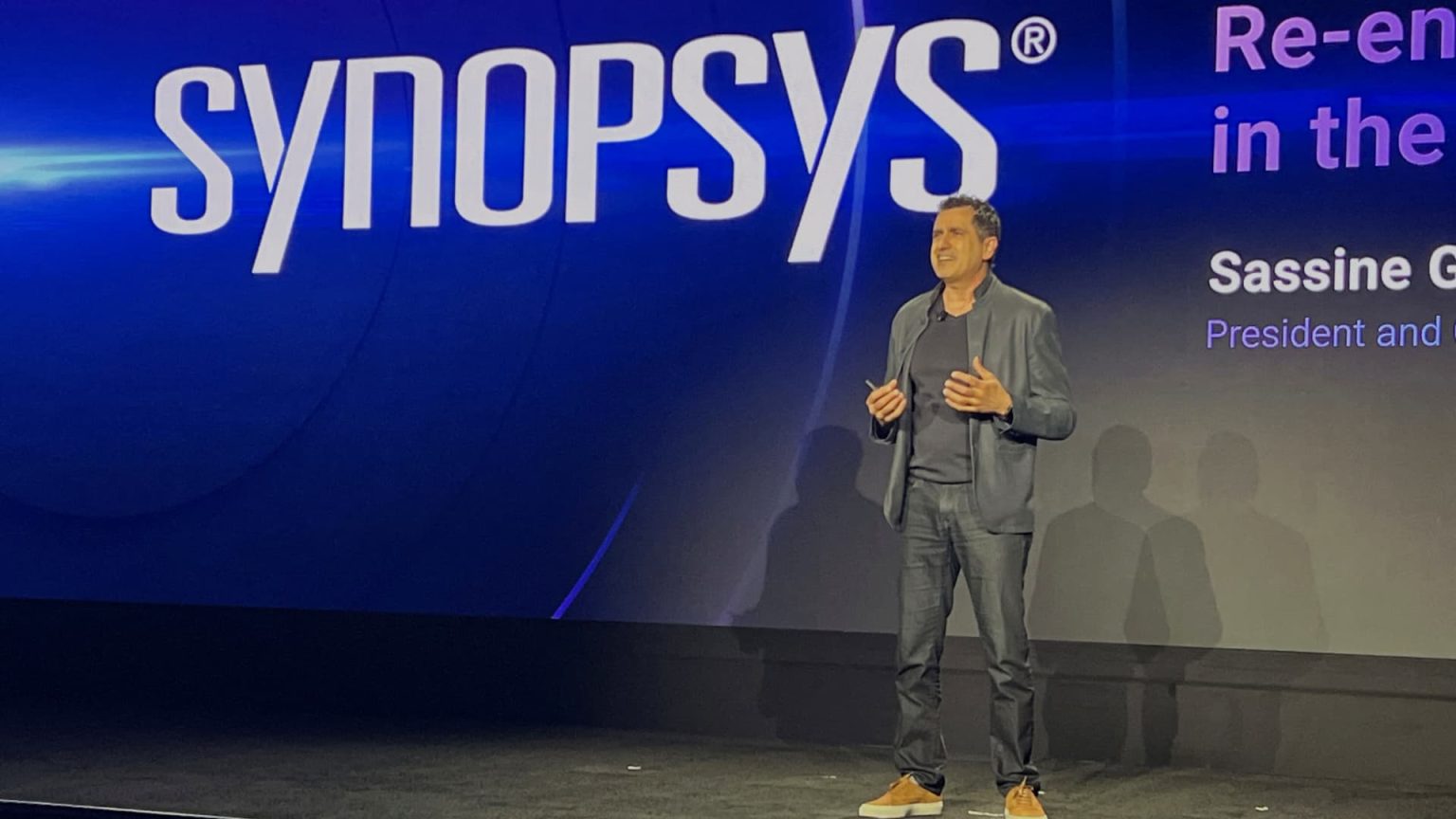

Synopsys, a semiconductor design software firm, is navigating significant challenges in its business landscape following recent restrictions imposed by the U.S. Commerce Department on sales to China. The company’s CEO, Sassine Ghazi, revealed plans to integrate artificial intelligence into the design of computer chips during the annual user conference held in Santa Clara, California. This announcement comes amidst a 3% drop in Synopsys stock, as the company withdraws its guidance for the fiscal year due to potential impacts from the regulatory changes.

| Article Subheadings |

|---|

| 1) The Impact of U.S. Sanctions on Synopsys |

| 2) Synopsys’ Response to Market Concerns |

| 3) AI Integration in Chip Design |

| 4) The Competitive Landscape in China |

| 5) Future Outlook for Synopsys |

The Impact of U.S. Sanctions on Synopsys

On March 19, 2025, Synopsys declared a withdrawal of its guidance for the full fiscal year due to a letter from the U.S. Commerce Department regarding restrictions on the sale of its products in China. This situation is particularly alarming for a company that had previously enjoyed a steady revenue stream from its Chinese clientele. Following this announcement, Synopsys’ stock experienced a decline of approximately 3%. The timing of this news raises questions about the implications of U.S.-China relations on American tech firms and the semiconductor industry as a whole.

The U.S. government has been tightening regulations surrounding the export of technology to China, aimed at safeguarding national security interests. The restrictions not only affect Synopsys but also have broader implications for companies operating in the tech sector that rely on the Chinese market for substantial revenue. Should these restrictions continue, it could hinder innovation, particularly in fields like semiconductor design, where Synopsys holds a critical position.

Synopsys’ Response to Market Concerns

In response to the unfolding situation, Synopsys has expressed its concerns about the impact of these regulatory changes on its business operations. In a transparent move, the company acknowledged in a statement, “Synopsys is currently assessing the potential impact of the BIS Letter on its business, operating results and financial condition.” This assertion indicates the seriousness with which the company is treating the new regulatory environment.

During a conference call with analysts, Sassine Ghazi discussed the slowdown observed in China, noting that about 10% of Synopsys’ $1.6 billion quarterly revenue is derived from clients in the region. Despite the challenges posed by the U.S. sanctions, Ghazi made it clear that the company is keen on evaluating alternative avenues to mitigate losses while maintaining robust communication with its stakeholders.

AI Integration in Chip Design

Amidst the challenges presented by the sanctions, Synopsys has been proactive in exploring new technologies. Ghazi announced ambitious plans for integrating artificial intelligence into the semiconductor design process at their annual user conference. The application of AI is seen as a potential game changer in how chips are designed, aiming to enhance efficiency and reduce time to market for new products.

Artificial intelligence can help mitigate some of the disruptions caused by sanctions by streamlining design processes, optimizing performance, and reducing costs. It can offer a competitive edge in an industry where speed and innovation are critical. However, successfully implementing AI technologies will require capital investment, talent acquisition, and a willingness to adapt to new methodologies.

The Competitive Landscape in China

Competition in the Chinese semiconductor market is notably intense, making it a challenging landscape for foreign companies like Synopsys. The Chinese government has implemented policies to bolster its domestic firms and promote self-reliance in semiconductor design. Investment funds have been backing local companies aggressively, thus undermining the position of international players.

Ghazi remarked on the compounding effects of these challenges, stating, “The cumulative impact of the restrictions in China, along with the macro situation inside China, has caused us to continue communicating that this deceleration will persist.” The dual threat of regulatory hurdles and fierce local competition raises concerns about Synopsys’ future profitability in that critical market.

Future Outlook for Synopsys

Looking ahead, the outlook for Synopsys remains fraught with uncertainty. The company is at a crossroads, needing to adapt quickly to external pressures and market conditions. While the integration of AI offers a promising direction, the potential regulatory constraints could limit the impacts of innovations.

The future performance of Synopsys will largely depend on its ability to successfully navigate the complex dynamics of international trade, governmental regulations, and competition. Stakeholders eagerly await further guidance as the fiscal year progresses, hoping for clarity on the direction of the company’s strategies and operations.

| No. | Key Points |

|---|---|

| 1 | Synopsys has withdrawn its fiscal year guidance due to U.S. export restrictions on sales to China. |

| 2 | CEO Sassine Ghazi emphasized the company’s commitment to evaluate the impact of regulatory changes. |

| 3 | Plans to integrate AI into chip design as a potential innovation strategy were announced at a user conference. |

| 4 | Local competition in China presents significant challenges for Synopsys’ market performance. |

| 5 | The future of Synopsys is uncertain as it must navigate external pressures and evolving market conditions. |

Summary

The recent regulatory changes have placed Synopsys at a critical juncture, forcing the semiconductor design company to reassess its strategies and operations. While the introduction of AI into chip design offers potential advantages, the combined impact of U.S. sanctions and fierce competition in the Chinese market presents formidable challenges. Observers are keenly monitoring the company’s moves as it strives to adapt to an ever-changing technological and geopolitical landscape.

Frequently Asked Questions

Question: What is Synopsys planning to do regarding chip design?

Synopsys is planning to integrate artificial intelligence into the design of computer chips to enhance efficiency and reduce time to market.

Question: How are U.S. restrictions affecting Synopsys?

U.S. restrictions on sales to China are impacting Synopsys’ ability to generate revenue, prompting the company to withdraw its guidance for the fiscal year.

Question: What competitive challenges does Synopsys face in China?

Synopsys faces significant competition in China due to local companies being bolstered by government policies and investment funds aimed at enhancing domestic semiconductor capabilities.